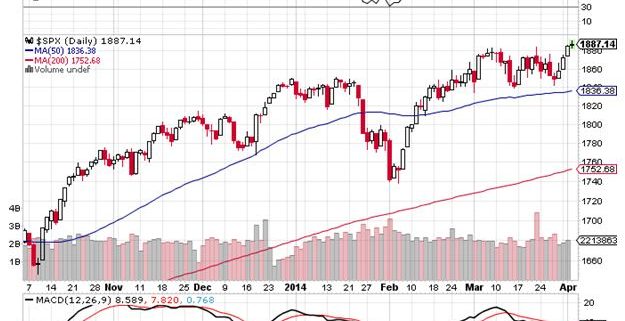

Traders throughout the industry have been left with their jaws hanging open in the wake of the complete collapse of volatility for the S&P 500 (SPY). When the volatility hit the $10 handle a few days ago, it was the lowest level in nearly a decade.

Especially hard hit has been the iPath S&P 500 VIX Short Term Futures ETN (VXX), which has cratered from $56 to $30, some 46%, just since February. I had a bet on last month that this note would hold its multiyear lows around $40.

Think again.

When it broke my 5% rule for non-leveraged instruments, I pulled the ripcord and stopped out at $37.80, paring 1.68% off of my 2014 performance. The (VXX) then went into free fall, breaking $30.

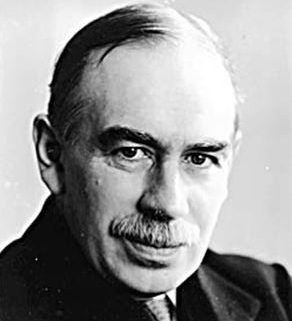

If I was stubborn, insisted that I was right and the market wrong, and shouted at the sea not to rise, like King Canute, this position would have cost me a heart breaking 8.66%. To quote the legendary economist and early hedge fund trader, John Maynard Keynes, ?Markets can remain irrational longer than you can stay solvent.?

What has been killing the (VXX) has been the contango in the futures market. The managers buy three-month (VIX) futures at higher implied volatilities, and ride them into expiration, when much lower implied volatilities prevail. For example, today, you can buy September volatility for $16, while June is only $11.

The (VXX) managers then roll their cash into the next batch of three-month futures and repeat the process. It is, in effect, a perfect money destruction machine. This is why the (VXX) has plummeted from an all time high of $8,000 to $30 in just five years. S&P 500 volatility has declined from $90 to $11 during the same time.

Why did I recommend purchase of such a suicidal instrument? Because during periods of market weakness, like you normally get in May, you can see dramatic pops in the price of the (VXX) as long only institutions rush to buy downside protection, sometimes on the order of 25%-50%.

Except, this time it was different. It really has been one of those abnormal, mean diverging kind of years, from day one.

It is all a lesson on the value of stop losses. I tell people I practice this discipline because I am too old to go back to Morgan Stanley broke, and start all over again. They probably wouldn?t have me anyway, I am so prone to farting in church.

You may have other reasons.