You know that 10% downside risk I talked about? In other words, you may have to eat a handful of your seed corn.

We may have to eat into some of that 10% this week. With the September Consumer Price Index out on Thursday, and the big bank earnings are out Friday, there is more than a little concern about the coming trading week.

That’s why all my remaining positions are structured to handle a 10% correction or more and still expire at their maximum profit point in nine trading days.

Even in the worst-case Armageddon scenario, which we are unlikely to get, the S&P 500 is likely to fall below 3,000, or 627.90 points or 17.25% from here.

That’s what you pay me for and that’s what you are getting.

I shot out of the gate with an impressive +3.25% gain so far in October. My 2022 year-to-date performance ballooned to +72.93%, a new high. The Dow Average is down -19.3% so far in 2022 or a gob-smacking -7,000 points. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +81.35%.

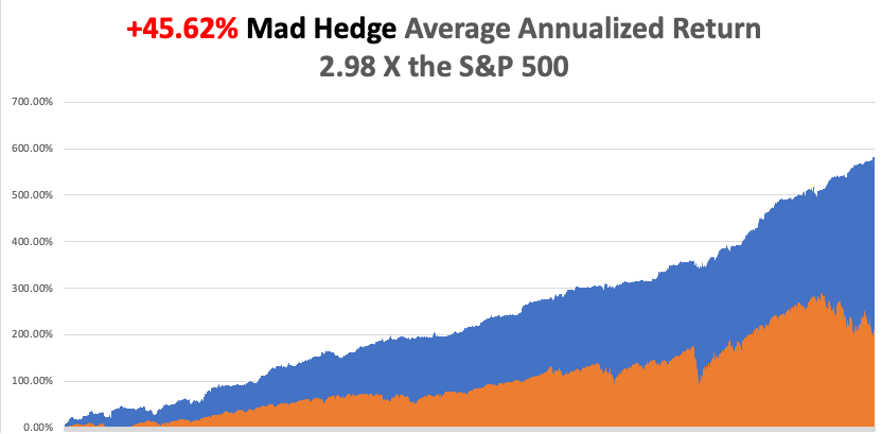

That brings my 14-year total return to +585.49%, some 3.03 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +45.62%, easily the highest in the industry.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago.

I used last week’s extreme volatility to rearrange positions, adding longs in Morgan Stanley (MS), JP Morgan (JPM), and Visa (V). That takes me to 80% long, 20% short, and 0% cash. I wisely rolled down the strikes on my Tesla position from $230-$240 to $200-$210. I covered one short in the S&P 500 (SPY). All of my options positions expire in only nine trading days.

I know that you’re probably getting boatloads of advice the sell all your stocks now, sell your house, and head for those generous 5% short term interest rates, and 8% in junk. Even I went 100% cash….in December last year. The problem is that these other gurus are giving you advice that is only a year late with perfect 20/20 hindsight.

To bail now, you risk giving up on the 100% gains in years to come. If I’m wrong, you lose 10%, if I’m right, you get a double or more. Sounds like a pretty good bet to me.

People always want to know how I pick market bottoms, something I have been doing since the Dow Average was at a miniscule $753.

The lower the market is, the less aggressive the Fed is going to be

Every single input into the Consumer Price Index is now turning down sharply, especially rents and housing costs, meaning we can expect a blockbuster decline when the next report comes out on October 13

We now have two outsiders doing the Fed’s job for it, the British economy, which is clearly collapsing, and a strong US dollar that is rapidly shrinking the foreign revenues of our multinationals, like big tech.

Capitulation indicators, occasionally spotted here and there, are now coming in volleys, the Volatility Index at $35, the (VIX) curve inversion, the RSI below 30, the ten-year US Treasury yield hit 4.0% and then instantly backed off, the British pound plunged to $1.03, and we saw absolutely massive retail selling in September.

The froth is now out of all tech stocks.

All of this brings forward the last Fed hike in interest rates and the next bull market in stocks. If the last Fed rate hike is two months away on December 14, then the reasons to sell stocks are disappearing like the last sands in an hourglass.

In my mere half century in the market, every time the CPI starts to fall, stock market “V” bottoms and begins classic “rip your face off’ rallies as the shorts panic to cover. It happened in 1970, 1974, 1980, 1990, and 2009. It will happen again in 2022. The market will smell that inflation is done, the Fed is done, and volatility becomes a distant memory.

And I hate to be so obvious, but if you sell in May, what do you do in October? You buy with both hands. Just do it on the right day. That could get you a 10% to 20% move by yearend. The S&P 500 earnings multiple has collapsed by eight points in nine months and that is too far, too fast.

How do midterm years perform? October is the best month of the year followed by November. Of the entire 16-month presidential election cycle, the coming first quarter of 2023 is the best of the entire lot.

Nonfarm Payroll Falls Short at 263.000 in September. The headline unemployment rate matched a 2022 low at 3.5%. The long-term unemployment rate, the U-6 also matched this year’s low at 6.7%. The report keeps the Fed on its current interest raising schedule. Stocks, bonds, and gold sold off 500-points.

JOLTS Drops Sharply, from an expected 11.0 million to only 10.05 million. This is the job openings report from the Department of Labor. It’s one of the sharpest declines in history. The jobs market is finally starting to deteriorate, which is just what the Fed wanted. Factory Orders for August were unchanged.

OPEC+ Cuts Quotas by 2 million, and production by 1 million, in one of the largest reductions in history. It’s an effort to maintain oil prices at current prices in the face of falling demand from a global recession. The Arabs are not your friends. It’s also a slap in the face of the anti-oil posture, pro-climate posture of the Biden administration, which responded with a further release of 10 million barrels from the Strategic Petroleum Reserve. Energy stocks soar across the board. Don’t get caught standing when the music stops playing. Avoid (USO).

Why Did Russia Blow Up Their Own Pipeline? International analysts are puzzled by Putin’s latest hostile move. Is this a prelude to limited nuclear war in Ukraine? My view is that Putin expects to be deposed soon and wants to make it difficult for the next government to resume relations with Europe. Others argue that the true motivation is to enable Nordstream to file a $10 billion insurance claim. Good luck collecting on that one.

Advanced Micro Devices Bombs on weak PC sales and supply chain problems, taking the stock down 5% aftermarket. Profit margins were cut. The news could take the stock down to new lows, which didn’t really participate in this week’s monster rally. The rest of the tech sector sold off in sympathy.

Tesla Breaks Production Records in Q3, manufacturing 365,000 EVs and delivering 365,000, a record high. Sales prices have risen three times this year, while commodity costs have fallen dramatically, widening profit margins. This is the most volatile stock in the market, with one 52% correction so far this year, and another 23% correction in recent weeks. It’s the reason we just saw a “buy the rumor, sell the news” type correction that took us to the bottom of a three-month range.

Another factor is that now that big tech is rallying again, people are rotating out of Tesla, which held up well in Q3. Below here, long term Tesla bulls like my friend Ron Baron, Cathie Wood, and I start adding to big positions. With OPEC+ threatening a million barrel a day production cut, taking crude up 6%, oil alternative Tesla should be rising.

Elon Musk Pays Full Price for Twitter at $54.20 a share, completely caving on pending litigation. Wall Street consensus is that the company is worth $15 a share. It may be years before we learn what’s really going on here, leaving many scratching their heads, including me. Tesla (TSLA) plunged $15 on the news, killing off a nascent rally. The distraction of management time will be huge. Avoid (TWTR).

Rivian Raises 2025 Production Goal, from 20,000 to 25,000, after a better-than-expected 7,363 third quarter. Mass production is reaching the sweet spot for the next Tesla. The company is planning a $5 billion investment in non-union Georgia. Buy (RIVN) on dips, sell short puts and buy LEAPS.

Micron Technology to Invest $100 Billion in New York Plant. It’s all part of a retreat from China and paring war risk in Taiwan. Massive government subsidies from the Chips Act helped. Biden also expanded restrictions on the export of key semiconductor manufacturing equipment, America’s crown jewels. It means more expensive buy safer supplied chips for US industry. Buy (MU) on dips.

Hurricane Ian to Cost Insurers $63 Billion, and deaths, and the federal government may be on the hook for more. The storm double-dipped, cutting a wide swath across Florida and the Carolinas. Some 95% of the costs are carried by foreign insurers through the reinsurance market. There are too many billionaire mansions on the beach which are fully insured. This paves the way for major rate increases by insurance companies, which is why Warren Buffet loves the insurance business. Many thanks to the many foreign Mad Hedge subscribers who expressed sympathy over the storm losses.

My Ten-Year View

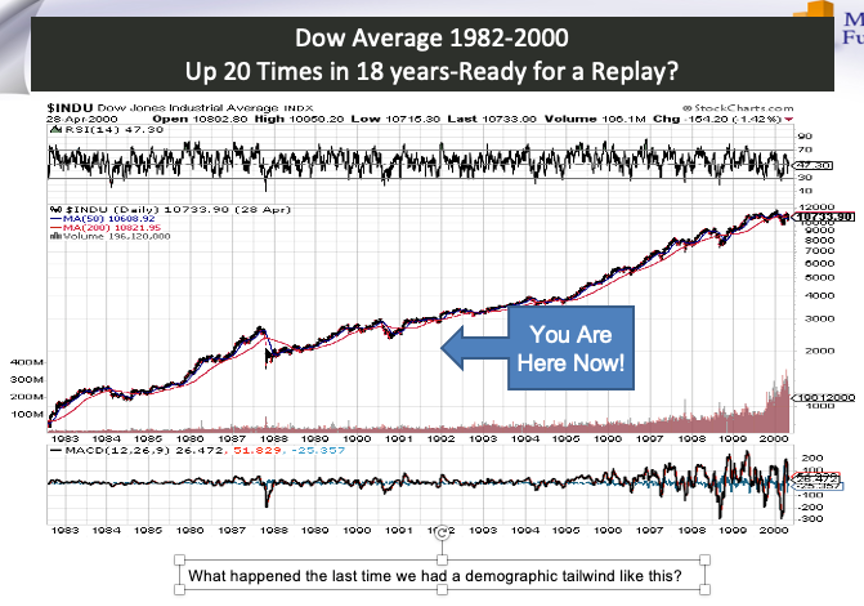

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil in a sharp downtrend and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, October 10, no data of note is released.

On Tuesday, October 11 at 7:00 AM, the 6:00 AM, the NFIB Business Optimism Index for September is released.

On Wednesday, October 12 at 8:30 AM, Producer Price Index for September is published. At 11:00 AM, the FOMC minutes from the last Fed meeting is released.

On Thursday, October 13 at 8:30 AM, Weekly Jobless Claims are announced. We also get the blockbuster Consumer Price Index.

On Friday, October 14 at 8.30 AM, US Retail Sales for September is disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, with the 35th anniversary of the October 19, 1987 crash coming up, when shares dove 22.6% in one day, I thought I’d part with a few memories.

I was in Paris visiting Morgan Stanley’s top banking clients, who then were making a major splash in Japanese equity warrants, my particular area of expertise.

When we walked into our last appointment, I casually asked how the market was doing (Paris is six hours ahead of New York). We were told the Dow Average was down a record 300 points.

Stunned, I immediately asked for a private conference room so I could call the equity trading desk in New York to buy some stock.

A woman answered the phone, and when I said I wanted to buy, she burst into tears and threw the handset down on the floor. Redialing found all Transatlantic lines jammed.

I never bought my stock, nor found out who picked up the phone. I grabbed a taxi to Charles de Gaulle airport and flew my twin Cessna as fast as the turbocharged engines could take me back to London, breaking every known air traffic control rule.

By the time I got back, the Dow had closed down a staggering 512 points, taking the Dow average down to $1,738.74. Then I learned that George Soros asked us to bid on a $250 million blind portfolio of US stocks after the close. He said he had also solicited bids from Goldman Sachs, Merrill Lynch, JP Morgan, and Solomon Brothers, and would call us back if we won.

We bid 10% below the final closing prices for the lot. Ten minutes later he called us back and told us we won the auction. How much did the others bid? He told us that we were the only ones who bid at all!

Then you heard that great sucking sound. Oops!

What has never been disclosed to the public is that after the close, Morgan Stanley received a margin call from the exchange for $100 million, as volatility had gone through the roof, as did every firm on Wall Street.

We ordered JP Morgan to send the money from our account immediately. Then they lost it! After some harsh words at the top, it was found. That’s when I discovered the wonderful world of Fed wire numbers.

The next morning, the Dow continued its plunge, but after an hour managed a U-turn, and launched on a monster rally that lasted for the rest of the year. We made $75 million on that one trade from Soros.

It was the worst investment decision I have seen in the markets in 53 years, executed by its most brilliant player. Go figure. Maybe it was George’s risk control discipline kicking in?

At the end of the month, we then took a $75 million hit on our share of the British Petroleum privatization, because Prime Minister Margaret Thatcher refused to postpone the issue, believing that the banks had already made too much money.

That gave Morgan Stanley’s equity division a break-even P&L for the month of October 1987, the worst in market history. Even now, I refuse to gas up at a BP station on the very rare occasions I am driving an internal combustion engine.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader