I will be evacuating the City of San Francisco upon the completion of this newsletter.

The smoke from the wildfires has rendered the air here so thick that it has become unbreathable. It reminds me of the smog in Los Angeles I endured during the 1960s before all the environmental regulation kicked in. All Bay Area schools are now closed and anyone who gets out of town will do so.

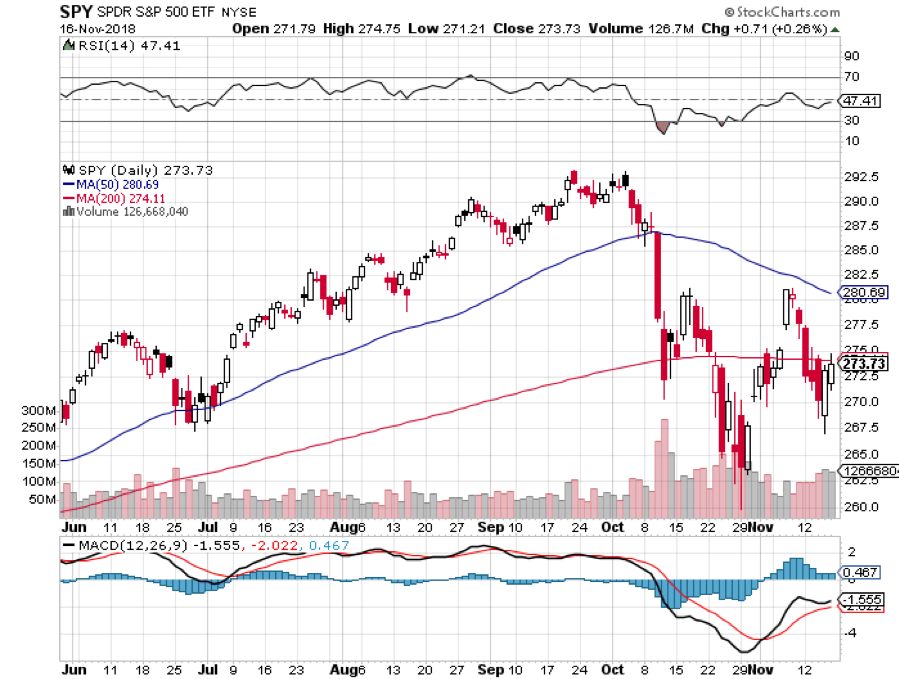

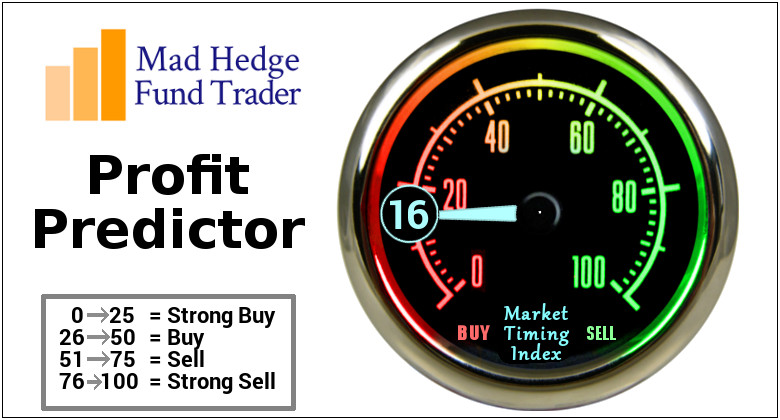

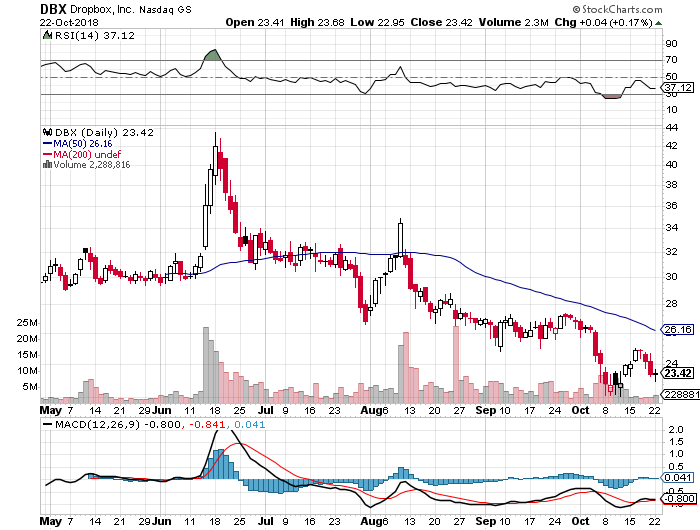

There has been a mass evacuation going on of a different sort and that has been investors fleeing the stock market. Twice last week we saw major swoons, one for 900 points and another for 600. Look at your daily bar chart for the year and the bars are tiny until October when they suddenly become huge. It’s really quite impressive.

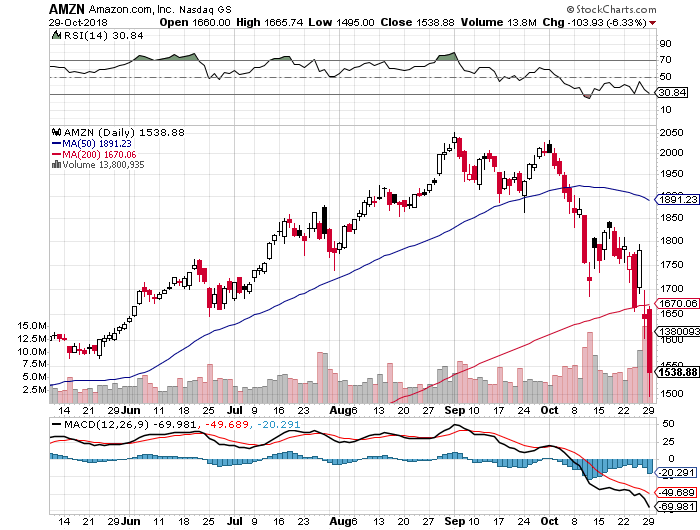

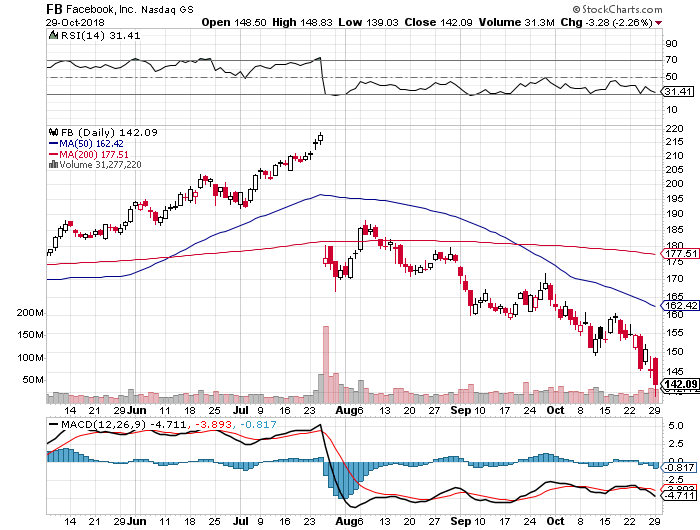

Concerns for stocks are mounting everywhere. Big chunks of the economy are already in recession, including autos, real estate, semiconductors, agricultural, and banking. The FANGs provided the sole support in the market….until they didn’t. Most are down 30% from their tops, or more.

In fact, the charts show that we may have forged an inverse head and shoulders for the (SPY) last week, presaging greater gains in the weeks ahead.

The timeframe for the post-midterm election yearend rally is getting shorter by the day. What’s the worst case scenario? That we get a sideways range trade instead which, by the way, we are perfectly positioned to capture with our model trading portfolio.

There are a lot of hopes hanging on the November 29 G-20 Summit which could hatch a surprise China trade deal when the leaders of the two great countries meet. Daily leaks are hitting the markets that something might be in the works. In the old days, I used to attend every one of these until they got boring.

You’ll know when a deal is about to get done with China when hardline trade advisor Peter Navarro suddenly and out of the blue gets fired. That would be worth 1,000 Dow points alone.

It was a week when the good were punished and the bad were taken out and shot. Wal-Mart (WMT) saw a 4% hickey after a fabulous earnings report. NVIDIA (NVDA) was drawn and quartered with a 20% plunge after they disappointed only slightly because their crypto mining business fell off, thanks to the Bitcoin crash.

Apple (AAPL) fell $39 from its October highs, on a report that demand for facial recognition chips is fading, evaporating $170 billion in market capitalization. Some technology stocks have fallen so much they already have the next recession baked in the price. That makes them a steal at present levels for long term players.

The US dollar surged to an 18-month high. Look for more gains with interest rates hikes continuing unabated. Avoid emerging markets (EEM) and commodities (FCX) like the plague.

After a two-year search, Amazon (AMZN) picked New York and Virginia for HQ 2 and 3 in a prelude to the breakup of the once trillion-dollar company. The stock held up well in the wake of another administration antitrust attack.

Oil crashed too, hitting a lowly $55 a barrel, on oversupply concerns. What else would you expect with China slowing down, the world’s largest marginal new buyer of Texas tea? Are all these crashes telling us we are already in a recession or is it just the Fed’s shrinkage of the money supply?

The British government seemed on the verge of collapse over a Brexit battle taking the stuffing out of the pound. A new election could be imminent. I never thought Brexit would happen. It would mean Britain committing economic suicide.

US Retails Sales soared in October, up a red hot 0.8% versus 0.5% expected, proving that the main economy remains strong. Don’t tell the stock market or oil which think we are already in recession.

My year-to-date performance rocketed to a new all-time high of +33.71%, and my trailing one-year return stands at 35.89%. November so far stands at +4.08%. And this is against a Dow Average that is up a miniscule 2.41% so far in 2018.

My nine-year return ballooned to 310.18%. The average annualized return stands at 34.46%. 2018 is turning into a perfect trading year for me, as I’m sure it is for you.

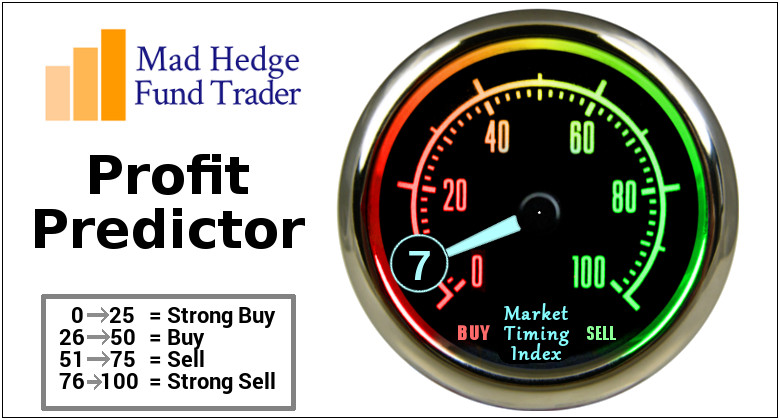

I used every stock market meltdown to add aggressively to my December long positions, betting that share prices go up, sideways, or down small by then.

The new names I picked up this week include Amazon (AMZN), Apple (AAPL), Salesforce (CRM), NVIDIA (NVDA), Square (SQ), and a short position in Tesla (TSLA). I also doubled up my short position in the United States US Treasury Bond Fund (TLT).

I caught the absolute bottom after the October meltdown. Will lightning strike twice in the same place? One can only hope. One hedge fund friend said I was up so much this year it would be stupid NOT to bet big now.

The Mad Hedge Technology Letter is really shooting the lights out the month, up 8.63%. It picked up Salesforce (CRM), NVIDIA (NVDA), Square (SQ), and Apple (AAPL) last week, all right at market bottoms.

The coming week will be all about October housing data which everyone is expecting to be weak.

Monday, November 19 at 10:00 EST, the Home Builders Index will be out. Will the rot continue? I’ll be condo shopping in Reno this weekend to see how much of the next recession is already priced in.

On Tuesday, November 20 at 8:30 AM, October Housing Starts and Building Permits are released.

On Wednesday, November 21 at 10:00 AM, October Existing Home Sales are published.

At 10:30 AM, the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, November 22, all market will be closed for Thanksgiving Day.

On Friday, November 23, the stock market will be open only for a half day, closing at 1:00 PM EST. Second string trading will be desultory, and low volume.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I'd be roaming the High Sierras along the Eastern shore of Lake Tahoe looking for a couple of good Christmas trees to chop down. I have two US Forest Service permits in hand at $10 each, so everything will be legit.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader