Jeff Bezos is a god.

Well, not quite but he is turning into one after Amazon delivered a mythical earnings report that left Amazon haters in awe.

The Amazon bears patiently waiting for the day of reckoning will have to wait longer as Amazon smashed earnings expectations by a magnitude of two or three.

Amazon had a lot riding on the most recent earnings report after racing to new highs in mid-March.

The brief macro-correction then gave investors yet another entry point into one of the best companies of our generation that is still up more than 30% this year.

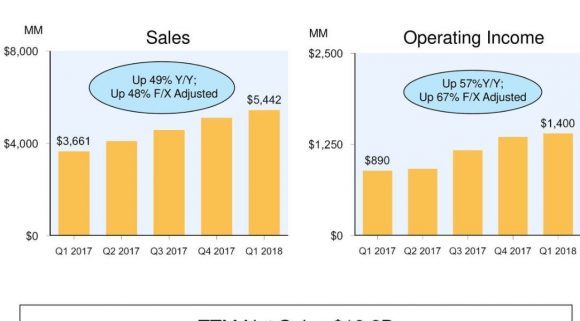

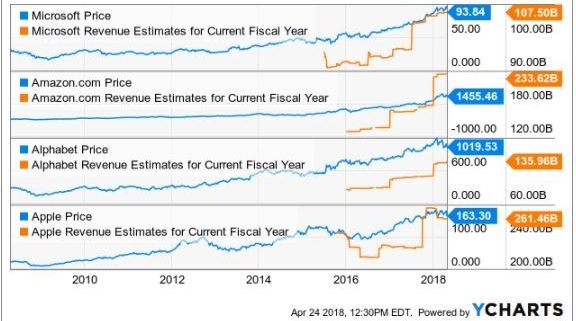

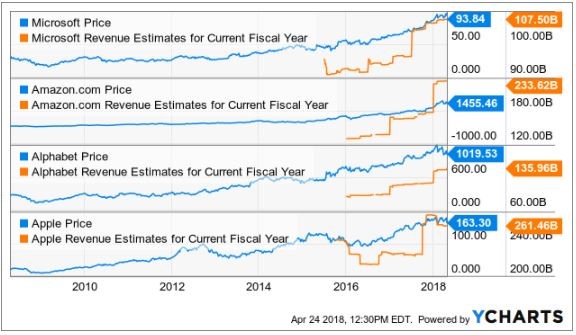

Amazon Web Services (AWS) revenue reaccelerated from its 42% growth last year to a high octane 49% YOY and made up a disproportionate 73% of Amazon's operating income.

Amazon is heavily reliant on the AWS segment to carry it through feast or famine.

According to Jeff Bezos, its critically acclaimed cloud segments' outstanding results originate from the "seven-year head start before like-minded competition."

This reaffirms the benefit of first-mover advantage with which large cap tech is obsessed.

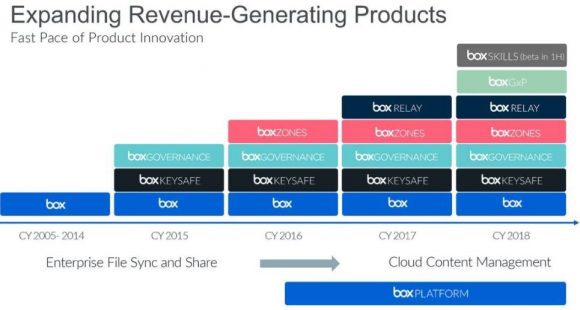

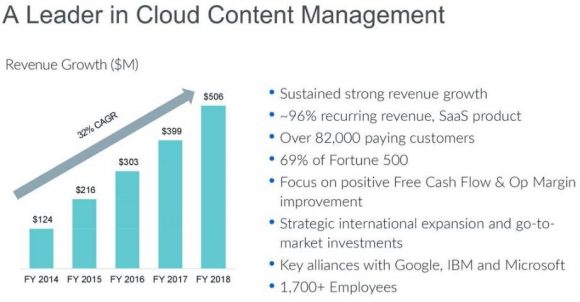

There is room for other companies in the cloud space, with the cloud industry expanding 20% in 2018 to $186 billion.

Therefore, expanding by 20% is the bare bones minimum to be considered relevant.

Amazon has positioned itself to funnel in the most dollars that migrate toward the cloud as the industries pioneer and best of breed.

After the latest earnings report, Amazon is in pole position to become the first publicly traded $1 trillion company.

This latest quarter wrapped up its 62nd consecutive quarter of 20% plus growth.

And the commentary coming out of the earnings reports makes it almost certain that Amazon will capture more market share.

There were a few bombshells dropped that were unequivocal positives for investors.

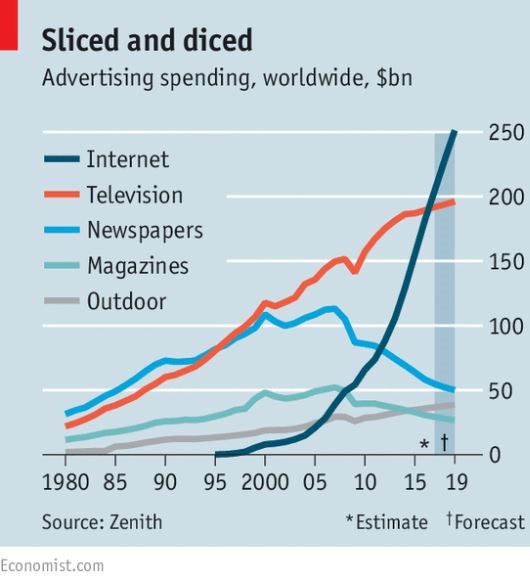

First, Amazon has become the third player in digital ad industry with the duopoly of Google search and Facebook.

Amazon revved up its digital ad revenue by 139% QOQ to a substantial $2.03 billion per quarter business.

This business is particularly appetizing because of its high margins and will help alleviate tight margins on the e-commerce side.

Amazon's digital ad business is by far the fastest growth lever in its portfolio. It will ramp up this side of the business whose main function is to match consumers with suitable products that consumers otherwise would miss out on in a standard Amazon search.

The extraordinary numbers support the notion that the hoopla of Washington regulation is all bark and no bite.

Facebook also delivered a prodigious quarter for the ages amid testimony and public backlash that resulted in immaterial damage to top- and bottom-line numbers.

The second bombshell announced was the change in pricing to prime members. Amazon upped its annual prime membership to $119 from $99.

This additional $20 price hike, or 20% on 100 million prime members, will swell revenue by an extra $2 billion of incremental revenue.

In total, Amazon will accrue a bonus of 4% of revenue by this price change.

Amazon has a high fixed-cost business, and slightly tweaking prices will create a huge windfall with the revenue almost entirely flowing down to the bottom line in the form of pure profit.

Many industry analysts claim that Amazon has the best management team in the industry and explicate this company as an "Internet staple."

More than 100 million products are delivered with free shipping for Amazon prime customers. This is starkly higher than the 20 million products shipped for free in 2014.

Amazon does everything in its power to offer a unique and efficient experience for customers.

The customer satisfaction reveals itself by the rock-bottom churn rate.

Amazon prime at an annual cost of $119 is such a value that no analysts even dared to ask Amazon CFO Brian Olsavsky if consumers would take issue with the rise in price.

Investors and strangers alike assume that broad-based reoccurring revenue from annual prime membership is a given.

In an era of mass-scrutinization, Amazon's earnings call seemed like a celebration of the mythical achievements that are changing consumer behavior by the day.

The lack of inquiry was justifiable this time because the one major shortcoming suddenly remedied itself.

Amazon's doubters frequently attack the lack of margin growth because its business model is first and foremost a land grab for market share ignoring any remnants of margin stability.

Now that Amazon's digital ad business has sprouted up, the margin story, starting from a miniscule base, will go from weakness to an unrelenting success.

Amazon started with its ultra-thin margin e-commerce business that made an operating loss of $160 billion in 2017.

Cranking up a shiny, high margin business will be hard for the other FANGs to compete with as they gyrate toward other businesses that have lower margins than Amazon's digital ad segment.

This is a horrible time to start fighting Amazon in price wars as the paradigm shift to quantitative tightening has made the cost of capital demonstrably pricier.

Operating margins almost doubled from 2% to 3.8% on $51 billion of quarterly sales.

This is a huge deal.

Amazon has been continuously harangued for "not making money." Well, that era is over.

Profits, and not only revenue, will start accelerating and Amazon will become the closest thing to a perfect company.

The years and years of plowing cheap capital back into fulfillment center and e-commerce activity gave Amazon a stained reputation for years.

However, as Amazon turns the screws and uses its foundational leverage to capture additional profits, the other FANGs will be forced down the same path ruining operating margins for the other big players.

Amazon telegraphed its quest for market share strategy to investors years ago, and investors understand they are paying for growth and growth only.

That will change now that profits have become a real part of its arsenal.

There is no doubt that Amazon will deploy its profits back into expanding its company because Jeff Bezos knows that if he can grow Amazon's top-line number, investors will follow suit.

Also, spending means improving the products, and Amazon has never hesitated to spend big.

The move into digital ad growth is a warning shot to Facebook and Google. Amazon will mobilize its workforce to take on other business, and anything that is high margin is fair game.

The future looks bleak for retail competitors Walmart and Target, as the contents of the earnings report reaffirms Amazon's unrelenting assault on the retail sector, which is systematically being dissected by Amazon for fun.

Google search and Facebook are in Amazon's crosshairs. Staving off this monster will be hard to do in the long run.

Amazon has a clear path to further market gains, and operating margins are almost at a tipping point.

Revenue is poised to re-accelerate because of the reignition of AWS to a higher growth trajectory.

Shoring up operating margins through a burgeoning digital ad division will only be a boon to earnings in the future.

Amazon is one of the best companies in the world, and any weakness in the stock should be bought and held forever.

_________________________________________________________________________________________________

Quote of the Day

"I do not fear computers. I fear a lack of them," - said writer Isaac Asimov.