The second tier of social distancing tech stocks will do well in this brave new world in which digital lives have superseded physical ones.

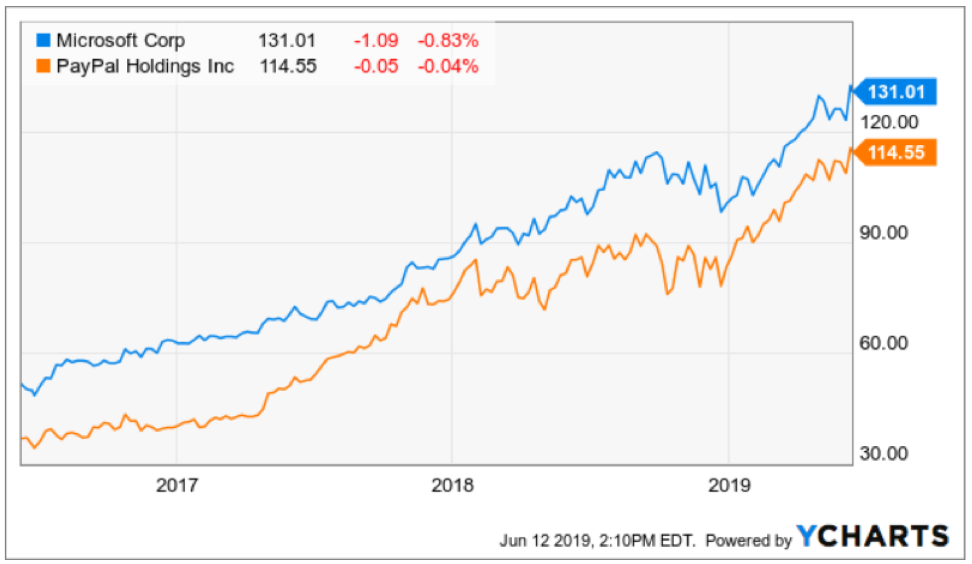

Sure, most of you already know that Amazon (AMZN), Slack (WORK), Microsoft (MSFT), Zoom Communications (ZM), and Teladoc Health (TDOC) are the crown jewels of current social distancing tech stocks, but there is another group that should also outperform.

Here are 4 that you should take a look at with DocuSign being the best of the bunch:

DocuSign (DOCU)

Teleconferencing and other niches have come front and center and consummating deals have migrated to one place since people cannot physically sign their name from pen to paper.

Electronic signatures were basically a cottage industry when it came out, but it is here to stay and this company has investors buzzing. Although the volume of business agreements being signed globally may temporarily slip, those that are continuing to work are enabled by DocuSign to close agreements without meeting eye to eye.

I expect resiliency in the type of products DocuSign provides and the remote implementation options.

DocuSign is well-positioned within the defensive category of digital transformation spend. Their recent acquisition of Seal Software will help boost DocuSign’s ability to leverage the power of artificial intelligence in the domain of contract analytics.

The opportunity to mitigate time spent on manual workflows through the addition of Seal to the portfolio can bolster the value proposition and drive ROI (return on investment) for customers.

The trajectory of the company was validated by DocuSign’s strong fourth-quarter earnings results with adjusted earnings increasing 12 cents per share which is a 100% increase year over year.

Just as impressive, DocuSign posted quarterly revenue of $274.9 million, an increase of 38%. As the data suggests, the signals all point to this company continuing its outperformance.

The e-document market has been monopolized by DocuSign with competition shut out, and as business goes 100% virtual in the current environment, this should have a positive network effect that will resonate when the world opens back up.

The next 3 stocks aren’t growth companies like DocuSign but are cheap stocks under $10 that might be worth a look.

Sirius XM Holdings (SIRI)

With all the extra time at home, satellite radio has hit the jackpot, making their services much more appealing.

Since Sirius and XM Radio merged in 2008, the combined Sirius XM Holdings has enjoyed a near-monopoly on satellite radio.

Sirius built on that with the 2018 acquisition of Pandora, the music streaming product, helping to fill the sails again with rapid revenue growth; its audio products now reach more than 100 million people.

Sirius' situation is appearing healthy and added a further 1.1 million subscribers in 2019 alone, bringing its total paying subscribers to roughly 30 million. The company's audacious strategy of partnering with auto manufacturers to pre-install SiriusXM in new models should help steadily grow the business.

Zynga (ZNGA)

This video game stock is cheap and could be a beneficiary of the stay at home revolution.

Zynga's portfolio of popular games, combined with hyper-charged growth, makes it one of the best cheap stocks to buy under $10.

Last quarter, the social gaming developer behind franchises like Words With Friends, Zynga Poker, CSR Racing, and FarmVille set new company revenue records up 48%.

While growth is likely to decelerate quickly from such temporary coronavirus catalysts, I expect double-digit revenue growth in 2020.

Still, Zynga is holding up remarkably well, especially in the COVID-19 era, as people increasingly turn to mobile devices for entertainment.

Nokia Corp. (NOK)

Nokia's expected earnings growth is impressive with Wall Street looking for an 8% bump in 2020 and roughly 30% profit growth in 2021.

Cheap stocks to invest in under $10 don't often come in the form of well-oiled global corporations valued at $15 billion.

The Finnish communication equipment telecom is one of the rare exceptions against the rule.

Sales have grown 14% annually for the last five years. Nokia may end up one of the 5G stocks to watch in the coming years because of the stigma of Huawei forcing many Europeans to go with brands closer to home.

Nokia pays a hefty 8% dividend as well and will never need a last-second bailout.