Markets are wonderful arbiters of the laws of supply and demand.

When there is a shortage of a particular security, Wall Street has a magical ability to manufacture more by running the printing presses to meet supply, or in the modern incarnation, open the spreadsheets.

Except for this time.

The amount of new cash created by global quantitative easing and the prolific saving habits of locked up Americans are creating more demand than even this efficient highly process can accommodate.

Which means that prices can only go up.

How long and how far is anyone’s guess. My target for the Dow Average is 120,000 in ten years, but even I don’t expect that to take place in a straight line. So, we are all sitting on our hands waiting for the next pullback to buy into, which may….or may not ever happen.

A lot of Dotcom Bubble memories are rising up from the dead. Analysts in 1999 made outlandish forecasts of stocks rising 50% in a year, which then took place in four days. That happened to Tesla (TSLA) last month and Airbnb (ABNB) last week.

In the meantime, the smartest traders, call them the oldest traders, are taking profits on the best years of their careers.

Of course, the short-term direction of the market will be determined by the January 5 Georgia Senate election, where the polls are in a dead heat. The last time this happened, during the presidential election, the Democrats won by a microscopic 15,000 vote margin.

If history repeats itself, the Biden administration will get an extra $6 trillion to play with to restore the shattered US economy. Think $2 trillion for infrastructure spending in all 50 states, $2 trillion for the rescue of bankrupt states and municipalities, $1 trillion for alternative energy and EV subsidies, and another $1 trillion in odds and ends. Needless to say, much of this will end up in the stock market.

I am getting a lot of questions these days regarding what will end this once-in-a-generation runaway bull market. The pandemic created this bull market by accelerating technology, business evolution, and corporate profitability by ten years. I bet a year ago, you weren’t spending your day on Zoom meetings, as I was.

The great irony is that the Pfizer (PFE) and Moderna (MRNA) vaccines may not only kill Covid-19 but the bull market as well. That’s because money will then come out of stocks and go back to the real economy.

That makes pandemic darlings like Peloton (PTON), DocuSign (DOCU), and Etsy (ETSY) especially risky. But then 6% growing GDPs were never what stock market crashes were made of, so any declines will be modest.

As for my own positions, I have a rare 100% long portfolio, mostly Tesla, but also the (TLT), (CAT), (JPM), and (BABA), 80% of which expires with the option expiration on Friday, December 18.

After that, I’ll take it easy with 10% short (TLT) and 10% long (TSLA) and wait for the market, or Georgians to tell me what to do.

A flood of money is to hit the stock market, says hedge fund legend Ray Dalio. The US is facing a perfect storm in favor of all risk assets. There is no reason why price earnings multiples for American stocks can’t reach 50X, double the current 25X. Buy what the central banks are buying. The funny thing is that I agree with Ray on everything. Buy risk on dips.

Stocks will keep soaring into 2021, says JP Morgan strategist Marko Kolanovik. The more risk the better. The Fed will keep interest rates low for at least another year, and ultra-low rates will force big institutions out of bonds and into stocks. Volatility (VIX) will decline. It all sounds like a great long stock/short bond trade to me. Hmmmmm.

Tesla completed a $5 Billion share issue, after a move to $650, up $142 from my November Mad Hedge BUY recommendation. The stock seems hell-bent on testing the Goldman Sachs $780 price recommendation before the December 18 S&P 500 entry. Elon Musk’s creation is now worth a staggering $608 billion. It’s the best recommendation in the 13-year history of the Mad Hedge Fund Trader.

San Francisco rents dive 35%, as tech workers flee to the suburbs. A lot of remote work is now permanent. Studio apartments are now a mere $2,100, and a one-bedroom can be had for $2,716. For a two-bedroom if you have to ask, you don’t need to know. Shocking!

Sales of million-dollar homes are soaring, as ultra-low interest rates persist and people spend much more time at home. So, bigger for your pod is better. Mortgages over $766,000 are up 57% YOY.

Jamie Diamond says he wouldn’t touch bonds with a ten-foot pole, and nor would I. A 91-basis point yield just doesn’t do it for the chairman of JP Morgan Chase (JPM), one of my recurring longs. Stocks are a much better choice, even if there is a bubble in progress. Keep selling every rally in fixed income, especially the (TLT).

Weekly Jobless Claims soar to 853,000, up a massive 153,000 from the previous week. To see this happen during the Christmas hiring season is heartbreaking. With 200,000 a day falling to Covid-19, I’m surprised it's not higher, which means it will be. This is what peaks look like. Washington has totally given up.

An $800 billion payday for the bay area. That is the amount of wealth created by just two companies, Tesla (TSLA) and Airbnb (ABNB), since March. And the great majority of shareholders live in the San Francisco Bay Area, including its venture capital and pension funds. No wonder home prices in the suburbs are up 20% YOY. The great irony is that (ABNB) received a massive government bailout only in March. I hope they repay the loans early.

Is Cuba the next big play? A Biden détente could lead to the emerging market investment opportunity of the decade with the $43 million Herzfeld Caribbean Basin Fund (CUBA). It just had its best month in 11 years (like many of us). With Fidel Castro long dead, what’s the point in continuing a 60-year-old cold war. A big market for American products and services beckons, not to mention the tourism and cruise opportunities. But can Biden afford to lose the Florida Cuban vote in the next election?

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

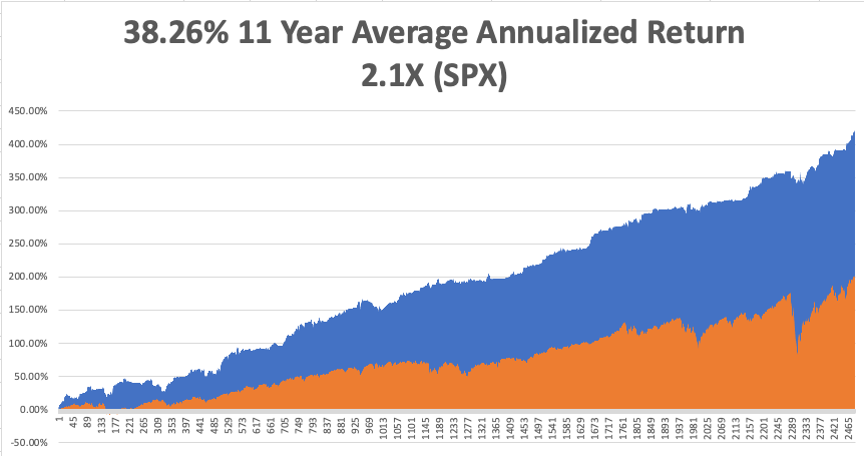

My Global Trading Dispatch catapulted to another new all-time high. December is up 8.55%, taking my 2020 year-to-date up to a new high of 64.99%.

That brings my eleven-year total return to 420.90% or more than double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.26%. My trailing one-year return exploded to 66.30%, the highest in the 13-year history of the Mad Hedge Fund Trader.

The coming week will be a slow one on the data front. We also need to keep an eye on the number of US Coronavirus cases at 16 million and deaths 300,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, December 14 at 12:00 PM EST, US Consumer Inflation Expectations for November are released.

On Tuesday, December 15 at 11:00 AM, the New York Empire State Manufacturing Index for December are published.

On Wednesday, December 16 at 8:00 AM, US Retail Sales for November are printed.

On Thursday, December 17 at 8:30 AM, the Weekly Jobless Claims are published. We also get November Housing Starts.

On Friday, December 18, at 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I was stunned to learn that 84 million people are watching The Mandalorian, the latest Star Wars installment Disney (DIS) launched in its hugely successful streaming service a year ago.

It reminds me of when I first saw Star Wars in 1977. I was changing planes in Vancouver, Canada on the way to Tokyo and used a long layover to take a taxi to the nearest theater to catch a film I’d heard so much about.

I was amazed when I realized that the guy sitting in the next seat had memorized the entire script and was mouthing all the words. The only other time I have ever seen this happen was sitting on the benches at Shakespeare’s Globe Theater in London. At least then, they were reciting Romeo and Juliet.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader