Below please find subscribers’ Q&A for the October 21 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: Bank of America (BAC) said the US consumer is strong and lending is robust. Does this mean no recession in 2023?

A: It could, because remember that while some sectors are clearly in recession, like real estate and automakers, and have been for a while, others are absolutely booming, like the airline business, and the banking business. There may not be a recession in here, or if there is one, it’s a very slight one. Count on the market to first discount a severe recession which would take the S&P 500 down to $3,000-$3,200 or so; and that’s what markets do, always overly pessimistic at the bottom and overly euphoric at tops. You can make your living off of this.

Q: What do you think about OPEC's behavior (USO) and its influence on the price of oil?

A: Clearly, they’re trying to influence the midterm elections and get an all-republican pro-oil Congress, which will be nicer to OPEC. That’s certainly what they got with the last administration and it’s safe to say that the pro-climate administration of Biden and the Saudis get along like oil and water. But long term, OPEC knows it’s going to zero, and in fact, Saudi Arabia has plans to turn their entire oil supply into hydrogen which can be exported and burned cleanly. I know the team here at UC Berkeley that’s working on that with the Saudi government. Cheap hydrogen also means airships come back, how about that? Hindenburg anyone?

Q: Will draining the Strategic Petroleum Oil Reserve (SPR) backfire, meaning deflation for the US economy and administration?

A: No, the SPR outlived its usefulness maybe 30 years ago—it’s essentially a government subsidy for Texas and Louisiana, and for the oil industry, that has taken on a life of its own. When we started the SPR in 1975, the US got more than half of its oil from the Middle East. Now, it’s almost zero. It goes to China instead. If we are a net energy producer and we have been for over 5 years, why do we even need a petroleum reserve? So no, I think we should shut it down and sell all the oil that’s in there. And it becomes even less relevant as more of the US economy turns over to alternatives.

Q: How do we operate our military with no oil?

A: The pentagon is working on a no-oil future, developing alternative fuels for all kinds of things that you wouldn’t imagine are possible. For example, instead of using diesel, jet fuel, or gasoline for our vehicles, you outfit them with electric batteries, and when the batteries go dead you just air drop new fully charged ones. It’s much better than trying to transport gasoline across the desert in a giant fuel bladder, which can be taken out by a single bullet and is what they do now. Take the pilots out of fighters and they become so light they can operate on battery power. So yes, the pentagon has actually been in the forefront of using every alternative technology they can get their hands on from the early days. Better they get them first before an enemy does.

Q: We will almost always need petroleum; far too many products use it as an ingredient.

A: That is absolutely right. Some will probably never be replaced, like asphalt, feedstock, or plastic. However, those represent less than 10% of the current oil demand. So yes, there always will be an oil industry, it just might be a heck of a lot smaller than it is now. You eliminate cars from the picture, and that’s half of all oil demand in the United States right there. And in most places in the United States, it will be illegal to sell a car that uses gasoline in 12 years. And do you make 30-year investments based on demand for your product dropping by half in 12 years? No, you don’t, which is why the oil companies themselves won’t invest in their own industries anymore. They’re only paying out profits as dividends and buying back shares, which they never used to do.

Q: Do you think the Standard & Poor’s 500 Index (SPX) $3,500 was the bottom?

A: No, we actually did get a little bit lower than that. We will be in a bottoming process over the next several months, but the pattern will be the same. Tiny marginal new bottoms, maybe 100 points lower than the last, and then these gigantic rallies. If we do make bottoms they will only be for seconds, so the way to deal with that is to only put in really low-limit orders to buy stuff, assuming 1,000 points down, and just keep entering the order every day. Eventually, you’ll get one of these throw-away fills when the algorithms panic and a bunch of market orders hit the market. That's the way to deal with that.

Q: I would say that Biden is trying to influence the elections by releasing oil reserves.

A: Absolutely he is, but then so is the oil industry, taking half of the refineries off stream 2 months before the elections, and spiking oil prices. So it’s a battle of the oil price going on here. No love lost between the oil industry and Biden, and US consumers for that matter. I don’t care if gasoline is $7 a barrel because I never buy it; I am all electric. But for a lot of working people, that’s definitely a lot of money.

Q: How concerned are you about the US going to a cashless currency?

A: I’m not worried because I pay my taxes and I don’t break any laws. If you don’t pay taxes and do break laws, like engaging in drug dealing or bribery, you should be extremely worried, as that would be the eventual goal of a cashless economy. That and the fact that the government has to spend $300 million a year printing paper money, which they’d love to get rid of. And of course, it’s cheaper for businesses to use digital currencies. Most countries in Europe don’t use physical currency anymore—it’s credit cards only.

Q: Do you expect Tesla (TSLA) to pop after earnings?

A: I have no idea; it depends on what the report says but suffice it to say that Tesla is historically cheap. It has the lowest PE multiple now than it has in the entire 13-year history of the company. Scale in on the LEAPS with Tesla—that’s what I’d be doing down here.

Q: Could the US debt situation spiral into something that gets out of hand?

A: No, because the purchasing power of debt is now deflating at an 8.4% annual rate, which means that it goes to zero in about 8.57 years. This is how the government always wins when issuing debt. It’s been going on since the French first issued government debt 300 years ago. Who pays for that? Bond investors. Anybody who owns bonds now has seen their purchasing power go up in smoke. That’s why it’s been a one-way zero bid market for two and a half years—they’ve been dumping like crazy.

Q: Should I buy debt here or sell it?

A: We’re actually getting close to a bottom in the junk debt market, which means you’re going to be yielding around 10%. That means the value of your holding doubles in 6 years, and the default rates never reach the high levels predicted by analysts in junk bonds. That has always been the key to junk bonds in the whole 50 years that I've been following this market. My neighbor up in Tahoe, Mike Milliken, made billions off that assumption.

Q: What do you think about Netflix (NFLX)?

A: Well, my advice was to buy it, to a lot of people. They’re clearly changing their business model for the better—they’re going to start picking up ad revenues, they’re cracking down on password sharing, and they delivered a 20% return in stocks. Plus their share price has just dropped down from $700 to $165. Great LEAP candidate here.

Q: What kind of position is best if a recession hits?

A: Cash. Cash is now yielding 4.4%. The best cash alternative is 90-day T-bills issued by the US Treasury. Execution costs almost zero, and liquidity is essentially infinite; but, remember also that bull markets start 6 to 9 months before recessions end. You just have to watch your timing. Which means that if the recession ends in say July, you have to be buying stocks today. Just keep that in mind, ladies and gentleman.

Q: How do you see the futures of semis?

A: Anything you buy here now will triple in three years, but it becomes a question of how much pain you want to take in the meantime. Everyone in the investment management industry thinks the same, and it really is a classic “catch-a-falling-knife” situation— knowing that the payoff down the road is enormous. Virtually all companies are designing new semis into their products at an exponential rate.

Q: Are LEAPS part of the service?

A: Yes, they are. I will send you one tomorrow. But concierge customers get first priority because that’s what they’re paying for.

Q: How far out should we go?

A: On LEAPS, always take the maximum maturity, which is usually 2 years and 4 months. And the reason is that the second year is almost free—they charge you almost nothing for going out to maximum maturity. And if we have a recession that does last longer than people think, that extra year of maturity will be worth its weight in gold. It’ll be the difference between a zero return and a 10x return.

Q: Can we go back into the ProShares UltraShort 20+ Year Treasury (TBT)?

A: No, it would be a horrible idea to buy the (TBT) here after it just moved from $14 to $36. That’s what you buy before it goes from $14 to $36. We’re topping out in all of these short bond plays, so avoid them like the plague.

Q: How much is the Concierge Service?

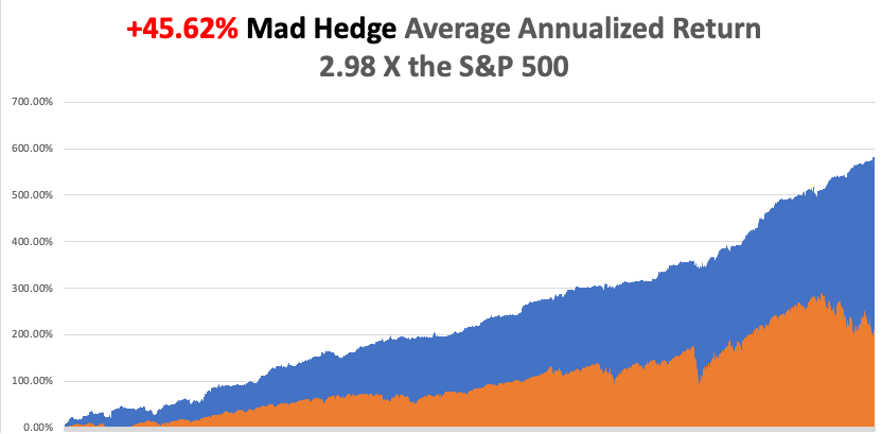

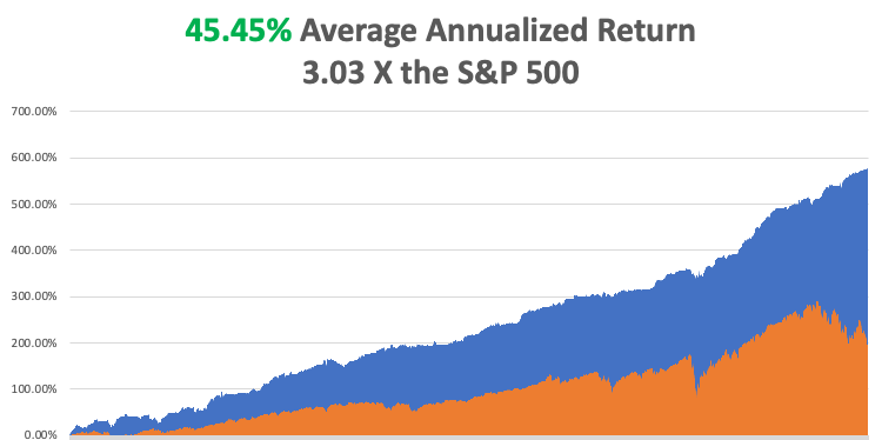

A: It’s $12,000 a year—and a bargain price at that! Almost everybody ends up covering that on their first trade, and you get an entire portfolio of LEAPS and a dedicated LEAPS website with the service. You also get my personal cell phone number so you can call me while I'm either on the beach in Hawaii or on the ski slopes of Lake Tahoe. If anyone has questions about the concierge service, contact customer support at support@madhedgefundtrader.com.

Q: What are your thoughts on data analytics companies Snowflake (SNOW) and Palantir (PLTR)?

A: Love Snowflake, hate Palantir because the CEO isn’t interested in promoting a share price. With (SNOW), you have Warren Buffet as a major holder, so that’s all you need to know there. (SNOW) also has a 75% fall behind it.

Q: Thoughts on the Ukraine/Russia war?

A: It’ll drag on well into next year, and obviously the Iranian drones are the new factor here. I wouldn’t be surprised if there were suddenly an accident at a certain factory in Iran; that’s what happens when these things play out.

Q: Is Snowflake (SNOW) a buy right now?

A: It’s like all the rest of tech. High volatility, could have lower lows, but long-term gains are at least a triple from here. You know how much risk you can take.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Dungeon in Montreux Castle on Lake Geneva in Switzerland