Avoid online furniture e-store Wayfair (W) – it’s too expensive.

That was my conclusion after going over the company’s data with a fine-tooth comb.

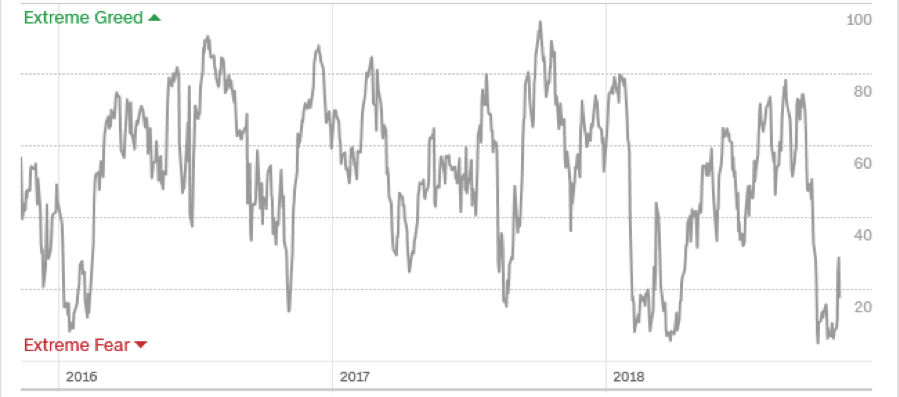

The stock is up over 600% over the past 5 years, it’s certainly a performance of a rock star in retrospect but it is far from a guaranteed indicator of future success by any means.

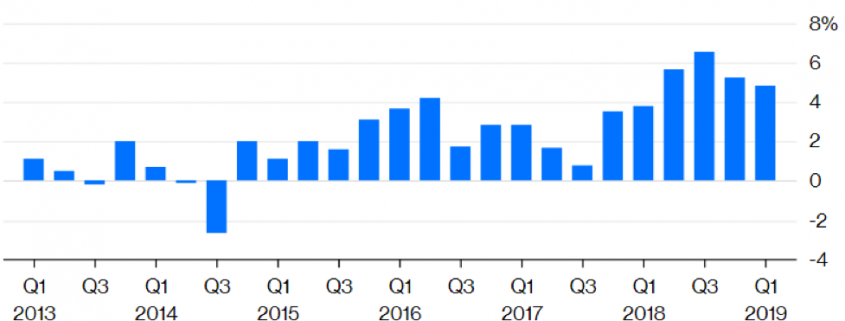

Shares have outgained the broader market by a wide margin resulting from January’s snapback in oversold territory scorching skyward 22% compared to an 8% spike in the S&P 500.

Investors must look at the performance of the company and deduce if the path forward is littered with booby traps or if it is as smooth as a slab of granite.

I would argue the former.

Just because the company is in e-commerce doesn’t mean it gets a free pass.

When you hear the word e-commerce, the mind darts and dives to the success of Amazon (AMZN) and observers must assume that if it’s doing the same job as Amazon, cash must be falling from the sky.

Well, the truth is sometimes harsh, and unfortunately, this company is nothing close to Amazon.

Wayfair sells furniture, a tough business from the onset.

Investors must ask themselves - does Wayfair optimally sell furniture and run its company efficiently?

First, the good.

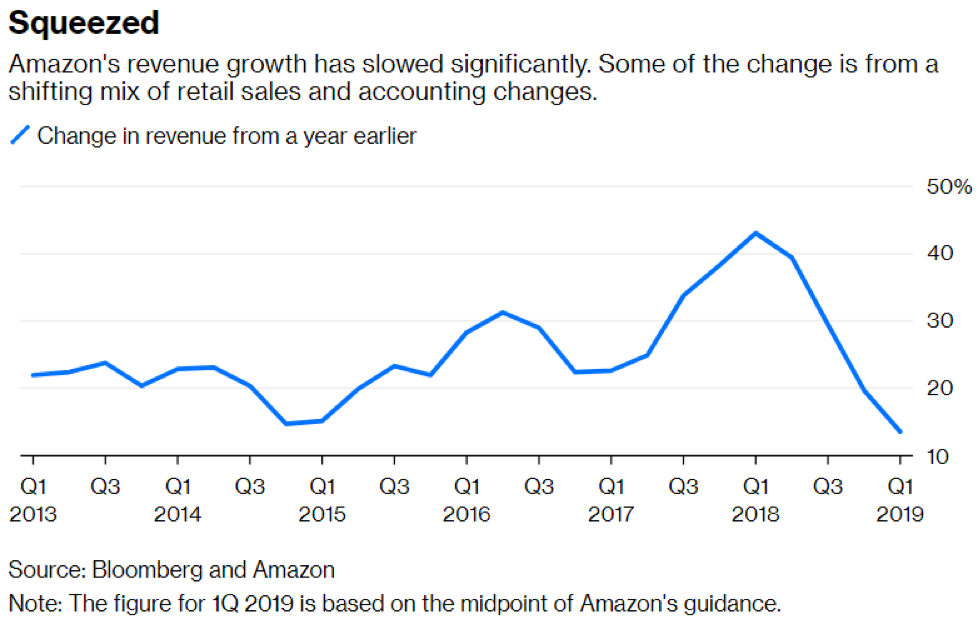

Sales have gone gangbusters the past few years and this is the catalyst driving the stock northwards.

The company presided over a 3-year sales growth rate of 44% - impressive for a cloud company, let alone an online furniture company.

In the past 3 years, the company has more than doubled sales from $2.25 billion in 2015.

Noticeably, tech growth investors have piled into this name propping it up irrespective of any problems behind the lipstick.

The knock on Wayfair is not the amount of growth but the net quality of growth.

These two must be differentiated and have ramifications affecting the firm’s ability to nurture return business down the road.

Take a quick spin on their official website by clicking here.

Right away, before the user can even take a glance at what the website has to offer, the company is vigorously fishing for an email address to allow the reader to continue.

Without entering an email, the prospective customer is stopped dead in its tracks clicking out of the website – too aggressive for my taste.

Why hand over a personal email when any Amazon prime user can just migrate to Amazon’s search bar without all these hoops that need to be jumped through?

The subsequent message attached to the email signup form says, “Up to 70% off Every Day - Shop every style of furniture and décor at up to 70% OFF. - Exclusive sales start daily.”

If you finally decide the site is worth your time and want to insert your email to move forward pass the first barrier, almost every inch of the site is peppered with over excessive 70% sales reminders.

Don’t forget the first pop-up described the same thing – and now it’s sales promotion overload.

This aggressive marketing push reminds me of a company who knows they cannot compete long-term and believes a marketing solution is the elixir to all of its ills.

Wayfair has performed admirably at growing sales the past few years, and that cannot be taken away.

But its sales success has been carried out in an over-reaching way with respect to the health of the company.

Effectively, Wayfair has been sacrificing margin and burning cash at a high rate potentially disenfranchising its shareholder base in the near future.

This will end in tears.

I cannot envision a scenario where this same business model perpetuates due to a lack of a differentiated advantage.

They do nothing more than the next guy does.

The more I use the website, the more I want to revert back to Amazon and buy furniture from Jeff Bezos.

The situation echoes the current situation with low-cost airlines Wow Airlines from Iceland and Norwegian Air Shuttle (NWARF) who doubled down on the same type of strategy that took them to the brink of solvency.

Wayfair’s advertising and marketing expenses have been growing 30-40% per year along with customer service expenses.

Net income has gotten clobbered during this time span as well.

Wayfair lost less than $50 million in 2015. The losses have racked up to almost $450 million at the beginning of 2019.

As quarterly EPS has cratered, Wayfair has missed the past 4 quarterly EPS forecasts demonstrating a continuous lack of execution from management and an inferior strategy.

The EPS percentage change on a sequential basis was negative 97% last quarter.

This company will end up as a pump-and-dump stock, and I speculate no viable path forward to profitability unless major surgery is done to this business model.

I highly doubt that Wayfair can consistently maintain mid-40% sales expansion, and if it does, it is only a matter of time until the ripcord is pulled and the pilots abort the plane before it crashes into the ocean.

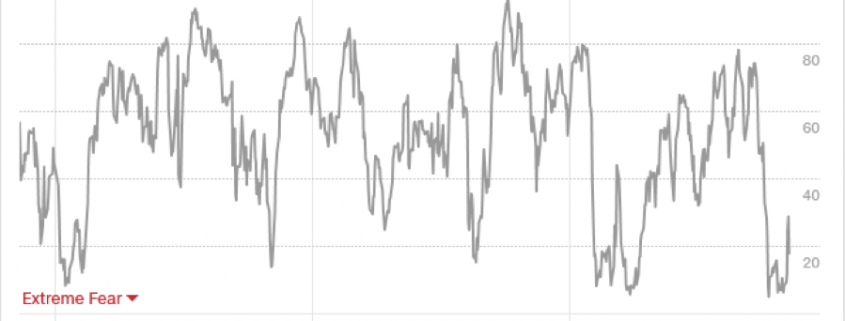

As soon as this turns sour, whether it be a recession or the sales strategy becomes impotent, shares will face Armageddon.

Ultimately, the risk/reward proposition is poor, but that doesn’t mean this stock can’t rally a further 30% on the back of a dovish Fed and kick the can down the road trade deal.

If they can clock in mid-40% sales growth, it doesn’t matter if they slaughter net income and expenses because growth investors will come out the woodwork to buttress this online furniture store.

Stay away from this high-risk company.

This is almost a tale of the emperor's new clothes.