If you think the market performance for the past month has been spectacular, you have seen nothing yet. We have two major positive catalysts that are about to hit stock prices.

On December 10, we will see a lower-than-expected Consumer Price Index, driving yet another stake through the heart of inflation. On December 13, we will also be greeted with a Federal Reserve decision to keep interest rates unchanged, as they will do over the next several meetings.

“Higher for shorter” is about to become the new market mantra.

That will give the market the shot in the arm it needs to reach my $4,800 yearend target, which was precisely the goal I laid out on January 1. Caution has been thrown to the wind and hedging downside risks has become a distant memory. One of the fastest market melt-ups in 100 years will do that. Complacency is the order of the day.

Equity-oriented mutual funds have seen $43 billion in inflows so far in November. Commodity Trading Funds, or CTA’s, have seen a breathtaking $60 billion piled into long equity strategies.

Hedge funds flipped from short to long and now have the most aggressively bullish positions in 22 years, mostly in big tech. All of this has taken the Volatility Index (VIX) down to a subterranean $12 handle. Bears are suddenly lonely….and afraid.

Yes, 55 years of practice makes this easy.

On October 28, it turns out that we reached a decade-high peak in bond investment when Treasuries were flirting with new highs in yields. With perfect rear-view mirror hindsight that’s when many investors cut stock holdings to the bone. They will spend the next several months desperately trying to get back in.

Oh yes, and Company buybacks are about to surge as companies race to pick up their own stocks before the yearend deadline. Apple is the top buyback stock followed by Alphabet (GOOGL) and Microsoft (MSFT). Heard these names before?

And while big tech is starting to look expensive, they are cheap when you factor in the trillions of dollars in profits that are headed their way over the next decade.

That’s what always happens.

What could pee on my victory parade? Ten-year US treasury bonds revisiting a 5.08% yield, crude oil popping back up to $100 a barrel, oil another new blacking swan alighting out of the blue, like a Chinese invasion of Taiwan, or Russia retaking the Baltic states. That’s all.

Avoid these and stocks will continue to rise, as will your retirement funds.

The Magnificent Seven will continue to lead, as will big financials, which are still at bargain-basement levels. Energy and commodities are already posting January sale prices, discounting a 2024 recession that isn’t going to happen. This is fertile LEAPS territory.

Weekly Jobless Claims Drop 24,000, to 209,000 in one of the sharpest declines this year. It makes last week’s jump look like an anomaly.

Consumer Inflation Expectations Rise, to 3.2%, a 12-year high. They are counting on a 4.5% in 2024. They are now looking at gasoline prices. There’s your mismatch. Any decline in inflation will be viewed as a shocker and drive share prices to new all-time highs.

US Gasoline Prices Hit Three-Year Low, on recession fears and replacement concerns by EVs. Energy stocks are tracing the downside tic for tic, pulling down all other commodities. Don’t buy this dip.

Pending Home Sales Plunge to 13-Year Low, down 4.1% in October, on a signed contracts basis. Sales were down 14.6% year over year. The median price of an existing home sold in October was $391,800, an increase of 3.4% from October 2022. These are the last poor sales numbers before the collapse in interest rates. At the end of October, there were 1.15 million homes for sale, down 5.7% from a year earlier. This is about half as many homes as were available for sale pre-Covid. At the current sales pace, that represents a 3.6-month supply. A six-month supply is considered a balanced market between buyer and seller.

Monster Pay Hikes Will Lead to Strong Japanese Yen, with whiskey maker Suntory offering 7% pay hikes. The prospect of falling US interest rates adds fuel to the fire. Buy (FXY) on dips.

Starship Two Blows Up, two minutes or 92 miles after launch. The test fire of the 33-engine spacecraft was considered a success. The massive 397-foot tall, 30-foot-wide rocket, the largest ever built, is crucial for the NASA moon launch in 2025 and the SpaceX Mars trip further down the road.

NVIDIA (NVDA) Beats, with a profit triple, but that stock sells off 6% on the news. It was a classic buy the rumor, sell the news move. Future earnings increases will not be as big. Keep "buy (NVDA) on dips" as a must-own.

Famed Short Seller Jim Chanos shut down after a massive short in Tesla shares blew up. His funds under management have plunged from $6 billion to $200 million since (TSLA) went public. Chanos had a few big wins, notably Enron in 2001. But he was also seen as a hedge against other long positions.

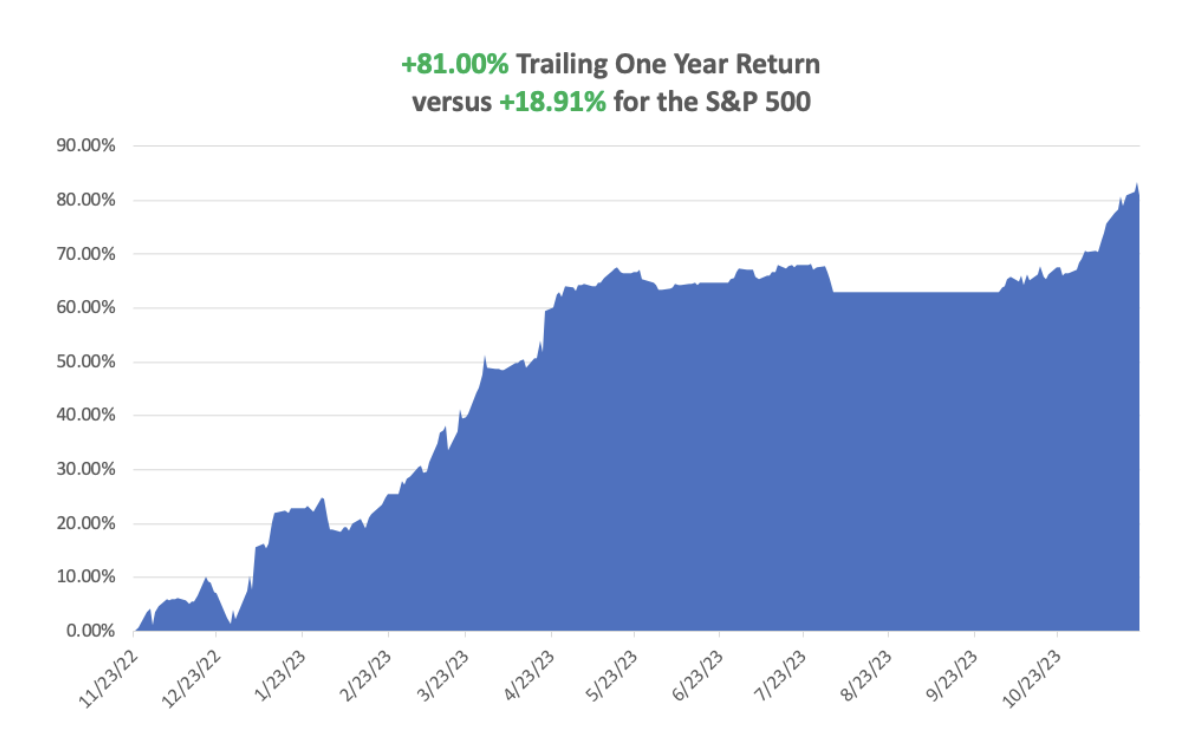

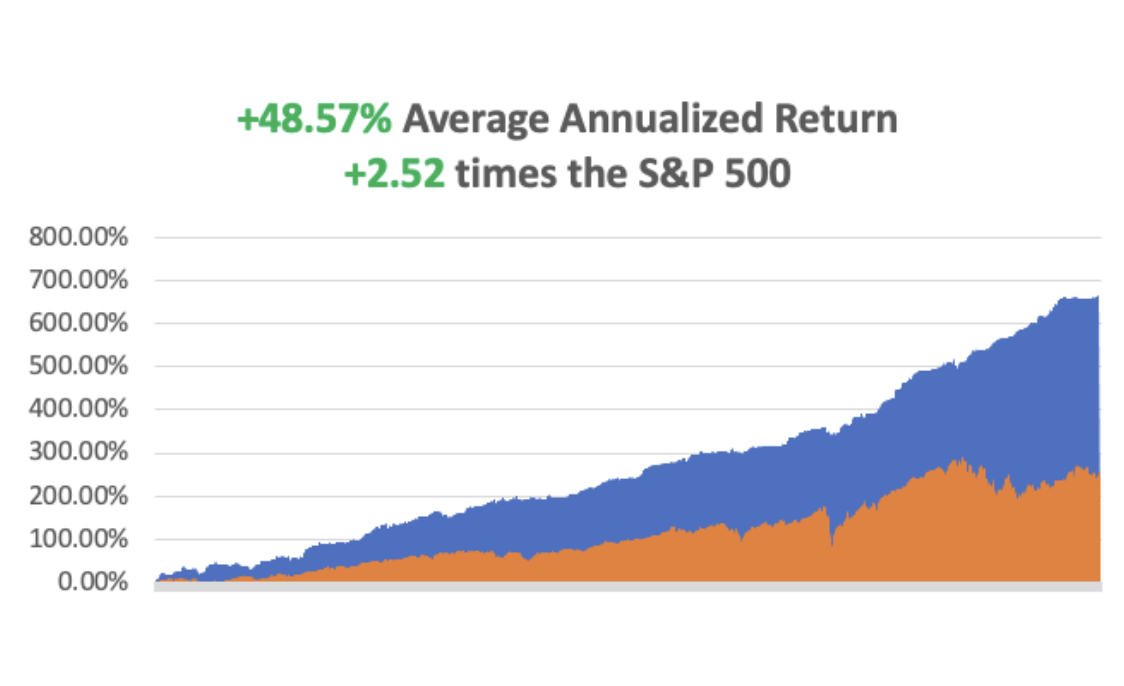

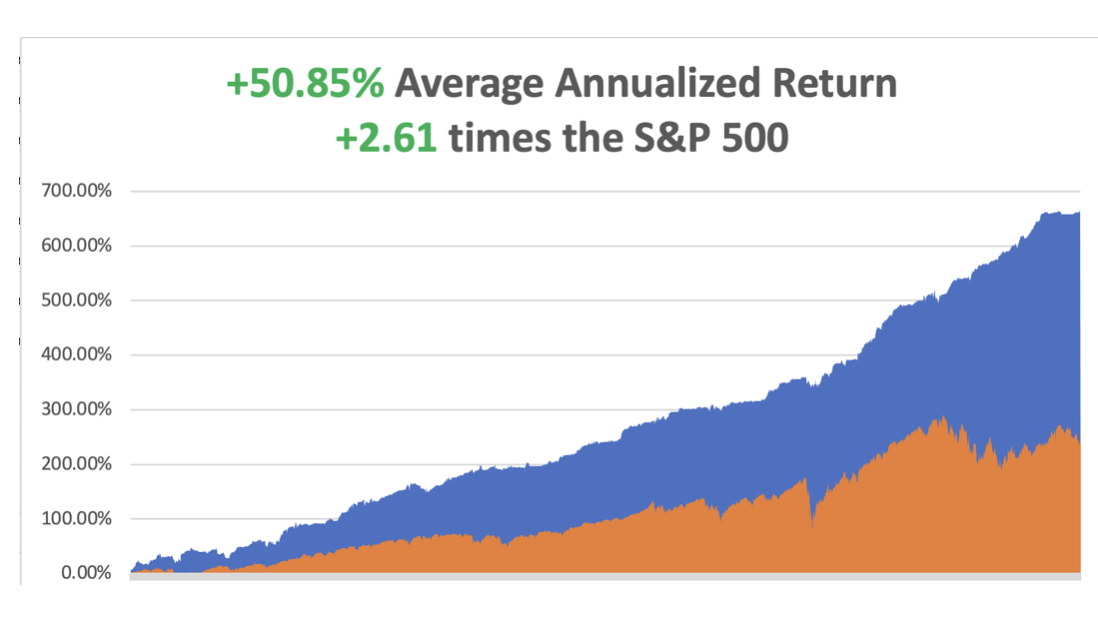

So far in November, we are up +12.62%. My 2023 year-to-date performance is still at an eye-popping +78.79%. The S&P 500 (SPY) is up +19.73% so far in 2023. My trailing one-year return reached +81.00% versus +18.91% for the S&P 500.

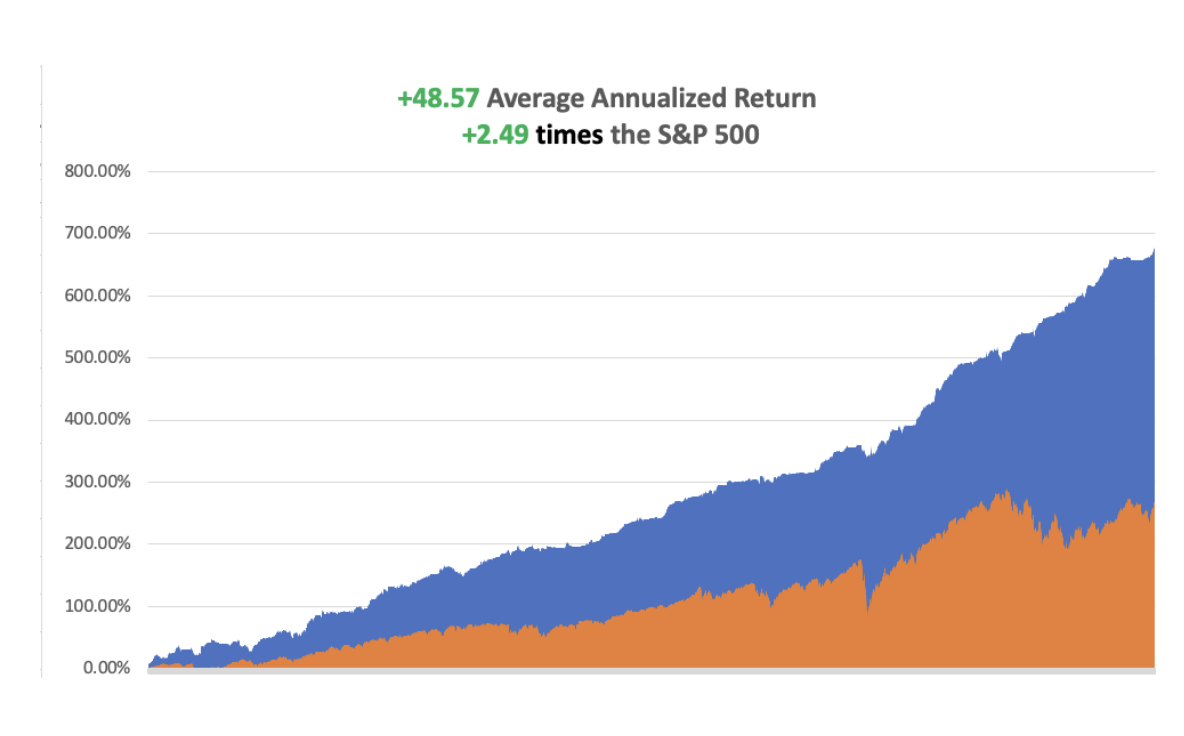

That brings my 15-year total return to +675.98%. My average annualized return has exploded to +48.57%, another new high, some 2.49 times the S&P 500 over the same period.

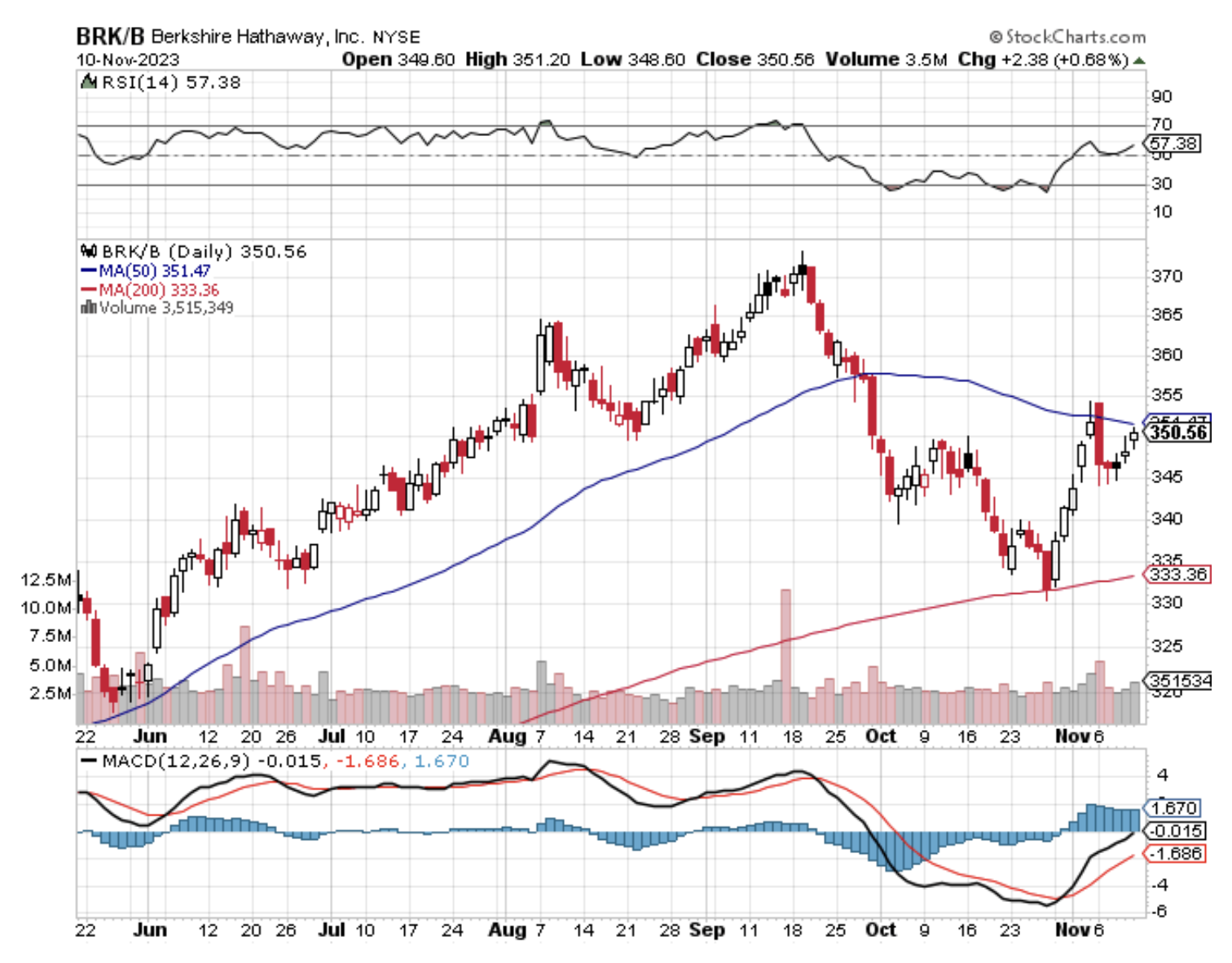

I am 100% fully invested, with longs in (MSFT), (NLY), (BRK/B), (CCJ), (CRM), (GOOGL), (SNOW), (CAT), and (XOM). I have one short in the (TLT).

Some 66 of my 61 trades this year have been profitable.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 27, at 8:30 AM EST, the New Home Sales are out.

On Tuesday, November 28 at 2:30 PM, the S&P National Home Price Index is released.

On Wednesday, November 29 at 8:30 AM, the Q2 GDP Growth Rate is published.

On Thursday, November 30 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, December 1 at 2:30 PM, the October ISM Manufacturing Index is published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, When I landed in Tokyo in 1974, there were very few foreigners in the country. The WWII occupation forces had left, but the international business community had yet to arrive. You met a lot of guys who used to work for Douglas MacArthur.

There was only one way to stay more than 90 days on the standard tourist visa. That was to get another visa to study “Japanese culture.” There were only two choices: flower arranging or karate.

Since this was at the height of Bruce Lee’s career, I went for karate.

It was not an easy choice.

World War II was not that distant, and there were still hundreds of army veterans missing limbs begging for money under railroad overpasses. Some back then were still fighting on remote Pacific islands.

Many in the karate community believed that the art was a national secret and should never be taught to foreigners. So those who entered this tight-knit community paid the price and had the daylights beaten out of them. I was one of those.

To this day, I am missing five of my original teeth. There is nothing like taking a kick to the mouth and watching your front teeth fly across the dojo, skittering on the teak floor.

We trained three hours a day, five days a week. It involved punching a bloody hardwood makiwara at least 200 times. The beginners were paired with black belts who thoroughly worked us over. Then the entire class met up at a nearby public bath to soak in a piping hot ofuro. You always hurt.

During the dead of winter, we ran five miles around the Imperial Palace in our karate gi’s barefoot in freezing temperatures daily. Then we were hosed down with cold water and trained for three hours.

During this time, I was infused with the spirit of bushido, the thousand-year-old Japanese warrior code. I learned self-discipline, stamina, and concentration. In the end, karate is a form of meditation.

Knowing you’re indestructible and unassailable is not such a bad thing, especially when you’re traveling in some of the harsher parts of the world. When muggers in bad neighborhoods see me late at night, they cross the street to avoid me. I am not a guy to mess with. Utter fearlessness is a great asset to possess.

The highlight of the annual training schedule was the All-Japan Karate Championship held in the prestigious Budokan, headquarters of all Japanese martial arts near the ghostly Yasukuni Jinja, Japan’s National Cemetery. By my last year in Japan, I had my black belt, and my instructor, Higaona Sensei, urged me to enter.

Because I had such a long reach, incredibly, I made it to the finals. I was matched with a very tough-looking six-footer who was fighting for Japan’s national prestige, as no foreigner had ever won the contest.

I punched, he kicked, fist met foot, and foot won. My left wrist was broken. My opponent knew what happened and graciously let me fight on one hand for another minute to save face. Then he knocked me out on points.

The crowds roared.

It’s all part of a full life.

Losing the All-Japan National Karate Championship

1974 Higaona Sensei

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader