20/20 hindsight is a wonderful thing, especially when all of your predictions come true.

In February, I announced that markets would trade in broad ranges until the run-up to the midterm elections. That is what has happened to a tee, with the decisive upside breakout taking place last week. From here on. You’re trying to buy dips for a year-end run-up to higher highs.

For many months I was the sole voice in the darkness crying out that the bull market was still alive, it was just resting. Now quality laggards are taking the lead, such as in Industrials (XLI), Health Care (XLV), Consumer Staples (XLP), and Consumer Discretionary (XLY).

Home Depot (HD), which I recommended a month ago has taken off for the races, as has competitor Lowes (LOW), thanks to a twin hurricane boost. Even the long dead banks have recently showed a pulse (MS), (GS).

Technology stocks are taking a long-needed rest after a torrid two-and-a-half-year run. But they’ll be back. They always come back.

It’s not only stocks that have broken out of ranges, so has the bond market (TLT), the U.S. dollar (UUP), and foreign currencies (FXE). Will commodity companies like Freeport-McMoRan (FCX) and emerging markets (EEM) be the last to pick themselves off the mat, or do they really need to see the end of the trade wars first?

Markets are essentially acting like the trade war is over and we won. Why would traders believe this? That’s what a Volatility Index touching $11 tells you and is why I have been telling them to avoid buying it all week. Because the president told them so.

Another not insignificant positive is that multinationals have been slow to repatriate foreign funds, so there is a lot more still abroad to buy back their own stocks.

Weekly jobless claims hit another half century low at 201,000. Major U.S. companies such as UPS (UPS) and Target (TGT) are planning record levels of Christmas hiring. By the way, this is what economic peaks look like.

The Senate passes a mini spending bill that keeps the government from shutting down until December 7. The budget deficit keeps on soaring, but apparently, I am the only one who cares. Live through a debt crisis like we had during the early 1980s and you’d feel the same way.

The data for housing continues to be terrible, and we saw our first increase in inventories in three years.

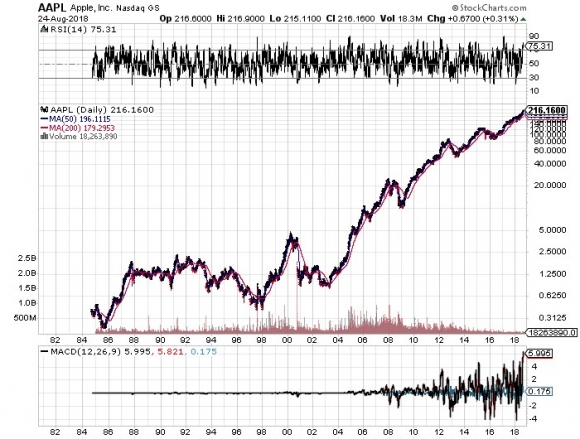

Finally, with people camping out overnight and lines around the block, Apple’s CEO Tim Cook opens the doors to the Palo Alto, CA, store at 9:00 AM sharp on Friday to three new phones. But did the stock peak at $230, as it has in past release cycles?

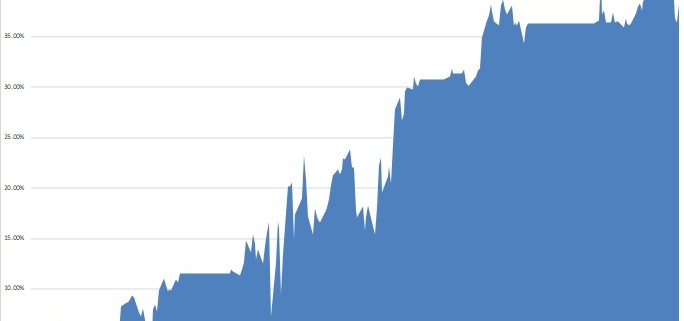

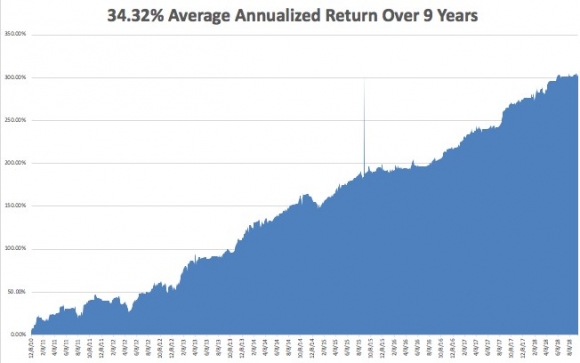

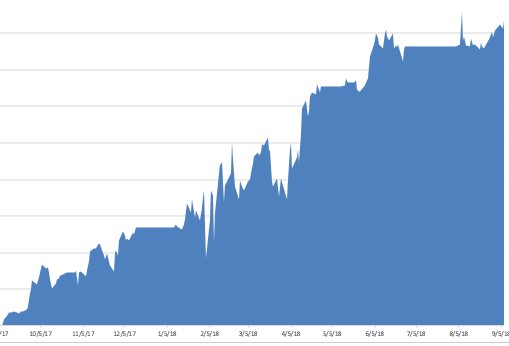

Last week, the performance of the Mad Hedge Fund Trader Alert Service forged a new all-time high and then gave it up on one bad trade. September is now unchanged at -0.32%. My 2018 year-to-date performance has retreated to 26.69%, and my trailing one-year return stands at 38.23%.

My nine-year return appreciated to 303.16%. The average annualized Return stands at 34.32%. I hope you all feel like you’re getting your money’s worth.

This coming week is all about the Fed, plus a plethora of housing data.

On Monday, September 24, at 10:30 AM, we learn the August Dallas Fed Manufacturing Survey.

On Tuesday, September 25, at 9:00 AM, the new S&P Corelogic Case-Shiller National Home Price Index for July, a three-month lagging indicator.

On Wednesday September 26, at 10:00 AM, the August New Home Sales is published. At 2:00 the Fed Open Market Committee announced its decision to raise interest rates by 25 basis points.

Thursday, September 27 leads with the Weekly Jobless Claims at 8:30 AM EST, which dropped 3,000 last week to 201,000, a new 43-year low. At the same time an update on Q2 GDP is published.

On Friday, September 28, at 9:45 AM, we learn the August Chicago Purchasing Managers Index. The Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me,

Good luck and good trading.