Last quarter’s earnings report sent Netflix shares nosediving to the depths of the ocean floor, and the wreckage saw Netflix’s stock down 24% in 5 weeks.

The short-term weakness in shares was justified after Netflix miscalculated on their quarterly subscriber numbers.

Netflix is still a buy because the wreckage can be salvaged.

In fact, it was never a wreckage to begin with because Netflix boasts the highest grade online streaming product in the industry.

An industry that is benefitting from massive secular tailwinds at its back, from cord cutters and the widespread pivot to mobile platforms.

Netflix has the best product on the market because they have the best strategy – throw $8 billion on content alone and hire the best production team money can buy to churn out content.

The method to their madness has worked and the haul of 23 Emmy’s was a result of this winning formula.

The 23 Emmy’s tied HBO, whose premier series Game of Thrones is still captivating audiences with its mix of graphic sexual exploits and violent tropes.

Several of Netflix’s award winners saluted Netflix’s hands-off approach, who allow these highly paid production specialists the creative freedom to inspire audiences.

For all of Hollywood’s razzmatazz, director’s and actor’s number one major gripe has been that the leash is tight with minimal wiggle room.

It’s not straightforward to change a culture that has developed over a century.

Cross-pollinating Silicon Valley’s lean business model with Hollywood top-grade content was the trick that removed the shackles from the director’s ankles.

The end-product has been the main beneficiary.

Scoping out Netflix’s end of year lineup has viewers drooling.

The tail end of the year sees Netflix reintroduce some hard-hitting content from Orange Is The New Black, Ozark, Daredevil, Narcos, and Making a Murderer, side by side with fresh content involving Simpsons creator Matt Groening and blockbuster names like Jonah Hill and Emma Stone.

As well as shelling out $8 billion for original content, Netflix upped its marketing budget from $1.28 billion to $2 billion in 2018.

The $2 billion budget is a classy touch but at this point, this product more or less sells itself.

The brand awareness is that far-reaching.

The platform is optimized by tweaking Netflix’s proprietary recommendation algorithm herding the audience into viewing more content that the algorithm deems likely viewable.

The man who is in charge of this is Greg Peters - Netflix chief product officer.

Kelly Bennett, Netflix chief marketing officer, will work with Peters to wield the massive $2 billion marketing budget in the most effective way possible.

To insulate the company from any potential Facebook-like data slipups, Netflix poached Rachel Whetstone from Facebook to head up the public relations division.

Who said there were no winners from Facebook’s PR disaster?

Whetstone’s professional year of hell offers valuable insight into how not to pull another Facebook (FB) stinker.

She previously worked for Google and Uber and is a veteran PR spinner.

Earlier this year CEO Reed Hastings detailed the possibility of using ads in Netflix’s ad-less platform by saying this about why Netflix has no ads:

“It is a core differentiator and again we're having great success on the commercial-free path. That's what our brand is about. So we're going to continue to expand the relevance of a commercial free service around the world and make that so popular that consumers are very used to it and appreciate Netflix.”

The relevancy of his statement is more meaningful now after a recently released report confirming that Netflix is testing the usage of ads to promote its content.

This would be a huge shift in the company’s ethos, and if the algorithms give Hastings the green light, this could alienate a big chunk of their subscriber base.

In a survey conducted about the implementation of ads, 23% said they would quit the service if ads are rolled out onto Netflix’s platform.

Only 41% said they would “definitely” or “probably” keep Netflix if ads are introduced.

In the same survey, if Netflix lowers the monthly cost by $3 while integrating ads, the cancellation rate falls from 23% to 16%, and half said they would keep Netflix.

The most important number of the survey was that only 8% would cancel if they increased monthly prices by $2, but if it went up by $5, 23% would say goodbye to the streaming service.

All signs point to an incremental price increase in the near future, partly helping to offset the mind-boggling amount of content spend this year.

Netflix subscribers are still willing to absorb price increases which is a great sign for future profitability.

But it is also worth mentioning that Netflix is a profitable company now, and margins have been slowly creeping up for the past few years.

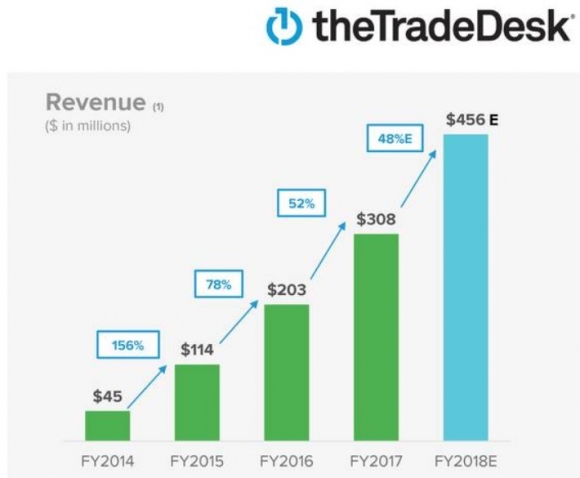

The tests demonstrate that Hastings is serious about profitability at a time when the premier profit machines in tech are Apple (AAPL) and Alphabet (GOOGL).

These two behemoths blaze the trail for the tech sector and offer important lessons on the potential future profitability of Netflix.

It will take time for Netflix to reach that level of profitability, but the pillars are in place to ramp up the monetization drive.

The treasure trove of data will surely help decision making for the management, but to make their platform more like Facebook (FB) would be a huge error of epic proportions.

It’s proven that digital ads are annoying like a swath of mosquitoes trapped in your bedroom at 2am.

To dilute the quality of their product would fly in the face of what the company represents.

So how on earth will Netflix’s shares go from the mid-$300’s and reach the glorious heights of $400-plus and stay there?

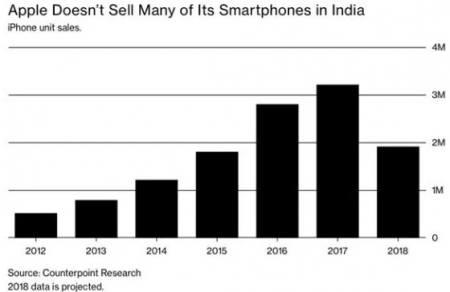

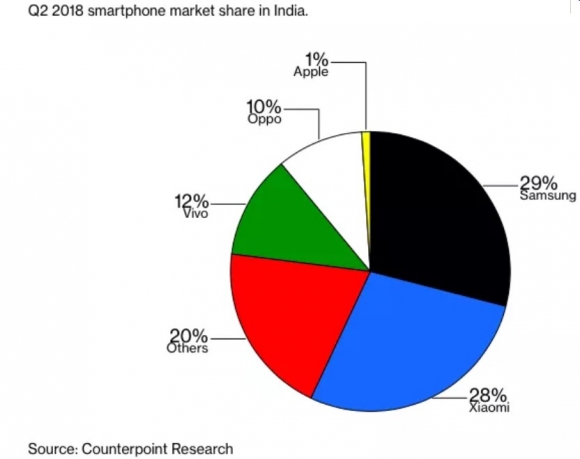

One word – India.

It’s no secret that Netflix has been charging hard to rev up international business.

India is the trump card.

India boasts around 78 million middle class dwellers who can afford Netflix’s service.

In the next two years, it’s feasible that 10% of this socioeconomic class could be tuning into Netflix.

That foothold into India could mushroom, and potentially expand with an audience whose DNA is comprised of a strong film culture.

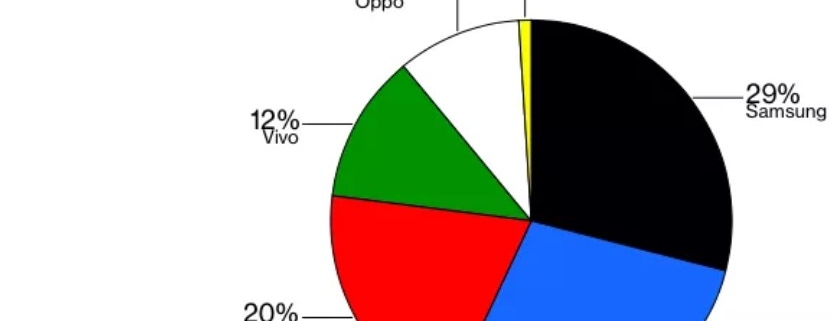

As broad-brand broadband expansion and smartphone penetration heating up in India, Netflix’s timely arrival could make Netflix look genius.

Their arrival coincides with a slew of American tech companies looking to tap revenue out of the largest democracy in Asia.

The unrealized potential cannot be ignored.

Netflix has primed their strategy by focusing on locally-produced content that will resonate with the Indian viewer.

Netflix’s India strategy started red hot with crime thriller Sacred Games imbued with a level of unfiltered, real filmmaking unseen in India.

The dark crime drama is already facing a legal battle concerning its lusty, foul-mouthed content that presses on the outer limits of what modern Indian society can handle.

The stereotype breaking series directed by Vikramaditya Motwane and Anurag Kashyap is Netflix’s first Indian feather in their cap as Netflix looks to accelerate the momentum.

Netflix has not produced back to back quarters where they failed to meet subscriber growth forecasts since 2012.

I firmly believe Netflix will continue this successful streak and beat subscriber estimates in the third quarter.

Initial indications show that Indians have gravitated towards Netflix’s original content, and with the 2018 Russian World Cup in the history books, the path has opened up for some nice surprises to the upside.

NETFLIX’S FUTURE - INDIA

________________________________________________________________________________________________

Quote of the Day

"Health care and education, in my view, are next up for fundamental software-based transformation." – Said Silicon Valley Venture Capitalist Marc Andreessen