As an astute purveyor of technology, it is my job to share with you the upcoming tech trends of 2019.

Some might be easily discernable and some might be a headscratcher, but all must be tabbed up and considered in the current tech outlook that is unpredictable and fluctuating, to say the least.

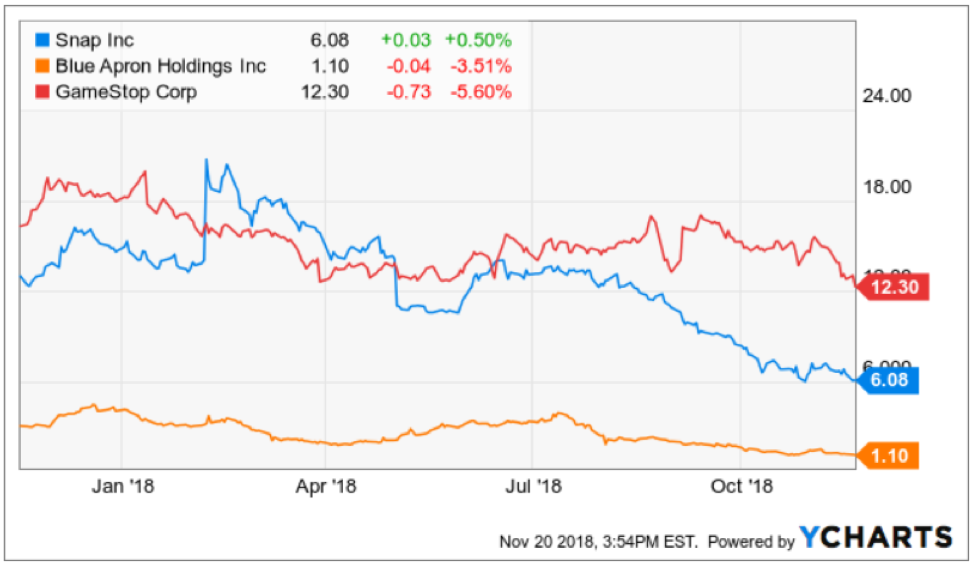

Part of the moody tech sentiment has been influenced by a changeable macro landscape - the tech sector’s winter freeze was woefully volatile and unfairly capsized good companies with the bad.

There is no means to get around it – the administration's delicate situation as it relates to Beijing and the American tech sector is front and center, and any movement of tech stocks must carefully absorb the ongoings from this complicated relationship.

The number of obstacles that confront this sensitive situation means that the 90-day window granted to solve the trade quagmires appear too brief of a timeframe to really knock out every single disagreement on the table.

The uncertainty over trade policy has really ruffled some of tech’s strongest feathers such as America’s pride and joy Apple (AAPL).

Apple is a great long-term story, but it does not preside over many short-term positive catalysts that can resuscitate the stock.

Analysts' downgrade after downgrade has been most harrowing for the chip components that make up Apple and other consumer electronic devices such as televisions and tablets.

This scenario is expected to extend into 2019 with Bank of America Merrill Lynch (BAC) slashing their price target by nearly 30% on electronics retailer Best Buy (BBY) then sticking the fork in them by downgrading it to underperform.

The premise behind this downgrade was that Best Buy carved out 25% of revenue from television sales and even though Adobe (ADBE) analytics has calculated record online sales in the holiday season, the follow-through has largely been without television sales participating in the seasonal bonanza.

Piggybacking on this trope, I believe electronic device sales could be hard-pressed to eke out growth next year and are set up for a rude awakening.

Therefore, it is sensible to extrapolate this idea out and assume that smart hardware competing against the big boys such as smart speaker firm Sonos (SONO), who I urged readers to stay away at $16 in September, is set up for a painstaking 2019.

To reread the story, please click here.

The stock is now trading at $11 and a mix of weakening consumer device demand layered with the domination that is the Amazon Alexa has pushed up this company’s risk-reward levels to untold heights.

Rounding out the negatives is that content streaming platform Roku has also debuted its own version of a smart speaker.

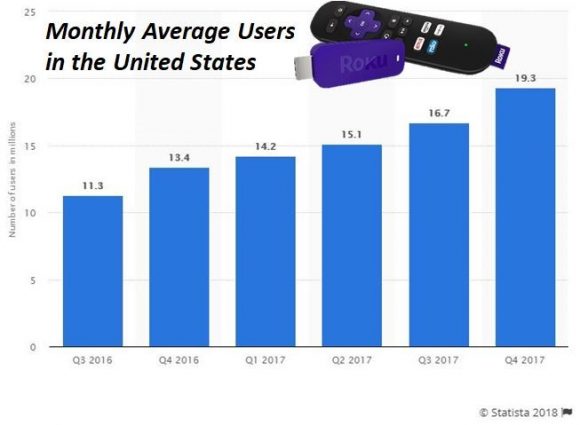

Roku (ROKU) is one of my favorite long-time tech plays but has been dragged down by the broader trade war because a portion of its revenue is still captured by hardware such as the new speakers and Roku OTT boxes.

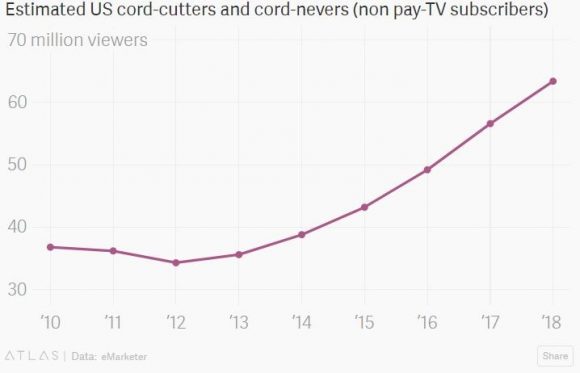

Differing from Apple, Roku earns most of their revenue from targeted ads on their proprietary platform, and this is its reason why most investors are in this stock that is set to capture a secular migratory wave of cord-cutters traversing to online streaming.

However, Roku TVs made by Chinese company TCL still draw in small portion of revenue and even though the China revenue is not as high on a relative basis as Apple’s 20%, the stock has floundered in the short-term.

If disruptors such as Roku can get hit savagely with a small portion of revenues from China, then I am convinced that any tech investor going into 2019 should stay away from hardware and hardware that is made in China.

The consensus is that the drawn-out trade war could become the X-factor in the 2020 election because the Chinese are willing to wait for the next guy on the carousel searching for a better deal.

If you thought Chinese supply chains had a tough time of it in 2018, then 2019 is poised to be even more treacherous.

What 2018 convincingly demonstrated was that the late economic price action is getting into later and later stages boding negative for tech stocks.

To construct a healthy tech portfolio going into 2019, the change in the tech partiality has made the pivot towards software much more important.

Investors need to mitigate Chinese supply chain risk and seek out domestic software plays.

That should be the playbook as tech investors are on pins and needles going into the new year.

The domestic economy is robust and tech investors should be attracted to top-quality cloud-based enterprise stocks that are profitable.

The FANG story collapsing in our face signaled to investors that it is time to cautiously consider whether to invest heavily into deep loss-maker tech growth stories.

A healthy rotation to premium quality tech with superior cash flow is one way to lock up stocks and slyly deflect the external factors shaking up the tech momentum.

PayPal (PYPL) is a stock that has large international exposure mainly in Europe, but none in China whose 3-year EPS growth rate is 26% and still driving sequential sales in the mid-20% range.

This is just one example of a stock that has the correct make-up in a harsh and brutal tech environment planted with invisible booby traps.

And the most tell-tale sign that the American economy is in for an all-out software frenzy is the number of head-spinning investments from big tech companies looking to expand their footprint into new talent spots around the country.

First, the farcical Amazon beauty pageant came to an end with the e-commerce giant announcing a three-part package deploying new operations in New York, Washington D.C., and Nashville as the next phase of digital growth ramps up.

Google (GOOGL) followed that up by plopping a software office in New York City devouring a huge chunk of the Chelsea neighborhood aimed at doubling the 7,000 employees already there.

Then it was Apple’s turn choreographing a significant investment in Austin, Texas that will cost them $1 billion along with juicing up operations in Seattle, San Diego, and Los Angeles.

They weren’t finished there and promised to double down its presence in Pittsburgh, New York and Boulder, Colorado over the next three years.

It’s clear that big tech has finally understood that it’s not invincible and milking the China supply chain for all its worth is now a taboo business practice that has bipartisan support firmly against it.

Like I said before, the trade war came 1-2 years too early for Apple, and these headline-grabbing talent investments in data centers and its staff underscore the sense of urgency to fully and comprehensively pivot towards a software and services company.

The transition has certainly been an excruciating process exposing the weak spots at a brilliant company at the worst possible time.

I blame CEO of Apple Tim Cook who is the operations expert in the building grappling with Apple overextending themselves in the Middle Kingdom that has come back to haunt him at night.

You would have thought that with the troves of big data on their hands, Apple’s consultants might have found a country allied with America to invest in such a massive supply chain.

This leads me to communicate with conviction that Microsoft (MSFT) is my favorite tech stock going into 2019 because it is the purest, scalable, high-quality software name with minimal hardware drag devoid of weak spots in its armor.

That was what the investment in GitHub for $7.5 billion was about, highlighting the value of owning the meeting place for coders, literally buying up a stash of over 28 million users and 57 million coding repositories in which 28 million are public.

Microsoft has also bought up six video game studios in 2018 attempting to capture a bigger piece of the pie for the video game market that has been throttled by Fortnite.

If the Microsoft baby gets thrown out with the bathwater, then the tech bear market is upon us in full force.

If you didn’t really believe content is king in 2018, then you will really feel the phenomenon further embedded into the economy and society in 2019.

Next year, almost all tech investments will result in more data centers and software engineers in the hope of pumping out the best content and data, whether it’s enterprise software, video games, or pure data storage.

In 2019, I am bullish on companies with a cloud-based bedrock able to grind out the best content in the world, backed by a strong balance sheet that dovetails nicely with a lack of China-based revenue exposure.

The uber-growth models could be taking a rest boding negatively for Uber, Lyft, and Airbnb who must convince a more skeptical tech audience with tighter purse strings as they inject yet another unique dimension into the tech world next year.