I am writing this from the balcony of my chalet high in Zermatt, Switzerland watching the sun set on the last bit of snow at the Matterhorn summit. There is a roaring Alpine River 100 feet below me as the melting of the glaciers accelerates. Mountain larks are diving and looping through the trees.

I have just had my third top-up on the schnapps and the cheese plate in front of me is to die for.

Life is good!

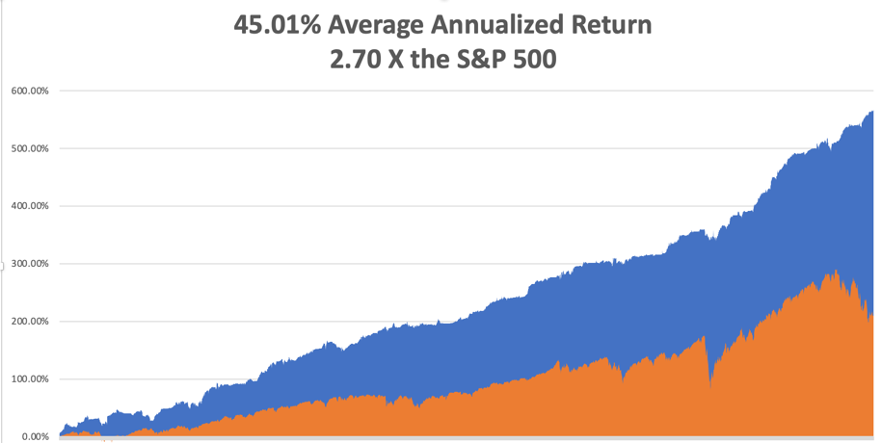

I have something else to celebrate as well. The performance of the Mad Hedge Fund Trader is off the charts and the best in its 14-year history. It seems the worse market conditions get, the better our numbers. We are up 3.81% so far in July, 54.66% year-to-date, and are averaging 45.01% a year. It doesn’t get any better than that.

Or maybe it does.

Where is the recession? If you work in the imploding Bitcoin universe or the suffering mortgage origination business, you are definitely in a recession. But if you work in any other industry, you are not.

Sure, things are slowing down in interest rate-related sectors, like new home construction. But that does not make a recession.

If we are in a recession, we are in a full employment one, with the headline Unemployment Rate at a near record low of 3.6%. No one has ever seen one of those before. And if no one is losing their job in this recession, who cares?

In the meantime, the Fed is slowly and unobtrusively winning its war against inflation. Soaring interest rates have caused the housing market to grind to a halt. Used car prices have rolled over and repossessions are climbing.

It may take a couple of months to see this in the official inflation numbers, but the next Fed shocker could be a hint that the pace of interest rate rises may be slowed or stopped. Stocks would go through the roof on this because the falling inflation trade will have begun.

By the time you realize that we are in a recession, it will be over, and the next decade-long bull market will have begun.

This is one of those rare times when the long-term investor is actually rewarded versus his shorter-term trading colleagues. If you bought stocks during every postwar recession over the last 80 years, stocks were ALWAYS up on a three-year view, and they always DOUBLE on a five-year view.

That doesn’t sound bad to me.

The rollover in the price of oil is a crucial part of this view. Of course, it is recession fears that are driving the price of crude down, now off 29% from its wartime $132 high. That cuts the price of gasoline, the major inflation driver this year. Falling inflation means fewer interest rate rises, making stocks more valuable.

You see, it’s all connected.

And before I sign off, I want to update you on the NATO piece I sent out on Friday.

I just spoke with the chairman of the British Chiefs of Staff Committee, their Joint Chiefs of Staff, and the one organization with the best read on Russian losses in the Ukraine War so far.

Russia has lost an incredible 2,000 tanks out of their initial 2,800 operational ones, and a further 4,000 armored vehicles. Russia has lost one-third of its army since February through deaths or injury, some 50,000 men.

Russia is now unable to defend itself from an attack from the West. Putin is assuming that we are nicer people than we actually are, which is always a fatal mistake.

I can’t tell you why I know this, only that I do. All I can say is that the Internet, advanced hardware, encryption, and artificial intelligence are amazing things.

London’s Heathrow Airport asks airlines to cap passengers at 100,000 a day, meaning many will cancel their least profitable flights. I was there yesterday, and it was a complete madhouse on the verge of a riot. You need to arrive three hours early to have any chance of making your flight. It’s all the result of three years of pent-up travel demand unleashing over a single problem. It makes America’s problems pale in comparison.

Musk Cancels Twitter Deal, saying there was no “there” there. Much of the business was bogus. Sure, it means five years of litigation, but why should the richest man in the world care. It’s good news for Tesla because it means less diversion of management time, although the news took the stock down $50. Buy (TSLA) on dips and avoid (TWTR) like Covid.

Crypto Hedge Fund Founders Go Missing, as the bankruptcy proceedings of 3AC go missing, leaving $12 billion in losses in their wake. It could be a death blow to emerging crypto infrastructure. Avoid crypto at all costs. There are too many better fish to fry, with the best quality stocks selling at big discounts.

Home Purchase Cancellations reach 15%, the highest since the pandemic began. Many deals are falling out of escrow because of failed financing at decade-high interest rates. Price cuts of 10% across the board are happening on the homes I have been watching. 30-year fixed rate mortgages at 5.75% are proving a major impediment. Homebuilders are also seeing shocking levels of cancellations.

Is There Now a Chip Glut? There is, says TechiInsight, a research firm. Extreme shortages have flipped to oversupply as a new Covid wave, and the Ukraine War cut back spending on new cell phones and PCs. The Crypto blow-up and contagion have completely eliminated high-end chip demand from new miners. That’s why the Philadelphia Semiconductor Index (SOX) is off 35% this year. Micron Technology has already cut back production of low-end chips by 20%. If a selloff ensues, buy (NVDA), (MU), and (AMD). They will lead any recovery.

The Euro Breaks Parity Against the US Dollar, a decades low, and the Swiss franc may be next. Soaring US interest rates are the reason, while recessionary Europe is still keeping theirs at negative numbers. The dollar will remain strong for another year, or as long as the US is raising and the continent is frozen.

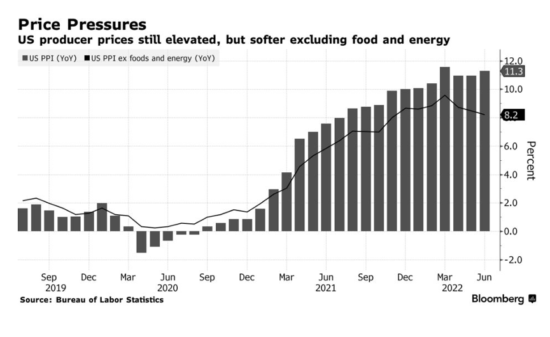

CPI Comes in at 9.1%, much hotter than expected, forcing the Fed to maintain an aggressive rate hike posture. That’s up an eye-popping 1.3% from May. It’s not what the Biden administration wanted to hear. A big part of that was oil price rises which have already gone away. Rents were up 0.8%, the most since 1986, and pressure from labor costs is rising. It puts on the table new lows for the Dow Average, but not by much.

Bonds Invert Big Time, posting the biggest 2/10 spread in 22 years, strongly suggesting a recession. That means short term interest rates are higher than long term ones, or the 2-year paper is yielding 20 basis points more than ten-year bonds. Oil is also holding its crushing $8.00 loss. Bonds are already suffering their worst year since 1865 when it had to shoulder the enormous cost of winning the civil war.

Doctor Copper Says the Recession is Here, dropping by 39% since February. Covid caused a slowdown in demand from China, the world’s largest consumer. It looks like we may get another chance to buy Freeport McMoRan at bargain basement prices.

Weekly Jobless Claims jump to 244,000, the highest since Thanksgiving week in November. New York led, with Google and Microsoft adding to the numbers. Let the mini-recession begin!

JP Morgan (JPM) Earnings Dive 28%. CEO Jamie Diamond says that growth, spending, and jobs remain good, but Covid, inflation, rising interest rates, and the geopolitical outlook are a drag. This is an opportunity to buy the best-run bank in America at a deep discount.

Morgan Stanley (MS) takes a hit, with Q2 earnings down 11.3% YOY at $13.13 billion. Return on equity dropped from 13.8% to 10.1%. Equity and bond trading were strong while investment banking in the falling market was weak. Money continues to pour into asset management, which I helped found 40 years ago. Buy (MS) on the dip.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my July month-to-date performance exploded to +3.81%.

My 2022 year-to-date performance ballooned to 54.66%, a new high. The Dow Average is down -18.91% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 74.56%.

That brings my 14-year total return to 567.22%, some 2.70 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to an eye-popping 45.01%, easily the highest in the industry.

With the July options expiration having gone spectacularly in our favor, we are now 80% in cash. The remaining 20% is in a Tesla (TSLA) August $500-$900 short strangle. If you don’t know what that is, please read your trade alerts.

We need to keep an eye on the number of US Coronavirus cases at 89.6 million, up 500,000 in a week and deaths topping 1,023,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, July 18 at 8:30 AM, NAHB Housing Market Index for July is released.

On Tuesday, July 19 at 7:00 AM, the US Housing Starts and Building Permits for June are out.

On Wednesday, July 20 at 7:00 AM, Existing Home Sales for June are published.

On Thursday, July 21 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, July 22 at 7:00 AM, the S&P Global Flash PMI for July is disclosed. At 2:00, the Baker Hughes Oil Rig Count is out.

As for me, I am constantly asked why I do what I do, what motivates me, and why I keep taking such insane risks.

I have thought about this topic quite a lot over the years while piloting planes on long flights, crossing oceans, and sitting on mountain tops.

From a very early age, I have had an immense sense of curiosity, wanted to know what was over the next hill, and what the next country and people were like.

When I was five, my parents gave me an old fashioned alarm clock. I smashed it on the floor to see how it worked and spent a month putting it back together.

When I was eight, the local public library held a contest to see who could read the most books over the summer vacation. By the time September rolled along, the number three contestant had read 5, number two had read 10, and I had finished 365. I read the entire travel section of the library.

I vowed to visit every one of those countries and I almost did. So far, I have been to 125, and they keep inventing new ones all the time.

It helped a lot that I won the lottery with my parents. Dad was a tough Marine Corps sergeant who never withdrew from a fight and endlessly tinkered with every kind of machine. He was a heavyweight boxer with hands the size of hams. Dad went to the University of Southern California on the GI Bill to study business.

When I was 15, I bought a green 1957 Volkswagen bug for $200 that consumed a quart of oil every 20 miles. I tore the engine apart trying to fix it but couldn’t put it back together. So, I brought in dad. He got about half the engine done and hit a wall.

So, we piled all the parts into a cardboard box and took them down to a local garage run by a man who had been a mechanic for the German Army during the war, was taken prisoner, and opted to stay in the US when WWII ended. Even he ended up with four leftover parts that he couldn’t quite place, but the car ran.

Mom was brilliant, earned a 4.0 average in high school and a full scholarship to USC. They met in 1949 on the fraternity steps when she was selling tickets to a dance. She eventually worked her way up to a senior level at the CIA as a Russian translator of technical journals. I was called often to explain what these were about. For years, that gave me access to one of the CIA’s primary sources. When the Cold War ended, the first place my parents went to was Moscow. Their marriage lasted 52 years.

I was very fortunate that some of the world’s greatest organizations accepted me as a member. The Boy Scouts taught me self-sufficiency and survival skills. At the karate dojo in Tokyo, I learned self-confidence, utter fearlessness, and the ability to defend myself.

The Economist magazine is where I learned how to write and perform deep economic research. That got me into the White House where I observed politics and how governments worked. The US Marine Corps taught me how to fly, leadership, and the value of courage.

Morgan Stanley instructed me on the art of making money in the stock market, the concept of risk versus reward, and how to manage a division of a Fortune 500 company.

Being such a risk taker, it was inevitable that I ended up in the stock market. A math degree from UCLA gave me an edge over all my competitors when it counted. This was back when the Black-Scholes option pricing model was a closely guarded secret and was understood by only a handful of traders.

In the early 80s, I took a tip on a technology stock from a broker at Merrill Lynch and lost my wife’s entire salary for a year on a single options trade. I’ll never make that mistake again. I spent a month sleeping on the sofa.

I figured out that if you do a lot of research and preparation, big risks are worth taking and usually pay off.

I have met a lot of enormously successful, famous, and wealthy people over the years. They are incredibly hard workers, inveterate networkers, and opportunists. But they will all agree on one thing, that luck has played a major part in their success. Being in the right place at the right time is crucial. So is recognizing opportunity when it is staring you in the face, grabbing it by both lapels, and shaking it for all it’s worth.

If I hadn’t worked my ass off in college and graduated Magna Cum Laude, I never would have gotten into Mensa Japan. If I hadn’t joined Mensa, I never would have delivered a lecture in Tokyo on the psychoactive effects of tetrahydrocannabinol (THC), which the Tokyo police department and the famous Australian journalist Murray Sayle found immensely interesting.

Without Murray, I never would have made it into the Foreign Correspondents Club of Japan and journalism. If a 50-caliber bullet had veered an inch to the right, I never would have made it out of Cambodia.

You know the rest of the story.

I am an incredibly competitive person. Maybe it’s the result of being the oldest of seven children. Maybe it’s because I spent a lifetime around highly competitive people. That also means being the funniest person in the room, something of immense value in the fonts of all humor, the Marine Corps, The Economist, and a Morgan Stanley trading floor. If you can’t laugh in the face of enormous challenges, you haven’t a chance.

I have also learned that retirement means death and has befallen many dear old friends. It is the true grim reaper. Most people slow down when they hit my age. I am speeding up. I just have to climb one more mountain, fly one more airplane, write one more story, and send out one more trade alert before time runs out.

So, you’re going to have to pry my cold dead fingers off this keyboard before I give up on the Mad Hedge Fund Trader.

I hope this helps.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader