Listening to 27 presentations during the Mad Hedge Traders & Investors Summit last week (click here for the replays), I couldn’t help but notice something very interesting, if not alarming.

All the charts are starting to look the same.

You would expect all the technology charts to be similar on top of the historic run we have seen since the March 23 bottom.

But I wasn’t only looking at technology stocks.

Analyzing the long-term charts for stock indexes, bonds, real estate, and gold, it is clear that they ALL entered identical parabolic moves that began during the notorious Christmas bottom in December 2018.

With the exception of the pandemic induced February-March hiccup this year, it has been straight up ever since.

The best strategy of all for the past three years has been to simply close your eyes and buy EVERYTHING and then forget about it. It really has been the perfect idiot’s market.

This isn’t supposed to happen.

Stocks, bonds, real estate, and gold are NEVER supposed to be going all in the same direction at the same time. The only time you see this is when the government is flooding the financial system with liquidity to artificially boost asset prices.

This latest liquidity wave started when the 2017 Trump tax bill initiated enormous government budget deficits from the get-go. It accelerated when the Federal Reserve backed off of quantitative tightening in mid-2019.

Then it really blew up to tidal wave proportions with the Fed liquidity explosion simultaneously on all fronts with the onset of the US Corona epidemic.

Asset classes have been going ballistic ever since.

From the March 23 bottom, NASDAQ is up an astounding 78%, bonds have gained an unprecedented 30%, the US Homebuilders ETF has rocketed a stagging 187%, and gold has picked up an eye-popping 26%.

That’s all well and good if you happen to be long these asset classes, as we have been advising clients for the past several months.

So, what happens next? After all, we are in the “What happens next?” business.

What if one of the charts starts to go the other way? Is gold a good hedge? Do bonds offer downside protection? Is there safety in home ownership?

Nope.

They all go down in unison, probably much faster than they went up. If fact, such a reversal may be only weeks or months away. If you live by the sword you die, by the sword.

Assets are now so dependent on excess liquidity that any threat to that liquidity could trigger a selloff of Biblical proportion, possibly worse than what we saw during February-March this year.

And you wouldn’t need simply a sudden tightening of liquidity to prompt such a debacle. A mere slowdown in the addition of new liquidity could bring Armageddon. The Fed in effect has turned all financial markets into a giant Ponzi scheme. The second they quit buying, they all crash.

The Fed and the US Treasury have already started executing this retreat surreptitiously through the back door. Some Treasury emergency loan programs were announced with a lot of fanfare but have yet to be drawn down in size because the standards are too tight.

The Fed has similarly shouted from the rooftops that they would be buying equity convertible bonds and ETFs but have yet to do so in any meaningful way.

If there is one saving grace for this bull market, it's that it may get a second lease on life with a new Biden administration. Now that the precedent for unlimited deficit spending has been set by Trump, it isn’t going to slow down anytime soon under the Democrats. It will simply get redirected.

One of the amazing things about the current administration is that they never launched a massive CCC type jobs program to employ millions in public works as Roosevelt did during the 1930s to end that Great Depression. Instead, they simply mailed out checks. Even my kids got checks, as they file their own tax returns to get a lower tax rate than mine.

I think you can count on Biden to move ahead with these kinds of bold, expansionist ideas to the benefit of the nation. We are still enjoying enormously the last round of such spending 85 years ago, the High Sierra trails I hiked weeks ago among them.

Stocks soared on plasma hopes. Trumps cited “political” reasons at the FDA for the extended delay. Scientists were holding back approval for fears plasma was either completely useless and would waste huge amounts of money or would kill off thousands of people. At best, plasma marginally reduces death rates for those already infected, but you’re that one it’s worth it. Anything that kills Covid-19 is great for stocks.

Existing Home Sales were up the most in history in July, gaining a staggering 24.7% to 5.86 million units. Bidding wars are rampant in the suburbs. Investors are back in too, accounting for 15% of sales. Inventories drop 21% to only 3.1 months. These are bubble type statistics. Can’t hold those Millennials back! This will be a lead sector in the market for the next decade. Buy homebuilders on dips.

Goldman said a quarter of job losses are permanent, as the economy is evolving so fast. Many of these jobs were on their way out before the pandemic. That could be good news for investors as those cost cuts are permanent, boosting profits. At least, that’s what stocks believe.

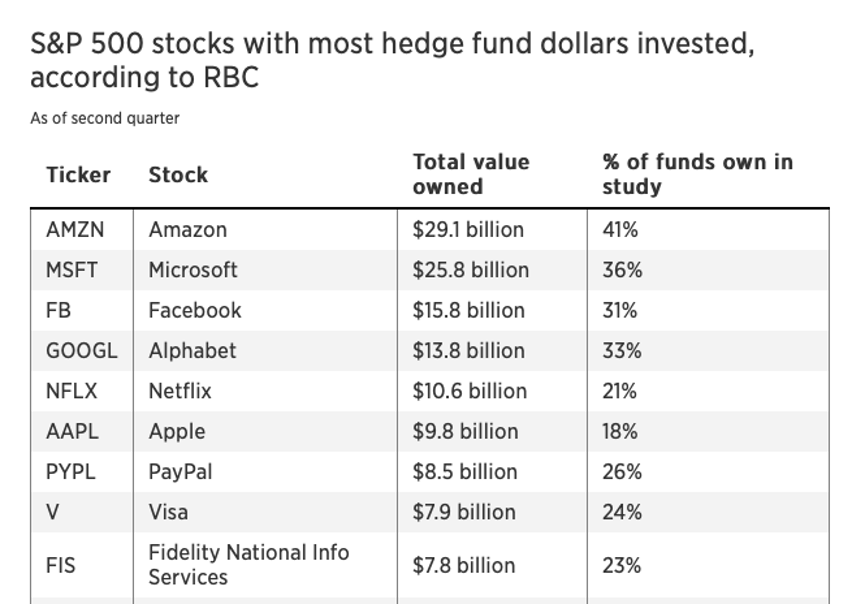

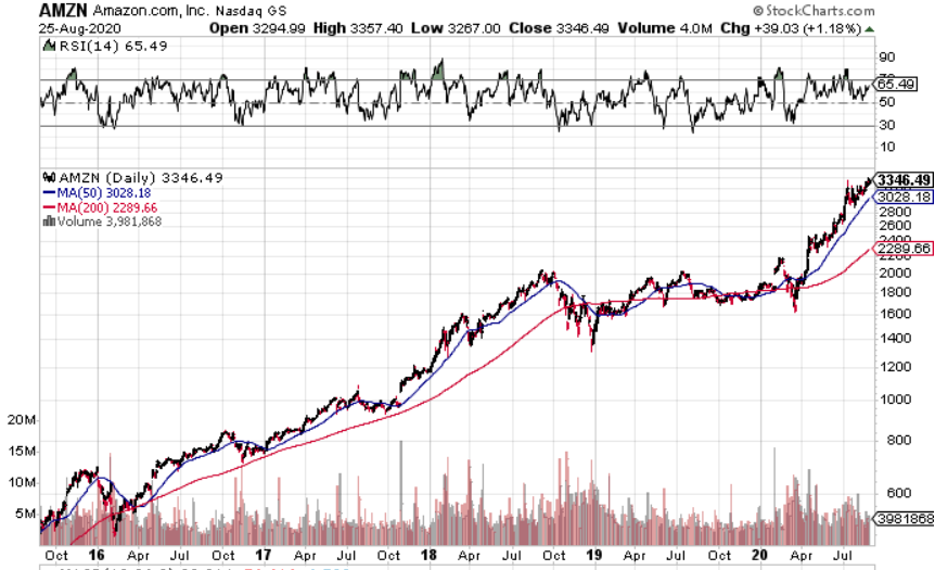

Hedge funds still love big tech, even though they are now at the 99th percentile of historic valuation ranges. Online financials, banks, and credit card processors also rank highly. Live by the sword, die by the sword.

Massive Zoom crash brought the world to a halt for two hours on Monday morning. It looked like a Chinese hack attack intended to delay online school opening of the new academic year. Unfortunately, it also delayed the start of the Mad Hedge Traders & Investors Summit.

The Dow Rebalancing is huge. Dow Jones rarely rejiggers the makeup of its famed but outdated index. But changing three names at once is unprecedented. One, Amgen (AMGN) I helped found, working on the team the discovered its original DNA sequencing. All of the founding investors departed yonks ago. The departure of Exxon (XOM) is a recognition that oil is a dying business and that the future is with Salesforce (CRM), whose management I know well. One big victim is Apple (AAPL) whose weighting in the index has shrunk.

The end of the airline industry has begun, with American (AAL) announcing 19,000 layoffs in October. That will bring to 40,000 job losses since the pandemic began. The industry will eventually shrink to a handful of government subsidized firms and some niche players. Avoid like a plat in a spiral dive.

30 million to be evicted in the coming months, as an additional stimulus bill stalls in Congress. It will no doubt be rolling evictions that stretch out over the next year. This will be the true cost of failing to deal with the virus.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

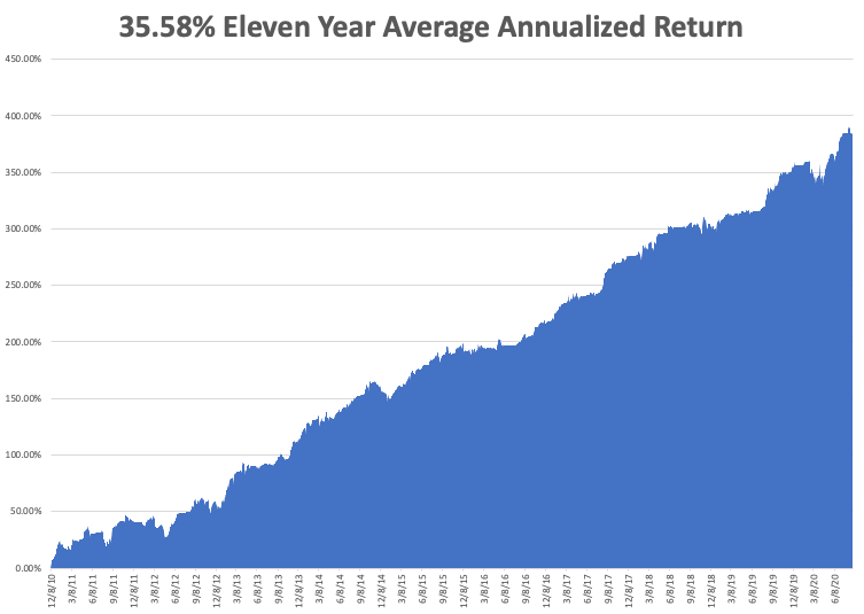

My Global Trading Dispatch suffered one of the worst weeks of the year, giving up most of its substantial August performance. If you trade for 50 years, occasionally you get a week like this. The good news is that it only takes us back to unchanged on the month.

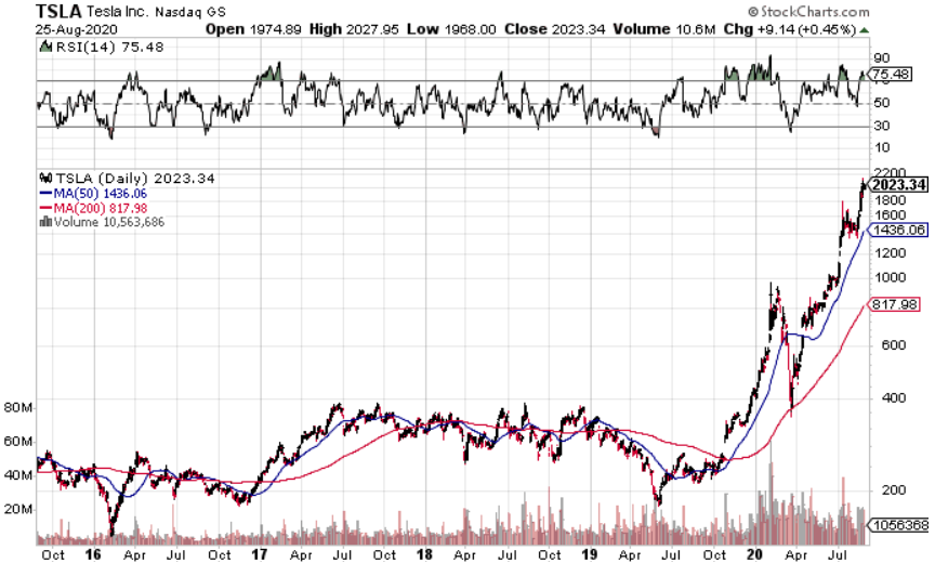

Longs in banks (JPM) and gold (GLD) and shorts in Facebook (FB) and bonds (TLT) held up fine, but we paid through the nose with shorts in Apple (AAPL), Amazon (AMZN), and Tesla (TSLA).

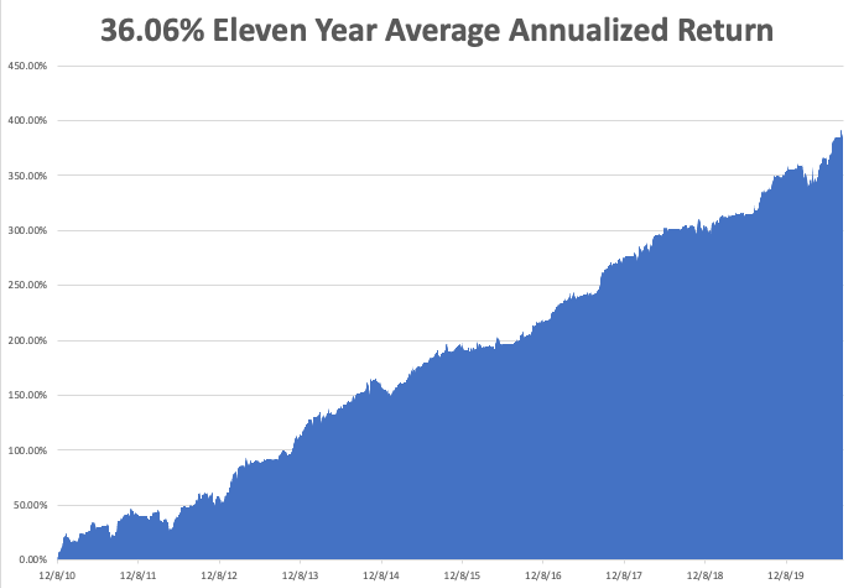

That takes our 2020 year to date down to 26.56%, versus +0.05% for the Dow Average. That takes my eleven-year average annualized performance back to 35.58%. My 11-year total return retreated to 382.47%.

It is jobs week so we can expect a lot of fireworks on the data front. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, August 31 at 10:30 AM EST, the Dallas Fed Manufacturing Index for August is released.

On Tuesday, September 1 at 9:45 AM EST, the Markit Manufacturing Index for August is published.

On Wednesday, September 2, at 8:13 AM EST, the August ADP Employment Change Index for private-sector job is printed.

At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out.

On Thursday, September 3 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, September 4, at 8:30 AM EST, The August Nonfarm Payroll Report is released.

At 2:00 PM The Bakers Hughes Rig Count is released.

As for me, I’ll be catching up on my sleep after hosting 27 speakers from seven countries and entertaining a global audience of 10,000 from over 50 countries and all 50 US states. We managed to max out Zoom’s global conferencing software, and I am now one of their largest clients.

It was great catching up with old trading buddies from decades past to connect with the up-and-coming stars.

Questions were coming in hot and heavy from South Africa, Singapore, all five Australian states, the Persian Gulf States, Saudi Arabia, East Africa, and every corner of the United Kingdom. And I was handling it all from my simple $2,000 Apple laptop from nearby Silicon Valley.

It is so amazing to have lived to see the future!

To selectively listen to videos of any of the many talented speakers, you can click here.

See you there.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader