The Nasdaq reversing all its previous gains and then some has more to do with the bond market disagreeing with US Fed Chair Jerome Powell.

How do I know that?

After the one-day reversal which materialized because Powell took a 75-basis point cut off the table, the 10-year US treasury bond ripped past the psychological mark of 3% and surged past 3.1%.

As many have taken note, expensive tech stocks crater the deepest with uncontrollable interest rate rises and the pace of the move has been quite rattling for many investors.

In addition, the price action sure smells like a massive hedge fund blowing up and a force unwinding as well to add insult to injury.

Unfortunately for the American consumers, Powell taking 75 basis point cuts off the table does nothing to tame inflation even though I would like to point out that in normal times when the Fed is actually doing its job, a 50-basis point rise would usually be suitable.

However, the Fed is so late to the game, basically ignoring a compounding inflation catastrophe for over a year, that to believe that a 50-basis point rate increase will tame 8.5% inflation is nonsensical.

Without a reasonable plan to fight inflation, Wall Street has sniffed this out and understands that tech firms will suffocate under the pressure of more inflation which is why we are getting these larger-than-life selloffs after Powell tried to package his speech as dovish as possible.

The Fed absolutely neglecting their work duties has real knock-on effects on the tech industry.

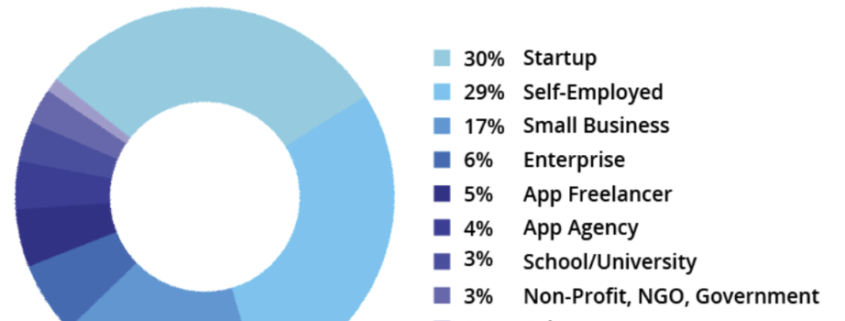

It has absolutely poo-pooed the trajectory of Amazon’s (AMZN) stock because Amazon is a comprehensive bet on the rich Western world buying more stuff in volume and the median Amazon prime buyer is bewildered by these aggressive price increases we are seeing all around the economic spectrum.

In short, people aren’t buying more stuff and that hurts Amazon’s ecommerce business.

If oil goes to $150 per barrel, that means more cutting back for Amazon prime customers because filling up at the pump is a necessity and not a luxury like an incremental bottle of perfume on Amazon prime.

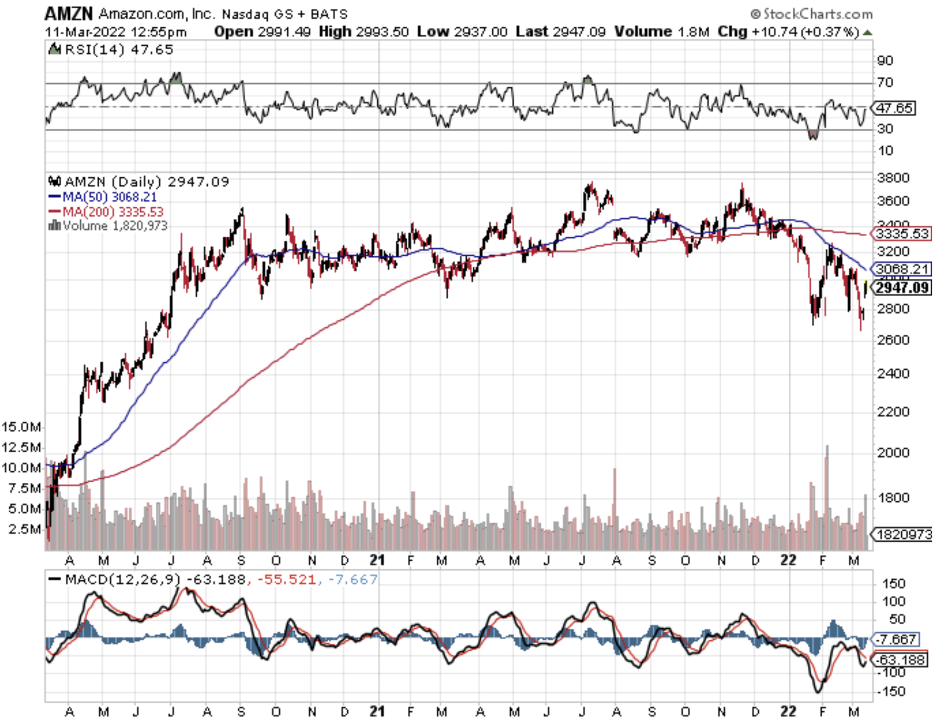

In the past 6 months, AMZN’s share price has dropped 35% and that was just a ramp up to the actual rate rises that have barely happened yet.

The market is completely disagreeing with the Fed and instead of aggressive raises, we are stuck with the incremental raises in which the bond market shrugs off and yields are off to the races.

The Fed’s missteps translate into a longer than necessary negative price momentum for tech stocks and it’s the Fed’s fault.

Amazon has been posting weaker-than-usual earnings for a few quarters because not only are their customers dealing with high inflation, but there have been various operational headwinds from unionization, higher expenses, and supply chain problems.

Amazon has almost doubled its fulfillment network since the start of the pandemic, and there is a lot that can go wrong with that in this day and age.

Essentially, the health situation of 2020, brought forward revenue and now we are seeing a major drop off in that rate of growth.

It doesn’t mean that Amazon is dead, but they will need to battle these headwinds for at least the next 12 months if not longer and much of this is not up to them.

That’s because firms have been suffering from the world's deglobalizing and Amazon is hurt more than others.

Amazon Web Services (AWS) is a bright spot.

The business posted a 57% increase in operating income and a 37% gain in sales in the most recent quarter.

For all that think this is the bottom for Amazon, you were also wrong in March as well.

The trading climate couldn’t be worse for Amazon and even though the secular bull case is still intact for Amazon long term, the rest of the year looks harsh.

Being a bet that Americans will buy more stuff isn’t the greatest bet right now.