Mad Hedge Technology Letter

April 30, 2018

Fiat Lux

Featured Trade:

(RIDING THE CHIP ROLLER COASTER),

(Samsung), (SK Hynix), (AMD), (NVDA), (INTC), (MU)

Tag Archive for: MU

The supply side of the chip market is spectacularly volatile, rotating between supply constraints and times of overcapacity.

A good place to analyze the heartbeat of the chip market is across the Pacific on South Korean shores.

South Korea takes pride and joy in having given the world two first-rate semiconductor companies - Samsung and SK Hynix.

Samsung is just behind Intel (INTC) in total annual sales.

American consumers are more familiar with Samsung through its consumer electronics division that constructs Samsung smartphones and tablets.

Samsung's silicon business mirrors the elevated earnings results stateside, as muscular demand derived from global data center expansion devours more chips than Samsung can pump out.

Global data centers in the U.S. and Asia will sustain blistering growth levels into the second quarter.

Samsung has displayed resilience to seasonally shift in the consumer electronics segment by staunchly bolstering its relentless chip business.

Samsung is harvesting the benefits of bountiful investments from over the past decade when this overly cyclical industry was exposed to extreme shifts in worldwide appetite for consumer electronics devices.

More than 70 percent of revenue was generated by the chip division boasting quarterly revenue of $19.25 billion.

In the past, memory chip companies endured a ruthless market environment with a diverse set of players ratcheting up supply on a whim then finding demand crumbling before their eyes.

Restructuring has left the burden of supplying the next generation of technology a backbreaking burden.

Tight chip supply and the general shortage of hardware rears its ugly head in earnings reports with a slew of CEOs complaining about input prices rising worse than global warming sea levels.

In Samsung's earnings call, management groaned that "memory supply and demand fundamentals remain tight."

In SK Hynix's earnings call, it echoed that "demand and supply dynamics in the market will remain favorable."

As large cap tech expands data center initiatives and throws piles of money at autonomous cars, A.I. and cloud computing, Samsung's semiconductor division appears nearly immortal.

Chip prices skyrocketed in this sellers' market and the UBS downgrade of Micron (MU) was a headscratcher.

Analyst Timothy Arcuri turned bearish on Micron citing "cyclical memory concerns" and "big estimate cuts."

Sometimes it feels that analysts don't follow the industry they cover.

It is fair to say chip volume might face marginal cuts closer to 2019, but the pendulum hasn't even started to shift back over to that direction.

Suppliers and buyers both agree that capturing the appropriate volume of chips is the first order of the day.

In response to outsized demand, Samsung will double chip capital spending because of failing to match skyrocketing demand.

Fortifying the bull case, SK Hynix guesstimated DRAM demand for the rest of 2018 to be in the "low-20 percent" and even the injection of new funds for facility expansion is not a proper solution.

Samsung also hammered into investors that it is not in the business to drive the chip prices to zero, and the gross profit metric is more important to them than most people expect.

A goldilocks scenario could ensue with Samsung supplying enough to create price hikes and ploughing its cash back into more silicon expansion.

Korean memory chip producers are expected to enjoy a booming business during the remainder of this year as global DRAM chip demand will surpass supply.

SK Hynix also indicated that server products would supersede mobile products as data center related products are all the rage.

Korea's No. 2 said NAND demand would rise by "mid-40 percent" in 2018, which is double the rise in demand than DRAM products.

Instead of the estimate cuts on which UBS is waiting, the more likely scenario is an easing of chip constraints. The easing will last just long enough before the next massive wave of demand hits with a vengeance.

You read my thoughts - the generational paradigm shift due to hyper-accelerating technology has largely made the boom-bust cycle irrelevant.

Chip demand will go up in a straight line, and this is just the beginning.

Legend has it that demand weakness shows up every 15 years. The last one was the global financial crisis in 2008, and the one before that was the dot-com crash of 2001.

In both instances, the disappearance of demand contributed to massive oversupply. The declining prices set off a price war eradicating margins and revenue.

SK Hynix net profit was $2.89 billion last quarter, an increase of 64.4 percent YOY.

SK Hynix capital allocation layout includes a spanking new factory in Cheongju, a city in South Korea.

The insatiable demand brought on by China's quest for technological supremacy is the market the new Cheongju factory will serve.

International chip directors fret that a sudden breakthrough in local Chinese technology could ignite a supply bonanza of cut-rate semiconductors, forcing a recapitulation of the entire industry that encountered egregious oversupply issues about 10 years ago.

But China can't dump low-cost chips into the market due to technological frailties.

Notice that Chinese capital has been flirting with American chip companies for years without success.

The Chinese government even initiated an investigation at the tail end of last year because DRAM price spikes were indigestible for local Chinese companies.

The dearth of supply is not just restricted to one extraneous niche of the hardware industry, as the tightness is broad-based.

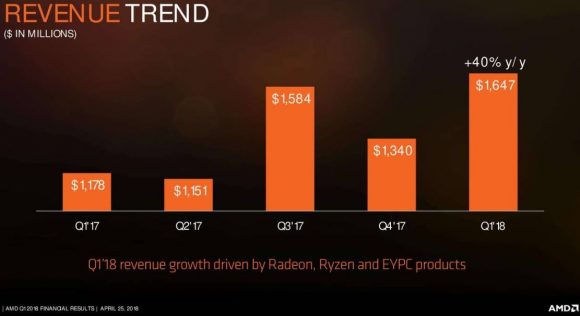

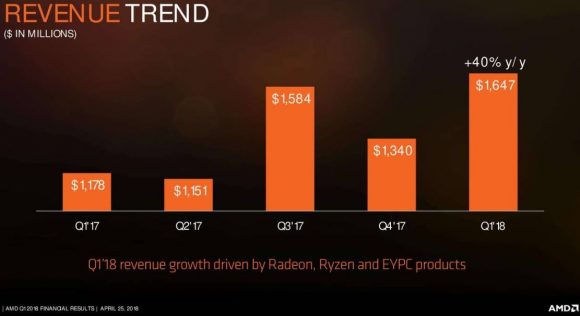

Don't look further than AMD (AMD), which specializes in GPU (graphics processing unit) products and has received glowing reviews for its Ryzen and EPYC CPU processors that boast higher-level performance than previous products.

The RX Vega series is the new line of GPUs from AMD that launched last August. Tech-enthusiast website techspot.com described finding these GPUs on sale in stores as "next to impossible."

AMD is well informed of the market outlook and NVIDIA (NVDA) notes that hardware-intensive cryptocurrency mining is stoking excess marginal demand for its products.

AMD is boosting production, but manufacturing is set back by a component shortage in GDDR5 memory, which is needed in the RX 400 card.

The RX 500 card, part of the RX Vega line, is also having delays with a lack of HBM2 memory.

Crypto-fanatics aren't the only consumers clamoring for extra GPUs; gamers require GPUs to perform at top levels.

AMD has even urged retailers to advise gamers of any outlets where they can buy GPUs because of the dearth of supply.

Gamers are being outmaneuvered for GPUs as crypto-miners usually buy up every last unit to transport to mining farms in far-flung places with cheap energy.

Hardware products cannot be produced fast enough to meet demand.

Other industries vying for a portion of chips are military, aerospace, IoT (Internet of Things) products, and autonomous cars.

Incremental supply is accruing but often the supply is added slower than initially thought. Suppliers are hesitant to double down on new factories because of past, bitter experiences at the end of a cycle.

Management monitors inventory channels like a hawk eyeing its prey, and it's clear that organic demand is following through.

After running away with 22.2% growth in 2017, the semiconductor industry is due to take a quick breather expanding in the upper teens in 2018.

A year is an eternity in technology and calling for production "cuts" in a period of massive undersupply is premature.

The claim of "cyclical" headwinds comes at a time of a new-found immunity to cyclical demand and is dubious at best.

This secular story has legs. Don't believe every analyst that pushes out reports. They often have alternative motives.

Nvidia (NVDA) reports earnings on May 10, and CEO Jensen Huang does a great job explaining the development at the front-end of the tech revolution.

Earnings should be extraordinary. Imagine if the price of bitcoin stabilizes, GPU manufacturers will wrestle with continuous quarters of strained supply.

I am bullish on chips.

_________________________________________________________________________________________________

Quote of the Day

"Focus on the 20 percent that makes 80 percent of the difference." - said Salesforce CEO Marc Benioff when asked to explain the story of his cloud business.

Mad Hedge Technology Letter

April 23, 2018

Fiat Lux

Featured Trade:

(HOW NETFLIX CAN DOUBLE AGAIN),

(NFLX), (AMZN), (IQ), (ORCL), (MU), (AMAT), (CRUS), (QRVO), (IFNNY), (NVDA), (JD), (BABA), (MSFT)

The first batch of earnings numbers are trickling in, and on the whole, so far so good.

A spectacular earnings season will further cement tech's position at the vanguard of the greatest bull market in history.

The bull case for technology revolves around two figures indicating "RISK ON" or "RISK OFF".

The first set of numbers from Netflix (NFLX) emanated sheer perfection.

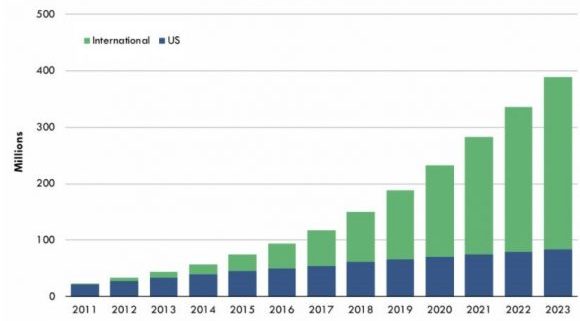

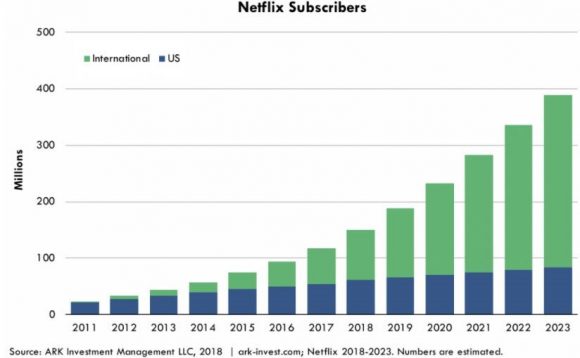

Netflix has gambled on its international audience to drive its growth and unceasing creation of premium content to reach these lofty targets set forth.

It worked.

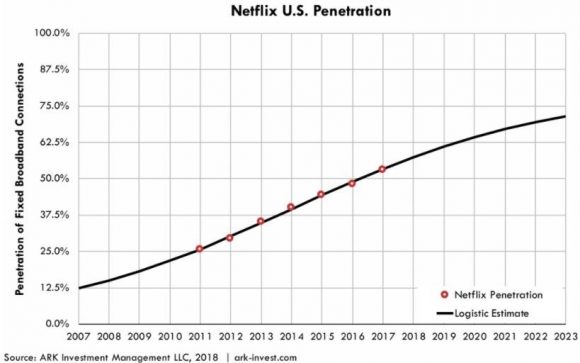

Consensus was that domestic subscription growth had peaked, and Netflix would have to lean on overseas expansion to beat earnings estimates.

American subscription growth knocked it out of the ballpark, beating expectations by 480,000 subscriptions. The street expected only 1.48 million new adds. The 1.96 million shows the American online streamer is resilient, and the migration toward cord-cutting is happening faster than initially thought.

International adds were pristine, beating the 5.02 million estimates by 440,000 million new subscribers.

Content is king as Netflix has proved time and time again (we notice that here at Mad Hedge Fund Trader, too). Netflix plans to fork out about 700 original series in 2018.

By 2023, Netflix could grow its subscriber base to close to 400 million. The potential for international advancement is immense considering foreign companies are playing catch-up and cannot compete with the level of Netflix's content.

The earnings report coincided with Netflix announcing a forceful push into Europe, doubling its allocated content-related investments to $1 billion.

All of Netflix's estimates take into consideration that it is shut out of the Chinese market. Ironically, the Netflix of China, named iQIYI (IQ), just recently went public on the Nasdaq.

Amazon Web Services (AWS), the cloud-arm of Amazon (AMZN), revenue numbers are the other numbers that are near and dear to the pulsating heartbeat of the bull market.

Jeff Bezos, Amazon's CEO, penned a letter to shareholders that Amazon prime subscribers blew past the 100 million mark.

The positive foreshadowing augurs nicely for Amazon to surprise to the upside when it reports earnings next week on April 26.

Expect more of the same from cloud companies that are overperforming.

The few glitches in tech are minor. It is mindful to stay on the right side of the tracks and not venture into marginal names that haven't proved themselves.

For instance, Oracle (ORCL) had a good, not great, earnings report but shares still cratered after CEO Safra Catz dissatisfied analysts with weak cloud forecasts of just 19%-23% growth.

The street was looking for cloud guidance over 24%. Oracle is still being punished for its legacy tech segments.

The chip sector got pummeled after several chip manufacturers announced weak supply order from Apple.

This is hardly a surprise with Apple slightly missing iPhone estimates last quarter by 1%.

Chip stocks such as Lam Research (LRCX), Micron (MU), and Applied Materials (AMAT) look like affordable bargains. They should be seriously considered after share prices stabilize buttressed by support levels.

The outsized problem is that hardware suppliers have headline risks because of large cap tech's preference toward vertically integrating.

Along with price efficiencies, vertically integration aids design aspects and streamline product production time horizons.

This is not the end of chips.

Consumers need the silicon to generate and extract all the data coming to market.

Particularly, Apple (AAPL) went over its skis trying to push expensive smartphones to a saturated market when all the rip-roaring growth is at the low end of the market.

Apple still managed to sell more than 77 million iPhones, but the trade war rhetoric will deter Chinese consumers from purchasing American tech products. Until now, Apple has counted on China as its best growth prospect. The administration had other ideas.

Any noteworthy Apple supplier has gotten punched in the nose, but crucially, investors must stay out of the SMALLER chip players that rely on narrow revenue sources to keep them afloat.

Bigger chip companies can withstand the shedding of a few revenue sources but not Cirrus Logic (CRUS).

(CRUS) shares have been beaten mercilessly the past year sliding from $68 to a horrifying $37.74 today.

(CRUS) produces audio amplifier chips used in iPhone devices, and weak iPhone X guidance is the cue to bail out of this name.

The company extracts more than 75% of its revenues by selling audio chips used in iPhone devices. Ouch!

Last quarter saw horrific performance, stomaching a 7.7% decline in revenues due to tepid demand for smartphones in Q4 2017.

Cirrus Logic provided an underwhelming outlook, and it is not the only one to be beaten into submission behind the woodshed.

Apple has signaled to its suppliers that it will view production in a different way.

Imagination Technologies, a U.K. company, was informed that its graphic chips are not needed after 2018.

Dialog Semiconductor, another U.K.- based operation, shared the same destiny, as its power management chip was cut out of the production process, sacrificing 74% of revenue.

To top it all off, Apple just announced it plans to manufacture its own MicroLED screens in Silicon Valley, expunging its alliance with Samsung, Sharp, and LG, which traditionally yield smartphone screens for Apple. And Apple plans to make its own chips, phasing out Intel's chips in Apple's MacBook by 2020.

Qorvo (QRVO), Apple's radio frequency chips manufacturer, also can be painted with the same brush.

Apple was responsible for 34% of the company's total revenues in 2017.

Weak iPhone guidance set off a chain reaction, and the trembles were most felt at the bottom feeder group.

Put Infineon Technologies (IFNNY) in the same egg basket as Qorvo and Cirrus Logic. This company installs its cellular basebands in iPhones.

FANG has split into two.

Netflix and Amazon continue producing sublime earnings reports, and Apple and Facebook have hit a relative wall.

It will be interesting if the government's harsh rhetoric toward Amazon amounts to anything.

One domino that could fall is Amazon's lukewarm relationship with the US Postal Service.

Logistics is something the Chinese Amazon's JD.com (JD) and Alibaba (BABA) have successfully adopted. Look for Amazon to do the same.

However, I will say it is unfair that most tech companies are measured against Netflix and Amazon, even for Apple, which earned almost $50 billion in profits in 2017.

It is insane that companies tied to a company that prints money are reprimanded by the market.

But that highlights investors' pedantic fascination with pandemic growth, cloud, and big data.

Making money is irrelevant today. Investors should be laser-like focused on the best growth in tech such as Amazon, Netflix, Lam Research, Nvidia (NVDA), and Microsoft (MSFT), which know how to deliver the perfect cocktail of results that delight investors.

__________________________________________________________________________________________________

Quote of the Day

"$500? Fully subsidized? With a plan? That is the most expensive phone in the world. And it doesn't appeal to business customers because it doesn't have a keyboard. Which makes it not a very good email machine." - said former CEO of Microsoft Steve Ballmer on the introduction of the first iPhone.

Global Market Comments

April 13, 2018

Fiat Lux

Featured Trade:

(ANNOUNCING THE MAD HEDGE LAKE TAHOE, NEVADA, CONFERENCE, OCTOBER 26-27, 2018),

(APRIL 11 GLOBAL STRATEGY WEBINAR Q&A),

(TLT), (TBT), (GOOGL), (MU), (LRCX), (NVDA) (IBM),

(GLD), (AMZN), (MSFT), (XOM), (SPY), (QQQ)

Below please find subscribers' Q&A for the Mad Hedge Fund Trader April Global Strategy Webinar with my guest co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Many of your April positions are now profitable. Is there any reason to close out before expiration?

A: No one ever got fired for taking a profit. If you feel like you have enough in hand - like 50% of the maximum potential profit in the position, which we do have in more than half of our current positions - go ahead and take it.

I'll probably run all of our April expirations into expiration day because they are very deep in the money. Also, because of the higher volatility and because of higher implied volatility on individual stock options, you're being paid a lot more to run these into expiration than you ever have been before, so that is another benefit.

Of course, one good reason to take profits now is to roll into another position, and when we find them, that may be exactly what we do.

Q: What do you think will be the impact of the US hitting Syria with missiles?

A: Initially, probably a 3-, 4-, or 500-point drop, and then a very rapid recovery. While the Russians have threatened to shoot down our missiles, in actual fact they can't hit the broad side of a barn. When Russians fired their cruise missiles at Syrian targets, half of them landed in Iran.

At the end of the day, it doesn't really impact the US economy, but you will see a big move in gold, which we're already starting to see, and which is why we're long in gold - as a hedge against all our other positions against this kind of geopolitical event.

Q: Will 2018 be a bull market or a bear market?

A: We are still in a bull market, but we may see only half the returns of last year - in other words we'll get a 10% profit in stocks this year instead of a 20% profit, which means it has to rise 12% from here to hit that 10% up by year-end.

Q: What is your take on the ProShares Ultra Short 20+ Year Treasury Bond Fund (TBT)?

A: I am a big buyer here. I think that interest rates (TLT) are going to move down sharply for the rest of the year. The (TBT) here, in the mid $30s, is a great entry point - I would be buying it right now.

Q: How do you expect Google (GOOGL) to trade when the spread is so wide?

A: It will go up. Google is probably the best-quality technology company in the market, after Facebook (FB). We'll get some money moving out of Facebook into Google for exactly that reason; Google is Facebook without the political risk, the regulatory risk, and the security risks.

Q: Are any positions still a buy now?

A: All of them are buys now. But, do not chase the market on any conditions whatsoever. The market has an endless supply of sudden shocks coming out of Washington, which will give you that down-400-points-day. That is the day you jump in and buy. When you're buying on a 400-down-day, the risk reward is much better than buying on a 400-point up day.

Q: What is "sell in May and go away?"

A: It means take profits in all your positions in May when markets start to face historical headwinds for six months and either A) Wait for another major crash in the market (at the very least we'll get another test of the bottom of the recent range), or B) Just stay away completely; go spend all the money you made in the first half of 2018.

Q: Paul Ryan (the Republican Speaker of the House) resigned today; is he setting up for a presidential run against Trump in 2020?

A: I would say yes. Paul Ryan has been on the short list of presidential candidates for a long time. And Ryan may also be looking to leave Washington before the new Robert Mueller situation gets really unpleasant.

Q: What reaction do you expect if Trump resigns or is impeached?

A: I have Watergate to look back to; the stock market sold off 45% going into the Nixon resignation. It's a different world now, and there were a lot more things going wrong with the US economy in 1975 than there are now, like oil shocks, Vietnam, race riots, and recessions.

I would expect to get a decline, much less than that - maybe only a couple 1,000 points (or 10% or so), and then a strong Snapback Rally after that. We, in effect, have been discounting a Trump impeachment ever since he got in office. Thus far, the market has ignored it; now it's ignoring it a lot less.

Q: Thoughts on Micron Technology (MU), Lam Research (LRCX), and Nvidia (NVDA)?

A: It's all the same story: a UBS analyst who had never covered the chip sector before initiated coverage and issued a negative report on Micron Technology, which triggered a 10% sell-off in Micron, and 5% drops in every other chip company.

He took down maybe 20 different stocks based on the argument that the historically volatile chip cycle is ending now, and prices will fall through the end of the year. I think UBS is completely wrong, that the chip cycle has another 6 to 12 months to go before prices weaken.

All the research we've done through the Mad Hedge Technology Letter shows that UBS is entirely off base and that prices still remain quite strong. The chip shortage still lives! That makes the entire chip sector a buy here.

Q: Can Trump bring an antitrust action against Amazon?

A: No, no chance whatsoever. It is all political bluff. If you look at any definition of antitrust, is the consumer being harmed by Amazon (AMZN)?

Absolutely not - if they're getting the lowest prices and they're getting products delivered to their door for free, the consumer is not being harmed by lower prices.

Second is market share; normally, antitrust cases are brought when market shares get up to 70 or 80%. That's what we had with Microsoft (MSFT) in the 1990s and IBM (IBM) in the 1980s. The largest share Amazon has in any single market is 4%, so no there is basis whatsoever.

By the way, no president has ever attacked a private company on a daily basis for personal reasons like this one. Thank the president for giving us a great entry point for a stock that has basically gone up every day for two years. It's a rare opportunity.

Q: How will the trade war end?

A: I think the model for the China trade war is the US steel tariffs, where we announced tariffs against the entire world, and then exempted 75% of the world, declaring victory. That's exactly what's going to happen with China: We'll announce massive tariffs, do nothing for a while, and then negotiate modest token tariffs within a few areas. The US will declare victory, and the stock market rallies 2,000 points. That's why I have been adding risk almost every day for the last two weeks.

Q: Would you be buying ExonMobil (XOM) here, hoping for an oil breakout?

A: No, I think it's much more likely that oil is peaking out here, especially given the slowing economic data and a huge onslaught in supply from US fracking. We're getting big increases now in fracking numbers - that is very bad for prices a couple of months out. The only reason oil is this high is because Iran-sponsored Houthi rebels have been firing missiles at Saudi Arabia, which are completely harmless. In the old days, this would have caused oil to spike $50.

Q: Would you be selling stock into the rally (SPY), (QQQ)?

A: Not yet. I think the market has more to go on the upside, but you can still expect a lot of inter-day volatility depending on what comes out of Washington.

Q: Do you ever use stops on your option spreads?

A: I use mental stops. They don't take stop losses on call spreads and put spreads, and if they did they would absolutely take you to the cleaners. These are positions you never want to execute on market orders, which is what stop losses do. You always want to be working the middle of the spread. So, I use my mental stop. And when we do send out stop loss trade alerts, that's exactly where they're coming from.

Q: Will the Middle East uncertainty raise the price of oil?

A: Yes, if the Cold War with Iran turns hot, you could expect oil to go up $10 or $20 dollars higher, fairly quickly, regardless of what the fundamentals are. It's tough to be blowing up oil supplies as a great push on oil prices. But that's a big "if."

Hello from the Italian Riviera!

After ignoring the constant chaos in Washington for 17 months, it finally mattered to the stock market.

Guess what was at the top of the list of retaliatory Chinese import duties announced last week?

California wine!

The great irony here is that half of the Napa Valley wineries are now owned by Chinese investors looking for a bolt-hole from their own government. Billionaires in China have been known to disappear into thin air.

And after years of trying, we were just getting Chinese consumers interested in tasting our fine chardonnays, merlots, and cabernet sauvignons.

It will be a slap in the face for our impoverished farmworkers who actually pick the grapes, who have just been getting back on their feet after last fall's hellacious fires.

Do you suppose they will call the homeless housing camps "Trumpvilles?"

California is on the front line of the new trade war with China.

Not only is the Middle Kingdom the largest foreign buyer of the Golden State's grapes, almonds, raisins, and nuts, it also is the biggest foreign investor, plowing some $16 billion in investments back here in 2016.

Down 1,700 Dow points on the week and a breathtaking 1,400 points in two days. It was the worst week for the markets in two years. And the technology and financial stocks suffered the worst spanking - the two market leaders. The most widely owned stocks are seeing the worst declines.

We certainly are paying the piper for our easy money made last year. The Dow Average is now a loser in 2018, off 4.1% and back to November levels.

The Dow 600 point "flash crash" we saw in the final two hours of trading on Friday was almost an exact repeat of the February 9 swoon that took us to the exact same levels.

There was no institutional selling. It was simply a matter of algorithms gone wild. The news flow that day was actually quite good.

Our favorite stock, Micron Technology (MU) announced blockbuster earnings and high target (for more depth, please read the Mad Hedge Technology Letter).

Dropbox (DBX) went public, and immediately saw its shares soar by 50% in the aftermarket. The president signed an emergency funding bill to keep the government open, despite repeated threats not to do so.

Which means the market fell not because of a fundamental change in the US economy. It is a market event, pure and simple.

I therefore expect a similar outcome. Only this time, we don't have an $8 billion unwind of the short volatility trade ($VIX) to deal with, as we did in February. That's why I thought markets would bottom at higher levels this time around.

There is only one problem with this theory.

The chaos, turmoil, and uncertainty in Washington is finally starting to exact a steep price on shareholders. Uncertain markets commend lower price earnings multiples than safer ones.

As a result, multiples are now 15% lower than the January high at 19.5X, and much more for individual stocks. And multiples have been falling even though earnings have been rising, quite substantially so. Such is the price of chaos.

Will markets bottom out here on a valuation basis as they did last time? Or will the continued destruction of our democracy command a higher price? We will find out soon.

Clearly the S&P 500 200-day moving average at $255.95 is crying out for a revisit, which we probably will see first thing Monday morning. Allow more shorts to get sucked in, and then you probably have a decent entry point to buy stocks for the rest of 2018.

Indeed, it was a week when the black swans alighted every day. First, the twin hits from Facebook (FB), followed by the worst trade war in eight decades. Then came the Chinese retaliation.

While the damage suffered so far has been limited, investors are worried about what is coming next.

One of the last supervising adults left the White House, my friend and comrade in arms, National Security Advisor H.R. McMaster. His replacement is Fox News talk show host John Bolton, who is openly advocating that the US launch a pre-emptive nuclear strike against North Korea.

Bolton has quite a track record. He is the guy who talked President Bush into invading Iraq. Now, that would trigger a new bear market in the extreme!

As I did not predict five black swans in five days, the Mad Hedge Trade Alert Service took a hit this week, backing off of fresh all-time highs.

The trailing 12-month return fell to 46.49%, the 8-year return to 284.01%, bringing the annualized average return down to only 34.08%.

Given all of the above, economic data points for the coming holiday shorted trading week seem almost quaintly irrelevant. But I'll give them to you anyway.

On Monday, March 26, at 10:30 AM, we get the February Dallas Fed Manufacturing Survey.

On Tuesday, March 27, at 9:00 AM, we receive an update on the all-important CoreLogic Case-Shiller National Home Price NSA Index for January. A 3-month lagging housing indicator.

On Wednesday, March 28, at 8:30 AM EST, the second read of Q1 GDP comes out.

Thursday, March 29, leads with the Weekly Jobless Claims at 8:30 AM EST, which hit a new 49-year low last week at an amazing 210,000. At 9:45 AM, we get the February Chicago Purchasing Managers Index. At 1:00 PM, we receive the Baker-Hughes Rig Count, which saw a small rise of three last week.

On Friday, March 30, the markets are closed for Good Friday.

As for me, I'll be doing my Christmas shopping early this year before the new Chinese import tariffs jack up the price for everything by 15% to 25%.

I'll be doing all of this courtesy of Amazon (AMZN), of course. Since I arrived here at Lake Tahoe, it has snowed 6 feet in two days in a storm of truly biblical proportions. We got a total of 18 feet of snow in March. By the time I dig out, it will be time to go home.

Good luck and good trading.

John Thomas

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.