Welcome to the perfect storm.

If there was ever any doubt that the market was going straight up for the rest of the year, it was dashed when the infrastructure budget passed on late Friday night with bipartisan support. Another $1.2 trillion will be dumped into the economy next year, adding 6% to GDP growth.

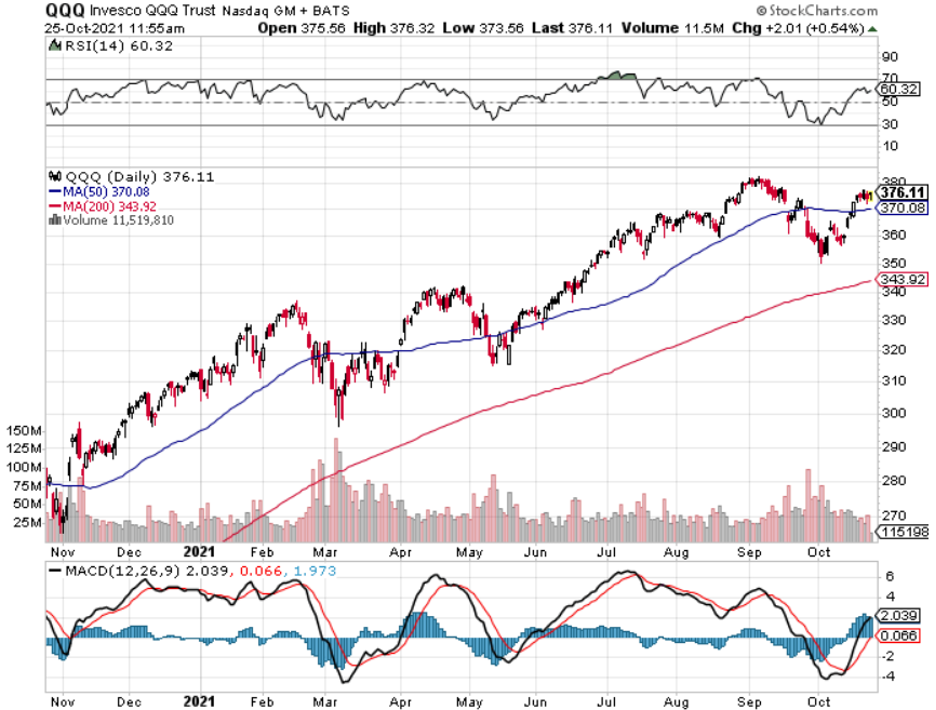

Of course, the stock market started sniffing out this possibility and resumed racing yet again to new all-time highs on September 30.

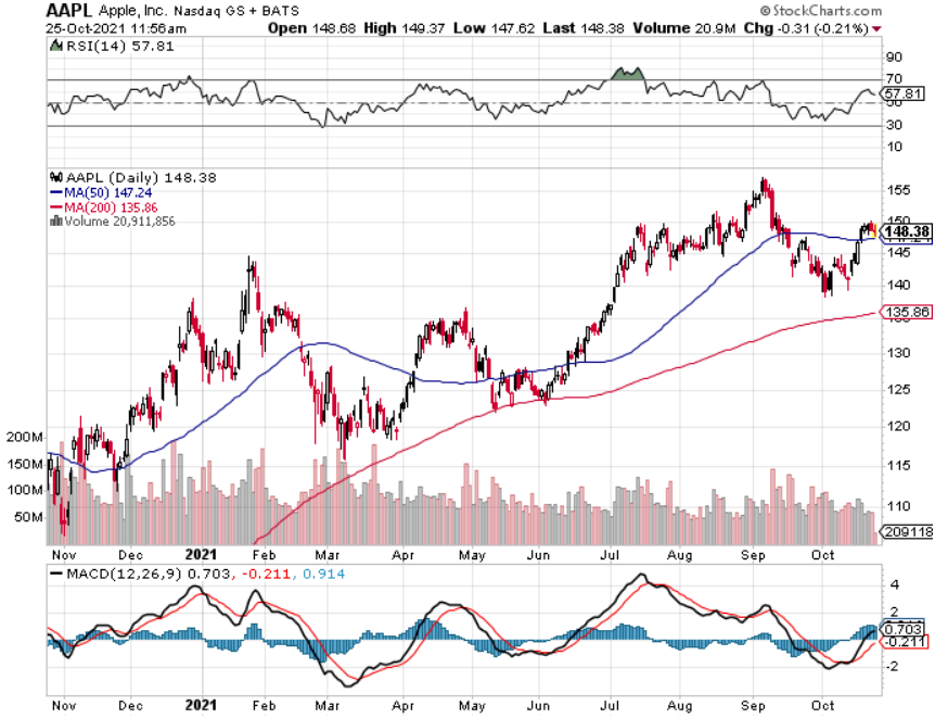

The latest round of earnings reports proved that corporate profit margins are exploding, along with profits. Demand is through the roof. It turned out that demand WASN’T lost, just deferred, as I vociferously begged followers to buy stocks at the April 2020 bottom.

Interest rates went down instead of up sharply on news of the Fed taper.

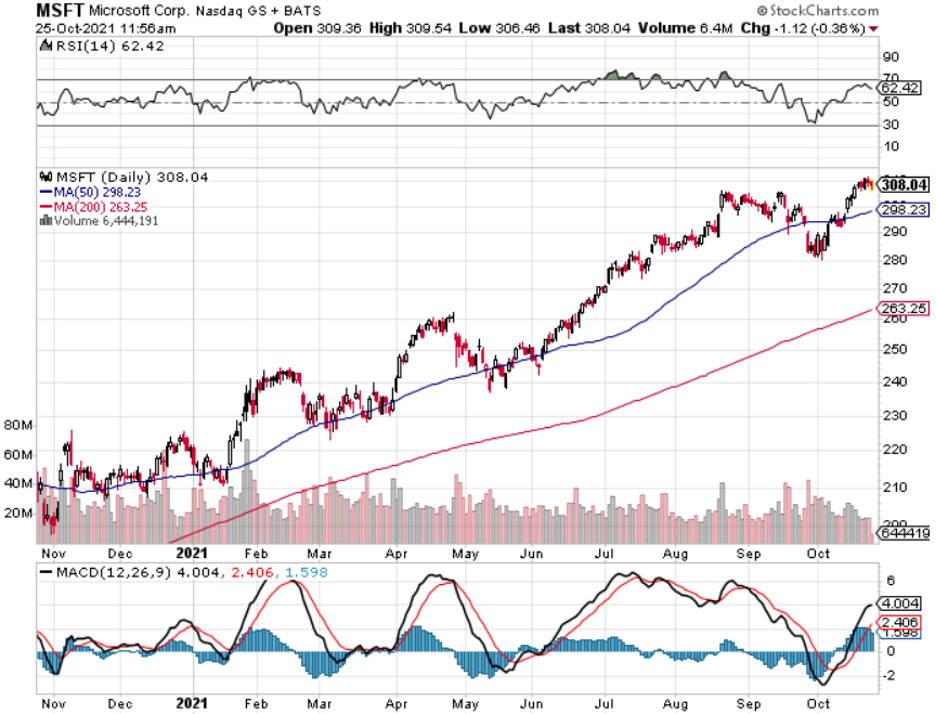

And the 10% correction that many expected never showed, forcing managers to chase the market so they can be seen as fully invested in the right names at yearend. That means buying more Alphabet (GOOGL), Microsoft (MSFT), Goldman Sachs (GS), and Morgan Stanley (MS) at whatever price so managers can look like the brilliant people that they really AREN’T.

There is no doubt that the economic data is turning from mixed to red hot.

We will see a Capital spending renaissance in 2022 as the economy shifts from manufacturing to service-driven, and services account for 80% of US GDP. It’s a perfect formula for an economy that is catching on fire.

As for the missing 5 million workers, I think what we are seeing is a 9/11 effect. That’s when people become aware of the transitory nature of life and ask themselves why they are working at a job they hate, some 80% of the labor force, especially at the minimum wage level. They retrain for better-paying, more meaningful professions, retire early, or otherwise go missing in action.

There is another category of missing workers: those who have made so much in the stock market and Bitcoin in the last 18 months they never have to work another day in their life. Are there 5 million of them? Maybe.

And how come everybody in the world knows that interest rates are rising except the bond market? The United States Treasury Bond Fund (TLT) has seen two, count them, two massive three-point RALLIES in the last ten days. The (TLT) may give all this back this week when we get hot inflation data.

It is a positioning issue and a classic “buy the rumor, sell the news” on interest rates. When the entire world is short bonds, they can only go UP. This means we are likely to see a $141-$151 (TLT) range in bonds for the next six months until we start to see actual interest rate RISES.

The Fed Tapers! The Fed taper starts immediately and will accelerate in 2022 until it goes to zero by June. Stocks took off, while bonds dove a $1.50 as soon as they noticed that “transitory” was missing from the release. Will the first interest rate hike in four years be moved up to June? Or do we get a double rate hike in December 2022? That’s where we may see the real volatility, after the market close. Semiconductor growth stocks hit new all-time highs. Financials moving back to highs, as are big tech stocks.

Q3 GDP comes in at a weak 2.0%, down from a 6% rate in Q2, thanks to the ravages of the delta virus, now in the rearview mirror. What happens next? That 4% wasn’t lost, just deferred into 2022. The rip-roaring 6% growth rate returns. That’s why stocks are pushing up to new all-time highs right now. I’m looking for a 5% growth rate next year as government stimulus spending eventually fades.

Nonfarm Payroll Report explodes to the upside in October at 531,000. The Headline Unemployment Rate drops to 4.6%. Pandemic benefits have ended, and a wider vaccination rate encouraged workers it is safe to go back on the job. The back months were revised up 250,000. Manufacturing was up 60,000 and Leisure & Hospitality was up 164,000, The U-6 “discouraged worker” unemployment rate fell to 8.3%. And there is massive pent-up hiring is yet to come. The US could see full employment by the end of Q3 anticipating a 6% GDP growth rate. The markets loved it and the (SPY) is zeroing in my $475 yearend target.

Inflation is rampaging, according to the Department of Commerce, which saw a sizzling 4.4% rate in September. That’s the fastest rate in 30 years. Rising energy and wage costs are big issues. This is why Goldman Sachs has moved up its forecast for the first interest rate rise to July 2022.

US Consumer Spending bounces back, up 0.6% in September after a hot 1% move in August. Demand for services took the lead as shortages head off spending on goods, like cars.

Ethereum hits a new all-time high, ticking at $4,670 in response to the Fed’s immediate taper. Bitcoin is still consolidating its recent three-month doubling. Buy (BITO), (ETHE), and (BLOK) on dips.

US Stock Buy Backs hit record in Q3, topping a staggering $224 billion, and the best is yet to come as companies try to burn through 2021 repurchase budgets. And you wonder why the stock market is going up?

US Dollar hits one-year high on red hot jobs data, presaging higher interest rates. Everyone seems to know that rates are rising except the bond market.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch saw a massive +8.95% gain in October, followed by a decent 1.74% so far in November. My 2021 year-to-date performance maintained 90.30%. The Dow Average is up 16.7% so far in 2021.

After the recent ballistic move in the market, I am continuing to run my longs in Those include (MS), (GS), (BAC), (BRKB), and a short in the (TLT). All are approaching their maximum profit point and we have nothing left but time decay to capture. So, I am going to run these into the November 19 expiration in 9 trading days. It’s like having a rich uncle write you a check one a day.

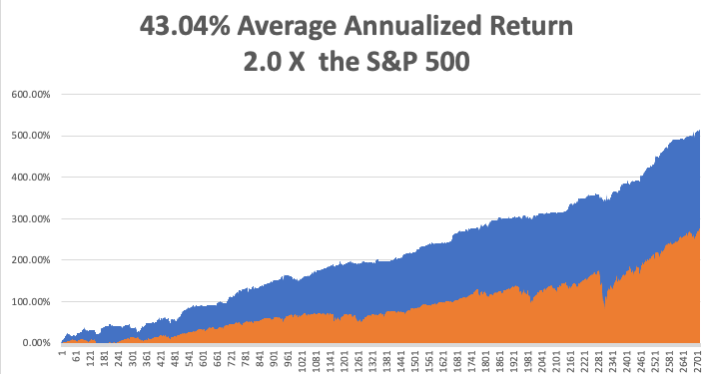

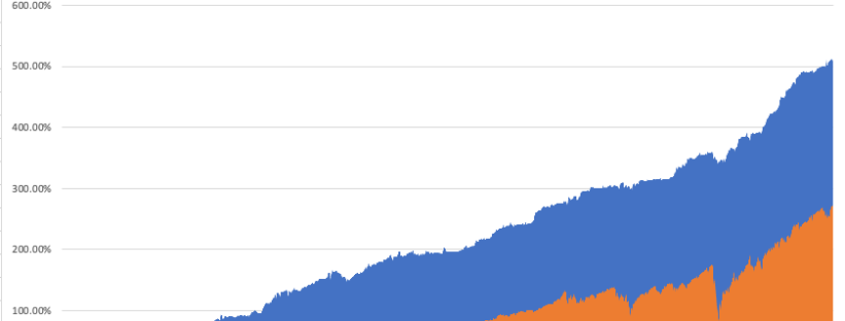

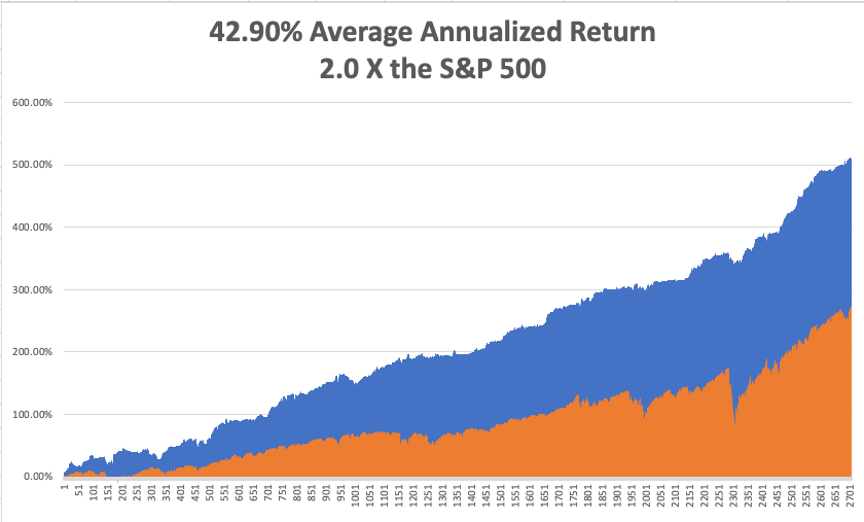

That brings my 12-year total return to 512.85%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 43.04 easily the highest in the industry.

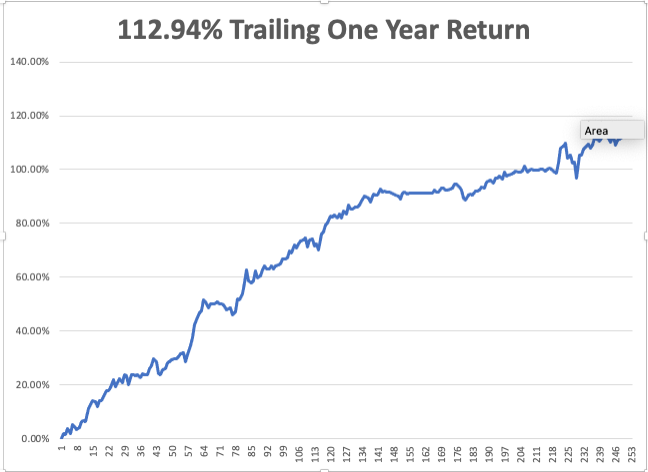

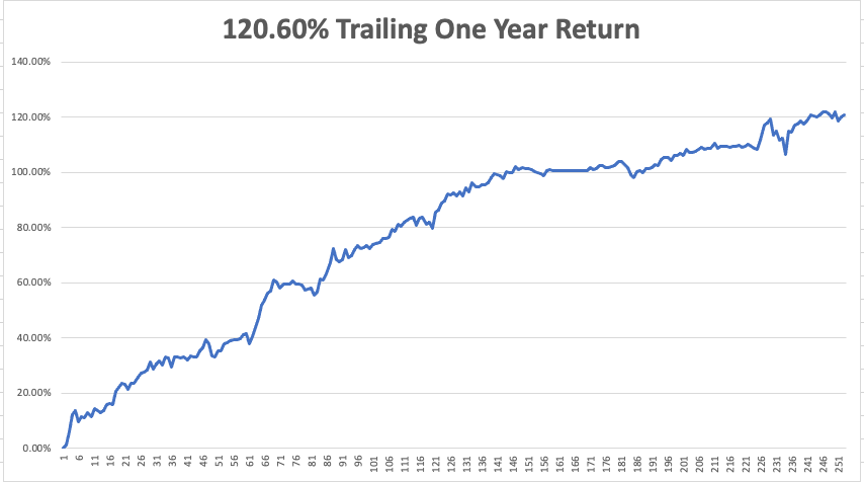

My trailing one-year return popped back to positively eye-popping 112.94%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 46.5 million and rising quickly and approaching 755,000 deaths, which you can find here.

The coming week will be all about the inflation numbers.

On Monday, November 8 at 9:00 AM, US Consumer Inflation Expectations for October are out. PayPal reports.

On Tuesday, November 9 at 8:30 AM, the all-important Producer Price Index is published. DR Horton (DHI) reports.

On Wednesday, November 10 at 8:30 AM, the Core Inflation Rate for October is printed. Walt Disney reports (DIS).

On Thursday, November 11 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, November 12 at 8:30 AM, the University of Michigan Consumer Sentiment is announced.

At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed.

As for me, dentists find my mouth fascinating as it is like a tour of the world. I have gold inlays from Japan, cheap ceramic fillings from Britain’s National Health, and loads of American silver amalgam.

But my front teeth are the most interesting as they were knocked out in a riot in Paris in 1968.

France was on fire that year. Riots on the city’s South Bank near Sorbonne University were a daily occurrence. A dozen blue police buses packed with riot police were permanently parked in front of the Notre Dame Cathedral ready for a rapid response across the river.

President Charles de Gaulle was in hiding at a French airbase in Germany. Many compared chaos to the modern-day equivalent of the French Revolution.

So, of course, I had to go.

This was back when there were five French francs to the US dollar and you could live on a loaf of bread, a chunk of cheese, and a bottle of wine for a dollar a day. I was 16.

The Paris Metro cost one franc. To save money, I camped out every night in the Parc des Buttes Chaumont, which had nice bridges to sleep under. When it rained, I visited the Louvre, taking advantage of my free student access. I got to know every corner. The French are great at castles….and museums.

To wash I would jump in the Seine River every once in a while. But in those days, not many people in France took baths anyway.

I joined a massive protest one night which originally began over the right of men to visit the women’s dorms at night. Then the police attacked. Demonstrators came equipped with crowbars and shovels to dig up heavy cobblestones dating to the 17th century to throw at the police, who then threw them back.

I got hit squarely in the mouth with an airborne projectile. My front teeth went flying and I never found them. I managed to get temporary crowns which lasted me until I got home. I carry a scar across my mouth to this day.

I visited the Left Bank just before the pandemic hit in 2019. The streets were all paved with asphalt to make the cobblestones underneath inaccessible. I showed my kids the bridges I used to sleep under, but they were unimpressed.

But when I showed them the Mona Lisa at the Louvre, she was as enigmatic as ever.

Everyone should have at least one Paris in 1968 in their lifetime. I’ve had many and am richer for it.

Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

1968

2019