Global Market Comments

May 22, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE MAY 23 GLOBAL STRATEGY WEBINAR),

(CHINA'S BIG TRADE WIN),

(SPY), (TLT), (UUP), (USO), (GLD), (SOYB),

(HOW TO USE YOUR CELL PHONE ABROAD)

Tag Archive for: (TLT)

My phone started ringing on Sunday afternoon as soon as the futures markets opened in Asia. The U.S. had reached agreement with China on trade and the Dow futures were up 200 points.

Had the next leg of the bull market begun? ?Was it time to buy?

I asked what were the specifics of the deal. There weren't any. I asked about generalities. Those were absent as well.

All they knew was that the U.S. was suspending threatened tariff increases in exchange for a vague Chinese promise to buy more U.S. exports over the long term.

It was in effect a big Chinese win. The development allows the Middle Kingdom to do nothing but stall for time until the next U.S. administration comes to power regardless of which party wins. The Chinese think in terms of centuries, so waiting three more years for a better negotiating backdrop is no big deal.

It vindicates my own call on how the Chinese trade war would play out. After a lot of threats and saber rattling, the administration would achieve nothing, declare victory, and go home.

Traders should NOT be buying this pop in stock prices on pain of death. All that will happen is that stocks will trade back up to the top of the recent range, and then stall out once again as we slide back into slow summer trading. In fact, all we have accomplished is to revisit last week's high in stocks.

Stocks (SPY) weren't buying this trade agreement for two seconds, nor were bonds (TLT), foreign exchange (UUP), gold (GLD), or energy (USO). Not even the agricultural markets were believing it. Soybeans (SOYB), the commodity most affected by the China trade, were up a measly 2.45%. If markets really believed something substantial was afoot they would be limit up three days in a row. I've seen this happen.

It was obvious that little was accomplished when you saw the endless parade of administration officials praising the deals merits. My half century of trading experience has taught me when someone is working so hard to sell you a bridge, you look the other way.

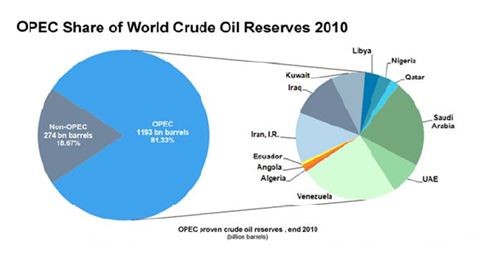

And here is the problem. Beyond cutting-edge technology, there's nothing that China HAS to buy from the U.S. China's largest imports are in energy and foodstuffs, both globally traded commodities.

The oil and gas coming out of America looks pretty much like the Saudi Arabian and Russian kind. U.S. energy infrastructure is already groaning at the seams as it approaches 11 million barrels a day.

To double that from current levels just to fill the trade gap with China would require a multi-decade effort financed with trillions of dollars in private capital just to produce more oil with prices at a three-year high. In other words, it isn't going to happen.

The same is true with agriculture. I doubt there is a single farmer in the country willing to risk his own money to increase production on the back of the China deal. Rainfall is a much bigger concern.

In the end, stocks will eventually rise to new highs by the end of the year, just not right now. And they will do so on the back of the prodigious earnings growth of U.S. companies, which has been expanding at a breakneck pace for nearly a decade.

It is notable that the only major index that hit new highs today was the small cap Russell 2000 (IWM) where the constituent companies essentially do NO trade with China.

To believe otherwise would be giving the cock the credit for the sun rising, which happens every morning like clockwork.

It Worked Again!

Global Market Comments

May 21, 2018

Fiat Lux

Featured Trade:

(JOIN ME ON THE QUEEN MARY 2 FOR THE MAD HEDGE JULY 11, 2018 SEMINAR AT SEA),

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or NO TRADE),

($INDU), (SPY), (TLT), ($TNX), (CPB)

That was the most boring week of 2018.

Not only did we get no net movement; the range was an infinitesimal 200 Dow points. It was hardly enough to make a dog's breakfast.

Of course, the big news was the yield on the 10-year U.S. Treasury bond (TLT), which rose to 3.12%, a seven-year high. You might have expected this to prompt a complete stock market rout. It didn't. Maybe that is next week's business.

It is rare that the bullish and bearish arguments reach a perfect balance, but that is what we got. In the meantime, trading volume is shrinking, never a good sign. Will the last one to leave please shut out the lights?

Which is all an indication of what I have been warning you about for months. This is setting up to be a dreadful summer. If you've already made your year, with a 19.88% gain like I have, you're better off taking a long cruise than trying to outsmart the algorithms.

I managed to squeeze off only one trade so far this month. I sold short the S&P 500 (SPY) right at the high of the week. However, when the downside momentum failed, and a Volatility Index (VIX) spike failed to confirm, I bailed for a small profit. Pickings are indeed thin.

Whenever my trading slows down, I get the inevitable customer complaints. My answer is always the same. Reach for the marginal trade and you will get your fingers bit off. Don't be in such a hurry to lose money. As my wise Latin professor used to say, "Festina lente," or "make haste slowly."

My May return is +0.53%, my year-to-date return stands at a robust 19.83%, my trailing one-year return has risen to 56.25%, and my eight-year profit sits at a 296.30% apex.

And remember, the market is making this move in the face of rising oil prices and interest rates, always bull market killers.

To mix a few metaphors, when the sun, moon, and stars line up once again I'll go pedal to the metal with the Trade Alerts once again.

If you held a gun to my head and ordered me to tell you how the markets will play out for the rest of the year, try this.

We remain is this narrowing trading range for months, ending with a final decisive break of the 200-day moving average to the downside, now at 23,909. But we find a new low only 1,000 points, or 4% below that.

Then we launch into the post midterm election year-end rally, which could take stocks up 15% to 20% from the 23,000 low. This is why I have been saying that the best trades of 2018 are ahead of us.

So, renew that subscription!

To witness how cruel and stock specific the current market is, look no further than hapless Campbell Soup (CPB), the first ticker symbol I have had to look up this year. There is probably not a reader alive who was not nursed back to health by its iconic red canned chicken noodle soup.

A surprise earnings loss triggered a hellacious 14% one-day plunge. It is the first big victim of the new steel tariffs. Although it amounts to only a few pennies a can, that can be disastrous in this hyper-competitive world. It also turns out that Millennials prefer eating fresh food rather that the canned stuff.

Give thanks for small mercies. With three daughters I am at ultimate risk for a tab for three weddings. The nuptials for Meghan Markle and Prince Harry are thought to cost $45 million, most of it on security. Hopefully I will not someday become the father-in-law of a prince.

This coming week has a plethora of Fed speakers, some key housing numbers, and that's about it.

On Monday, May 21, at 8:30 AM, we get April Chicago Fed National Activity Index.

On Tuesday, May 22, nothing of note is announced.

On Wednesday, May 23, at 10:00 AM, the April New Home Sales.

Thursday, May 24, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a rise of 11,000 last week from a 43-year low. At 10:00 AM, we get April Existing Home Sales.

On Friday, May 25, at 8:30 AM EST, we get April Durable Goods Orders.

We wrap up with the Baker Hughes Rig Count at 1:00 PM EST.

As for me, I will be spending the weekend putting the finishing touches on my 2018 Mad Hedge European Tour.

Thanks to rising U.S. interest rates and a strong dollar, the price of a continental trip has dropped about 10% since the beginning of the year. Got to love that Swiss franc at 1:1 parity with the greenback. Maybe I can afford an extra cheese fondue.

Good Luck and Good Trading.

Yes, It All Looks Like Magic

Global Market Comments

May 15, 2018

Fiat Lux

Featured Trade:

(FRIDAY, JUNE 15, 2018, DENVER, CO, GLOBAL STRATEGY LUNCHEON)

(GET READY FOR THE COMING GOLDEN AGE),

(SPY), (INDU), (FXE), (FXY), (UNG), (EEM), (USO),

(TLT), (NSANY), (TSLA)

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950s, and which I still remember fondly.

This is not some pie in the sky prediction. It simply assumes a continuation of existing trends in demographics, technology, politics, and economics. The implications for your investment portfolio will be huge.

What I call "intergenerational arbitrage" will be the principal impetus. The main reason that we are now enduring two "lost decades" of economic growth is that 80 million baby boomers are retiring to be followed by only 65 million "Gen Xers."

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and "RISK ON" assets such as equities, and more buyers of assisted living facilities, health care, and "RISK OFF" assets such as bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward six years when the reverse happens and the baby boomers are out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xers being chased by 85 million of the "millennial" generation trying to buy their assets.

By then we will not have built new homes in appreciable numbers for 20 years and a severe scarcity of housing hits. Residential real estate prices will soar. Labor shortages will force wage hikes.

The middle-class standard of living will reverse a then 40-year decline. Annual GDP growth will return from the current subdued 2% rate to near the torrid 4% seen during the 1990s.

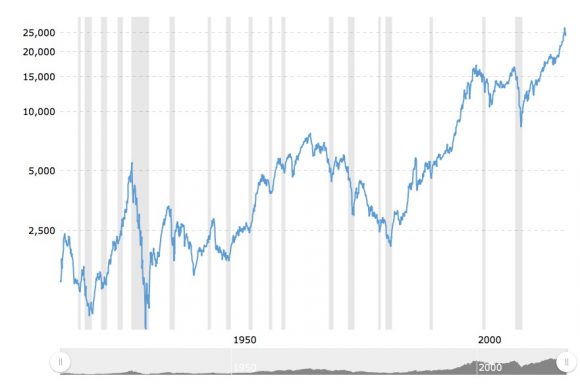

The stock market rockets in this scenario. Share prices may rise very gradually for the rest of the teens as long as tepid 2% growth persists. A 5% annual gain takes the Dow to 28,000 by 2019.

After that, after a brief dip, we could see the same fourfold return we saw during the Clinton administration, taking the Dow to 100,000 by 2030. If I'm wrong, it will hit 200,000 instead.

Emerging stock markets (EEM) with much higher growth rates do far better.

This is not just a demographic story. The next 20 years should bring a fundamental restructuring of our energy infrastructure as well.

The 100-year supply of natural gas (UNG) we have recently discovered through the new "fracking" technology will finally make it to end users, replacing coal (KOL) and oil (USO). Fracking applied to oilfields is also unlocking vast new supplies.

Since 1995, the United States Geological Survey estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion. OPEC's share of global reserves is collapsing.

This is all happening while automobile efficiencies are rapidly improving and the use of public transportation soars.

Mileage for the average U.S. car has jumped from 23 to 24.7 miles per gallon in the past couple of years, and the administration is targeting 50 mpg by 2025. Total gasoline consumption is now at a five-year low.

Alternative energy technologies will also contribute in an important way in states such as California, accounting for 30% of total electric power generation by 2020, and 50% by 2030.

I now have an all-electric garage, with a Nissan Leaf (NSANY) for local errands and a Tesla Model S-1 (TSLA) for longer trips, allowing me to disappear from the gasoline market completely. Millions will follow. The net result of all of this is lower energy prices for everyone.

It will also flip the U.S. from a net importer to an exporter of energy, with hugely positive implications for America's balance of payments. Eliminating our largest import and adding an important export is very dollar bullish for the long term.

That sets up a multiyear short for the world's big energy consuming currencies, especially the Japanese yen (FXY) and the Euro (FXE). A strong greenback further reinforces the bull case for stocks.

Accelerating technology will bring another continuing positive. Of course, it's great to have new toys to play with on the weekends, send out Facebook photos to the family, and edit your own home videos.

But at the enterprise level this is enabling speedy improvements in productivity that are filtering down to every business in the U.S., lowering costs everywhere.

This is why corporate earnings have been outperforming the economy as a whole by a large margin.

Profit margins are at an all-time high. Living near booming Silicon Valley, I can tell you that there are thousands of new technologies and business models that you have never heard of under development.

When the winners emerge, they will have a big cross-leveraged effect on economy.

New health care breakthroughs will make serious disease a thing of the past, which are also being spearheaded in the San Francisco Bay area.

This is because the Golden State thumbed its nose at the federal government 10 years ago when the stem cell research ban was implemented. It raised $3 billion through a bond issue to fund its own research, even though it couldn't afford it.

I tell my kids they will never be afflicted by my maladies. When they get cancer in 20 years they will just go down to Wal-Mart and buy a bottle of cancer pills for $5, and it will be gone by Friday.

What is this worth to the global economy? Oh, about $2 trillion a year, or 4% of GDP. Who is overwhelmingly in the driver's seat on these innovations? The USA.

There is a political element to the new golden age as well. Gridlock in Washington can't last forever. Eventually, one side or another will prevail with a clear majority.

This will allow the government to push through needed long-term structural reforms, the solution of which everyone agrees on now, but for which nobody wants to be blamed.

That means raising the retirement age from 66 to 70 where it belongs and means-testing recipients. Billionaires don't need the maximum $30,156 annual supplement. Nor do I.

The ending of our foreign wars and the elimination of extravagant unneeded weapons systems cuts defense spending from $800 billion a year to $400 billion, or back to the 2000, pre-9/11 level. Guess what happens when we cut defense spending? So does everyone else.

I can tell you from personal experience that staying friendly with someone is far cheaper than blowing them up.

A Pax Americana would ensue.

That means China will have to defend its own oil supply, instead of relying on us to do it for them. That's why they have recently bought a second used aircraft carrier. The Middle East is now their headache.

The national debt then comes under control, and we don't end up like Greece.

The long-awaited Treasury bond (TLT) crash never happens. The Fed has already told us as much by indicating that the Federal Reserve will only raise interest rates at an infinitesimally slow rate of 25 basis points a quarter.

Sure, this is all very long-term, over-the-horizon stuff. You can expect the financial markets to start discounting a few years hence, even though the main drivers won't kick in for another decade.

But some individual industries and companies will start to discount this rosy scenario now.

Perhaps this is what the nonstop rally in stocks since 2009 has been trying to tell us.

Dow Average 1908-2018

Another American Golden Age is Coming

Global Market Comments

May 11, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, JUNE 13, 2018, PHILADELPHIA, PA, GLOBAL STRATEGY LUNCHEON),

(MAY 9 BIWEEKLY STRATEGY WEBINAR Q&A),

(FB), (MU), (NVDA), (AMZN), (GOOGL),

(TLT), (SPX), (MSFT), (DAL),

(MAD HEDGE DINNER WITH BEN BERNANKE)

Below please find subscribers' Q&A for the Mad Hedge Fund Trader May 9 Global Strategy Webinar with my guest co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Would you still short Facebook (FB)?

A: Right now, no. I thought the dynamics changed off the last earnings report, so the answer is no. We have made a ton of money trading Facebook this year, and all of it has been from the long side.

Q: How will the election affect the market?

A: It will go down into the election, but you'll then get a strong rally as the uncertainty fades away. It really makes no difference who wins. It is the elimination of uncertainty that is the big issue.

Q: Do you have a price to buy Micron Technology (MU) or NVIDIA (NVDA), or do you want to wait for a crash day?

A: I want to wait for a crash day, because even though these are great companies, on the down days, they fall twice as fast as any other stock. Your entry point is very important in that situation.

Q: Do you see opportunities to sell short the U.S. Treasury bond market (TLT) again?

A: Yes. But wait for the four-point rally not the two-point rally.

Q: Rising interest rates should benefit banks - why are they such horrible performers?

A: The double in bank stocks in 2017 fully discounted this year's interest rate move. For banks to really perform interest rates have to move higher still, which they will eventually.

Q: When will the yield curve invert and what will be the implications?

A: You can take the Fed's current rate of interest rate rises (which is 25 basis points every three months) and essentially calculate that the yield curve inverts at the end of 2018 or the beginning of 2019. Recessions and bear markets always follow six months after that inversion takes place. That's when interest rates start to rise very sharply as bond investors panic and unwind all their leveraged long positions.

Q: Why are you not involved with Amazon (AMZN) and Google (GOOGL)?

A: I've already taken big profits in both of these and I'm just waiting for another serious dip before I get back in again.

Q: What happens to stock buybacks?

A: While other investors are pulling out of the market, stock buybacks are doubling. But, that is only happening, essentially, in the tech stocks - they're the buyback kings. If you don't have a serious buyback program this year, your stock is falling. Companies are the sole net buyers of the market this year, and they are only buying their own stocks.

Q: What do you see the upper and lower end of the S&P 500 (SPY) range to November?

A: I think we've already got it: 2,550 on the low side, 2,800 on the high side - that a 10% range and you can expect it to get narrower and narrower going into November. After that, we get an upside breakout to new all-time highs.

Q: When will rates be negative next?

A: In the next recession, the bottom of which will be in 2 to 2.5 years; that's when interest rates in the U.S. could go negative, as they did in Japan and Europe for several years.

Q: What is your No. 1 pick in the market today?

A: We love Microsoft (MSFT) long term. However, right now the background macro picture is more important than stock selection than any single name, so we're keeping a position in Microsoft in the Mad Hedge Technology Letter, but not in Global Trading Dispatch. We're sort of hanging back, waiting for another sell-off before we touch anything on the long side in GTD. Remember, the money is made on a buy in the new position, not on the sell going out.

Q: Was the semiconductor chip sell-off overdone?

A: Absolutely - the negative report was put out by a new analyst to the industry who doesn't know what he's talking about. If you ask all the end users of the chips, all they talk about is A.I., and that means exponential growth of chip demand.

Q: Is it a good time to buy airline stocks (DAL)?

A: No, until we get a definitive peak in oil, and a speed up again in the economy, you don't want to touch economically sensitive sectors like the airlines.

Global Market Comments

May 1, 2018

Fiat Lux

Featured Trade:

(FRIDAY, JUNE 15, 2018, DENVER, CO, GLOBAL STRATEGY LUNCHEON)

(ANATOMY OF A GREAT TRADE)

(TLT), (TBT), (SPY), (GLD), (USO),

(CYBERSECURITY IS ONLY JUST GETTING STARTED),

(PANW), (HACK), (FEYE), (CSCO), (FTNT), (JNPR), (CIBR)

So, I'm sitting here agonizing over whether I should sell short the US Treasury bond market (TLT) once again.

Thanks to the bombshell Israel announced today alleging the existence of a secret Iranian nuclear missile program, oil has rallied by 2%, the US dollar has soared, and stocks have been crushed.

The (TLT) has popped smartly, some $2.5 points off of last week's low, taking yields down from a four-year high at 3.03% down to 2.93%.

The report is probably based on false intelligence, which is becoming a regular thing in the Middle East. Suffice it to say that the presenter, Prime Minister Benjamin "Bibi" Netanyahu, may soon be indicted on corruption charges. Clearly, they are going "American" in the Holy Land.

But for today, the market believes it.

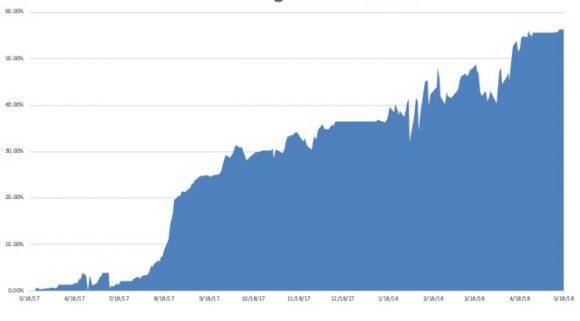

You can understand me chomping at the bit, as selling short US government bonds has been my new rich uncle since the market last peaked in July 2017.

I just ran my Trade Alert history over the past nine months and here is what I found.

I sent you 38 Trade Alerts to sell short bonds generating 18 round trips, AND EVERY SINGLE ONE WAS PROFITABLE! In total these Alerts generated a trading profit of 216%, or 21.62% of my total portfolio return.

That means 35% of my profits over the past year came from selling short Treasuries.

You should do the same.

Falling Treasury prices have been one of the few sustainable trends in financial markets during the past year.

Stock rallied, then gave up a chunk. Gold (GLD) has gone nowhere. Only oil has surpassed as a sustainable trade, thanks to successful OPEC production quotas, which have been extended multiple times.

Texas tea is up an admirable 67% since the June $42 low. And who was loading up on crude way down there?

Absolutely no one.

Of course, I have an unfair advantage as a bond trader, as I have been doing this for nearly 50 years.

I caught the big inflation driven fixed income collapse during the 1970s, which had a major assist then from a rapidly devaluing US dollar.

That's when they brought out zero-coupon bonds, effectively increasing our leverage by 500% for virtually no cost. Principal only strips followed, another license to bring money on the short side.

The big lesson from trading this market for a half century is that trends last for a really long time. The bull market in bonds that started in 1982, when 10-year yields hit 14%, lasted for 33 years.

As we are less than three years into the current bear market the opportunities are rife. We are very early into the new game. This one could last for the rest of my life.

The reasons are quite simple. The fundamentals demand it.

1) The Global Synchronized Recovery is accelerating.

2) The Fed will start dropping on the bond market in the very near future $6 billion a month, or $200 million a day, worth of paper in its QE unwind.

3) Tax cuts will provide further stimulus for the US economy.

4) With the foreign exchange markets now laser-focused on America's exploding deficits, a weak US dollar has triggered a capital flight out of the US.

5) We also now have evidence that China has started to dump its massive $1 trillion in US Treasury bond holdings.

All are HUGELY bond negative.

All of this should take bonds down to new 2018 lows. What we could be seeing here is the setting up for the perfect head and shoulders top of the (TLT) for 2018.

As for that next Trade Alert, I think I'll hold out for a better price to sell again. What's the point in spoiling a perforce record?

Time to Stick to Your Guns

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.