Below please find subscribers’ Q&A for the March 31 Mad Hedge Fund Trader Global Strategy Webinar broadcast from frozen Incline Village, NV.

Q: Would you buy Facebook (FB) or Zoom (ZM) right here?

A: Well, Zoom was kind of a one-hit wonder; it went up 12 times on the pandemic as we moved to a Zoom economy, and while Zoom will permanently remain a part of our life, you’re not going to get that kind of growth in stock prices in the future. Facebook on the other hand is going to new highs, they just announced they’re laying a new fiber optic cable to Asia to handle a 70% increase in traffic there. So, for the longer term and buying here, I think you get a new high on Facebook soon; there's maybe another 20-30% move in Facebook this year.

Q: I can’t really chase these trades here, right?

A: Correct; if you wait any more than a day or 2 on executing a trade alert, you’re missing out on all of the market timing value we bring to the game. So that's why I include an entry price and the “don’t pay more than” price. And we never like to chase, except last year, when we did it almost all the time. But last year was a chase market, this year not so much.

Q: How are LEAP purchase notifications transmitted?

A: Those go out in the daily newsletter Global Trading Dispatch when I see a rare entry point for a LEAP, then we’ll send out a piece and notify everybody. But it’s very unusual to get those. Of course, a year ago we were sending out lists of LEAPS ten at a time when the Dow Average ($INDU) is at 18,000. But that is not now, you only wait for those once or twice a year. On huge selloffs to get into two-year-long options trades, and that is definitely not now. The only other place I've been looking out for LEAPS right now are really bombed out technology stocks begging for a rotation. Concierge members get more input on LEAPS and that is a $10,000 a year upgrade.

Q: What are your thoughts on silver (SLV) and long-term gold (GLD)?

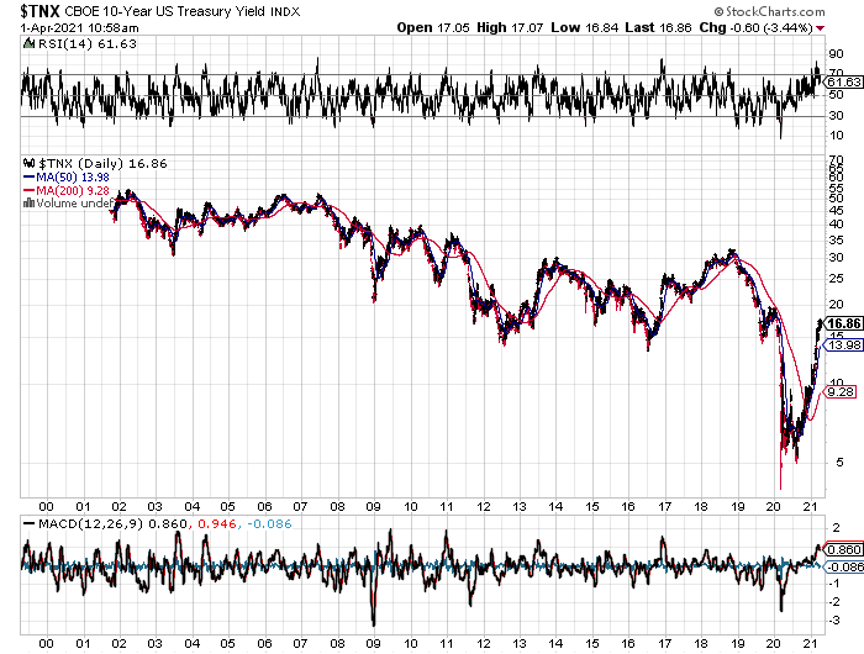

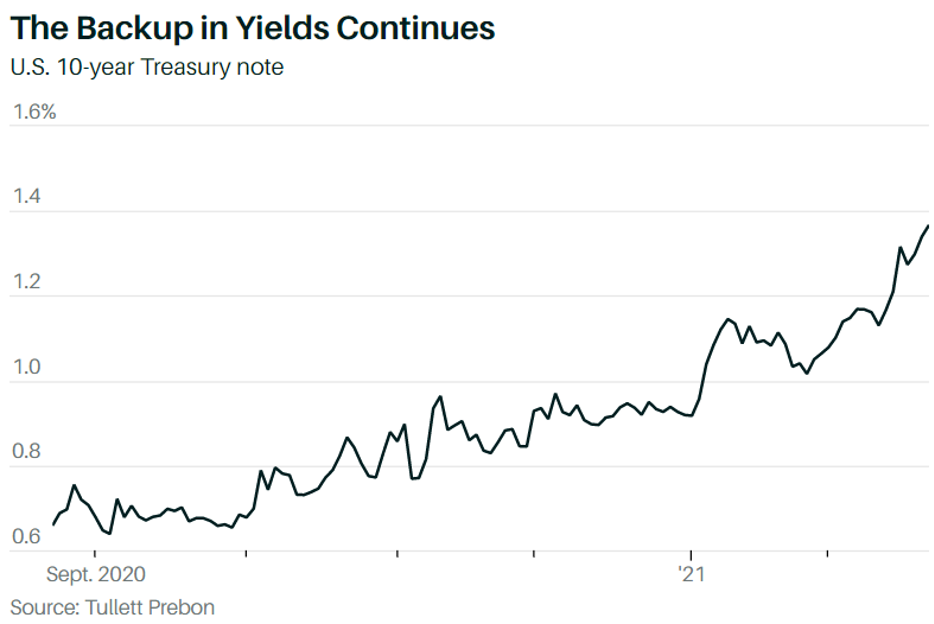

A: I see silver going to $50 and eventually $100 in this economic cycle, but it's out of favor right now because of rising interest rates. So, once we hit 2.00% in the ten years, it’s not only off to the races for tech but also gold and silver. Watch that carefully because your entry point may be on the horizon. That makes Wheaton Precious Metals (WPM) a very attractive “BUY” right now.

Q: Are you going to trade the (TLT)?

A: Absolutely yes, but I’m kind of getting picky now that I’m up 42% on the year; and I only like to sell 5-point rallies, which we got for about 15 minutes last week. And I also only like to buy 5- or 10-point dips. Keep your trading discipline and you’ll make a ton of money in this market. Last year we made about 30% trading bonds on about 30 round trips.

Q: How much further upside is there for US Steel (X) and Nucor Corp. (NUE)?

A: More. There's no way you do infrastructure without using millions of tons of steel. And I kind of missed the bottom on US Steel because it had been a short for so long that it kind of dropped off the radar for me. I think we have gone from $4 to 27 since last year, but I think it goes higher. It turns out the US has been shutting down steel production for decades because it couldn't compete with China or Japan, and now all of a sudden, we need steel, and we don’t even make the right kind of steel to build bridges or subways anymore—that has to be imported. So, most of the steel industry here now is working for the car industry, which produces cold-rolled steel for the car body panels. Even that disappears fairly soon as that gets taken over by carbon fiber. So enough about steel, buy the dips on (X) and (NUE).

Q: What stocks should I consider for the infrastructure project?

A: Well, US Steel (X) and Nucor Corp (NUE) would be good choices; but really you can buy anything because the infrastructure package, the way it’s been designed, is to benefit the entire economy, not just the bridge and freeway part of it. Some of it is for charging stations and electric car subsidies. Other parts are for rural broadband, which is great for chip stocks. There is even money to cap abandoned oil wells to rope in Texas supporters. All of this is going to require a massive upgrade of the power grid, which will generate lots of blue-collar jobs. Really everybody benefits, which is how they get it through Congress. No Congressperson will want to vote against a new bridge or freeway for their district. That’s always the case in Washington, which is why it will take several months to get this through congress because so many thousands of deals need to be cut. I’ve been in Washington when they’ve done these things, and the amount of horse-trading that goes on is incredible.

Q: Is it a good thing that I’ve had the United States Treasury Bond Fund (TLT) LEAPS $125 puts for a long time.

A: Yes. Good for you, you read my research. Remember, the (TLT) low in this economic cycle is probably around $80, so you probably want to keep rolling forward your position….and double up on any ten-point rally.

Q: Do you think we get a pop back up?

A: We do but from a lower level. I think any rallies in the bond market are going to be extremely limited until we hit the 2.00%, and then you’re going to get an absolute rip-your-face-off rally to clean out all the short term shorts. If you're running put LEAPS on the (TLT) I would hang on, it’s going to pay off big time eventually.

Q: If we see 3.00% on the 10-year this year, do you see the stock market crashing?

A: I don’t think we’ll hit 3.00% until well into next year, but when we do, that will be time for a good 10% stock market correction. Then everyone will look around again and say, “wow nothing happened,” and that will take the market to new highs again; that's usually the way it plays out. Remember, then year yields topped all the way up at 5.00% when the Dotcom Bubble topped in April 2020.

Q: Has the airline hospitality industry already priced in the reopening of travel?

A: No, I think they priced in the hope of a reopening, but that hasn’t actually happened yet, and on these giant recovery plays there are two legs: the “hope for it” leg, which has already happened, and then the actual “happening” leg which is still ahead of us. There you can get another double in these stocks. When they actually reopen international travel to Europe and Asia, which may not happen this year, the only reopening we’re going to see in the airline business is in North America. That means there is more to go in the stock price. Also coming back from the brink of death on their financial reports will be an additional positive.

Q: Do you think a corporate tax increase will drive companies out of the US again and raise the unemployment rate?

A: Absolutely not. First of all, more than half of the S&P 500 don’t even pay taxes, so they’re not going anywhere. Second, I think they will make these offshoring moves to tax-free domiciles like Ireland illegal and bring a lot of tax revenues back to the US. And third, all Biden is doing is returning the tax rate to where it was in 2017; and while the corporate tax rate was 35%, the stock market went up 400% during the Obama administration, if you recall. So stocks aren't really that sensitive to their tax rates, at least not in the last 50 years that I’ve been watching. I'm not worried at all. And Biden was up on the polls a year ago talking about a 28% tax rate; and since then, the stock market has nearly doubled. The word has been out for a year and priced in for a year, and I don't think anybody cares.

Q: What about quantum computers?

A: I’m following this very closely, it’s the next major generation for technology. Quantum computers will allow a trillion-fold improvement in computing power at zero cost. And when there's a stock play, I will do it; but unfortunately, it’s not (IBM), because we’re not at the money-making stage on these yet. We are still at the deep research stage. The big beneficiaries now are Alphabet (GOOGL), Microsoft (MSFT), and Amazon (AMZN).

Q: Is it time to buy Chinese stocks?

A: I would say yes. I would start dipping in here, especially on the quality names like Tencent (TME), Baidu (BIDU), and Alibaba (BABA), because they’ve just been trashed. A lot of the selloff was hedge fund-driven which has now gone bust, and I think relations with China improve under Biden.

Q: Your timing on Tesla (TSLA) has been impeccable; what do you look for in times of pivots?

A: Tesla trades like no other stock, I have actually lost money on a couple of Tesla trades. You have to wait for things to go to extremes, and then wait two more days. That seems to be the magic formula. On the first big selloff go take a long nap and when you wake up, the temptation to buy it will have gone away. It always goes up higher than you expect, and down lower than you expect. But because the implied volatilities go anywhere from 70% to 100%, you can go like 200 points out of the money on a 3-week view and still make good money every month. And that’s exactly what we’re going to do for the rest of the year, as long as the trading’s down here in the $500-$600 range.

Q: Is Editas Medicine (EDIT), a DNA editing stock, still good?

A: Buy both (EDIT) and Crisper (CRSP); they both look great down here with an easy double ahead. This is a great long-term investment play with gene editing about to dominate the medical field. If you want to learn more about (EDIT) and (CRSP) and many others like them, subscribe to the Mad Hedge Fund Biotech & Healthcare Letter because we cover this stuff multiple times a week (click here).

Q: Is the XME Metals ETF a buy?

A: I would say yes, but I'd wait for a bigger dip. It’s already gone up like 10X in a year, but the outlook for the economy looks fantastic. (XME) has to double from here just to get to the old 2008 high and we have A LOT more stimulus this time around.

Q: What about hydrogen?

A: Sorry, I am just not a believer in hydrogen. You have to find someone else to be bullish on hydrogen because it’s not me. I've been following the technology for 50 years and all I can say is: go do an image Google for the name “Hindenburg” and tell me if you want to buy hydrogen. Electricity is exponentially scalable, but Hydrogen is analog and has to be moved around in trucks that can tip over and blow up at any time. Hydrogen batteries are nowhere near economic. We are now on the eve of solid-state lithium-ion batteries which improve battery densities 20X, dropping Tesla battery weights from 1,200 points to 60 pounds. So “NO” on hydrogen. Am I clear?

Q: Why do you do deep-in-the-money call and put spreads?

A: We do these because they make money whether the stock goes up down or sideways, we can do them on a monthly basis, we can do them on volatility spikes, and make double the money you normally do. The day-to-day volatility on these positions is very low, so people following a newsletter don’t get these huge selloffs and sell at bottoms, which is the number one source of retail investor losses. After 13 years of trade alerts, I have delivered a 40.30% average annualized return with a quarter of the market volatility. Most people will take that.

Q: Is ProShares Ultra Short 20 Year Plus Treasury ETF(TBT) still a play for the intermediate term?

A: I would say yes. If ten-year US Treasury bonds Yields soar from 1.75% to 5.00% the (TBT) should rise from $21 to $100 because it is a 2X short on bonds. That sounds like a win for me, as long as you can take short term pain.

Q: What is the timing to buy TLT LEAPS?

A: The answer was in January when we were in the $155-162 range for the (TLT). Down here I would be reluctant to do LEAPS on the TLT because we’ve already had a $25 point drop this year, and a drop of $48 from $180 high in a year. So LEAP territory was a year ago but now I wouldn’t be going for giant leveraged trades. That train has left the station. That ship has sailed. And I can’t think of a third Metaphone for being too late.

Q: Would you buy Kinder Morgan (KMI) here?

A: That’s an oil exploration infrastructure company. No, all the oil plays were a year ago, and even six months ago you could have bought them. But remember, in oil you’re assuming you can get in and out before it crashes again, it’s just a matter of time before it does. I can do that but most of you probably can’t, unless you sit in front of your screens all day. You’re betting against the long-term trend. It works if you’re a hedge fund trader, not so much if you are a long-term investor. Never bet against the long-term trend and you always have a tailwind behind you. All surprises work to your benefit.

Q: If you get a head and shoulders top on bitcoin, how far does it fall?

A: How about zero? 80% is the traditional selloff amount for Bitcoin. So, the thing is: if bitcoin falls you have to worry about all other investments that have attracted speculative interest, which is essentially everything these days. You also have to worry about Square (SQ), PayPal (PYPL), and Tesla (TSLA), which have started processing Bitcoin transactions. Bitcoin risk is spread all over the economy right now. Those who rode the bandwagon up will ride it back down.

Q: Is Boeing (BA) a long-term buy?

A: Yes, especially because the 737 Max is back up in the air and China is back in the market as a huge buyer of U.S. products after a four-year vacation. Airlines are on the verge of seeing a huge plane shortage.

Q: What about Ags?

A: We quit covering years ago because they’re in permanent long-term downtrends and very hard to play. US farmers are just too good at their jobs. Efficiencies have double or tripled in 60 years. Ag prices are in a secular 150-year bear market thanks to technology.

Q: Is this recorded to watch later?

A: Yes, it goes on our website in about two hours. For directions on where to find it, log in to your www.madhedgefundrader.com account, go to “My Account,” and it will be listed under there, as are all the recorded webinars of the last 12 years.

Q: Would you buy Canadian Pacific (CP) here, the railroad?

A: No, that news is in the price. Go buy the other ones—Union Pacific (UNP) especially.

Q: What are your thoughts on Bitcoin?

A: We don’t cover Bitcoin because I think the whole thing is a Ponzi scheme, but who am I to say. There is almost ten times more research and newsletters out there on Bitcoin as there is on stock trading right now. They seem to be growing like mushrooms after a spring storm. There are always a lot of exports out there at market tops, as we saw with gold in 2010 and tech stock in 2000.

Q: What do you think about Juniper Networks (JNP)?

A: It’s a Screaming “BUY” right here with a double ahead of it in two years. I’m just waiting for the tech rotation to get going. This is a long-term accumulate on dips and selloffs.

Q: Did the Archagos Investments hedge fund blow threaten systemic risk?

A: No, it seems to be limited just to this one hedge fund and just to the people who lent to it. You can bet banks are paring back lending to the hedge fund industry like crazy right now to protect their earnings. I don’t think it gets to the systemic point, but this is the Long Term Capital Management for our generation. I was involved in the unwind of the last LTCM capital, which was 23 years ago. I was one of the handful of people who understood what these people were even doing. So, they had to bring me in on the unwind and huge fortunes were made on that blowup by a lot of different parties, one of which was Goldman Sachs (GS). I can tell you now that the statute of limitations has run out and now that it's unlikely I'll ever get a job there, but Goldman made a killing on long-term capital, for sure.

Q: Will Tesla benefit from the Biden infrastructure plan?

A: I would say Tesla is at the top of the list of companies the Biden administration wants to encourage. That means more charging stations and more roads, which you need to drive cars on, and bridges, and more tax subsidies for purchases of new electric cars. It’s good not just Tesla but everybody’s, now that GM (GM) and Ford (F) are finally starting to gear up big numbers of EVs of their own. By the way, I don't see any of the new startups ever posing a threat to Tesla. The only possible threats would be General Motors, Ford, and Volkswagen, which are all ten years behind.

Q: Would you put 10% of your retirement fund into cryptocurrencies?

A: Better to flush it down the toilet because there’s no commission on doing that.

Q: Is growing debt a threat to the economy? How much more can the government borrow?

A: It appears a lot more, because Biden has already indicated he’s going to spend ten trillion dollars this year, and the bond market is at a 1.70%—it’s incredibly low. I think as long as the Fed keeps overnight rates at near-zero and inflation doesn't go over 3%, that the amount the government can borrow is essentially unlimited, so why stop at $10 or $20 trillion? They will keep borrowing and keep stimulating until they see actual inflation, and I don’t think we will see that for years because inflation is being wiped out by technology improvements, as it has done for the last 40 years. The market is certainly saying we can borrow a lot more with no serious impact on the economy. But how much more nobody knows because we are in uncharted territory, or terra incognita.

To watch a replay of this webinar just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader