“The rise of extreme inequality both within nations and between nations that is being turbocharged by globalization and technology (is one of the biggest risks for young people).” - Said former President of the United States Barack Obama at Salesforce.com Inc.’s annual Dreamforce Conference in San Francisco.

Mad Hedge Technology Letter

November 22, 2019

Fiat Lux

Featured Trade:

(THE REAL STORY BEHIND THE CHARLES SCHWAB/TD AMERITRADE MERGER),

(SCHW), (AMTD), (ETFC), (IBKR)

There are certain parts of tech that I routinely bash on like travel tech, music streaming tech, and the usefulness of social media companies.

One other group of companies that I’m just as sour on are the discount e-brokers.

Yes, tech has embedded deflation into every company causing operations to become more efficient while boosting performance.

That doesn’t necessarily translate into more sales for some, and they have cut down the barriers of entry to e-brokers who have struggled.

The race down to zero finally hit rock bottom a few months ago when Interactive Brokers (IBKR) announced doing away with trading fees.

Buying and selling stocks and ETFs now costs the consumer nothing and this has been great news for investors and traders who don’t need to shoulder the extra trading costs.

But what about the e-brokers themselves?

Today Charles Schwab (SCHW) announced they are in negotiations to buy out the smaller TD Ameritrade (AMTD).

This was due to happen and is just another round of an industry-wide reshuffle.

I have never once thought these e-broker companies were a candidate for a tech alert, there are so many better companies out there.

Smaller commissions mean less revenue and the exact opposite of what investors should hope for in a tech company.

The lack of pricing power stems from the issue that e-brokers offer a commodified service of selling standard products and pricing is the only way to differentiate themselves.

The first startup company to offer zero was Menlo Park, California dark horse Robinhood which was recently valued at $7.6 billion.

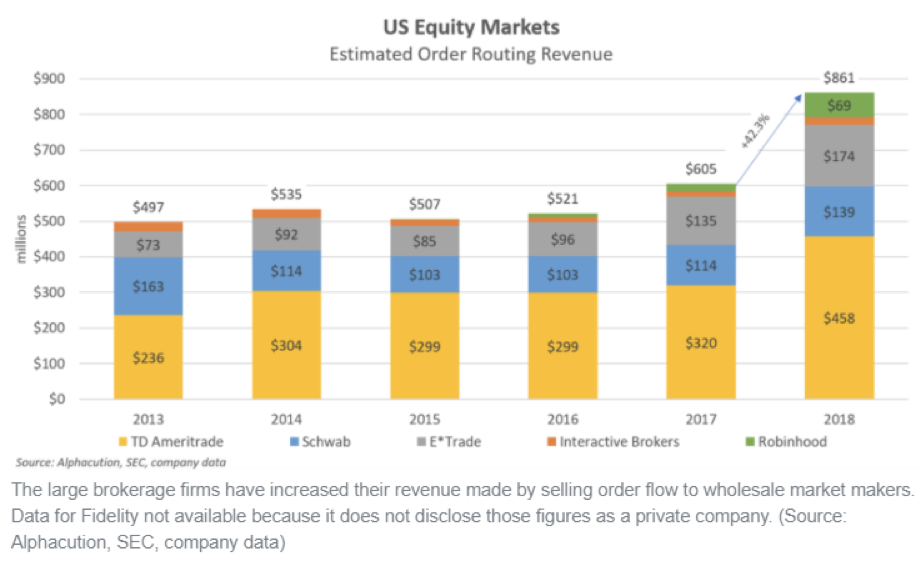

They make money on the interest from customer deposits and sell data flow to high-frequency traders who in turn monetize the numbers using faster internet connections.

The spirited startup was found in 2013 and has added over 6 million users who are mostly from the Millennial age group.

These 6 million also represent the numbers lost to the discount e-brokers.

Robinhood’s influence in the industry cannot be understated as they singlehandedly forced an e-broker to cut commissions one by one blowing up their business model.

E-brokers had no choice but to cut to zero unless they were content to bleed customers.

Don’t forget that TD Ameritrade acquired competitor Scottrade just two years ago as the consolidation merry-go-round began.

The Schwab and TD Ameritrade deal will create over $5 trillion in asset management together.

Moving forward, the big question is how can these companies sustain themselves.

Exactly, there appears to be no panacea and I would recommend any investor to avoid investing in these e-brokers.

Schwab appears to be hanging their hat on their additional financial services they will be able to provide customers like offering mutual funds.

In addition to offering online brokerage accounts and robo-advisor services, Schwab and TD Ameritrade play a pivotal role in the independent advisory space because they custody assets and offer related services to RIAs.

According to Financial Advisor magazine, Schwab is the leading RIA custodian, and TD Ameritrade ranks third after Fidelity.

A merged company can theoretically offer more services to RIAs, but could also create opportunities for others.

Could these services become a race down to zero as well?

Disruption is in the early innings and round two could see Interactive Brokers or E*Trade (ETFC) in the next round of consolidation.

Smaller e-brokers will in time go bust or get bought out.

This reaffirms the broad trend of financial jobs eroding rapidly as the onslaught of technology has made certain jobs obsolete.

U.S. financial jobs are set to slide by 10% in the upcoming years.

Back office bank jobs are disappearing as we speak and the next big wave of job losses after that will be the front-office broker.

Yes, your Schwab broker could become an algorithm.

At some point, there will be a few managers left over, a handful of executives, and an army of software engineers.

“I am so disturbed by kids who spend all day playing videogames.” – Said Co-Founder and CEO of Oracle Larry Ellison

Mad Hedge Technology Letter

November 20, 2019

Fiat Lux

Featured Trade:

(MY CURRENT TECHNOLOGY TRADING STRATEGY),

(GOOGL), (MSFT), (APPL), (ADBE), (AKAM), (VEEV), (FTNT), (WKDAY), (TTD)

Some might say that we were due for a revaluation of growth tech stocks.

They have contributed greatly in this nine-year bull market.

Profit-generating software stocks are the order of the day.

Tech has led the overall market higher after projected quarterly earnings growth of -9% came in better than expected at -5%.

We have ebbed and flowed from pricing in a full-out recession in mid-2020 to now believing a recession is further off than first thought.

The pendulum swing ruptured many growth stocks from Workday (WKDAY) to The Trade Desk, Inc. (TTD) plummeting 30%.

We have retraced some of those losses but momentum in share appreciation has shifted to the perceived safer variation of tech stocks.

Investors have cut volatility and headed into bulletproof companies of Apple (AAPL), Google (GOOGL), and Microsoft (MSFT).

These companies have significant competitive advantages, Teflon balance sheets, and print money.

The tech markets just about priced in the U.S - China trade war in the fall as broad-based volatility plummeted because of optimism around making a deal.

This, in turn, has boosted chips stocks along with investors front running the 5G revolution and the administration granting Huawei a reprieve was a cherry on top.

The Mad Hedge Technology Letter has taken every dip to initiate new longs in safe trades like software companies Adobe (ADBE) and Veeva Systems (VEEV).

Tech is at the point that all loss-making companies are out of the running for tech alerts because the moment there is a recession scare, these shares drop 10% and often don’t stop until they lose 30%.

Now there is a deeply embedded set of narrow tech leadership by a few dominant tech companies buttressed by a select set of second-tier software stocks.

I would put PayPal (PYPL) and Twitter (TWTR), which I currently have open trades on, in the ranks of the second tier and they should do well as long as economic growth does better than expected.

Their share prices dipped on weak guidance and the bad news appears to have been shaken out of these names.

Professional investors could also be hanging on to meet end-of-year performance targets.

I do expect unique entry points on software stocks that drop after bad future guidance.

Profitability has moved to the fore as the biggest factor in holding a name or not.

Newly minted IPOs have fared even worse showing the markets' waning appetite for loss makers like Uber (UBER) and Lyft (LYFT).

Loss-making companies often tout their ability to change the world and disrupt industry, but that has been discovered as nothing more than a ruse.

They aren’t disrupting the way we change the world. For example, Uber is a dressed-up taxi service and the new CEO has failed to create any new momentum in the unit economics that spectacularly fail by any type of metric.

Even worse for these growth stocks, as the economy starts to falter, there will be even less appetite for them, and even more appetite for safer tech stocks.

A worst-case scenario would see Uber drop to $10 and Lyft to $20.

New all-time highs have crystalized with Google (GOOGL) under the gauntlet of regulation hysteria displaying the domination of these big tech machines.

The ongoing, consistent rotation out of growth and into value hasn’t run its course yet and fortunately, by identifying this important trend, our readers will be well placed to advantageously position themselves going into 2020.

Growth stocks won’t make a comeback anytime soon and deteriorating conditions could trigger renewed synchronized global monetary policy easing and central bank stimulus.

And yes, more negative rates.

I believe Oracle (ORCL), Fortinet (FTNT), Akamai Technologies, Inc. (AKAM) could weather the storm next year.

Tech growth is slowing and trade uncertainty is high, and readers must have a sense of urgency to avoid the losers in this scenario.

U.S. economic growth could slow to 1.3% next year, avoiding a recession, and the lack of enterprise spend will reduce software sales and combine that with peak smartphone growth and it won’t be smooth sailing.

The Mad Hedge Technology Letter has the pulse of the tech market and will show you how to navigate this minefield.

“The best customer service is if the customer doesn't need to call you, doesn't need to talk to you. It just works.” – Said Founder and CEO of Amazon Jeff Bezos

Mad Hedge Technology Letter

November 18, 2019

Fiat Lux

Featured Trade:

(THE FANG’S BIG MOVE INTO BANKING),

(GOOGL), (MSFT), (APPL), (MA), (V), (PYPL), (SQ), (GS), (FB)

First, Apple (APPL) collaborates with Goldman Sachs’ (GS) offering of a credit card even giving credit access to subprime borrowers.

And now Google (GOOGL) has its eyes on the banking industry — specifically, it’ll soon offer checking accounts.

In a copycat league where anything and everything is fair game, we are seeing a huge influx of big tech companies vie for the digital wallets of Americans.

The project is aptly named Cache and accounts will be handled by Citibank (C) and a credit union at Stanford.

Google’s spokesman shared with us admitting that Google hopes to “partner deeply with banks and the financial system,” and further added, “If we can help more people do more stuff in a digital way online, it’s good for the internet and good for us.”

I would disagree with the marginal statement that it would be good for us.

Facebook (FB) is now offering a Pay option and how long will it be until Amazon (AMZN), Microsoft (MSFT), and others throw their name into the banking mix.

I believe there will be some monumental failures because it appears that these tech companies won’t offer anything that current bank intuitions aren’t offering already.

Moving forward, the odd that digital banking products will become saturated quickly is high.

Let’s cut to the chase, this is a pure data grab, and not in the vein of offering innovative services that force the consumer down a revolutionary product experience.

As the consumer starts to smarten up, will they happily reveal every single data point possible to these tech companies?

Big tech continues to be adamant that personal data is secure with them, but their track records are pitiful.

Even if Google doesn’t sell “individual data”, there are easy workarounds by just slapping number tags on aggregated data, then aggregated data can be reverse-engineered by extracting specific data with number tags.

The cracks have already started to surface, Co-Founder of Apple Steve Wozniak has already claimed that the credit algorithm for Apple’s Goldman Sach’s credit card is sexist and flawed.

Time is ticking until the first mass data theft as well and let me add that the result of this is usually a slap on the wrist incentivizing bad behavior.

I believe big tech companies should be banned from issuing banking products.

Only 4% of consumers switched banks last year, and a 2017 survey by Bankrate shows that the average American adult keeps the same checking account for around 16 years.

As anti-trust regulation starts to gather more steam, I envision lawmakers snuffing out any and every attempt for big tech to diversify into fintech.

It’s fair to say that Google should have done this 10 years ago when the regulatory issues were nonexistent.

Now they have regulators breathing down their necks.

Let me remind readers that the reason why Facebook abandoned their digital currency Libra was because of the pressure lawmakers applied to every company interesting in working with Facebook’s Libra.

Lawmakers threatened Visa and Mastercard that they would investigate every part of their business, including the parts that have nothing to do with Facebook’s Libra, if they went ahead with the Libra project.

The most telling insight comes from the best tech company Microsoft who has raised the bar in terms of protecting their reputation on data and trust.

They decided to stay away from financial products like the black plague.

Better to stay in their lane than take wild shots that incur unneeded high risks.

When U.S. Senator Mark Warner, a Democrat on the Senate panel that oversees banking, was asked about Google and banking, he quipped, “There ought to be very strict scrutiny.”

Big tech is now on the verge of getting ferociously regulated and that could turn out positive for the big American banks, PayPal (PYPL), Visa (V), Mastercard (MA) and Square (SQ).

I heavily doubt that Google will turn Cache into a meaningful business unless Google offers some jaw-dropping interest rates or elevated points to move the needle.

Google has canceled weekly all-hands meetings because of the tension between staff members and Facebook is also just as dysfunctional at the employee level.

Whoever said it's easy to manage a high-stake, too-big-to-fail tech firm?

Even with all the negativity, Google is still a cash cow and if regulatory headwinds are 2-3 years off, they are a buy and hold until they are not.

The recent tech rally, after the rotation to value, has seen investors flood into Apple, Microsoft, and Google as de-facto safe haven tech plays.

“I worry that if you regulate for the sake of regulating it, it has a lot of unintended consequences.” – Said CEO of Google Sundar Pichai

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.