The Chinese BATs (Baidu, Alibaba, and Tencent) are China's response to the American FANG group.

It's one of few sectors outperforming the vigorous American tech sector, and valuations have soared in the past year.

Former English teacher Jack Ma founded the Amazon (AMZN) of China named Alibaba in April 1999, which has grown to become one of the biggest websites on the Internet.

This company even has a massive cloud division that acts in the same way as Amazon Web Services (AWS).

Alibaba also has Alipay on its roster, the fintech and digital payments subsidiary of Alibaba.

Baidu, led by Robin Li, is the de-facto Google search of China and is entirely tailored for the Chinese market without English language support.

Tencent, created by Ma Huateng, has an assortment of businesses from social media, instant messaging, online gaming, and digital payments.

Tencent's WeChat platform is the lynchpin acting as the gateway to the robust Tencent eco-system.

The BATs have heavily invested in autonomous vehicle technology set to roll out in the coming years.

These companies are some of the biggest venture capitalists in the world throwing around capital like Masayoshi Son's SoftBank.

Alibaba has seen its share price rocket from $135 in June 2017 to $206.

Baidu has also seen huge gyrations in its share price elevating from $174 in June 2017 to $270.

Tencent, public on the Hong Kong Hang Seng Index, has gone from $273 HKD (Hong Kong dollars) to $412 HKD.

And this is all just the beginning!

An economy growing a stable 6.5% per year with companies able to scale to a mind-boggling 1.3 billion people is something of which to take notice.

China hopes to wean itself from its industrial heritage betting the ranch on a rapidly expanding tech sector.

Does this put China on a collision course steamrolling toward the American FANGs?

Highly possible but not yet.

Even though the BATs modus operandi has been to follow in the footsteps of the FANG's business model, they do not directly compete.

Ant Financial, the fintech arm of Alibaba, was blocked from purchasing MoneyGram International (MGI), effectively, closing any doors leading to the lucrative American digital payments industry.

This also meant curtains for WeChat, the multi-functional app that half of the Chinese use as a digital wallet, in the digital payments space.

The Committee on Foreign Investment in the United States (CFIUS) has made it crystal clear that BAT's capital will be scrutinized more than ever before because of China's open policy of transferring Western technology expertise to the mainland for the purpose of leading the world in technology.

China cannot have its cake and eat it.

The first stumbling block is that the American market does not suit the BAT's FANG business model with Chinese characteristics.

For example, the only other market Baidu search operates in is Brazil.

It has leveraged itself to the Chinese consumer whose purchasing power has spiked from its burgeoning middle class.

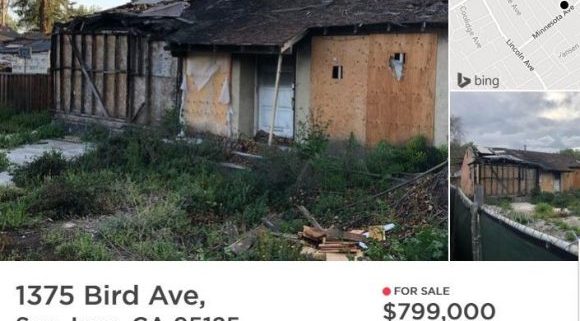

Another headwind is the lack of innovation caused by a rigid education system punishing freedom of thought in favor of rote memorization.

Innovation is American tech's bread and butter and investors pay up for this ingenuity that cannot be found elsewhere in the world.

This is also the reason why the BATs need to buy American technology and not the other way around.

Original concepts such as Uber and Airbnb were made in America first and Didi Chuxing and Tujia are rip-offs of these American companies.

The list is endless.

The BATs understand they cannot go head to head with American talent, but that does not mean they won't win out in the end.

To make matters worse, global tech talents do not want to work in China if they are reliant on America to develop something and copy it.

Why not just go work in Silicon Valley for a higher salary?

This was highlighted when the only tech talent to cross over to the other side quit in a blaze of glory.

Hugo Barra was poached from Alphabet in 2013, where he worked as vice present for the Android mobile operating system.

He was installed as the vice president of international development for smartphone maker Xiaomi, the Apple (AAPL) of China.

Barra suddenly threw in the towel at Xiaomi in 2017, offering a harsh critique stating, "What I've realized is that the last few years of living in such a singular environment have taken a huge toll on my life and started affecting my health."

Not exactly the stamp of approval the Mandarins were looking for.

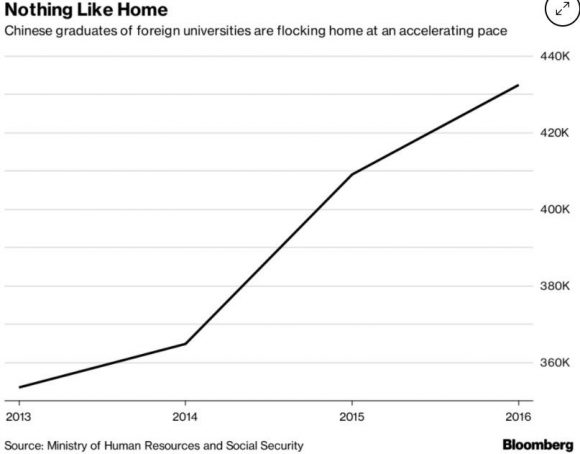

In turn, China has focused its effort on recruiting Chinese-Americans who understand the working environment better and have roots or even family on the mainland.

The dire tech talent shortage is worse in China than Silicon Valley because Chinese tech companies have zero access to non-Chinese talent.

Even with a reverse in immigration policies by the administration, America continues to be the holy grail of tech jobs.

That is why you see hoards of Chinese, Indians, Russians, and every other country's best and brightest waiting in line to make the move.

Taiwanese American CEOs lead some of Silicon Valley's best companies such as the CEO for Nvidia (NVDA), Jensen Huang, and the CEO of Advanced Micro Devices (AMD), Dr. Lisa Su.

Only 1% of Baidu's revenues is extracted from American soil underscoring the BAT's China-first business model. Tencent isn't much better at 5%, and Alibaba heads the list at 11%.

Compare these statistics with Alphabet (GOOGL) making 53% and Facebook (FB) earning 56% of revenue from international sales.

Amazon is still very much an American business but 32% of revenue comes from international sales.

The bulk of this revenue is mainly from Europe where American large-cap tech companies are staunch mainstays.

China has focused on building out its business in Southeast Asia instead.

Those governments are cozy with Beijing and are willing to relinquish some sovereign influence to develop its poor digital infrastructure.

The nail in the coffin for potential BAT companies doing business in America is the total lack of data protection in China.

If you think what Facebook is doing doesn't make you sleep at night, the BATs are running riot with personal data in China.

Expect multiple attempts of hackers breaking into your email while your phone number is constantly harassed by spam messages and robo-calls galore.

This is a normal day in the life of a Chinese national and they are used to it.

China understands they are not ready to eclipse the juggernaut that is Silicon Valley.

The BATs are biding their time organically growing by investing into American tech firms helping their overall products and services.

The past five years have seen a gorge of American investment amounting to 95 deals totaling $27.6 billion.

However, this smash-and-grab investment party is effectively over because CFIUS has clamped down on exporting local technology.

Consequently, the BATs will continue to focus on what they know best - the Chinese market.

Southeast Asia is also ripe to become the next stomping ground for the BATs. Expect them to dominate in this region for years to come.

The runway is long in domestic China. The 6.5% annual growth is entirely biased toward these three companies to prolong their hearty growth trajectories.

The communist party even has a seat on the board at each of these companies highlighting another area of conflict if these companies dive head into the American market.

Let's just say corporate governance in China is a shell of what it is in America.

One day there could be an all-out battle for tech supremacy, but these Chinese companies would need some assurances they would likely come out on top.

That is hardly the case yet and they make way too much money by copying Silicon Valley.

_________________________________________________________________________________________________

Quote of the Day

"The leader of the market today may not necessarily be the leader tomorrow," - said Tencent founder and CEO Ma Huateng.