“Now there is a new long march, and we should make a new start.” – Said Chairman of China Xi Jinping

Mad Hedge Technology Letter

May 23, 2019

Fiat Lux

Featured Trade:

(ANOTHER 5G PLAY TO LOOK AT)

(EQIX), (CSCO), (GOOGL), (MSFT), (ORCL)

One of the seismic outcomes from the upcoming rollout of 5G is the plethora of generated data and data storage that will be needed from it.

If you are a cloud purist and want to bet the ranch on data being the new oil, then look no further than Equinix (EQIX) who connects the world's leading businesses to their customers, employees, and partners inside the most-interconnected data centers.

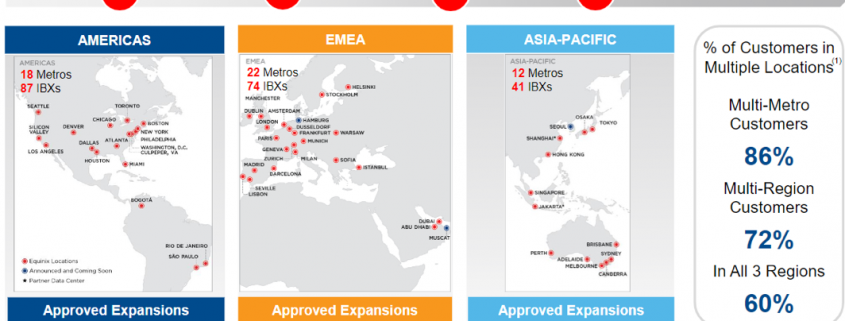

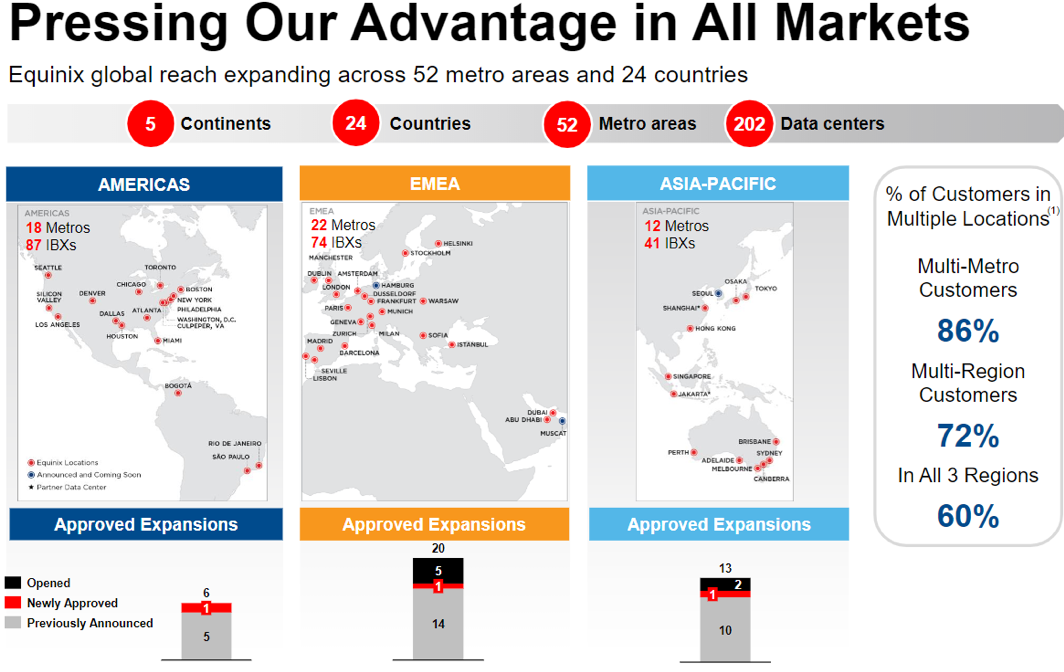

On this global platform for digital business, companies come together worldwide on five continents to reach everywhere, interconnect everyone and integrate everything they need to reap a digital windfall.

And whether we like it or not, the future will be more interconnected than ever because of the explosion of data and the 5G that harnesses the data will allow business to reach across the globe and expand their addressable audience.

The stock has reacted like you would have thought with a victorious swing up after a tumultuous last winter.

The cherry on top was the positive earnings report earlier this month.

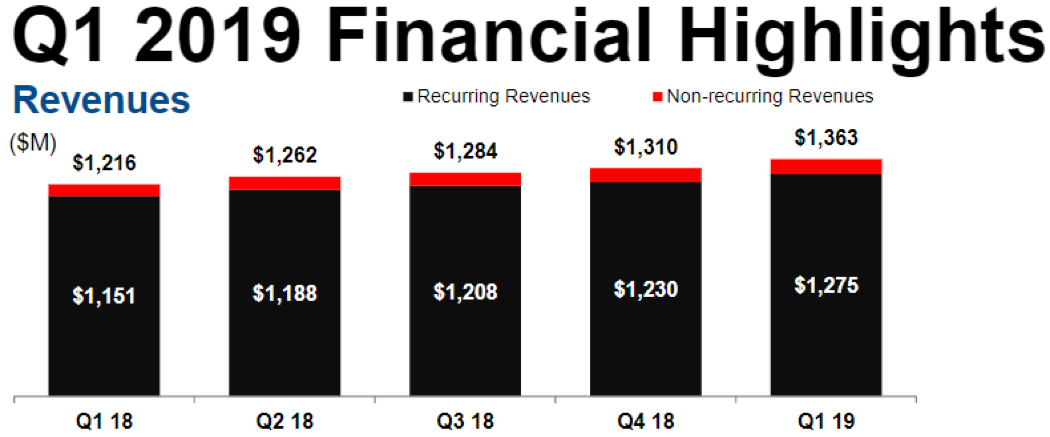

The highlights were impressive and plentiful with revenues for Q1 coming in at $1.36 billion, up 11% year-over-year meaningfully ahead of management expectations.

Equinix’s market-leading interconnection franchise is performing well, with revenues continuing to outpace colocation, growing 12% year-over-year, as the cloud ecosystem continues to scale.

Penetration in “lighthouse accounts” or early adopters increased nearly 50% from the Fortune 500 and 35% from the Global 2,000 demonstrating the expanding opportunity as Equinix unearths more value from the enterprise industry.

Equinix is now the market leader in 16 out of the 24 countries in which they operate, and they’re expanding its platform with 32 projects announced across 27 markets, with Q1 openings in Frankfurt, Hong Kong, London, Paris, and Shanghai.

Equinix’s network vertical experienced solid bookings led by strength in Access Point (AP), which is a hardware device or a computer's software that acts as a communication hub for users of a wireless device to connect to a wired LAN.

APs are important for providing heightened wireless security and for extending the physical range of service a wireless user has access to and driven by major telecommunication companies, mobile operators, and NSP resale.

Expansions this quarter include Hutchison, a leading British mobile network operator upgrading their infrastructure to support 5G and cloud services, as well as a leading Asian communication provider, migrating subsea cable notes and connecting to ECX Fabric for low latency.

Equinix’s financial services vertical experienced record bookings led by Europe, the Middle East and Africa (EMEA) and rapid growth in insurance and banking.

New contracts include a fortune 500 Global insurer transforming IT delivery with a cloud-first strategy, a top three auto insurer transforming network topology while securely connecting to multiple clouds, and one of the largest global payment and technology companies optimizing their corporate and commercial networks.

Demand in the social media sub-segment as providers are hellbent on improving user experience and expanding the scope of their business models.

Equinix’s gaming and e-commerce sub-segment grew the fastest year-over-year led by customers, including Tencent, neighbor, and roadblocks.

Cloud and IT verticals also captured strong bookings led by SaaS as the cloud diversifies towards a hybrid multi-cloud architecture.

A robust pipeline can be rejoiced around as cloud service providers continue to push to new frontiers and roll out additional services.

Developments include a leading SaaS provider expanding to support growth in new markets and with the Federal Government as well as an AI-powered commerce platform upgrading to enhance user experience support a rapidly growing customer base.

As digital transformation accelerates, the enterprise vertical continues to be Equinix’s sweet spot led by healthcare, legal and travel sub-segments this quarter and main catalysts to why I keep recommending reader into enterprise software companies.

The chips are being counted with new contracts from Air Canada, a top five North American airline deploying a hybrid multi-cloud strategy, Space X deploying infrastructure to interconnect dense network and partner ecosystems and one of the big four audit firms regenerating networks and interconnecting to multi-cloud to improve the user experience for both employees and clients.

Channel bookings also registered continued strength delivering over 20% of bookings with accelerated growth rates selling to Equinix’s key cloud players and technology alliance partners, including Cisco (CSCO), Google (GOOGL), Microsoft (MSFT), and Oracle (ORCL).

New channel wins this quarter includes a win with Anixter for a leading French transportation and freight logistics company deploying mobility platform, as well as a win with AT&T for a top-five U.S. Bank accessing our network and cloud provider.

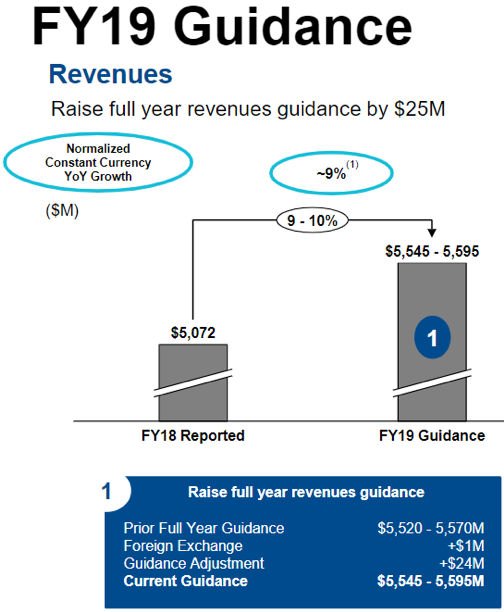

Management signaled to investors they are expecting a great year with full-year revenue guidance of $5.6B, a 9-10% year-over-year boost and a $25M revision from the previous guidance.

Equinix can boast 65 consecutive quarters of increasing revenues, which eclipses every other company in the S&P 500, and it anticipates 8%-10% in annual revenue growth through 2022.

This is an incredibly stable yet growing business and the 2.17% dividend yield, although not the highest, is another sign of a healthy balance sheet for a profitable company.

If you had any concerns about this stock, then just take a look at its 3-year EPS growth rate of 73% which should tell you that the massive operational scale of Equinix is starting to allow efficiencies to take hold dropping revenue straight down to the bottom line.

If you are searching for a company that cuts across every nook and cranny of the tech sector by taking advantage of the unifying demand and storage requirements of big data, then this is the perfect company for you.

This company will only become more vital once 5G goes online and being the global wizards of the data center will mean the stock goes higher in the long-term.

“What's dangerous is not to evolve.” – Said Founder and CEO of Amazon Jeff Bezos

Mad Hedge Technology Letter

May 22, 2019

Fiat Lux

Featured Trade:

(WHY YOU NEED TO CONSIDER ALIBABA)

(BABA), (AMZN)

If you’re looking for a long-term trend that highlights the state of the world, then there is no other source than Alibaba (BABA), the Amazon (AMZN) of China.

I am not saying to go out and buy this e-commerce juggernaut hand over fist, but understanding the essence of Alibaba offers an insight into the technological effects that big tech companies have on the global consumer.

Alibaba and Amazon, together, and their success have had an outsized influence on central banks around the world.

Back stateside, mixed data of persistently low inflation has confounded economists in the years since the Federal Reserve first adopted its 2% inflation target after the financial crisis.

These e-commerce firms' endeavors mean that we can whittle down expenses, migrating pricing power away from the middle class while padding the pockets of a few tech shareholders.

And if you thought Amazon offers low prices, Alibaba often offers even lower price tags because of knockoffs that are blatantly hawked on their platform.

These two companies have rocked the current marketplace by jacking up supply, which in effect brings prices down with their volume-first business models.

Inflationary signals have continued to be suppressed below the Federal Reserve’s 2% target and is mostly likely to stay low into the foreseeable future.

The Fed’s concocted measure of inflation – or the “core” personal consumption expenditures index excludes the volatile categories of food and energy.

This slowed to a rate of 1.6% year-over-year in March, marking the slowest pace since January 2018.

Combine low inflation with a national unemployment rate cratering to a 49-year low in April, and economists start to sniff around attempting to understand what is truly happening.

Theoretically, a low unemployment rate generally translates into higher levels of inflation, but the inflation is being captured by tech CEOs who are offering free services or something close to it that destroys traditional pricing mechanisms.

Once ingrained economic relationships are going extinct, and the underlying relationship has mutated to the benefit of Silicon Valley.

The economic models you once learned in school are now dead and I am giving you the reasons why.

In the Federal Reserve’s most recent policy meeting, Chairman Jerome Powell attributed factors blaming lower inflation on “transitory” variables including slipping financial service fees after the stock market’s fourth-quarter slide, along with healthcare costs.

The consequence is massive with the Fed unable to aggressively raise rates while putting the kibosh on any meaningful wage growth even while the economy is growing at 4% annually.

This has given the Fed the impetus to put rates on pause this year, which is a net dovish outcome after offering a more hawkish stance last winter.

The closely watched Fed Funds Futures tool signaled markets pricing in a 75% probability that the central bank would cut rates at least once by its December meeting which could be an overzealous prediction.

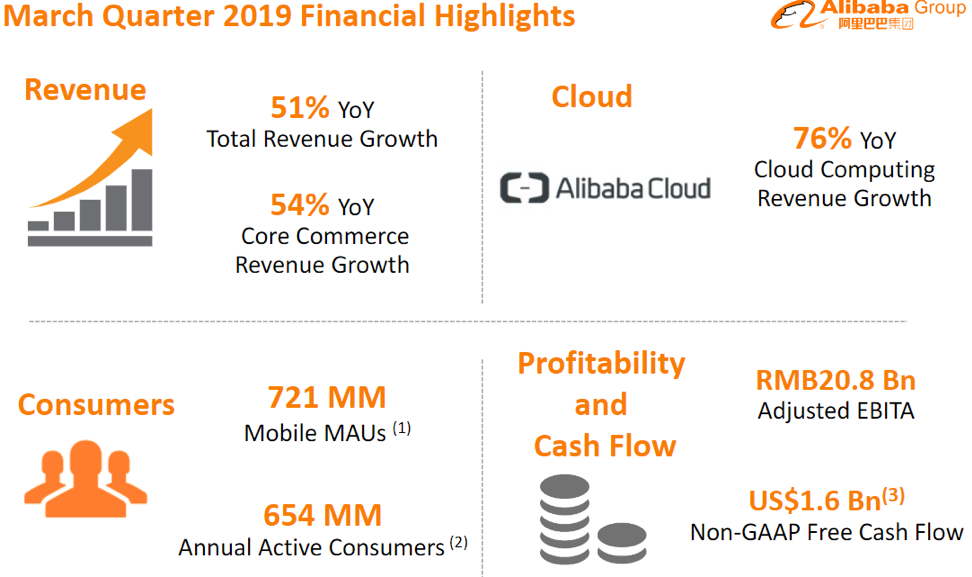

Alibaba is doing its best to crush global inflation by selling over $850 billion in Gross Merchandizing Volume (GMV) last quarter.

Not only are they selling physical goods, but they hope to crash the price for storing digital data with its cloud revenue growing 84% last year dotting Europe with new data centers.

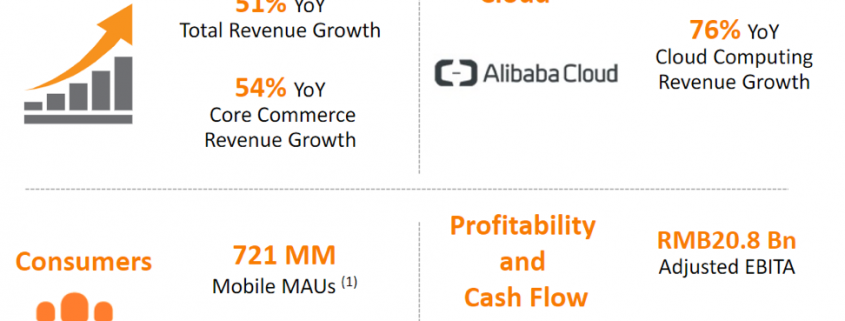

Alibaba’s core e-commerce revenue was up 51% YOY last quarter with 721 million monthly active users.

Alibaba’s monthly active user totals are twice the population size of the United States epitomizing the breadth of this business that is quickly gaining traction in parts of Europe and Russia.

And even with Silicon Valley hijacking inflation, their interests are being staunchly defended by the current American administration from the Chinese who have copied the Silicon Valley deflation model themselves.

The trade fallout could cause massive store closures in America with more malls shuttering from the extra costs of the levied tariffs giving tech even more leeway into the e-commerce game enabling them to capture more revenue.

Brick & mortar retail is incrementally struggling with less foot traffic as customers stay home and click away on Amazon, and the new 25% bump in costs of goods could be the death knell for a large segment of physical stores.

UBS issued a note projecting nearly 21,000 retail stores will close by 2026 in the U.S.

The trade war will put into question future American jobs and increase costs for consumers.

Ultimately, Silicon Valley can have their cake and eat it too boding well for future tech stocks.

The most powerful part about Silicon Valley is the speed in which they can put analog firms out of business leaving the tech wolves to scoop up the most scrumptious leftovers.

We are just scratching the surface of what Silicon Valley will deliver for its stakeholders giving the average investor a strong hint that if you don’t have skin in the tech game yet, then it’s time to join the bandwagon.

Technology will outperform every sector going forward in almost every feasible circumstance, contrast this with sectors who are burning before our eyes, and the smart investor will understand that the deflation signs of the economy are a gilded edge buy sign for the best of breed tech.

Investors should be aware long-term that Amazon and Alibaba will harvest the inflation and pocket it in terms of revenue instead of profits because of the decision to prioritize growth over profits growing so large that they will be akin to a monopoly.

In either outcome, it equates to buy and buy some more of these shares.

“I know nothing about tech.” – Said Founder of Alibaba Jack Ma

Mad Hedge Technology Letter

May 21, 2019

Fiat Lux

Featured Trade:

(HUAWEI HITS THE FAN)

(HUAWEI), (MU), (NVDA), (GOOGL), (FB), (TWTR), (APPL)

If you ever needed a signal to stay away from chip stocks short-term, then the Huawei ban by the American administration was right on cue.

Huawei, the largest telecommunications company in China, is heavily dependent on U.S. semiconductor parts and would be seriously damaged without an ample supply of key U.S. components

The surgical U.S. ban may cause China and Huawei to push back its 5G network build until the ban is lifted while having an impact on many global component suppliers.

The Chinese communist party has exhibited a habit for retaliation and could target Apple (AAPL) who is squarely in their crosshairs after this provocative move.

At a national security level, depriving Huawei of U.S. semiconductor components now is still effective as China’s chip industry is still 5 years behind the Americans.

China has a national mandate to develop and surpass the U.S. chip industry and denying them the inner guts to build out their 5G network will have long-lasting ramifications around the world.

Starting with American chip companies, they will send chip companies such as Micron (MU) and Nvidia (NVDA) into the bargain basement where investors will be able to discount shop at generational lows because of a monumental drop in annual revenue.

Even worse for these firms, Huawei anticipated this move and stocked itself full of chips for an extra 3 months, meaning they were not going to increase shipments in a meaningful way in the short-term anyway.

This kills the chip trade for the rest of the first half of 2019, and once again backs up my thesis in avoiding hardware firms with Chinese exposure.

Alphabet (GOOGL) has cut ties with cooperating with Huawei and that means software and the apps that are built around the software too.

Gmail, YouTube, Google Maps and Chrome will be removed from future Huawei smartphones, and even though this doesn’t amount to much in mainland China, this is devastating for markets in Eastern Europe and Huawei smartphone owners in the European Union who absolutely rely on many of these Google-based apps and view Chinese smartphones as a viable alternative to high-end Apple phones.

Users who own an existing Huawei device with access to the Google Play Store will be able to download app updates from Google now, but these same users will not consider Huawei phones in the future when the Google Play Store is banned forcing them to go somewhere else for the new upgrade cycle.

The fallout further bifurcates the China and American tech ecosystems.

I would argue that China had already banned Google, Facebook (FB), Twitter (TWTR), and marginalized Amazon (AMZN) before the trade war even started.

The American government is merely putting in place the same measures the Chinese communist party has had in place for years against foreign competition.

The recent ban on Huawei was a proactive response to China backing away from negotiations that they already had verbally agreed upon after hawks inside the Chinese communist party gained the upper hand in the tireless fight against the reformist.

These hawks want to preserve the status quo because they benefit directly from the current system and economic structure in place.

The American administration appears to have taken on an even more aggressive tone with the Chinese, as the resulting tariffs are putting even more stress on the Chinese hawks.

However, there is only so much bending they can do until a full-scale fissure occurs and debt rated “A” which is its third-highest classification has recently been slashed to a negative outlook as the tariff headwinds pile up.

The U.S. administration could further delve into its party bag by rebanning Chinese tech firm ZTE who almost folded after the first ban of U.S. semiconductor components.

The U.S. administration is emboldened to play the hand they have now because as long as Chinese tech need U.S. chips, the ball is in the American’s court and going on the offensive now would be more effective than if they carried out the same strategy in the future.

China is clearly attempting to delay the process enough to get to the point where they can install their own in-house chips and can say adios to America and the chips they currently rely on.

It’s doubtful at the current pace of escalation if China can survive until that point in time.

How will China react?

Massive easing and dovishness by the Chinese central bank will be needed to maintain stability and remedy the economy.

The manufacturing sector will face another wave of mass layoffs and debt pressures will inch up.

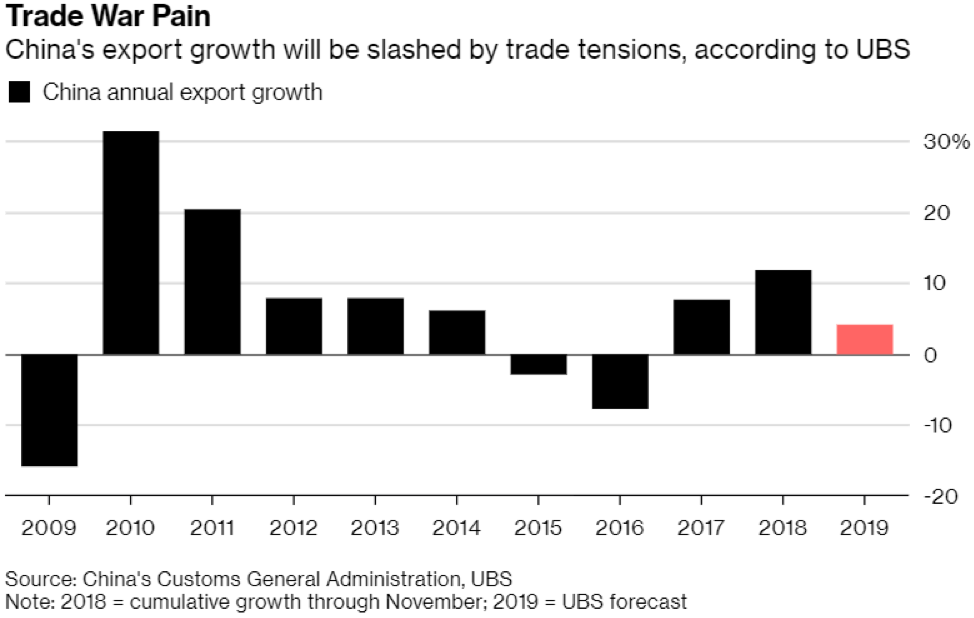

Chinese exports will get slashed with international corporations looking to move elsewhere to stop the hemorrhaging and rid itself of uncertainty.

Many Chinese tech companies will have entire divisions disrupted and even shut down because of the lack of hardware needed to operate their businesses.

Imagine attempting to construct a smartphone without chips, almost like building a plane to fly without wings.

This is also an easy to decode message to corporate America letting them know that if they haven’t moved their supply chains out of China yet, then time is almost up.

Going forward, I do not envision any meaningful foreign tech supply chain that could survive operating in mainland China because nationalistic forces will aim for revenge sooner or later.

There are many positives to this story as the provocative decision has been carried out during a time when the American economy is fiercely strong and firing on all cylinders.

Unemployment is spectacularly low at 3.6%, the lowest rate since 1969, while wage growth has accelerated to 3.8% annually up from 3.4%.

The robust nature of the economy has led to stock market performance being incredibly resilient in the face of continuous global headline risk.

The positive reactions are in part based on the notion that investors expect the Fed Governor Jerome Powell to adopt an even more dovish stance towards rates.

It’s almost as if we are back to the bad news is good news narrative.

Each dip is met with a furious bout of buying and even though we are trudging along sideways, for the time being, this sets up a great second half of the year as China will be forced to fold or face mass employment or worse offering at least a short-term respite for investors to go risk on.

As for the chip sector, high inventories on semiconductor balance sheets and in the channel will continue, as well as weak end demand in nearly every semiconductor end market meaning a once-in-a-generation magnitude of memory oversupply.

The trade war will most likely turn for the worse giving investors even more beaten down prices that will turn into great entry points when the time is ripe.

“It is imperative to respect national sovereignty and refrain from seeking technological hegemony.” – Said Vice President of China Wang Qishan

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.