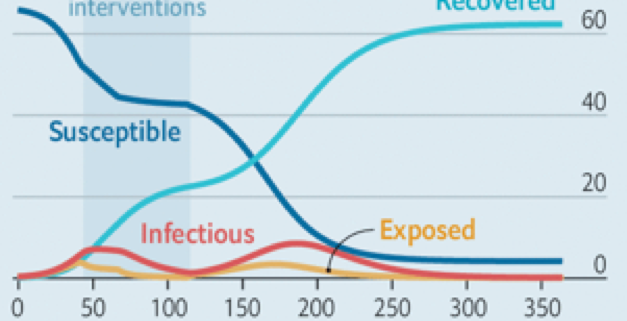

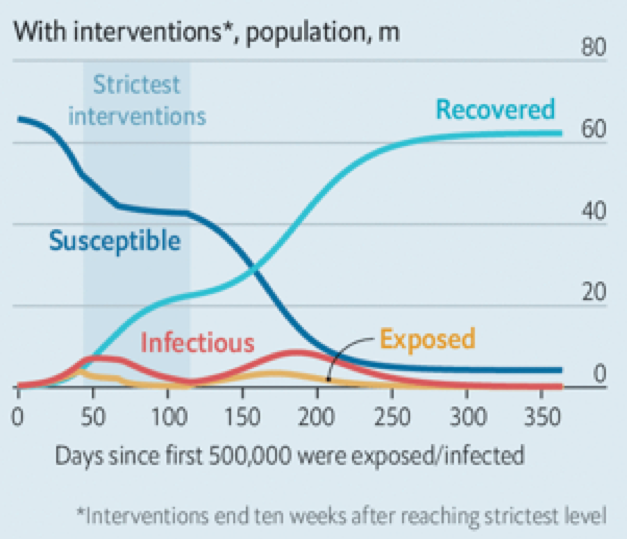

This was the week that the Coronavirus came back with a vengeance.

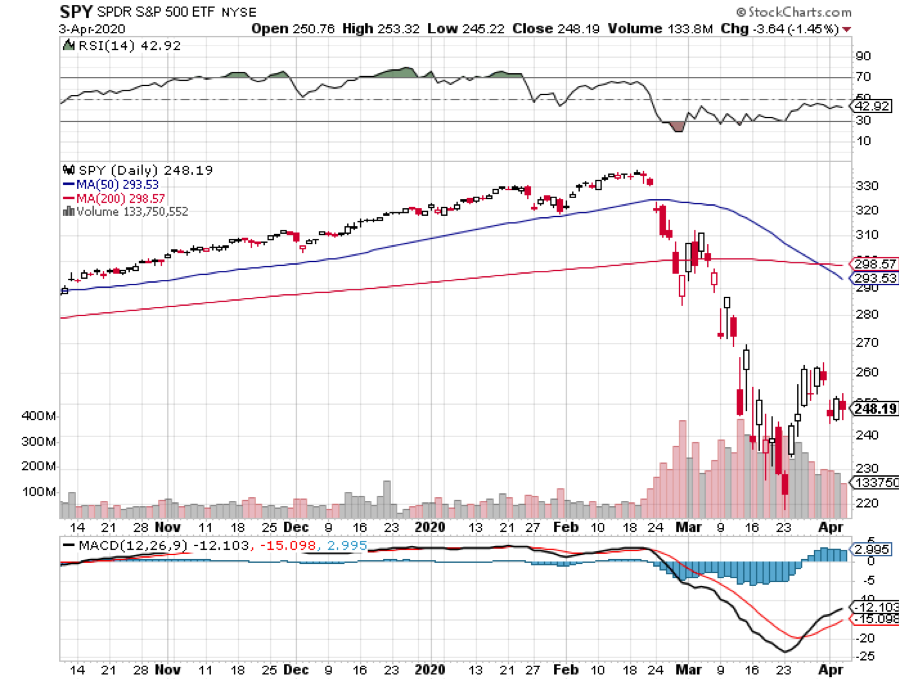

The market had been backing out the pandemic for the past three months. Now it is abruptly pricing it back in.

Hospitalizations soared in 16 states to new all-time highs, as the first wave continues to grow exponentially. Deaths have topped 125,000. The good news is that only 5,000 died last week. That is nearly two 9/11’s, or 12 Boeing 747’s crashes worth of victims.

Apple has closed eight stores in Texas and another 14 stores in Florida. Arizona is on the verge of running out of hospital beds. This is going to weigh heavily on the market until we see another interim peak. It looks like the last one was certainly a false summit, in climber’s lingo.

What was really interesting last week is what DIDN’T happen. While the “reopening” stock LIKE banks (BAC), energy (XOM), cruise lines (CCL), hotels (MGM), casinos (WYNN), airlines (UAL) were absolutely slaughtered, gold, technology, and biotech barely moved. It says volumes about what happens next. You want to use selloffs to buy quality at a discount, not garbage that is going to zero.

Technology and biotech are where you want to focus your buying of stock, futures, and LEAPS. The next big dip is the one you buy.

You can count on the government stepping in and announcing more stimulus on the next down 1,000-point day. Thursday mornings seem to be a favorite time, right before the next horrific Weekly Jobless Claims are announced, which also seem to be reaccelerating.

The Fed can do this for free, without spending any money, simply by expanding the asset classes eligible for quantitative easing. Some $8 trillion in QE certainly buys a lot of friends in the market. I believe that any run in the S&P 500 (SPX) down to 2,700 will be met by government action.

Treasury Secretary Steve Mnuchin expects another stimulus package in July, but only if he gives away the store to Nancy Pelosi. Just what the market needs, more stimulus. Most of the 40 million out of work are still jobless. It could be $1 trillion worth of stimulus checks and other giveaways headed for the stock market, like the last lot. My kids still haven’t spent their first checks! We’re going broke anyway, so why not?

The stock market is clearly running out of gas, at a 26 multiple, the highest since the Dotcom bubble top. Any more stimulus may simply go into bank deposits. The risk/reward for new positions here is terrible. It sits nicely into my sideways range scenario for the rest of the year.

Existing Home Sales are down 9.7% in May, the worst in ten years. They are off 26.6% YOY, the worst figure since 1982 when home mortgage rates were at 18%. Inventories are down an eye-popping 18.8% to 4.8 months as sellers pulled listing to avoid virus-infested buyers. The first-time buyers live, but the action is shifting out of condos and into single family homes in the burbs.

Weekly Jobless Claims jump 1.5 million, far worse than forecast. It looks like we are getting a second wave of jobless as Corona ravages the south and business hangers-on throw in the towel. Some 20 million Americans remain on state unemployment benefits, which will start to run out shortly. Will stocks look through this?

Banks are banned from paying dividends and buying back shares, orders the US Treasury. The Fed estimates that pandemic-related loan losses could reach $700 billion, wiping out their capital. Every bailout comes with a pound of flesh. The banks have made billions off of stimulus loans, like the PPP. The banks rallied because the news wasn’t worse, like a mandatory 5% share giveaway, which happened last time. Buy banks like (JPM), (BAC), and (C) on an expected yield curve steepening.

Tesla (TSLA) is now the world’s most valuable car company, with a market capitalization of over $180 billion. It just passed Toyota Motors (TM). (TSLA) is now worth more than the entire US car industry combined. That could double very quickly. The upcoming model Y is expected to be its biggest seller and a third production plant will be announced imminently. The rush out of public transit and into private cars simply accelerated a pre-existing trend or the company.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

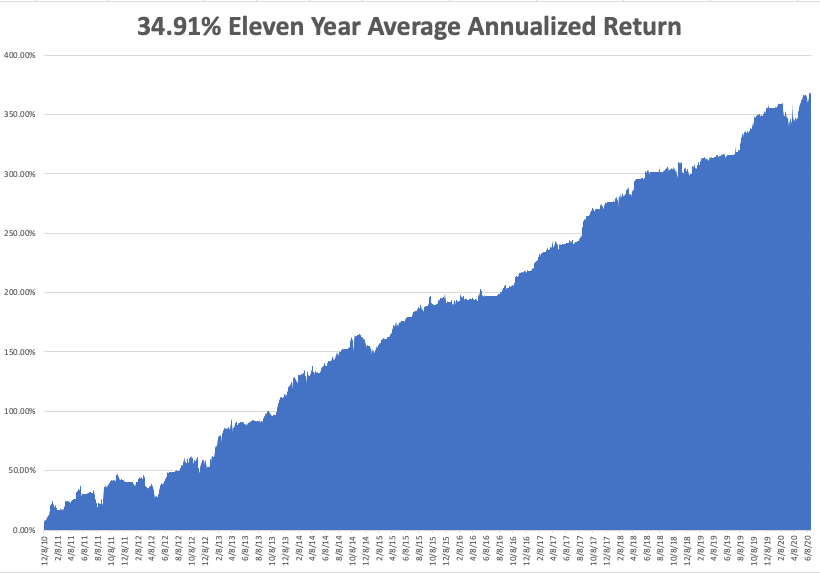

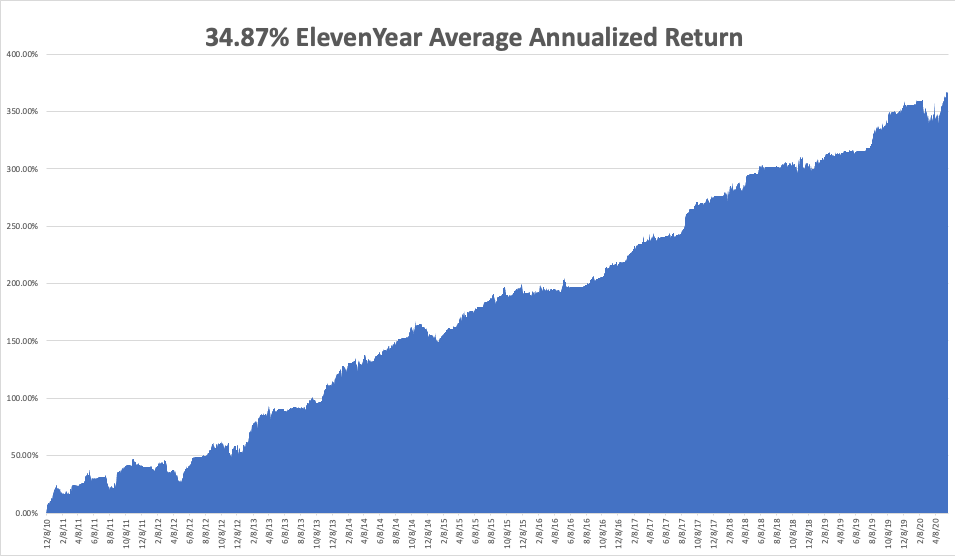

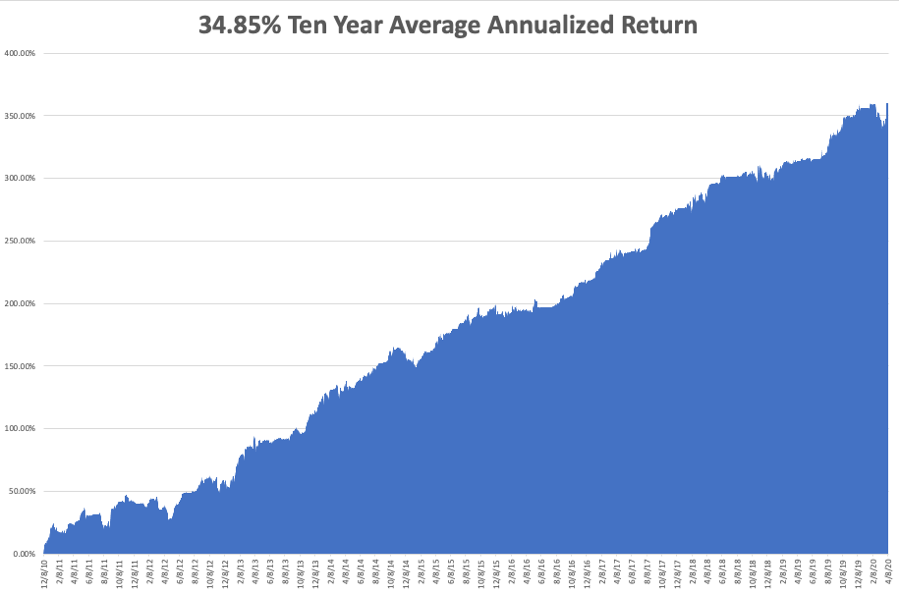

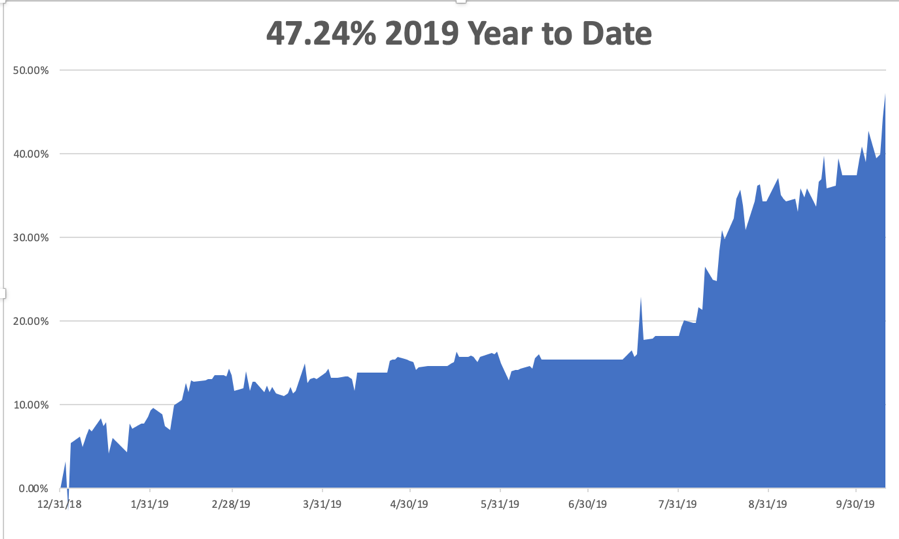

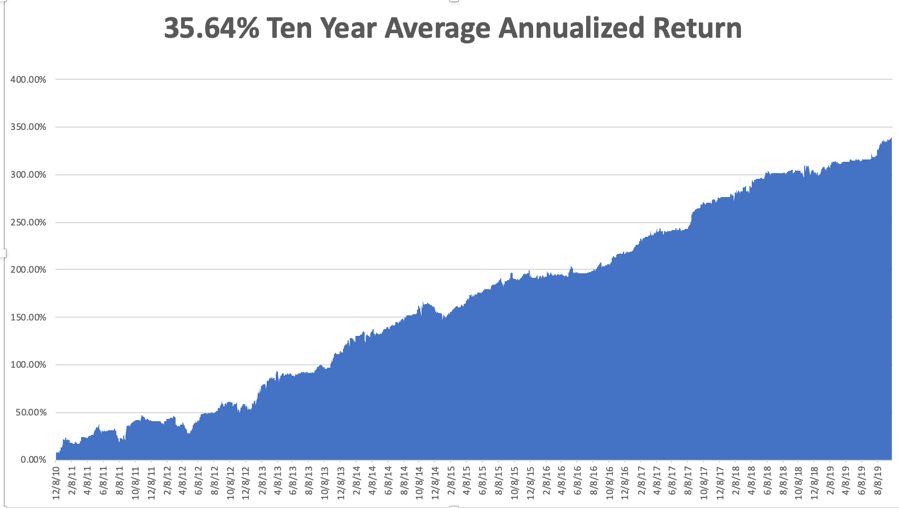

My Global Trading Dispatch enjoyed another respectable week, taking in a welcome 3.87%, bringing June in at +2.56%. Despite the market diving nearly 10%, we pulled in big profits from our short positions and captured accelerated time decay on our longs. My eleven-year performance stands at a new all-time high of 368.75%.

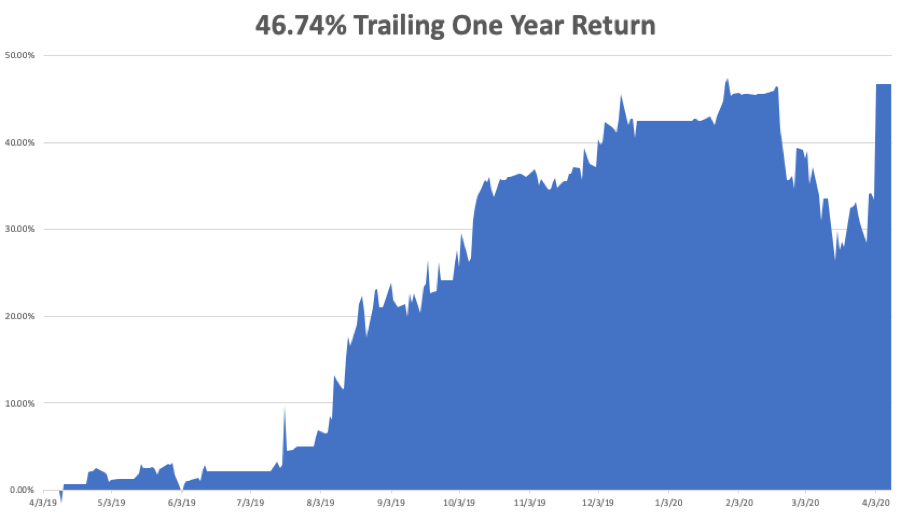

That takes my 2020 YTD return up to a more robust +12.88%. This compares to a loss for the Dow Average of -12.3%, up from -37% on March 23. My trailing one-year return popped back up to 53.27%. My eleven-year average annualized profit recovered to +34.91%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here. It’s jobs week and we should see an onslaught of truly awful numbers.

On Monday, June 29 at 11:00 AM EST, US Pending Home Sales for May are out.

On Tuesday, June 30 at 10:00 AM EST, the April Case-Shiller National Home Price Index is published.

On Wednesday, July 1, at 9:15 AM EST, the ADP Private Employment Report is released. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published.

On Thursday, June 2 at 8:30 AM EST, Weekly Jobless Claims are announced.

On Friday, June 3, at 8:30 AM EST, the June Nonfarm Payroll Report is printed. Since last month was a large overstatement, June could be positively diabolical. The Baker Hughes Rig Count is out at 2:00 PM EST.

As for me, I am rushing out and doing errands, like a trip to the barber, haircut, hardware store, dry cleaners, the dentist, and the doctor in case the California economy shuts down once again. We’ve been slightly open for a few weeks.

That may be all we get this year.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader