With the massive technology rally off the March 23 market bottom, the risk/reward for entering new trades has dramatically shifted.

Back then. I was begging followers to load the boat with the best big tech and biotech & healthcare names with call options and two-year LEAPS (Long Term Equity Participation Securities).

One reader told me he bought Humana (HUM) call options for 70 cents and sold them for a breathtaking $30 for a profit of 4,280%! FedEx showed up with a bottle of single malt Glenfiddich Scotch whiskey the next day.

The times have changed. Many tech stocks are now only a few dollars short of new all-time highs, like Microsoft (MSFT) and Apple (AAPL), or are at all tie highs, such as Amazon (AMZN), Teledoc (TDOC), and Zoom (ZM).

What a difference 6,000 Dow points make!

As a result, it is far more interesting now to pick up stocks that currently look like potential chapter 11 candidates, but will likely prosper once the American economy starts to reopen. Call it my “Reopening Portfolio.”

You can buy any of the stocks below outright, sit on them, and probably reap a double over the next two years. However, if you are a much more aggressive kind of trader like me, then you might consider LEAPS, where 500%-%1,000% profits are possible.

The advantage of a stock or a two-year LEAPS is that if we get a second Coronavirus wave in the fall, which is highly likely, you can outlast any short term pain and still come out a huge winner.

Some of these names we sold short at the market top and made a killing. It is now time to flip to the other side.

I am often asked how professional hedge fund traders invest their personal money. They all do the exact same thing. They wait for a market crash like we are seeing now and buy the longest-term LEAPS (Long Term Equity Participation Securities) possible for their favorite names.

The reasons are very simple. The risk on LEAPS is limited. You can’t lose any more than you put in. At the same time, they permit enormous amounts of leverage.

Two years out, the longest maturity available for most LEAPS, allow plenty of time for the world and the markets to get back on an even keel. Recessions, pandemics, hurricanes, oil shocks, interest rate spikes, and political instability all go away within two years and pave the way for dramatic stock market recoveries.

You just put them away and forget about them. Wake me up when it is 2022.

I put together this portfolio using the following parameters. I set the strike prices just short of the all-time highs set two weeks ago. I went for the maximum maturity. I used today’s prices. And of course, I picked the names that have the best long-term outlooks.

You should only buy LEAPS of the best quality companies with the rosiest growth prospects and rock-solid balance sheets to be certain they will still be around in two years. I’m talking about picking up Cadillacs, Rolls Royces, and even Ferraris at fire-sale prices. Don’t waste your money on speculative low-quality stocks that may never come back.

If you buy LEAPS at these prices and the stocks all go to new highs, then you should earn an average 131.8% profit from an average stock price increase of only 17.6%.

That is a staggering return 7.7 times greater than the underlying stock gain. And let’s face it. None of the companies below are going to zero, ever. Now you know why hedge fund traders only employ this strategy.

There is a smarter way to execute this portfolio. Put in throw away crash bids at levels so low they will only get executed on the next cataclysmic 1,000-point down day in the Dow Average.

You can play around with the strike prices all you want. Going farther out of the money increases your returns, but raises your risk as well. Going closer to the money reduces risk and returns, but the gains are still a multiple of the underlying stock.

Buying when everyone else is throwing up on their shoes is always the best policy. That way, your return will rise to ten times the move in the underlying stock.

If you are unable or unwilling to trade options, then you will do well buying the underlying shares outright.

Enjoy.

United Airlines (UAL) just raised $1 billion in a new equity issue to tide it over hard times. That is just a drop in the bucket for what it needs. It’s hard to imagine the company coming through the crisis without any government involvement. The most likely is for the feds to offer a big chunk of cash in exchange for a minority ownership. Around 35% might work, which is the portion the US Treasury of General Motors (GM) during the 2008-09 crash. Still, if you’re looking for a double in the shares, that just water off a duck’s back.

LEAPS: the January 21 2022 $45-$50 vertical bull call spread at a price of 83 cents delivers a 525% gain with the stock at $50, up 94.5% from the current level.

Delta Airlines (DAL) is Warren Buffet’s favorite airline, although he has been selling lately. All of the arguments above apply for this best run of US Airlines.

LEAPS: January 21 2022 $40-$45 vertical bull call spread at a price of 83 cents delivers a 502% gain with the stock at $45, up 98.8% from the current level.

MGM Resorts (MGM)

Yes, Las Vegas is reopening soon, but it certainly won’t resemble the old Vegas. (MGM) is the dominant hotel owner of the strip, owning the Bellagio, Mandalay Bay, Aria Resort, and MGM Grand hotels. It also has a China presence.

LEAPS: the January 21 2022 $25-$30 vertical bull call spread at 75 cents delivers 566% gain with the stock at $30, up 95.6% from the current level.

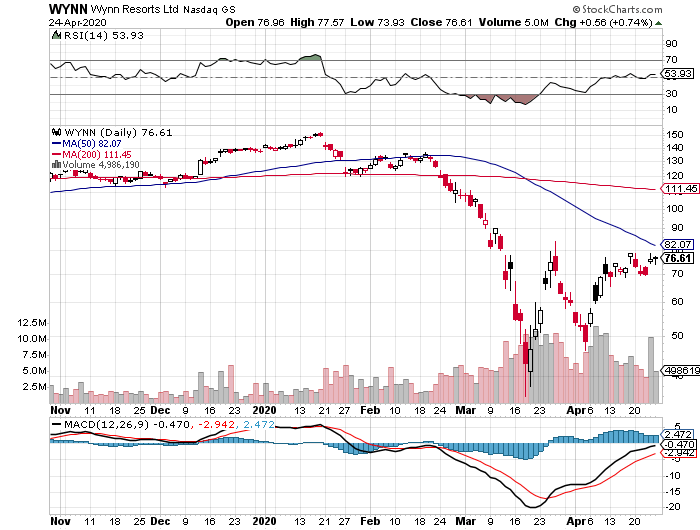

Wynn Hotels (WYNN)

We killed it on the short side with (WYNN), capturing an eye-popping 90% decline. (WYNN) is poised to lead the upturn. It has a major exposure in Macao, where China will lead any economic recovery.

LEAPS: the January 21 2022 $140-$150 vertical bull call spread at 90 cents delivers a 455% gain with the stock at $150, up 81% from the current level.

Union Pacific (UNP)

The reopening of industrial American means a resurgence of railroad traffic. These are not your father’s railroads. Over the last 30 years, they have evolved into highly efficient operators that offer the cheapest way far to over heavy good and bulk commodities, virtually turning into closet high-tech companies. (UNP) had the additional advantage in that as the country’s dominant East/West road, it stands to benefit the most from a recovery in trade with China. That is a likely outcome of any future administration.

LEAPS: the January 21 2022 $180-$185 vertical bull call spread at $1.40 delivers a 257% gain with the stock at $185, up 15.00% from the current level.

CSX Corp. (CSX)

Same arguments here, except that (CSX) wins on North/South trade, especially with Mexico. With a NAFTA 2 new trade agreement in place, this company benefits from an extra turbocharger.

LEAPS: the January 21 2022 $75.00-$77.50 bull call spread at 84 cents delivers a 495% gain with the stock at $77.50, up 16.27% from the current level.

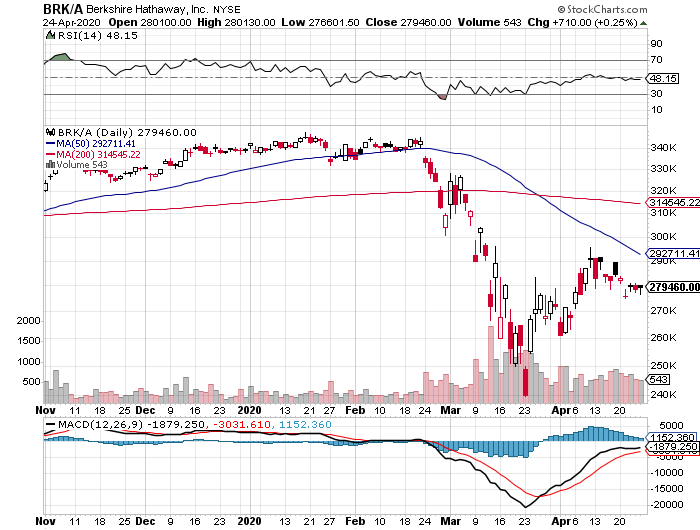

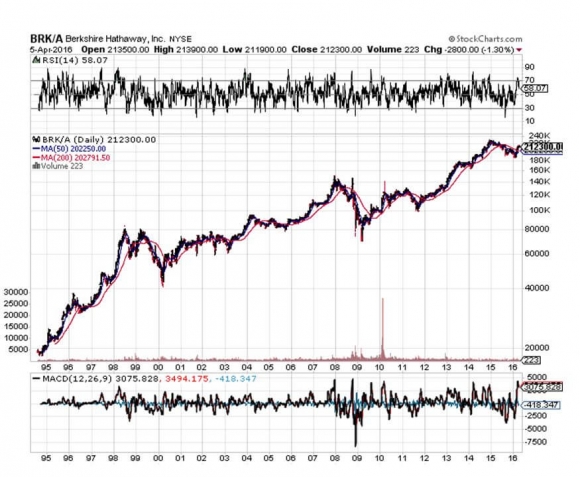

Berkshire Hathaway (BRK/A)

Yes, they make more than sheets these days. Warren Buffet’s flagship holding company is the poster bot for industrial American. The shares are high priced, but after this 32% pullback, you may finally have a chance to get in.

LEAPS: the June 17 2022 $225-$230 vertical bull call spread at $2.61 delivers a 91.5% gain with the stock at $230, up 22.7% from the current level.

Boeing Co. (BA)

This has been the worst falling knife situation in the market for the last two years, cratering from $450 to $85, or down 81%. The decertification of the 737 MAX started the rot, and the grounding of its major airline customers was the coup de grace. This is another company that may require a government bailout and stock ownership, as it is a strategic national value. You may have to wait until the next administration as its Washington State location is currently politically incorrect.

LEAPS: the June 17 2022 $185-$190 bull call spread at $1.25 delivers a 400% gain with the stock at $190, up 47.8% from the current level.

Buy all eight of these and if they all work, your average return will be 411.4%.

Enjoy!