Market’s tried to rally last week….and failed.

The reason, of course, is Fed governor Jay Powell’s comments that interest rates may have to stay higher for longer. He seems hell-bent on reaching his 2.0% inflation target, down from the current 3.2% and well off the 9.0% high.

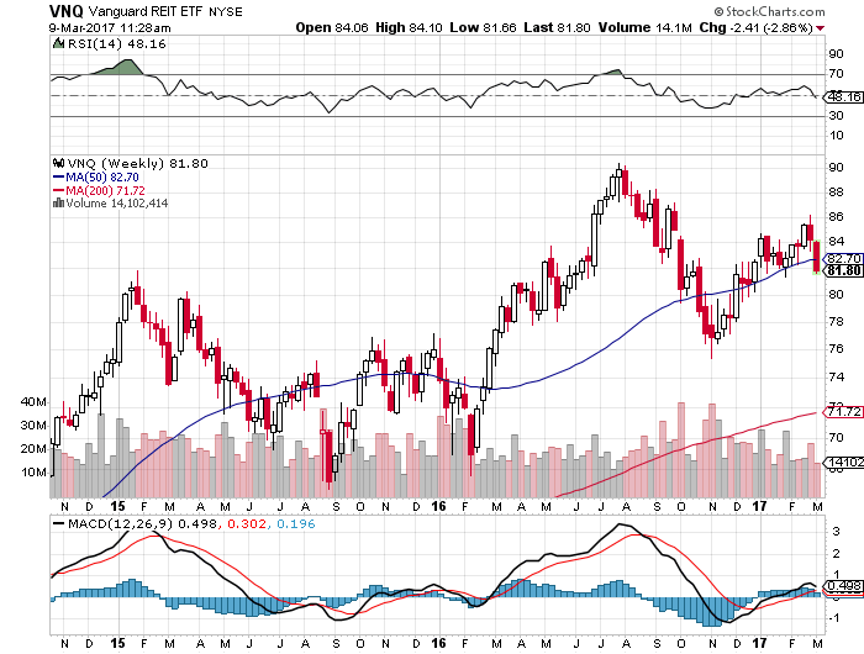

That puts off any rally in the interest rate-sensitive sectors, which is almost everything, by three to six months. But then, markets discount fundamentals by six to nine months in advance.

You do the math.

That means a monster rally in all financial assets should ensue sometime in September or October that could last a decade.

What a surprise!

The possibility that the next rally will be explosive is bereft of doubt. A record $5.6 trillion is now sitting on the sidelines ready to dive into risk assets on the slightest pretense. We might be in for another January 4 repeat. That includes funds in money market funds, overnight bank deposits, 90-day T-bills, IRAs, 401Ks, and cash under the mattress.

It's all very reminiscent of 1982 when we enjoyed the exact demographic tailwind as we are enjoying now. An 18-year rally followed and took the Dow Average up 20-fold.

The United States has by far the strongest major economy in the world for a reason. A 3.5% Headline Unemployment Rate, 5.25% overnight interest rates, and a 3.2% inflation rate are supposed to be mathematically impossible, yet here we are.

Did I mention that 2024 is an election year? That's when the economic data magically improve, as they have during every election over the past 200 years. Stock investors notice this.

As I spent all day every day and well into the night conducting research, I noticed a curious development. All the bears seem to live on the East Coast, while those in Silicon Valley are the most bullish I’ve ever seen.

That’s because we here in California see the hyper-accelerating technology in every meeting, with every human contact, and right on our own doorsteps. We are the beta testers for the technology that the rest of the country and the world won’t see for a few years.

While the nation is debating climate change, there is a “Robot War” taking place in San Francisco over how rapidly to permit the expansion of the self-driving taxi fleet, now capped at 1,000.

The fact that their accident rate has been near zero, far lower than human-driven vehicles, is a major point in their favor. I’m getting used to seeing no driver in the car next to me.

Walked into a McDonald's or a Taco Bell lately? It’s all computers. My theory as to why UPS agreed to such a generous 40% pay increase over five years for 340,000 workers is that when the next contract comes up for negation, they will have gone all robotic by then.

Autonomous driving, artificial intelligence, quantum computers are all still in their infancy and are in no way reflected in share prices.

In the meantime, keep massaging those 5.25% 90-day T-bill rates and enjoy your summer vacation. But the time to go all in with risk is approaching.

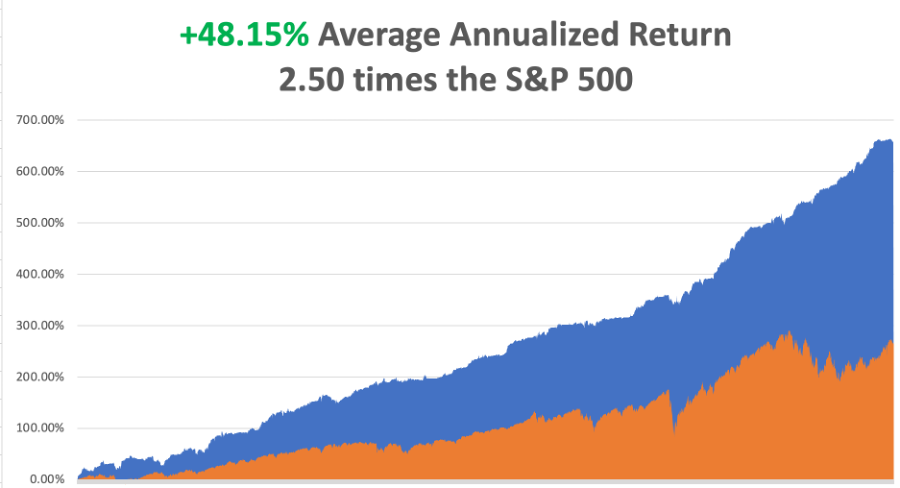

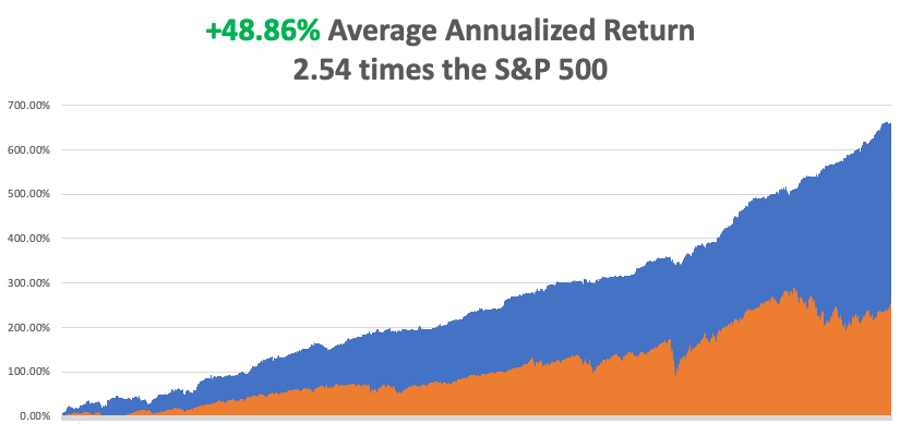

So far in August, we are down -4.70%. My 2023 year-to-date performance is still at an eye-popping +60.80%. The S&P 500 (SPY) is up +17.10% so far in 2023. My trailing one-year return reached +92.45% versus +8.45% for the S&P 500.

That brings my 15-year total return to +657.99%. My average annualized return has fallen back to +48.15%, some 2.50 times the S&P 500 over the same period.

Some 41 of my 46 trades this year have been profitable.

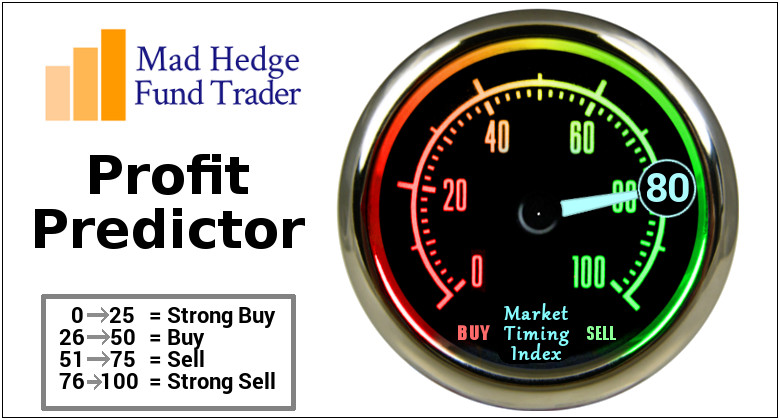

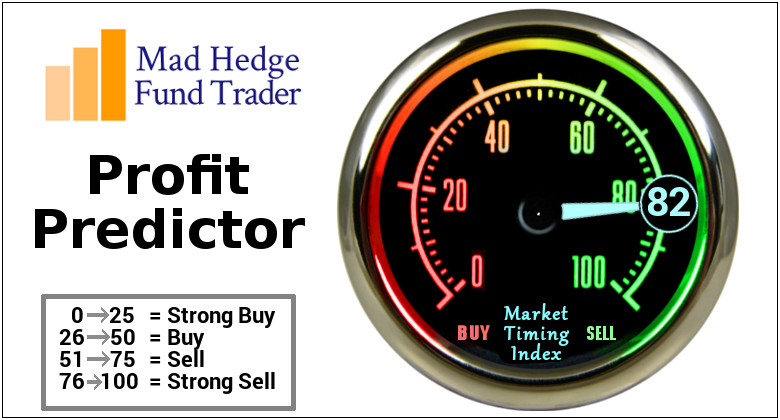

The Oracle Speaks! Fed Governor Jay Powell might as well have been reading me the New York telephone book when he indicated that “Interest rates may have to stay higher for longer” during his Jackson Hole speech. The Fed only knows two speeds: too slow and too fast. The bears are coming out of the woodwork once again. Look for lower lows to buy into for all asset classes. Start positioning yourself for a monster yearend rally.

Markets Will Snore Until September 1 Jobs Report. The August Nonfarm Payroll report is expected to come in at a weak 175,000. Enjoy the last week of summer.

The US Budget Deficit is Climbing Once Again, after a super spike in 2020. Recent environmental spending has added another trillion dollars to the bill. That will seem a bargain if we can’t slow down exploding global temperatures….quickly. It was 120 degrees in Italy this summer. Mama Mia!

Has Apple (AAPL) Topped Out? With no new products on the horizon and interest rates rising, the bull market in Apple shares may have called it a day at last month’s 200 peak. As with the rest of the “Magnificent Seven,” there was a giant pull forward of performance into the first half of this year. All of the stock’s gains have been through multiple expansions, regaining much of what was lost in 2022.

Existing Home Sales Drop Again, demolished by record-high mortgage rates. July saw sales decline by 2.2% to a six-month low on sales of 4.15 million units. Home resales, which account for a big chunk of U.S. housing sales, fell 16.6% on a year-on-year basis in July.

Ten-Year Treasuries Hit New 16-year High, at 4.32%. We could be approaching a bond-selling climax around Jay Powell’s Jackson Hole Speech on Friday and the buying opportunity of the decade.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, August 28 at 8:00 AM EST, the Dallas Fed Manufacturing Index is out.

On Tuesday, August 29 at 8:30 AM, the US JOLTS Job Openings Report is released.

On Wednesday, August 30 at 2:30 PM, the ADP Employment Change is published.

On Thursday, August 31 at 8:30 AM, the Weekly Jobless Claims are announced. Personal Income & Spending are also announced.

On Friday, September 1 at 2:30 PM, the Nonfarm Payroll Report for August is published. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, The Diary of a Mad Hedge Fund Trader is now celebrating its 15th year of publication.

During this time, I have religiously pumped out 3,000 words a day, or 18 newsletters a week, of original, independent-minded, hard-hitting, and often wickedly funny research.

I spent my life as a war correspondent, Marine Corps combat pilot, Wall Street trader, and hedge fund manager, and if you can’t laugh after that, something is wrong with you.

I’ve been covering stocks, bonds, commodities, foreign exchange, energy, precious metals, real estate, and even agricultural products.

You’ve been kept up on my travels around the world and listened in on my conversations with those who drive the financial markets.

I also occasionally opine on politics, but only when it has a direct market impact, such as with the recent administration's economic and trade policies. There is no profit in taking a side.

The site now contains over 20 million words, or 30 times the length of Tolstoy’s epic War and Peace.

Unfortunately, it feels like I have written on every possible topic at least 100 times over.

So, I am reaching out to you, the reader, to suggest new areas of research that I may have missed until now which you believe justify further investigation.

Please send any and all ideas directly to me at support@madhedgefundtrader.com/, and put “RESEARCH IDEA” in the subject line.

The great thing about running an online business is that I can evolve it to meet your needs on a daily basis.

Many of the new products and services that I have introduced since 2008 have come at your suggestion. That has enabled me to improve the product’s quality, to your benefit. Notice how rapidly my trade alert performance is going up, now annualizing at +47% a year.

This originally started out as a daily email to my hedge fund investors giving them an update on fast market-moving events. That was at a time when the financial markets were in free fall, and the end of the world seemed near.

Here’s a good trading rule of thumb: Usually, the world doesn’t end. History doesn’t repeat itself, but it certainly rhymes.

The daily emails gave me the scalability that I so desperately needed. Today’s global mega enterprise grew from there.

Today, the Diary of a Mad Hedge Fund Trader and its Global Trading Dispatch is read in over 140 countries by 30,000 followers. The Mad Hedge Technology Letter, the Mad Hedge Biotech & Health Care Letter, Mad Hedge AI, and Jacquie’s Post also have their own substantial followings. And the daily Mad Hedge Hot Tips is one of the most widely read publications in the financial industry.

I’m weak in distribution in North Korea and Mali, in both cases due to the lack of electricity. But that may change.

One can only hope.

If you want to read my first pitiful attempt at a post, please click here for my February 1, 2008 post.

It urged readers to buy gold at $950 (it soared to $2,200), and buy the Euro at $1.50 (it went to $1.60).

Now you know why this letter has become so outrageously popular.

Unfortunately, I also recommended that they sell bonds short. I wasn’t wrong on that one, just early, about eight years too early.

I always get asked how long will I keep doing this?

I am already collecting Social Security, so that deadline came and went. My old friend and early Mad Hedge subscriber, Warren Buffet is still working at 92, so that seems like a realistic goal. And my old friend, Henry Kissinger, is still hard at it at 100 years old.

Hiking ten miles a day with a 50-pound pack, my doctor tells me I should live forever. He says he spends all day trying to convince his other patients to be like me, and the only one who actually does it is me.

The harsh truth is that I don’t know how to NOT work. Never tried it, never will.

The fact is that thousands of subscribers love me for what I do, pay for me to travel around the world first class to the most exotic destinations, eat in the best restaurants, fly the rarest historical aircraft, then say thank you. I even get presents (keep those pounds of fudge and bottles of bourbon coming!).

Given the absolute blast I have doing this job; I would be Mad to actually retire.

Take a look at the testimonials I get only on an almost daily basis and you’ll see why this business is so hard to walk away from (click here for those).

In the end, you are going to have to pry my cold dead fingers off of this keyboard to get me to give up.

Fiat Lux (let there be light).

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader