With the Dow Average now up 13,300 points, or 73.89%, since April, I’m getting besieged by questions from readers as to what could make the market go down. This is, after all, the sharpest move up in stocks in history.

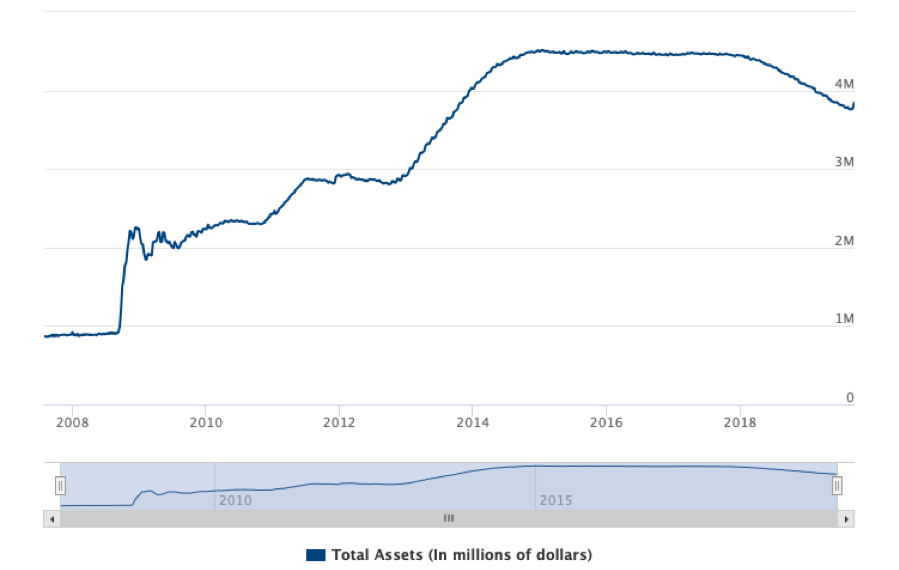

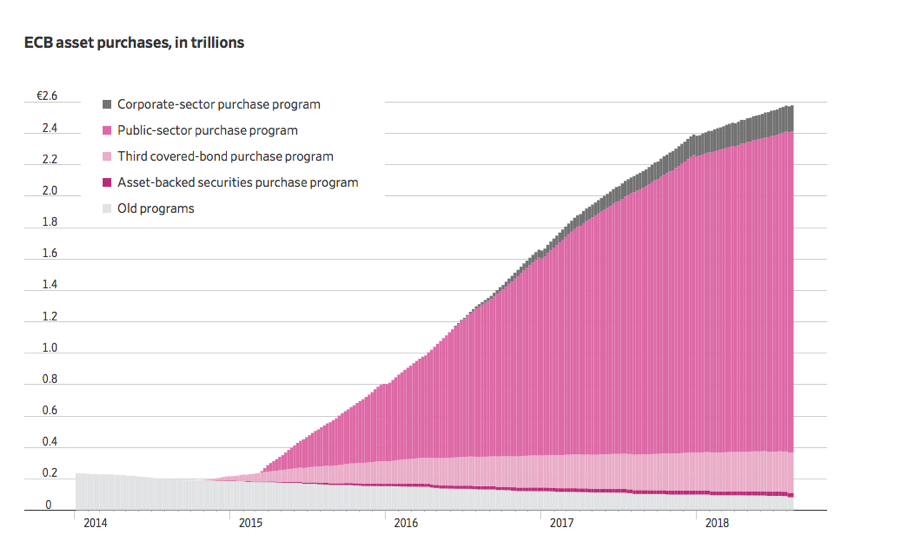

With $20 trillion about to hit the US economy, $10 trillion in stimulus, $10 trillion in quantitative easing, and overnight interest rates remaining at zero for three years, there’s not much.

Still, even the most Teflon of bull markets eventually go down. Let’s explore the reasons why. I’m not intending to give you sleepless nights. But the best traders always believe that anything can happen to markets all the time.

1) The Pandemic Ends – If Covid-19 can take the market up 13,300 points in nine months, its disappearance may take it down. That’s because the all-clear on the disease may prompt investors to pull money out of stocks and put it in the real economy.

A lot of people are buying stocks because there is nothing else to do and you can execute trades in the safety of your own home without going outside. Still, this effect may be muted as there are at least 2 million fewer businesses today than before the pandemic.

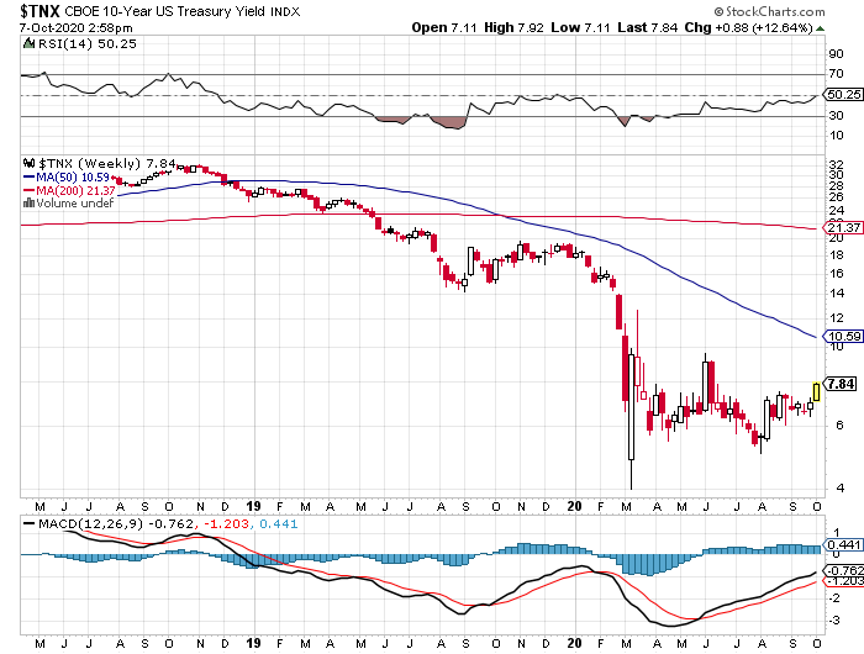

2) Interest Rates Rise – The Fed has promised not to raise overnight rates for three years, or until the inflation rates top 2% for at least a year (it’s now 0.4%). That seems to give the most aggressive investors a green light for the foreseeable future.

However, the Fed has no control over long term rates, which are set by the bond market. Since January 1, the yield on the ten-year US Treasury bond has soared from 0.90% to an eye-popping $1.20%, and 1.50% is certainly within reach during the first half.

The markets could easily handle that. But if the ten-year yield jumps to 3.0%, which it could do in two years, stocks could suffer, especially if we are at much higher levels by then.

3) Stocks Go Down – A lot of new traders are buying stocks simply because they are going up, independent of the thought process. What if stocks go down? Scads of you are now promising to buy on the next 10% pullback. I guarantee you that when we ARE down 10%, the only thing on your mind will be selling. That’s the way it always works. Loss of upside momentum could easily turn into vicious downside momentum.

4) The Pandemic Gets a Lot Worse – The Teflon market (which was invented during the Manhattan Project to prevent the corrosion of the insides of steel pipes by uranium or plutonium) has matched rising share prices with increasing Corona deaths tic for tic since March. We are now at 4,000 deaths a day and many hospitals now have fleets of freezer trucks parked outside because they can’t bury the bodies fast enough.

Government health officials tell us the pandemic is peaking right now. What if they are wrong? What if in the coming months, deaths top 10,000 a day? That would definitely be worth a 10% correction, if not a 20% one.

Summary

It all sets up a continuing run for stocks that could last at least two years and take the Dow as high at 45,000, or up 50% from here.

Which leads me to a different subject.

What if I am wrong?

I know that many of you have invested in two-year call options (LEAPS, or long term equity participation securities) at the March-May bottom and are sitting on the biggest profits in your life. Lots of these are several thousand percent in the money and have turned into 10X leveraged long equity positions, essentially synthetic futures. As a result, you now have no downside protection whatsoever.

If you bought the 2022 $120-$130 call spread at $20, it is now worth $765, a gain of 38.25X, or 3,825%. You have essentially just won the lottery.

This is what you need to do right now: roll up your strikes.

I shall explain.

Let’s say that when Tesla was at $80 on a split-adjusted basis, I begged many of you to buy the 2022 $120-$130 call spread. Tesla shares then rose by a mind-boggling 1,006%.

Here’s what you do. Sell your 2022 $120-$130 call spread immediately. Lock in the profit. Then buy a 2023 $900-$950 call spread. If Tesla falls, it will be at a much slower rate than your existing position.

Long-dated out-of-the-money options fall at a much slower rate than stocks because they have immense time value. They demonstrate a downside “hockey stick” effect. Very roughly speaking and without doing any math, a 50% drop in the stock will deliver only a 25% drop in the options. However, if Tesla shares rise, you will still participate in the upside and get 95% of the gain.

It’s a classic “heads I win, tails you lose” set up.

This is what professional traders do automatically, without thinking about it as if it were second nature.

I just thought you’d like to know.

About Last Week

A second insurrection is in play for January 20 according to the FBI, with armed demonstrations planned in the capitols of all 50 states. Don’t plan on traveling that day. Public access to the capitol building has ceased for the foreseeable future. Washington is now an armed camp, with 25,000 National Guard called in. The FBI is attempting to arrest the ring leaders as fast as possible. Market will keep seeing this as a buying opportunity, the fires under the market are burning so hot.

The US budget deficit soared to $573 billion in Q4, up 61% YOY. For the full calendar year, the deficit reached a mind-boggling $3.3 trillion, triple the previous year. Almost all the increase went to spending on pandemic related benefits. It’s another nail in the coffin for the bond market. Keep selling the (TLT), even on small rallies. This could be the trade of the century.

The US has 3 million fewer jobs than when Trump took office four years ago. It’s the worst performance since Herbert Hoover took office in 1928. That’s exactly what I predicted back in 2016. Up to March 2020, we also had a zero return in the stock market under Trump, which only started to improve when Biden took the lead in the primaries in May. In the meantime, the National Debt soared from $20 trillion to $28 trillion and it is still soaring. Over 100% of US growth during the Trump administration has been borrowed from the future on credit. It’s not a way to run a country.

The semiconductor shortage is slowing the auto industry, with Toyota, Ford, and Fiat cutting back production. It’s a global problem. Modern cars use more than 100 chips each and are becoming more apps than hardware. I’ve been predicting this for a year, and the problem will continue as it takes billions of dollars and years to ramp up new production. Buy the daylights out of (NVDA), (AMD), and (MU).

Technology is 2% of US employment but 27% of market capitalization and 38% of profits, says my old friend Jeffrey Gundlach of Double Line. Bitcoin is a bubble, inflation will be 3% by June, and bonds (TLT) are beyond terrible. Stocks are expensive but could run for a long time.

Weekly Jobless Claims delivered a horrific print, up 181,000 to 965,000, the worst since the spring. Covid-19 is clearly the reason. Stocks could care less and pushed on to new all-time highs, up eight days in a row. It really is a “Look Through” market.

No rate hike until 2% inflation for a year, said Fed Governor Clarida. It could be a long wait as indicated by the recent 0.4% report.

US air travel is down 61% in November YOY, and that includes the big Thanksgiving travel bump. A trend up will start later this year, but airlines will still emerge from the pandemic with tons of debt. Avoid.

Netflix is launching a movie a day, for all of 2021. It’s disrupting legacy Hollywood at Internet speed, which Covid-19 has brought to a screeching halt. The stock has seen a sideways correction since tech peaked in sideways. Buy at the bottom end of the recent range.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch shot out of the gate with an immediate 6.25% profit for the first ten trading days of the year. That is net of a 4% loss on a Tesla short which I added one day too soon. I went pedal to the metal immediately, again going 100% invested with a 50% long/50% short market-neutral portfolio.

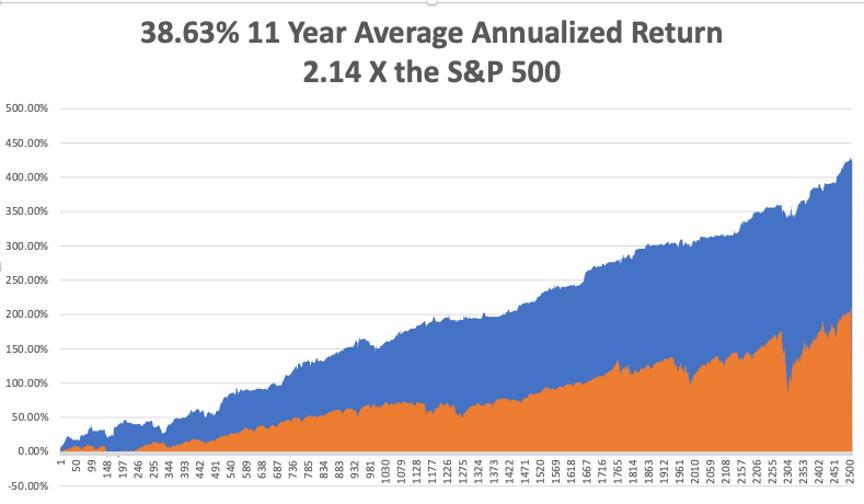

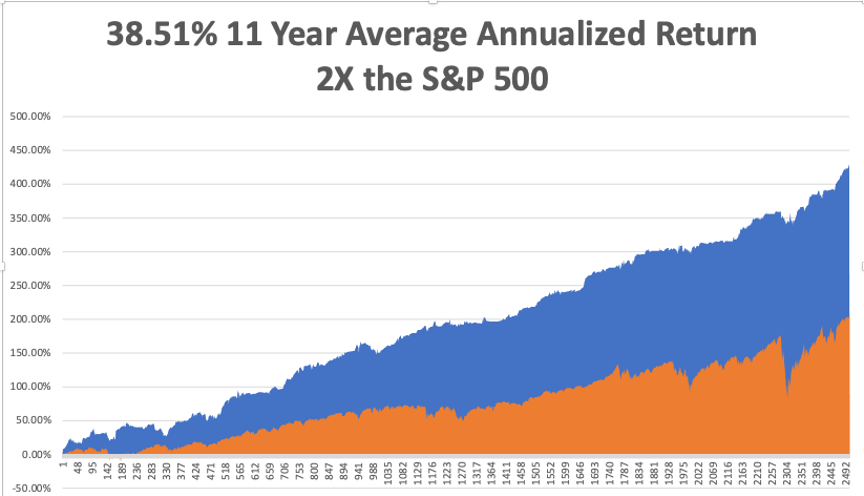

That brings my eleven-year total return to 428.80% double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.63%, a new high. My trailing one-year return exploded to 72.34%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 90% since the March low.

I did bail on my precious metals positions on (GOLD), (NEM), and (WPM) for small profits. The metals hate rising interest rates and competition from Bitcoin. They have effectively gone into a long bond, short Bitcoin position and I am not interested in either.

The coming week will be a slow one on the data front with Q4 earnings reports coming out daily.

We also need to keep an eye on the number of US Coronavirus cases at 24 million and deaths at 400,000, which you can find here. We are now running at a staggering 4,000 deaths a day.

When the market starts to focus on this, we may have a problem.

On Monday, January 18 at 11:00 AM EST, the US Markets will be closed for Martin Luther King Day.

On Tuesday, January 19 at 4:30 PM, Bank of America (BAC), Goldman Sachs (GS), and Netflix (NFLX) report.

On Wednesday, January 20 at 10:00 AM, we get the NAHB Housing Market Index. Morgan Stanley (MS) and Proctor and Gamble (PG) report.

On Thursday, January 21 at 8:30 AM, December Housing Starts are printed. Intel (INTC) and Union Pacific (UNP) report.

On Friday, January 22 at 10:00 AM, Existing Home Sales for December are out. Schlumberger (SLB) reports. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I’m still waiting for orders on where to report for my Pfizer Covid-19 vaccination. In the meantime, since I will still be locked up for months to come, I have been viewing precious old pictures and videos from my past travel extravaganzas.

In 2019, I took my girls around the world via New Zealand, Sydney, Brisbane, Melbourne, Perth, Manila, New Delhi, Dubai, Cairo, Athens, Venice, Budapest, Brussels, Zermatt, and then back to San Francisco. We don’t do anything small in my family. Click here for the link to my favorite video of us arriving in Venice.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader