Global Market Comments

March 15, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or LISTEN TO THE (VIX),

(SPY), (IWM), (QQQ), (TLT), (VIX), (DAL), (BA), (ALK)

Global Market Comments

March 15, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or LISTEN TO THE (VIX),

(SPY), (IWM), (QQQ), (TLT), (VIX), (DAL), (BA), (ALK)

I decided to take a day off over the weekend and see what was happening in the real economy.

As I drove over the Bay Bridge, I spotted over 30 very large container ships from China loaded to the gills. They were diverted from Los Angeles where the delay to unload ships has extended to two months.

The San Francisco farmers market was jammed with a mask-wearing crowd. Standing in front of me in the line to buy lavender salt was former 49ers quarterback Joe Montana, who took his team to the Super Bowl four times. He was in great shape, looking at least 30 pounds lighter than in his heyday.

Leaving Half Moon Bay after picking up some driftwood for my garden, the traffic to get into town was at least an hour long.

It all underlies a theme for the economy and the markets that I have been expounding upon for the last year.

The Roaring Twenties have begun, the number of consumers and investors who believe this is increasing every day, and the impact on business and stocks is still being wildly underestimated.

You can see this in the Volatility Index (VIX), which has made a rare two roundtrips over the past month, and that means two possible things. Markets are undecided. When they make up their minds, they will either crash, or make a new leg up.

I vote for the latter.

I keep especially close attention on the (VIX) these days because it tells me when I can turn on or off my printing press for $100 bills. Anywhere over a (VIX) of $30 and I can strap on “free money” trades where the chances of losing money are virtually nil.

You can see this in my performance this year, where 40 roundtrips trade alerts in 11 weeks generated 38 wins and only two losses. That’s a success rate of an unprecedented 95%.

The indecision in the markets is obvious in the charts below. The large cap S&P 500 (SPX) and the small cap Russell 2000 (IWM) clawed their way to new highs last week, but the tech heavy NASDAQ (QQQ) made a feeble, halfhearted effort at best. Technology alone is being punished for rising interest rates as the ten-year US Treasury yield hit 1.62%.

This makes absolutely no sense as the larger tech companies are massive cash generators, run huge cash balances, and are enormous let lenders to the financial system. That means they make millions in interest payments from rising rates. What they are really being punished for is doubling from the pandemic low a year ago.

But never argue with Mr. Market.

Biden signs, with a record $1.8 trillion hitting the economy immediately. Money could start hitting your bank account this weekend if you are signed up for electronic payments with the IRS. Let the party begin! I already spent my money a long time ago. The Fed is forecasting a 10% GDP growth rate in Q2. Money is about to come raining down upon the economy….and the stock market. The big question is how much of this is already in the market. “Buy the rumor, sell the news”. Given the wild swings in the market, and multiple visits to a $32 (VIX), it’s clear that markets don’t know….yet.

The Next Battle is over infrastructure, which the democrats want to have an environmental. “green” slant. Look for a big gas tax rise to pay for it. They may get what they want with Senate control. Look for a September target. The economy needs $2 trillion a year in new government spending to keep the stock market rising and it will probably happen.

Nonfarm Payroll comes in at a blockbuster 379,000 in February, far better than expected. It's a preview of explosive numbers to come as the US economy crawls out of the pandemic. That’s with a huge drag from terrible winter weather. The headline Unemployment Rate is 6.2%. The U-6 “discouraged worker” rate of still a sky high 11%, those who have been jobless more than six months. Leisure & Hospitality were up an incredible 355,000 and Retail was up 41,000. Government lost 86,000 jobs. See what employers are willing to do when they see $20 trillion about to hit the economy?

Weekly Jobless Claims dive to 712,000 has pandemic restrictions fall across the country, the lowest since November. However, ongoing claims still stand at an extremely high 4.1 million. Total US joblessness still stands at 18 million. Will the pandemic come back to haunt us from these early reopenings?

California Disneyland (DIS) to reopen April 1, lifting a very dark cloud and huge expenses off the company. Cases on the west coast have fallen so dramatically that the state feels it can get away with this. Maybe this is an effort to derail the recall movement against the government. Stock is up 2% in the after-market, which Mad Hedge followers are long. Time to dig out my mouse ears. Keep buying (DIS) on dips.

Oil (USO) soars 3% on an attack on Saudi oil facilities and a building US economic recovery. $69 a barrel is printed. This is setting up as a great short. High prices in a decarbonizing economy have no future. A (USO) $34-$36 put LEAP with a January 2023 maturity might make all the sense in the world here.

Boeing (BA) announced Fist Positive Deliveries, in 14 months, finally turning around the mess with the 737 MAX. United Airlines was the biggest buyer. The perfect storm is finally over. And Boeing is about to snag another giant order, this time from Southwest (LUV). This comes on the heels of similar big order from Alaska Air (ALK). Keep buying (BA) on dips. An upside breakout is imminent.

Consumer Price Index Comes in at 0.4%, and 0.1% ex food and energy. It’s still at a nonexistent level. Rising gasoline prices were a factor, but airline ticket prices remain at all-time lows. I’ll worry about inflation when I see the whites of its eyes. Commodity prices have doubled in a year but show nowhere in the inflation numbers. With a headline Unemployment Rate at 6.1% and a U-6 at 18 million, it's unlikely we’ll see wage any time soon, which is 70% of the inflation calculation.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

It’s amazing how well selling tops and buying bottoms can help your performance. My Mad Hedge Global Trading Dispatch profit reached a super-hot 16.32% during the first half March on the heels of a spectacular 13.28% profit in February. The Dow Average is up a miniscule 8.2% so far in 2021.

It was a total rip your face off rally in the markets last week, so I took off my hedged and covered shorts in the S&P 500 (SPY) and the NASDAQ (QQQ). That leaves me to run my seven remaining profitable positions into the March 19 options expiration.

I also had my hands full running the three-day Mad Hedge Traders & Investors Summit, introducing some 27 speakers to a global audience of 10,000. The speakers’ videos go up on Tuesday at www.madhedge.com.

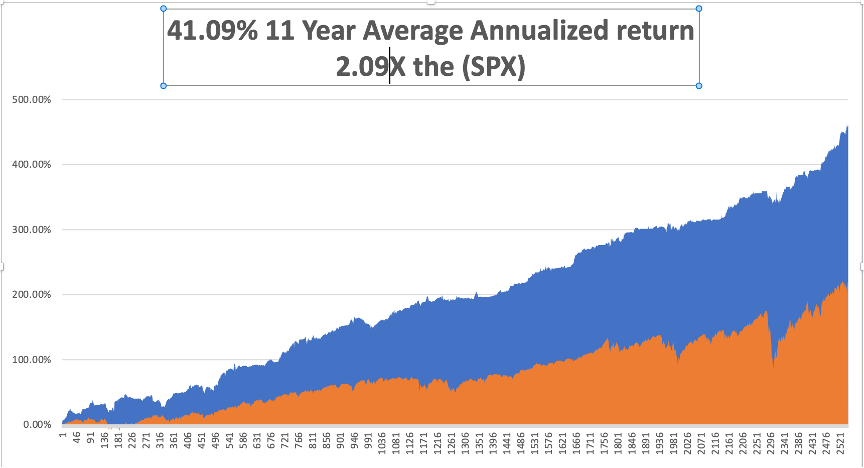

This is my fifth double-digit month in a row. My 2021 year-to-date performance soared to 39.81. That brings my 11-year total return to 465.36%, some 2.12 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.09%. I am concerned because numbers any higher than this will look fake.

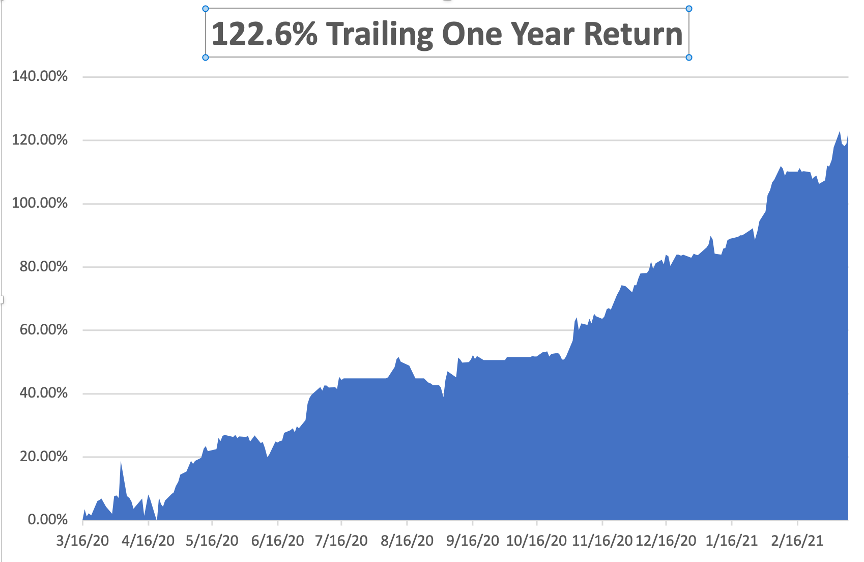

My trailing one-year return exploded to 122.6%, the highest in the 13-year history of the Mad Hedge Fund Trader. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 29.5 million and deaths topping 535,000, which you can find here. Thankfully, death rates have slowed dramatically, but Obituaries are still the largest sector in the newspaper.

The coming week will be a boring one on the data front.

On Monday, March 15, at 7:30 AM EST, the New York Empire State Manufacturing Index for March is released.

On Tuesday, March 16, at 8:30 AM, US Retail Sales for February are published.

On Wednesday, March 17 at 8:30 AM, we learn Housing Starts for February. At 2:00 PM we get the Federal Reserve interest rate decision and press conference.

On Thursday, March 18 at 8:30 AM, Weekly Jobless Claims are out. We also obtain the Philadelphia Fed Manufacturing Index.

On Friday, March 19 at 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I was saddened to learn of the death of George Schultz, Treasury Secretary and Secretary of State under president Ronald Reagan. He was 101.

George graduated from Yale at the outbreak of WWII and immediately joined the US Marine Corps (Semper Fi) where he used his ample math background to become an anti-aircraft officer. He issued my dad’s unit the useful advice to always lead an attacking Zero fighter by four plane lengths to hit the engine with a machine gun. It’s simple ballistics.

After the war, he used the GI bill to get a PhD from MIT, and later worked for President Eisenhower. He then became the Dean of the Chicago Business School.

I first met George when The Economist magazine sent me to interview him in San Francisco as the CEO of Bechtel Corp, a major engineering and construction company in 1982. The following week, he was drafted by the incoming Reagan administration, where he stayed for eight years. We kept in touch ever since.

When the Soviet Union collapsed in 1991, Schultz as Secretary of State was instrumental in managing the event so that it stayed peaceful….and moved forward. I later flew to Berlin to watch the Russian Army pull its troops out of my former home.

In his later years, George was very active in the Marines Memorial Association where I got to know him very well, he often was wearing his full-dress blues looking as new as if they came out of the factory that day, bringing a fascinating series of military speakers.

As Schultz got older, he couldn’t remember what he knew was top-secret or classified, and what wasn’t. I benefited greatly from that, but kept my mouth shut. However, I learned some amazing things.

He was also very active in arms control and flew to Moscow as recently as 2019. In recent years, I help him to the podium, George grasping my arm and walking his slow shuffle.

George Schultz was a great example of the best leaders that American can produce. He will be missed.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

February 17, 2021

Fiat Lux

Featured Trade:

(HOW TO HANDLE THE FRIDAY, FEBRUARY 19 OPTIONS EXPIRATION),

(TSLA), (MS), (BA), (BLK), (GS), (AMD), (KO), (BAC), (NFLX), (AMZN), (AAPL), (INTU), (QCOM), (CRWD), (AZN), (GILD)

Followers of the Mad Hedge Fund Trader Alert Services have the good fortune to own no less than 16 deep in-the-money options positions, all of which are profitable. All but one of these expire in two trading days on Friday, February 19, and I just want to explain to the newbies how to best maximize their profits.

It was time to be aggressive. I was aggressive beyond the pale.

These involve the:

Global Trading Dispatch

Mad Hedge Technology Letter

Mad Hedge Biotech & Healthcare Letter

Provided that we don’t have a huge selloff in the markets or monster rallies in bonds, all 15 of these positions will expire at their maximum profit point.

So far, so good.

I’ll do the math for you on our oldest and least liquid position, the Tesla February 19 $650-$700 vertical bull call spread, which I initiated on January 25, 2021 and will definitely run into expiration. At the Friday high, Tesla shares were at a lowly $816, some $53 lower than the $869.70 that prevailed when I strapped on this trade.

Provided that Tesla doesn’t trade below $700 in two days, we will capture the maximum potential profit in the trade. That’s why I love call spreads. They pay you even when you are wrong on the direction of the stock. All of the money we made was due to time decay and the decline in volatility in Tesla stock.

Your profit can be calculated as follows:

Profit: $50.00 expiration value - $44.00 cost = $6.00 net profit

(4 contracts X 100 contracts per option X $6.00 profit per options)

= $2,400 or 20% in 18 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning February 22 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, occasionally machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears, and the spreads substantially widen, when security has only hours, or minutes until expiration on Friday, February 19. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

If for some reason, your short position in your spread gets “called away,” don’t worry. Just call your broker and instruct them to exercise your long option position to cover your short option position. That gets you out of your position a few days early at your maximum profit point.

If your broker tells you to sell your remaining long and cover your short separately in the market, don’t. That makes money for your broker, but not you. Do what I say, and then fire your broker and close your account because they are giving you terrible advice. I’ve seen this happen many times among my followers.

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next month-end.

Take your winnings and go out and buy yourself a well-earned dinner. Just make sure it’s take-out. I want you to stick around.

Well done, and on to the next trade.

Global Market Comments

February 1, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or GAMBLERS HAVE ENTERED THE MARKET),

($INDU), (TSLA), (TLT), (BA), (JPM), (MS), (GME), (STBX), (GE), (MRNA)

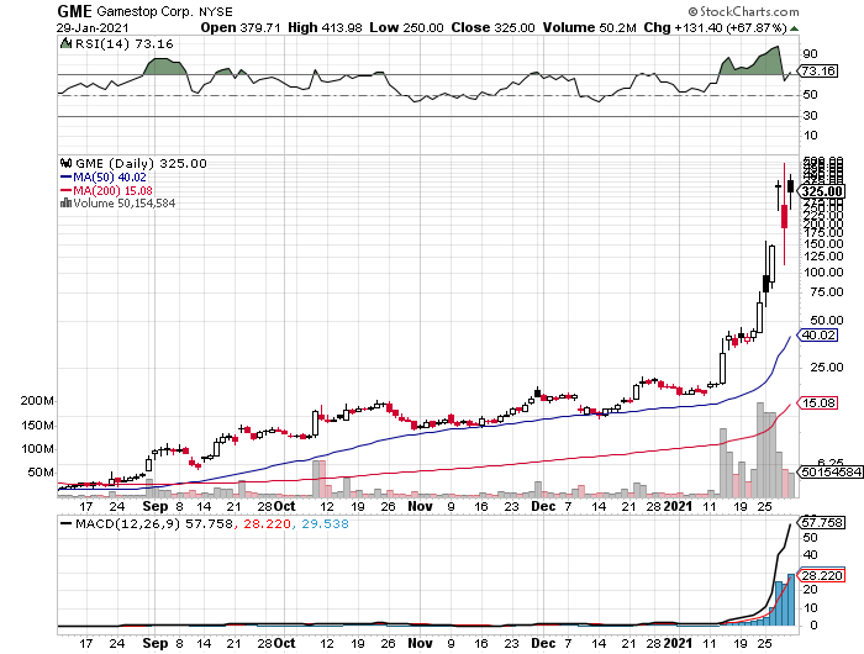

At long last, the 10% correction I have been predicting is happening. No, it wasn’t caused by the usual reasons, like a bad economic data point, an earnings disappointment, or a geopolitical event.

The market delivered the worst week since October because gamblers have entered the stock market. Perish the thought!

It turns out that if a million kids buy ten shares each of a $4 stock, they can wipe out even the largest hedge funds on their short positions. It also turns out they can wipe out their brokers, with infinite capital calls triggered by massive order flows.

If Chicago’s Citadel had not stepped in with a $1 billion bailout, Robin Hood would have gone under last week. Citadel buys Robin Hood’s order flow and is their largest customer. That’s where systemic risk enters the picture.

And it’s not like there was really any systemic risk. Markets have an inordinate fear of the unknown, and no one has ever seen a bunch of kids in a chat room like Redditt wipe out major hedge funds.

Fortunately, there are only a dozen small illiquid stocks that could be subject to such ‘buyers raids”. So, the spillover to the main market is very limited, probably no more than a week or two.

And the regulations to reign in such a practice are already in place. Whenever a broker gets more business than it can handle, it will simply shut it down. Robin Hood did that on Friday when it has limited purchases in 20 stocks to a single share, including Starbucks (STBX), Moderna (MRNA), and General Electric (GE).

What all this does is set up an excellent buying opportunity for you and me, of which there have been precious few in recent months. By ramping up the Volatility Index to $38, it is almost impossible to lose money on front month call options spreads. We are the real winners of the (GME) squeeze.

Stocks would have to fall another 10%-20% on top of existing 10%-20% declines, and that is not going to happen in 13 trading days to the February 19 options expiration with $20 trillion about to hit the economy and the stock markets. That breaks down to $10 trillion in stimulus and $10 trillion worth of global quantitative easing.

My own long, hard-won experience is that a (VIX) at $38 earns you about 20% a month in profits. Options prices are so elevated that scoring winners now is like shooting fish in a barrel. So, join the party as fast as you can.

On Friday, I was taking profits on exiting positions and shipping out new trade alerts in the best quality names as fast as I could write them. Where is that easy, laid back retirement I was hoping for!

Keep at the barbell portfolio. The big tech names are finishing up a six-month sideways “time” corrections. Their earnings are catching up with valuations at a prolific rate. The domestic recovery names have just given back 10%-20% and are ripe for another leg up. All of these are good candidates for 2023 options LEAPS.

After all, if an insurrection and the sacking of the capitol can’t take the market down more than 1%, GameStop (GME) is certainly not going to take it down more than 10%.

GameStop (GME) posted record volatility, up from $4 a month ago to $483. Even the biggest hedge funds can’t stand up to a million kids buying ten shares each at market. All single name shorts in the market are getting covered by hedge funds in fear of getting “Gamestopped”, producing a 700-point Dow rally.

Several brokers banned trading in the name and the SEC is all over this like a wet blanket. Trading is halted due to an excess of sell orders. The problem is that funds are selling real stocks to cover the losses we own, like JP Morgan (JPM) and Tesla (TSLA) and short (TLT).

In the meantime, the action has moved over the American Airlines (AA), which has soared by 50%. AMC Entertainment Holdings (AMC) saw a 400% pop, but I haven’t seen anyone rushing back into theaters to watch Wonder Woman. Blame Jay Powell for flooding the financial system with mountains of cash seeking a home. There is so much money in circulation that traders are invented asset classes to put it into. This can’t last. Buy the dip.

Here are the best short squeeze targets with the greatest outstanding short interests. GameStop (GME) tops the list with an eye-popping 139% short interest, followed by Bed Bath & Beyond (BBBY) (67%) and Ligand Pharmaceutical (LGND) (64%). National Beverage (FIZZ), The Macerich Company (MAC), and Fubo TV (FUBO) bring up the rear. These are all failed companies in some form or another, which is why hedge funds had such large short positions.

New Home Sales disappointed in December, up only 1.6% to 842,000 units. This is on a signed contract basis only. Affordability is the big issue caused by high prices. Who buys a house at Christmas anyway?

Case Shiller soared by 9.5% in November, the fastest home price appreciation in history. Phoenix (13.8%), Seattle (12.7%), and San Diego (12.3) were the big movers. Blame a long-term structural housing shortage, a huge demographic push from Millennials, near-zero interest rates, and a flight from the cities to larger suburban homes. The Pandemic is keeping millions of homes off the market.

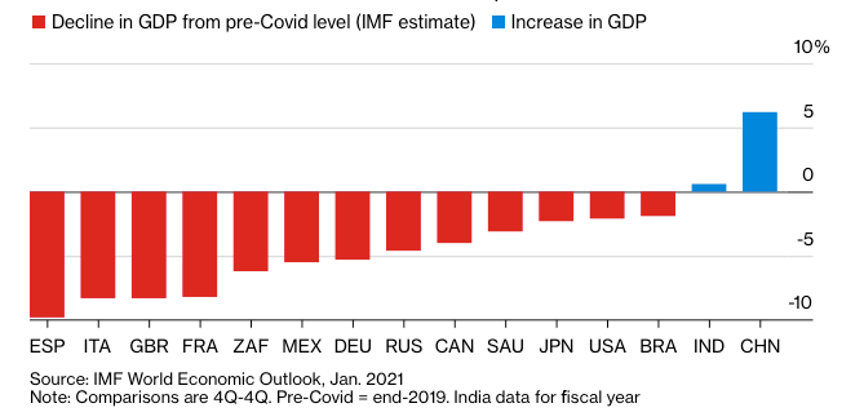

US GDP may reach pre-pandemic high by end of 2021, it the vaccine gets distributed to every corner of the nation and aggressive stimulus packages pass congress. Growth should come in at a minimum of 5% or higher this year, wiping out last year’s disaster. Keeping interest rates near zero will be a big help, as Treasury Secretary Yellen is determined to do. China and India are already there.

Share Buybacks have returned, the catnip of share prices. Q4 saw a jump to $116 billion from $102 billion in Q2, and this year, banks now have free reign to buy back their own shares. That’s still below the $182 billion seen in Q4 2019. It can only mean that share prices are rising further.

California lifts stay-at-home regulations, enabling restaurants to open after a nearly two-month shutdown. It’s the first ray of hope that the pandemic will end by summer. It will if Biden hits his 1.5 million vaccinations a day target.

Tesla posts sixth consecutive profit quarter, taking the stock down $60 in the aftermarket momentarily on a classic “buy the rumor, sell the news” move. The once cash-starved company now has an eye-popping $19.4 billion in reserves. Revenues reached a massive $10.7 billion, better than expected. Gross margins reached 19.2%. Looking for 50% annual growth for several years. Shanghai, Berlin, and Austin will make their first deliveries this year. Cash flow is at $19.4 billion, enough to build six more factories. No short sellers left here. It’s a perfect entry point for a LEAP. Buy the March 2023 $1,150-$1,200 call spread for a ten bagger.

Space X rocket carries 143 spacecraft into space. The Falcon 9 rocket set a new record with new satellites launched at once. Yes, you too can put 200kg into orbit for only $1 million. Many are from small tech startups selling various types of data. Elon Musk’s hobby, now worth $20 billion according to its government contracts, could be his next IPO. Don’t pass on this one!

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch earned a blockbuster 10.21% in January, versus a Dow Average that is now down in 2021. This is my third double-digit month in a row.

I used the market selloff to take substantial profits in my short (TLT) holdings and buy new longs in Boeing (BA) and Morgan Stanley (MS). I rolled the strikes down on my JP Morgan (JPM) long by $10.

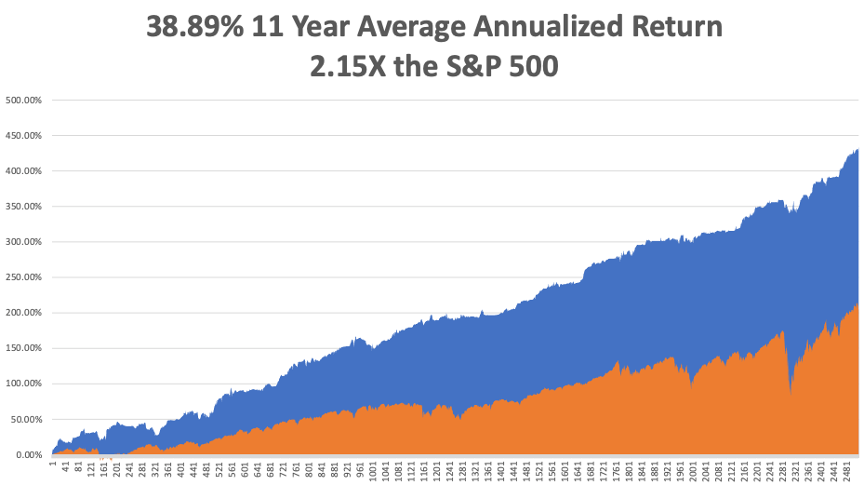

That brings my eleven-year total return to 432.76%, some 2.15 times the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.85%, a new high.

My trailing one-year return exploded to 75.28%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 91.43% since the March 20 2020 low.

We need to keep an eye on the number of US Coronavirus cases at 26 million and deaths at 440,000, which you can find here. We are now running at a staggering 3,800 deaths a day.

The coming week will be all about the monthly jobs data.

On Monday, February 1 at 9:45 AM EST, the Markit Manufacturing PMI for January is out. Caterpillar (CAT) announces earnings.

On Tuesday, February 2 at 7:00 AM, Total Vehicle Sales for January are published. Alphabet (GOOG) and Amgen (AMGN) report.

On Wednesday, February 3 at 8:15 AM, the ADP Private Employment Report is published. QUALCOMM (QCOM) reports.

On Thursday, February 4 at 9:30 AM, Weekly Jobless Claims are printed. Gilead Sciences (GILD) reports.

On Friday, February 5 at 9:30 AM, the January Nonfarm Payroll Report is announced. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I am often kept awake at night by painful arthritis and a collection of combat injuries and I usually spend this time thinking up new trade alerts.

However, the other night, I saw a war movie just before I went to bed, so of course, I thought about the war. This prompted me to remember the two happiest people I have met in my life.

My first job out of college was to go to Hiroshima Japan for the Atomic Energy Commission and interview survivors of the first atomic bomb 29 years after the event. There, I met Kazuko, a woman in her late forties who was attending college in Fresno, California in 1941 and spoke a quaint form of English from the period. Her parents saw the war and the internment coming, so they brought her back to Hiroshima to be safe.

Her entire family was gazing skyward when a sole B-29 bomber flew overhead. One second before the bomb exploded, a dog barked and Kazuko looked to the right. Her family was permanently blinded, and Kazuko suffered severe burns on the left side of her neck, face, and forearms. A white summer yukata protected the rest of her, reflecting the nuclear flash. Despite the horrible scarring, she was the most cheerful person I had ever met and even asked me how things were getting on in Fresno.

Then there was Frenchie, a man I played cards with at lunch at the Foreign Correspondents Club of Japan every day for ten years. A French Jew, he had been rounded up by the Gestapo and sent to the Bergen-Belson concentration camp late in the war. A faded serial number was still tattooed on his left forearm. Frenchie never won at cards. Usually, I did because I was working the probabilities in my mind all the time, but he never ceased to be cheerful no matter how much it cost him.

The happiest people I ever met were atomic bomb and holocaust survivors. I guess, if those things can’t kill, you nothing can, and you’ll never have a reason to be afraid again. That is immensely liberating.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

August 5, 2020

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY),

(MSFT), (TLT), (BA), (GOOGL), (SPY)

Global Market Comments

June 19, 2020

Fiat Lux

Featured Trade:

(JUNE 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (AAPL), (FXE), (FXA), (BA), (UAL), (AAPL), (MSFT), (BIIB), (PFE), (OXY), (SPCE), (WMT), (CSCO), (TGT)

Below please find subscribers’ Q&A for the June 17 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What is the best way to buy long term LEAPS for unlimited profits?

A: There is no such thing as unlimited profits on LEAPS; they are specifically limited to about 500% or 1,000%. Most people will take that. The answer is to wait for crash day. That’s when you dive into LEAPS, or during very prolonged sell-offs like we had in February or March. That’s where you get the bang per buck. On a capitulation day, you can pick up these things for pennies.

Q: How do you explain that all the cities and states that had major COVID-19 outbreaks and deaths are controlled by Democrats?

A: That’s like asking why you don’t get foot and mouth disease in New York City. The majority of US cities are Democratic, while the rural areas tend towards Republicans and the suburbs that flip back and forth. So, you will always get these big hotspots in cities where the population density is highest and there is a lot of crowding because that’s where the people are. Covid-19 is a disease that relies on within six-foot transmission. You are not going to get these big outbreaks in rural places because there are few people. Horse, cow, and pig diseases are another story. That is one reason the disease has become so politicized by the president.

Q: What is the time horizon for your picks?

A: It’s really a price function rather than a time horizon. Sometimes, a trade works in a day, other times it’s a month. I try to send out a large number of trade alerts because we have new subscribers coming in every day and the first thing they want is a trade alert. Occasionally, I’ll make 10% in a day and I take that immediately.

Q: I’m a new investor; trading in a pandemic is one thing, but what about other risks like volcanic eruptions, major solar flares, or global war? How do I prepare for one of three of these things in the next 25 years?

A: I’m actually worried about all three of those happening this year. If you lived through 1968, everything bad tends to happen in one year, and bad things tend to happen in threes. This is a year where we’re kind of making it up as we go along because there is no precedent. The playbook has been thrown out. Those who always relied on trading stocks and securities predictable ranges got wiped out.

Q: Beijing has quarantined its population again and canceled flights; is this going to cause the Chinese government to ramp up the blame game with the US?

A: Absolutely, the US is the number one Corona incubator in the world by far. We have 120,000 deaths—China had 4,000 deaths with four times the population. Many countries are blaming us for keeping this pandemic alive and spreading it further. But I don’t think foreign relations are a high priority right now with our current government. That said, it is easier for a dictatorship to control an epidemic than a democracy. In China, they were welding people’s doors shut who had the disease.

Q: Do you think taking away the $600 or $1200 stipend for the unemployed is going to crush the chances for many trying to get back to work?

A: It will. A lot of the stimulus measures only delay collapse by a couple of months. The PPP money was only for 2 months; I know a lot of companies are counting on that to stay in business. Some state unemployment benefits run out soon. Either you’re going to have to start forking up $3 trillion every other month, or you’re going to get another sharp downturn in the economy. Cities are bracing themselves for the worst eviction onslaught ever. Mass starvation among the poor is a possibility.

Q: Where do you place stops on vertical spreads?

A: Since vertical spreads don’t lend themselves to technical analysis, you have to draw a line in the sand—for me, it’s 2%. If I lose 2% of my total capital, or 20% on the total position, then I get the heck out of there and go look for another trade. That’s easy for me to do because I know that 90% of the time my next trade is a winner.

Q: Why did you sell your S&P 500 (SPY) July $330/$320 put spread at absolutely the worst moment?

A: The market broke my lower strike price, which is always a benchmark for getting out of a losing trade. When you go out-of-the-money on these spreads, the leverage works against you dramatically. This market isn’t lending itself to any kind of conventional historic analysis. The market went higher than it ever should have based on any kind of indicator you’re using. When the market delivers once in 100 year moves like we had off the March 23 bottom, you are going to be wrong. However, we immediately made the money back by putting on a (SPY) July $335/$340 put spread with a shorter maturity, and a (SPY) July $260-$$270 call spread. If you’re in this business, you’re going to take losses and be made to look like a perfect idiot, like I did twice last week.

Q: Who is getting involved down 10%?

A: I would say you’re getting both institutions and individuals involved down 10%. You keep hearing about $5 trillion in cash on the sidelines, and that’s how it’s coming to work. Plus, we have 13 million new day traders gambling away their stimulus checks.

Q: Why have you not put on a currency trade this year?

A: With the incredible volatility of the stock market, there were always better fish to fry. Currencies haven’t moved that much, and you want stocks that are dropping by 80% in two months and gapping up 200% the next two months. So, in terms of trading opportunities, currencies are number three on that list. Would you rather buy Apple (AAPL) for a 75% move, or the Euro (FXE) for a 6% move? My favorite has been the Aussie (FXA) and it has only gone up 20%.

Q: Do you issue trade alerts on LEAPS?

A: I don’t; most trade alerts are short term trades in the next month or two because we have to generate a large number of them. However, in February, March, and April, we started sending out lists of LEAPS. We sent out about 25 LEAPS recommendations. We did ten for Global Trading Dispatch (BA), (UAL), (DAL), ten for the Mad Hedge Technology Letter (AAPL), (MSFT), and five for the Mad Hedge Biotech & Health Care Letter (BIIB), (PFE). Even if you got just one or two of these, you got a massive impact on your performance because they did go up 500% to 1,000% in 2 months, which is normally the kind of return you see in two years. So, getting people to buy all those LEAPS was probably the greatest call in the 13-year history of this letter. I know subscribers who made many millions of dollars.

Q: I am new to trading; other than placing a trade, what do you recommend I get a handle on in the learning process?

A: We do have two services for sale. We have “Options for the Beginner,” and that I would highly recommend, and I’ll make sure that’s posted in the store. You can’t read or study enough. If you really want to go back to basics, read the 1948 edition of Graham and Dodd, where Warren Buffet got his education actually working for Benjamin Graham in the ’40s.

Q: Will Occidental Petroleum (OXY) go bankrupt?

A: No, they have the strongest balance sheet of any of the oil majors, so I would bet they would hang around for some time. They also have no offshore oil, which is the highest cost source of oil. But it’s going to be a volatile time for a while.

Q: Usually the selling is telling me to go away. With this market, the amount of money on the sidelines, is it going to be a stock picker’s market?

A: Yes, like I said the playbook is out the window. Normally, you get a month’s worth of trading in a month, now you get a month's worth in a day or two. So, we’re on fast forward, Corona is the principal driver of the market and no one knows what it’s going to do. The teens were a great index play. The coming Roaring Twenties will be a stock picker’s market because half of the companies will go out of business, while many will rise tenfold. You want to be in the latter, not the former. And index gets you the wheat AND the chaff.

Q: Will there be another opportunity to buy LEAPS?

A: Yes, especially if we get a second corona wave and it slaps the market down to new lows again. There’s a 50/50 chance of that happening. The rate of Corona cases is now increasing exponentially. We had 4,000 new cases in California yesterday.

Q: How do you see Main Street two years from now? Will the battered middle class ever recover?

They will if they move online. I think main street will be empty in two years. Only the largest companies are surviving because they have the cash reserve to do so. And they seem to be able to get government bailout money far better than the local nail salon or dry cleaner. Again, this was a trend that had been in place for decades but was greatly accelerated by the pandemic. I was in Napa, CA yesterday and half of the storefront shops had gone out of business.

Q: What are your thoughts on the spacecraft company Virgin Galactic (SPCE)?

A: Great for day traders, great for newbies, but not real investment material here. I don’t think the company will ever make money. It was just part of the temporary space had. Better to read about it in the papers and have a laugh than risk your own hard-earned money. Elon Musk’s Space X though is a completely different story.

Q: Which is the better buy now: Walmart (WMT), Costco (CSCO), or Target (TGT)?

A: I’d probably go for Target because they have been the fastest to move to the new online order and curb pickup universe. But Costco is also a great play.

Q: When should I buy Tesla?

A: On the next meltdown or down 30% from here, if and whenever we get that. It’s going to $2,500, then $5,000.

Q: With QE infinity, it doesn’t sound like we’ll get to LEAPS country. Do you agree?

A: No, I wouldn’t agree because at some point, the government might run out of money, the bond market won’t let them borrow anymore, and the money that gets approved doesn’t actually get spent because the works are so gummed up. Plus, Corona is in the driver's seat now. What if we’re wrong and we don’t get 250,000 cases by August, but 500,000 cases? 20 million? There are 100 things that could go wrong and get us back down to lows and only one that can go right and that is a Covid-19 vaccine. We’ve essentially been on nonstop QEs for the last 10 years already and the market has managed many 20% selloffs during that time. If we pursue a Japanese monetary policy, we will get a Japanese result, near-zero growth for 30 years.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 8, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HISTORY IS REPEATING),

(SPY), (INDU), (TLT), (TBT) (TSLA), (DAL), (BA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.