Global Market Comments

December 26, 2023

Fiat Lux

Featured Trade:

(THE NEXT COMMODITY SUPERCYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

Global Market Comments

December 26, 2023

Fiat Lux

Featured Trade:

(THE NEXT COMMODITY SUPERCYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

Global Market Comments

August 25, 2023

Fiat Lux

Featured Trades:

(THE NEXT COMMODITY SUPERCYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

CLICK HERE to download today's position sheet.

When I closed out my position in Freeport McMoRan (FCX) near its max profit earlier this year, I received a hurried email from a reader if he should still keep the stock. I replied very quickly:

“Hell, yes!”

When I toured Australia a couple of years ago, I couldn’t help but notice a surprising number of fresh-faced young people driving luxury Ferraris, Lamborghinis, and Porsches.

I remarked to my Aussie friend that there must be a lot of indulgent parents in The Lucky Country these days. “It’s not the parents who are buying these cars,” he remarked, “It’s the kids.”

He went on to explain that the mining boom had driven wages for skilled labor to spectacular levels. Workers in their early twenties could earn as much as $200,000 a year, with generous benefits.

The big resource companies flew them by private jet a thousand miles to remote locations where they toiled at four-week on, four-week off schedules.

This was creating social problems, as it is tough for parents to manage offspring who make far more than they do.

The Next Great Commodity Boom has started and, in fact, we are already years into a prolonged supercycle that could stretch into the 2030s.

China, the world’s largest consumer of commodities, is currently stimulating its economy on multiple fronts, to break the back of a Covid hangover.

Those include generous corporate tax breaks, relaxed reserve requirements, government bailouts of financial institutions, and interest rate cuts. Get triggers like the impending moderation of its trade war with the US and it will be off to the races once more for the entire sector.

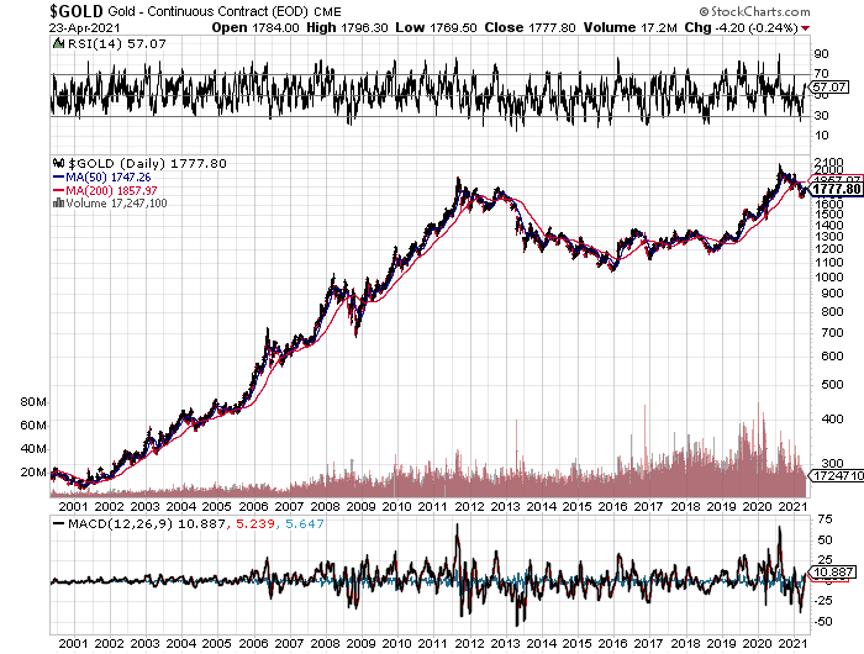

The last bear market in commodities was certainly punishing. From the 2011 peaks, copper (COPX) shed 65%, gold (GLD) gave back 47%, and iron ore was cut by 78%. One research house estimated that some $150 billion in resource projects in Australia were suspended or cancelled.

Budgeted capital spending during 2012-2015 was slashed by a blood-curdling 30%. Contract negotiations for price breaks demanded by end consumers broke out like a bad case of chicken pox.

The shellacking was reflected in the major producer shares, like BHP Billiton (BHP), Freeport McMoRan (FCX), and Rio Tinto (RIO), with prices down by half or more. Write-downs of asset values became epidemic at many of these firms.

The selloff was especially punishing for the gold miners, with lead firm Barrack Gold (GOLD) seeing its stock down by nearly 80% at one point, lower than the darkest days of the 2008-9 stock market crash.

You also saw the bloodshed in the currencies of commodity-producing countries. The Australian dollar led the retreat, falling 30%. The South African Rand has also taken it on the nose, off 30%. In Canada, the Loonie got cooked.

The impact of China cannot be underestimated. In 2012, it consumed 11.7% of the planet’s oil, 40% of its copper, 46% of its iron ore, 46% of its aluminum, and 50% of its coal. It is much smaller than that today, with its annual growth rate dropping by more than half, from 13.7% to 3.50% today.

What happens to commodity prices when China recovers even a fraction of the heady growth rates of yore? It boggles the mind.

The rise of emerging market standards of living will also provide a boost to hard asset prices. As China goes, so does its satellite trading partners, who rely on the Middle Kingdom as their largest customer. Many are also major commodity exporters themselves, like Chile (ECH), Brazil (EWZ), and Indonesia (IDX), who are looking to come back big time.

As a result, Western hedge funds will soon be moving money out of paper assets, like stocks and bonds, into hard ones, such as gold, silver (SIL), palladium (PALL), platinum (PPLT), and copper.

A massive US stock market rally has sent managers in search of any investment that can’t be created with a printing press. Look at the best-performing sectors this year and they are dominated by the commodity space.

The bulls may be right for as long as a decade thanks to the cruel arithmetic of the commodities cycle. These are your classic textbook inelastic markets.

Mines often take 10-15 years to progress from conception to production. Deposits need to be mapped, plans drafted, permits obtained, infrastructure built, capital raised, and bribes paid in certain countries. By the time they come online, prices have peaked, drowning investors in red ink.

So a 1% rise in demand can trigger a price rise of 50% or more. There are not a lot of substitutes for iron ore. Hedge funds then throw gasoline on the fire with excess leverage and high-frequency trading. That gives us higher highs, to be followed by lower lows.

I am old enough to have lived through a couple of these cycles now, so it is all old news for me. The previous bull legs of supercycles ran from 1870-1913 and 1945-1973. The current one started for the whole range of commodities in 2016. Before that, it was down from seven years.

While the present one is short in terms of years, no one can deny how business cycles will be greatly accelerated by the end of the pandemic.

Some new factors are weighing on miners that didn’t plague them in the past. Reregulation of the US banking system is forced several large players, like JP Morgan (JPM) and Goldman Sachs (GS) to pull out of the industry completely. That impairs trading liquidity and widens spreads— developments that can only accelerate upside price moves.

The prospect of falling US interest rates is also attracting capital. That reduces the opportunity cost of staying in raw metals, which pay neither interest nor dividends.

The future is bright for the resource industry. While the gains in Chinese demand are smaller than they have been in the past, they are off of a much larger base. In 20 years, Chinese GDP has soared from $1 trillion to $14.5 trillion.

Some 20 million people a year are still moving from the countryside to the coastal cities in search of a better standard of living and improved prospects for their children.

That is the good news. The bad news is that it looks like the headaches of Australian parents of juvenile high earners may persist for a lot longer than they wish.

Buy all commodities on dips for the next several years.

Global Market Comments

August 3, 2023

Fiat Lux

SPECIAL PRECIOUS METALS ISSUE

Featured Trades:

(WHAT’S UP WITH GOLD?),

(GLD), (UGL), (PPLT), (PLAT), (WPM)

(THE ULTRA BULL CASE FOR GOLD)

CLICK HERE to download today's position sheet.

Global Market Comments

February 27, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MAKING A SILK PURSE FROM A SOW’S EAR)

(META), (GOOGL), (MSFT), (AAPL), (AMZN), (NFLX), (TSLA), (SPY), (TLT), (ENPH), (UUP), (GLD), (SLV), (EEM)

CLICK HERE to download today's position sheet.

Global Market Comments

February 24, 2023

Fiat Lux

Featured Trade:

(FEBRUARY 22 BIWEEKLY STRATEGY WEBINAR Q&A)

(SPY), (BA), (CCI), (HD), (TLT), (TSLA), (PPLT), (PALL),

(JPM), (NVDA), (AAPL), (GOOGL), (META), (AMZN)

CLICK HERE to download today's position sheet.

Below please find the subscribers’ Q&A for the February 22 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: Will Russia use nuclear weapons on Ukraine?

A: No, they won’t. If you’re trying to take over a country, you don’t exactly want to drop atomic bombs on it first and render it useless. If they do, Ukraine will retaliate in kind with the nukes they have. Most of the nuclear weapons the old Soviet Union had were assembled in Ukraine and the machinery is still there. We know Ukraine has four nuclear power plants and hundreds of tons of fuel so they have uranium. You only need to increase the purity from 80% to 93% and then convert it to plutonium to get weapons-grade and you only need 20 pounds to make a small bomb. At the very least, they could build a dirty truck bomb and make Moscow uninhabitable for 100 years. If the Russians did explode a nuke, the fallout cloud would blow back on them the next day, China in three days, the US in 10 days, and back on Russia again in two weeks. If Ukraine doesn’t remember how to make nuclear weapons, they can just ask me. I do have “Nuclear Test Site” on my resume.

Q: What would be the impact on the markets of a government debt default?

A: Bonds would collapse, causing interest rates to spike, and taking down stocks big time. Higher interest rates would crash the real estate market. You also can’t do real estate closings during a shutdown because Fannie Mae and Freddie Mac aren’t there to buy the debt. Commodities would fall sharply on recession fears. Even gold and silver do poorly on a massive liquidity squeeze. Government payments would cease, including Social Security, Medicare, and military salaries. Air traffic control would stop unless they are happy to work for free. The only place to hide is cash under your mattress since US Treasury bills and commercial banks will also be at risk. This is what the House Republicans are risking. It really depends on how long the shutdown lasts. Every time Georgia representative Marjorie Taylor Greene shouted “liar” at the State of the Union address you could see bond prices ticking down. She is one of the people who has to agree to a rise in the debt ceiling and she didn’t inspire a lot of confidence in bondholders. All that said, a $10 dip is a good place to buy the (TLT).

Q: Would you buy Boeing up here?

A: I loved Boeing at $100 and we did a could trades down there. At $220 not so much. It’s more than doubled off the October low and all the best-case scenarios have happened. The 737 MAX, which crashed twice due to an AI issue, got back in the air. The 787 Dreamliner is selling well. The company now has a two-year order backlog. And Air India followed up with the biggest aircraft order in history, some 450 planes over ten years. If Boeing dips $50 that would be another story because I think it hits a new all-time high at $450 in a couple of years. By the way, I took a 737 MAX on my flight back from Hawaii last weekend and the crew loved it. There are no screens on the seats. Instead, they broadcast the 800 greatest movies of all time on free WIFI.

Q: How do we know if your trade alert is for the stock, the ETF, or another underlying position?

A: Look at the ticker symbol—it always tells you exactly which security we are working in.

Q: With Bullard signaling a 50 basis-point rate hike, will the S&P (SPY) go down in the near term and how much?

A: Well Bullard is only one guy out of nine, so he doesn’t have the final say. It really depends on what Jay Powell wants. And if the data continues hot and inflation keeps rising, we will get a 50 basis point rise, and that should take the index down 10% from the recent high, or give up half of its recent year-to-date gains, so that’s a good rule of thumb. As long as we’re waiting for bad news, (which we won’t get until March 22) the markets will do nothing until then.

Q: What do you think about Crown Castle International (CCI), the cell tower company, taking a big hit with the bond market?

A: It pretty much moves in sync with the bond market, which has just dropped 10 points, so you probably want to be buying or doubling up on (CCI) right here, because it will be the first thing to recover once we see a negotiated increase in the debt ceiling which has to happen before the summer. The 5G buildout continues unabated.

Q: Would you recommend buying Tesla (TSLA) shares again?

A: Yes, but at least $50 lower, which we may get. Or at least $50 off the $217 top. I think Tesla goes to $1,000 sometime in the next couple of years and so does Elon Musk. All of the factors that could drive the stock that high are in progress. I know it’s happening over there, and that’s easily a $1,000 stock once their current breakthroughs go mass-market.

Q: Any interest in Iron Condors?

A: It is the same as Strangles, with more limited risk with four legs, a call spread and a put spread because you stop out your losses at much lower levels. But they are very trading-intensive, commission-intensive trades, and it’s really too much for most beginners to handle. However, if you’re a professional, you might consider doing iron condors on these positions. Iron Condors also max profits when nothing moves, and lately, no move is a pretty rare event. We’re going to get it for the next couple of months, but don’t count on that being a frequent trade.

Q: Any iShares 20 Plus Year Treasury Bond ETF (TLT) LEAPS to buy now?

A: Yes I've been kind of sitting on my hands waiting to see if this bottom here holds at 99 before I put out LEAPS, but we’re so close it really almost makes no difference. And if I were to do a LEAPS here it probably would be the $100-$105 one-year out. That might get you about a 100% profit in a year. That’s a very safe LEAPS, and I’ll get the numbers out when I get a chance.

Q: What’s your opinion on Home Depot (HD)?

A: I like it for the long term. Clearly, their disastrous earnings report shows that the economy for home repair is not as strong as we thought it was, so it may go lower first. I would hold off until we get a real capitulation selloff in those stocks.

Q: Are gold and silver possible candidates for LEAPS?

A: Yes, especially in view of the recent correction in these metals. And we did put these out last October at the market bottom. I probably will be updating that sometime in the next few weeks.

Q: How much longer will the Ukraine/Russia war last?

A: The general consensus among the military now is that this goes on for several more years, and both sides will just keep pouring troops into the meat grinder until they get exhausted.

Q: Any way to play Platinum (PPLT) or Palladium (PALL)?

A: Yes, there are ETFs on each of them.

Q: Any thoughts on the crypto industry?

A: I have given up on the crypto industry because it has been shown that so many of these trading platforms were stealing from their customers. Once you lose the confidence of a customer on trust, you never get it back in the financial industry. Also, crypto was interesting a couple of years ago when it was going up and everything else in the world was too expensive, but now you have all the best stocks trading not far from multi-year lows, and that makes quality stocks much more attractive than a crypto where you really don't know what’s going to happen. Crypto could be another Nikkei, which after 32 years still hasn’t reached its old highs. That is unless it gets taken over by big banks like (JPM) and regains respectability that way.

Q: Any thoughts on investing in the AI trend?

A: AI has suddenly become what crypto was 2 years ago, and what 3D printing was 15 years ago. It’s just the theme of the day, and something to promote. There are no pure AI plays. Basically, all companies have been using it for 10 or 15 years, it’s not a new thing. In fact, AI is already in every aspect of your life, you just might not know it yet. NVIDIA (NVDA) is probably the purest AI play out there whose chips everyone needs to execute AI. Beyond that, the biggest AI users are Apple (AAPL), Alphabet (GOOGL), Meta (META), and Amazon (AMZN). When Amazon makes ten more recommendations on books you might like or movies you might watch, that is AI.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

With Medal of Honor Winner Colonel Mitchel Paige

Global Market Comments

December 10, 2021

Fiat Lux

Featured Trade:

(THE NEXT COMMODITY SUPERCYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

Global Market Comments

April 27, 2021

Fiat Lux

Featured Trade:

(THE SECRET FED PLAN TO BUY GOLD),

(GLD), (GDX), (PALL), (PPLT),

(TESTIMONIAL)

With the latest effort to expand quantitative easing through the Fed purchase of individual corporate bonds, we must consider what else our central bank has up its sleeve.

With American interest rates already near zero, the markets will take the rates for all interest-bearing securities well into negative numbers. This has already happened in Japan and Germany.

At that point, our central bank’s primary tool for stimulating US businesses will become utterly useless, ineffective, and impotent.

What else is in the tool bag?

How about large-scale purchases of Gold (GLD)?

You are probably as shocked as I am with this possibility. But there is a rock-solid logic to the plan. As solid as the vault at Fort Knox.

This theory gained credence when my old friend, Judy Shelton, was appointed to the federal reserve, a noted gold bug.

The idea is to create asset price inflation that will spread to the rest of the economy. It already did this with great success from 2009-2014 with quantitative easing, whereby almost every class of debt securities were hoovered up by the government.

“QE on steroids”, to be implemented only after overnight rates go negative, would involve large-scale purchases of not only gold, but stocks, government bonds, and exchange-traded funds as well. Corporate bond purchases are simply a step in that direction.

If you think I’ve been smoking California’s largest cash export (it’s not the raisins) you would be in error. I should point out that the Japanese government is already pursuing QE to this extent, at least in terms of equity-type investments and ETFs, and already owns a substantial part of the Japanese stock market.

And, as the history buff that I am, I can tell you that it has been done in the US as well, with tremendous results.

If you thought that President Obama had it rough when he came into office in 2009 with the Great Recession on, it was nothing compared to what Franklin Delano Roosevelt inherited.

The country was in its fourth year of the Great Depression. US GDP had cratered by 43%, consumer prices crashed by 24%, the unemployment rate was 25%, and stock prices vaporized by 90%. Mass starvation loomed.

Drastic measures were called for.

FDR issued Executive Order 6102 banning private ownership of gold, ordering them to sell their holdings to the US Treasury at a lowly $20.67 an ounce.

He then urged Congress to pass the Gold Reserve Act of 1934, which instantly revalued the government’s holdings at $35.00, an increase of 69.32%. These and other measures caused the value of America’s gold holdings to leap from $4 to $12 billion. That’s a lot of money in 1934 dollars, about $208 billion in today’s money.

Since the US was still on the gold standard back then, this triggered an instant dollar devaluation of more than 50%. The high gold price sucked in massive amounts of the yellow metal from abroad creating, you guessed it, inflation.

The government then borrowed massively against this artificially created wealth to fund the landscape-altering infrastructure projects of the New Deal.

It worked.

During the following three years, the GDP skyrocketed by 48%, inflation eked out a 2% gain, the unemployment rate dropped to 18%, and stocks jumped by 80%. Happy days were here again.

Monetary conditions are remarkably similar today to those that prevailed during the last government gold buying binge.

There has been a de facto currency war underway since 2009. The Fed started when it launched QE, and Japan, Europe, and China have followed. Blue-collar unemployment and underpayment are at a decades high. The need for a national infrastructure program is overwhelming.

However, in the 21st century version of such a gold policy, it is highly unlikely that we would see another gold ownership ban.

Instead, the Fed would most likely move into the physical gold market, sitting on the bid for years, much like it recently did in the Treasury bond market for five years. Gold prices would increase by a multiple of current levels.

It would then borrow against its new gold holdings, plus the 4,176 metric tonnes worth $200 billion at today’s market prices already sitting in Fort Knox, to fund a multi trillion-dollar infrastructure spending program.

Heaven knows we need it. Millions of blue-collar jobs would be created, and inflation would come back from the dead.

Yes, this all sounds like a fantasy. But negative interest rates were considered an impossibility only years ago.

The Fed’s move on gold would be only one aspect of a multi-faceted package of desperate last-ditch measures to extend economic growth into the future which I outlined in a previous research piece (click here for “What Happens When QE Fails” by clicking here).

That’s assuming that the gold is still there. Treasury Secretary Stephen Mnuchin says he saw the gold himself during an inspection that took place on the last solar eclipse over Fort Knox in 2018. The door to the vault at Fort Knox had not been opened since September 23, 1974.

But then Steve Mnuchin says a lot of things. Persistent urban legends and internet rumors claim that the vault is actually empty or filled with fake steel bars painted gold.

But is it Really Gold?

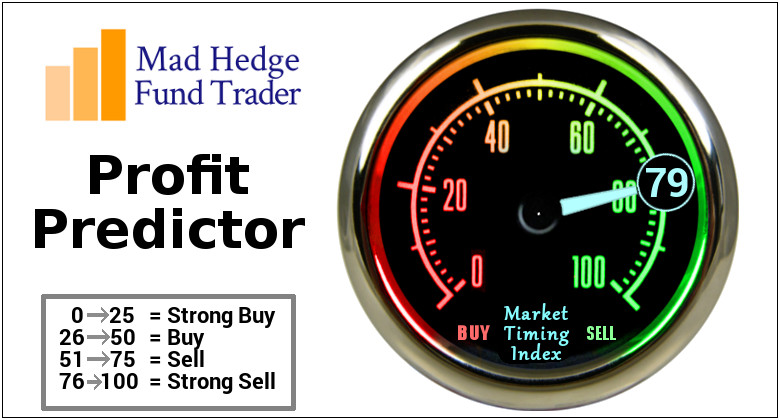

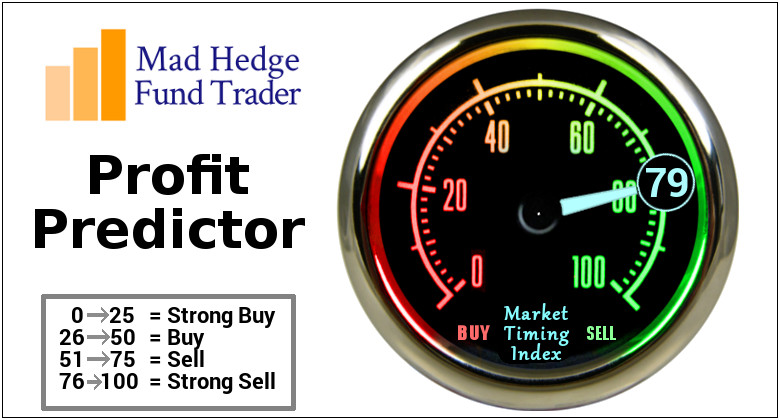

You Can See the Upside Breakout Coming Clear as Day

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.