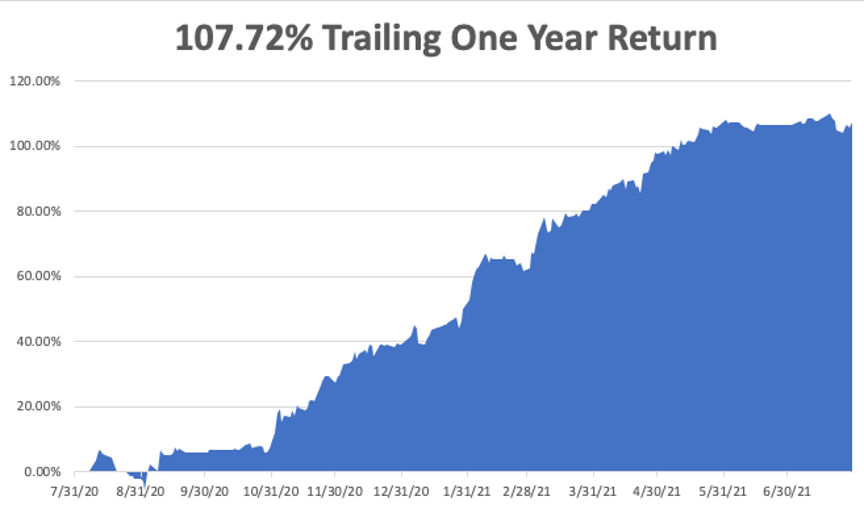

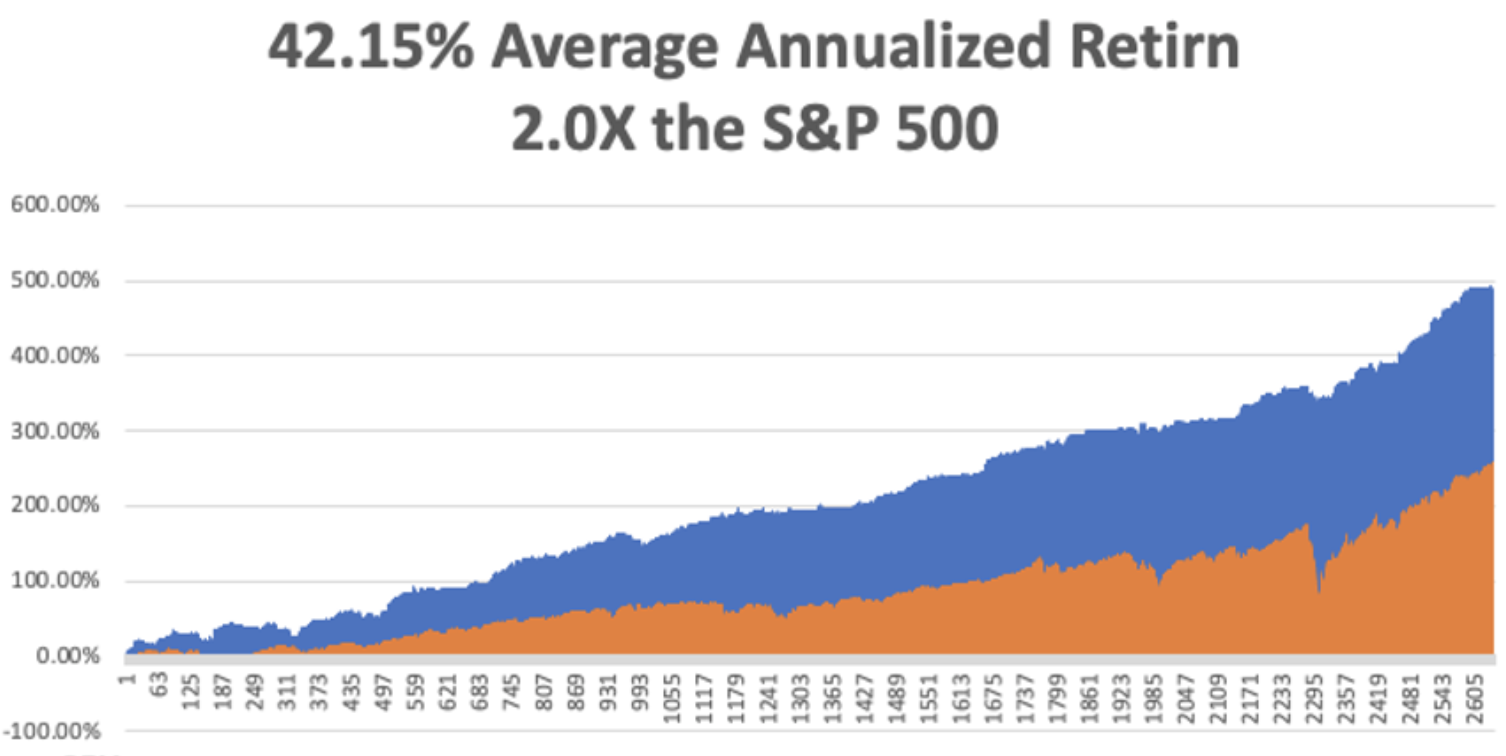

Below please find subscribers’ Q&A for the August 11 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA.

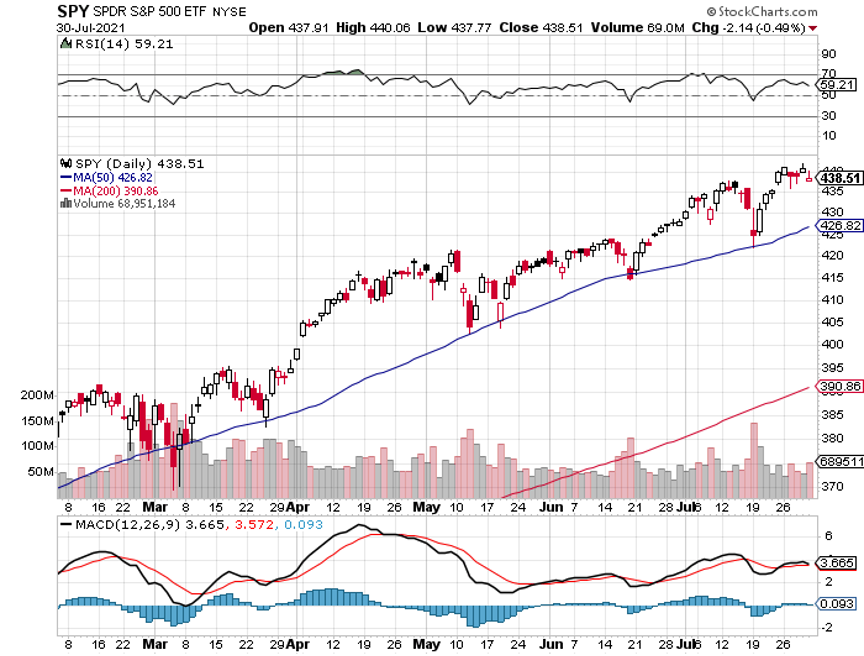

Q: If we see a correction in stocks, what would you do?

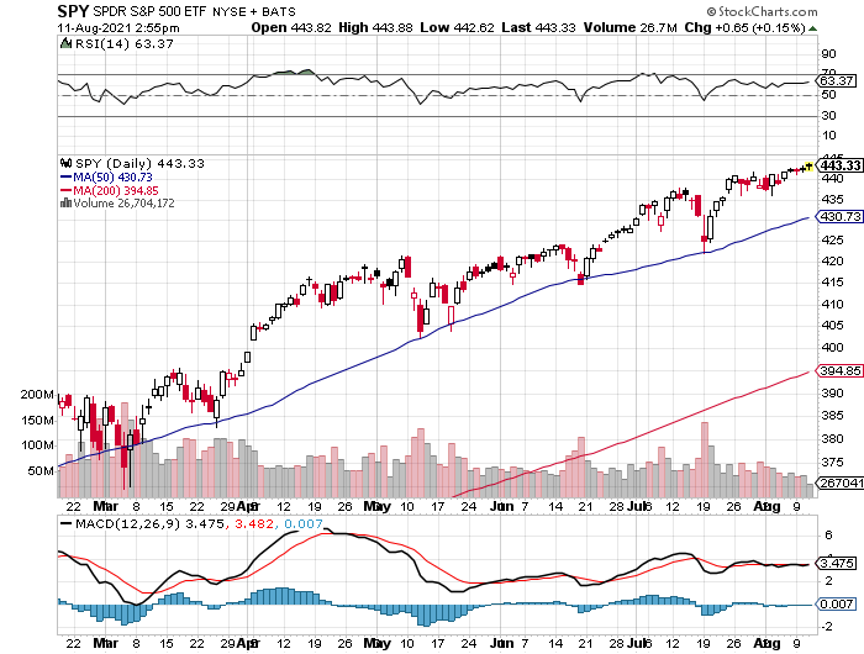

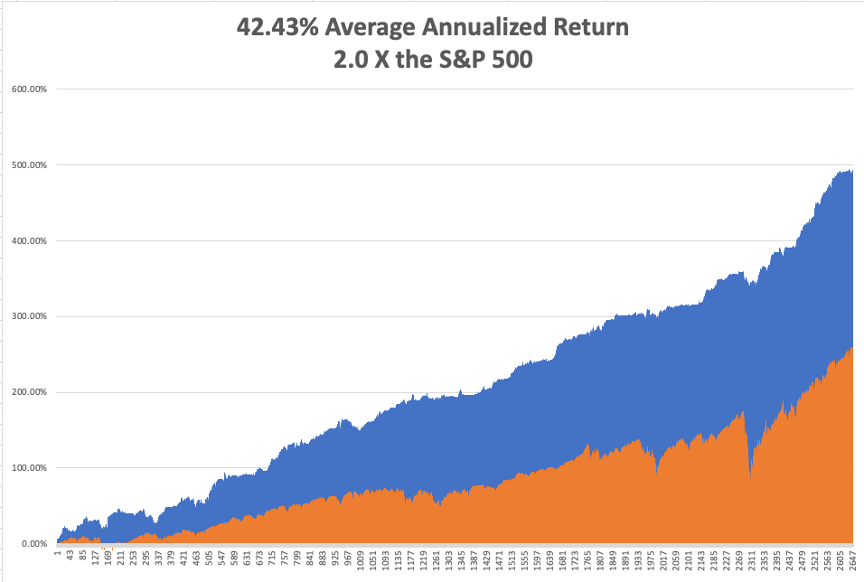

A: Buy more stocks (SPY). All of our positions expire next week, and we go 100% into cash. I’m looking for just a 5% correction and then I’m just going to go piling in 100% invested with a barbell portfolio since everything is working now and some of the best tech stocks like Amazon have already had 10% corrections.

Q: Time for LEAPS again on Amazon (AMZN)?

A: Yes, but let Amazon have more time to bottom out. It may just be a “time” correction where it goes sideways for a month or two. The company is still growing at an incredible rate.

Q: What about FedEx (FDX) and Walt Disney (DIS) LEAPS?

A: Those LEAPS I would do, right here, right now. We’ve had our corrections already in those sectors and they’re ready to take off. It’s just a matter of time before these sectors come back into favor. These are both delta peaking plays.

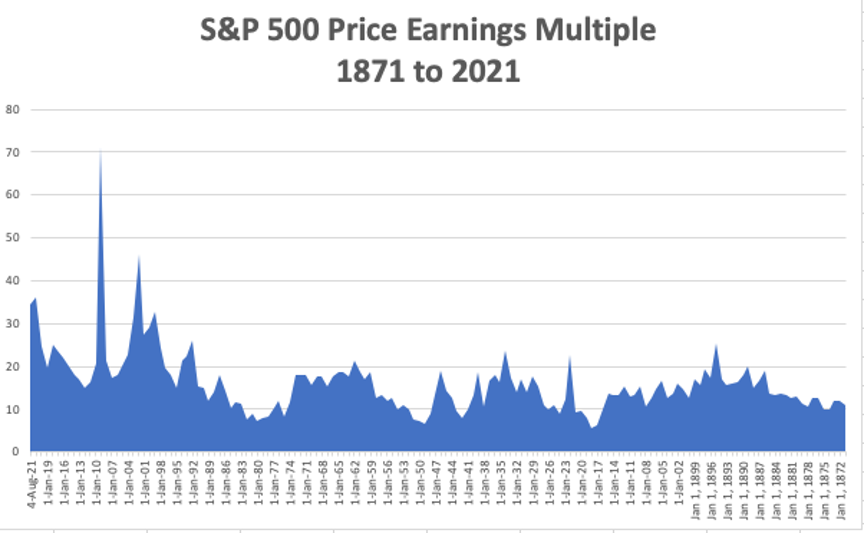

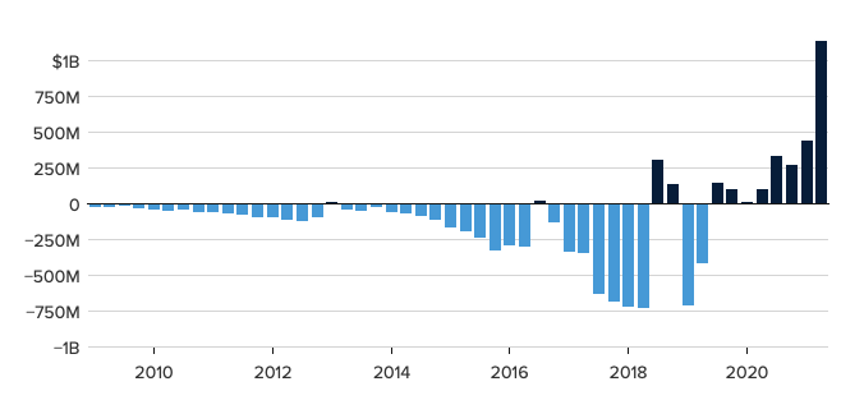

Q: It seems that the US government is taking the stance that they can tax their way out of the fiscal hole; is this true?

A: No, they don’t need to tax their way out of the fiscal hole; deflation will wipe out all US government debt on a 30-year view, and this is what’s happened to not only all the government debt in US history but all government debts all over the world starting with France in the 1600s. By the time the government has to pay back its 30-year bonds, the purchasing power of that dollar will have fallen by 80% or 90%, meaning that essentially the bonds get deflated away to nothing. And this is why we have governments, so they can borrow that money now, spend it now to rescue the economy, and then they never have to pay it back in real dollars. This is why governments borrow. The investors who really have to pick up the bill for this are bond owners, who see the purchasing power of the bonds decline by 2%-3% a year.

Q: When do you see a correction, and what would you do?

A: It’s either going to be in the next couple of weeks or never. If we get one, I would load the boat again with more long positions. Of the five positions out of 100 I’ve lost money this year, four have been short positions, so you can see why we’re really trying to limit the short positions here.

Q: Visa (V) is going ex-dividend tomorrow—is there a risk of early assignment?

A: There is, but if you get an early assignment, just say thank you very much, Mr. Market, call your broker to tell them to exercise your long call position to cover your call short position, and you will get the maximum profit several days earlier than expiration. This happens sometimes as hedge funds try to get the quarterly dividend on the cheap, but you have to act fast, otherwise, you’ll end up with a short position in Visa on your hands, and most likely a margin call. Brokers are not allowed to automatically exercise longs to meet calls anymore. You have to call them and order them to exercise that long. So, pay attention going into quarterly option expirations.

Q: I don’t trust your COVID information any more than I trust the government line.

A: All of my Covid data comes from Johns Hopkins University and is interdependently collated from every country in the United States. If you have any complaints you can go to them. All I can say is there are 620,000 bodies in the country that died of something. Oh, and we had the lowest population growth last month in 50 years. I’ve had family members die from it so I believe that.

Q: If the Republicans win in 2022 and 2024, will the bull market continue?

A: Absolutely not. We get a new recession and another bear market. Everything that’s going well now reverses, the entire environmental infrastructure strategy goes down the toilet, and Covid makes a huge recovery. I would go with what’s working, and 6.5% economic growth now and a market going up 30% a year totally works for me. Of course, I would make another fortune on the short side.

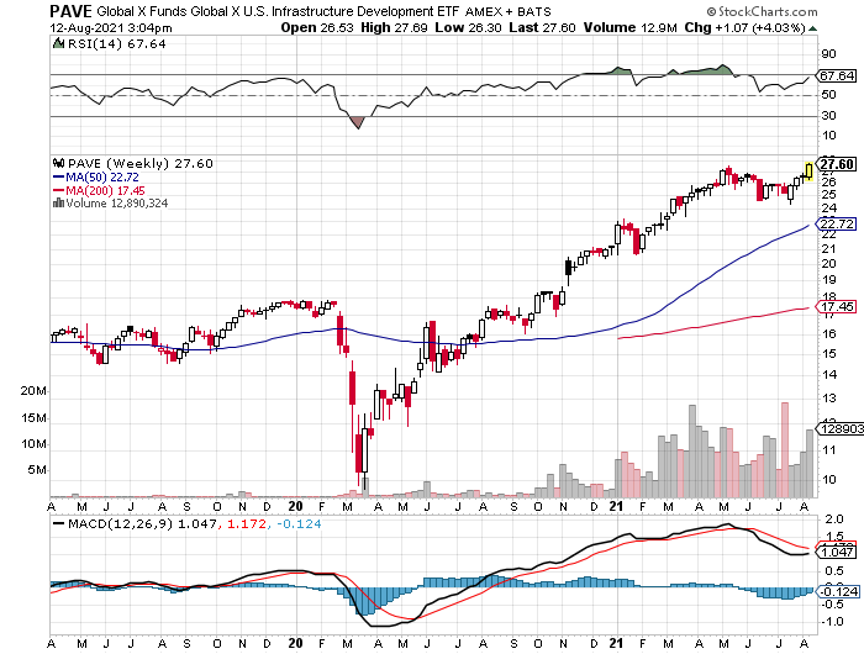

Q: How should you play infrastructure?

A: There is an infrastructure ETF called the Global X Funds Infrastructure ETF (PAVE) that has already had a big move, up 176% in 17 months. Other than that you can just play your basic commodity stocks like US Steel (X), Nucor (NUE), and Freeport McMoRan (FCX).

Q: How long will the hot housing market continue?

A: Ten more years. That's how long it will take to digest the current 85 million strong millennial generation who are now buying first-time homes or upgrading what they’ve got. And remember, we’re still operating with half of the new home construction capacity that we had 15 years ago before the last financial crisis.

Q: What's your prognosis for semiconductors?

A: They just had a super-heated spike; I expect them to take a break. That's why I took profits on Advanced Micro Devices (AMD). We’ll find a new bottom, and then I want to buy back into it. It’s taking a break with the rest of technology right now, which is perfectly normal.

Q: Would you take this dip to add to mRNA and BioNTech?

A: I would say yes. This is an industry that’s on the eve of a biotech revolution—the cure of all human diseases. And these two companies with their mRNA technologies are in the best place to take advantage of that.

Q: Will there be a big spike down in August?

A: It looks like it’s not happening. Like I said, if it doesn’t happen in the next few weeks, it’s not going to happen. Excess liquidity is just driving all investment decisions. If it doesn’t go down now, what’s the reason for it to go down in October? I just see no negatives at all on the horizon except for another out-of-the-blue variant like a Lambda or an Epsilon variant.

Q: Does slow population growth include illegal immigration?

A: It does, immigration both legal and illegal has been constant for decades and decades, it’s about a million people a year. But Americans are not reproducing like they used to, the birth rate hit a 50-year low last year because women did not want to go to the hospitals which were full of COVID patients. A lower population growth over the long term is very bad for economic growth. That is why Japan has essentially been in a nonstop recession for the last 32 years, because of their baby bust.

Q: Do you have political debt ceiling concerns?

A: No, these are always last-minute before midnight deals. I don't see this being any different, never underestimate the ability of Congress to spend more money, no matter who is in power.

Q: What do you think of oil in the short run?

A: Short term it may go sideways, we may even have a rally to new highs, but the long-term trade for oil is that it’s going out of business. EVs, mean you lose 50% of demand for oil in the next 10 years, and they will start discounting that now in the price of oil.

Q: Why is silver down so much?

A: It’s being dragged down by Gold (GLD), and silver (SLV) always moves twice as fast as gold.

Q: How are muni bonds going forward?

A: I don’t see them going much further. They had a massive rally, discounting an increase in taxes which hasn’t happened. So even if they do raise taxes which may be next year’s business, that is fully discounted in the Muni market already.

Q: What am I missing? You’ve been saying for months not to get involved with Bitcoin but then I heard you say you bought LEAPS.

A: No, I didn’t buy the LEAPS. I tried to buy the LEAPS but missed them and it ran away and they ended up tripling in two weeks. It’s just not like buying a normal stock. Once these things turn, they just start going up every day for weeks with no pullbacks whatsoever. This is valuation-free security with no dividend, interest, or earnings. It’s driven by pure supply and demand.

Q: What do you think of the precious metal miners like the Van Eck Vectors Gold Miners ETF (GDX)?

A: Let the current meltdown burn out and then go into long term LEAPS.

Q: What’s the best way to buy silver?

A: The best way is doing 2-year LEAPS on Wheaton Precious Metals (WPM) at current levels.

Q: What do you think about Coinbase (COIN)?

A: It’s definitely a candidate, but you want to get it on a down day. Coinbase is in the “selling shovels to the gold miners” business which is always a fantastic business model and we here in California know all about it. It’s just a question of when and where to get involved. It’s been gyrating this week because of their new burden of doing the tax reporting on all crypto buyers among their customers. That will definitely be a drag on the business.

Q: What's your short-term view on the big commodity plays like Freeport McMoRan (FCX), Alcoa Aluminum (AA), and US Steel (X)?

A: I would say they’re all going up. Maybe half the infrastructure bill has been discounted into the metals prices, but not all of it, therefore they have more to go to the upside.

Q: What are the best real estate buys?

A: There are none anywhere; maybe somewhere in eastern Europe, but still unlikely. It’s the best time ever now to rent. Buying here would be madness. And by the way, I predicted this property boom 10 years ago, if you go back in my research because 2021 was when the millennials would show up as massive buyers in the housing market, right when there was going to be a demographic shortage. That’s why I think the real estate boom goes on for another 10 years. But you won't see the gains that we’ve seen this year. You will maybe see 5% or 10% gains a year, definitely not 50% or 100% gains that we’ve just seen.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in here, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader