The imminent launch of the Lyft IPO is telling investors that the next era of technology is upon us.

Does that mean that you should go out and buy Lyft shares as soon as they hit the market?

Yes and no.

30 million shares are up for grabs and the price of the IPO appears to be pinpointed between $62 and $68.

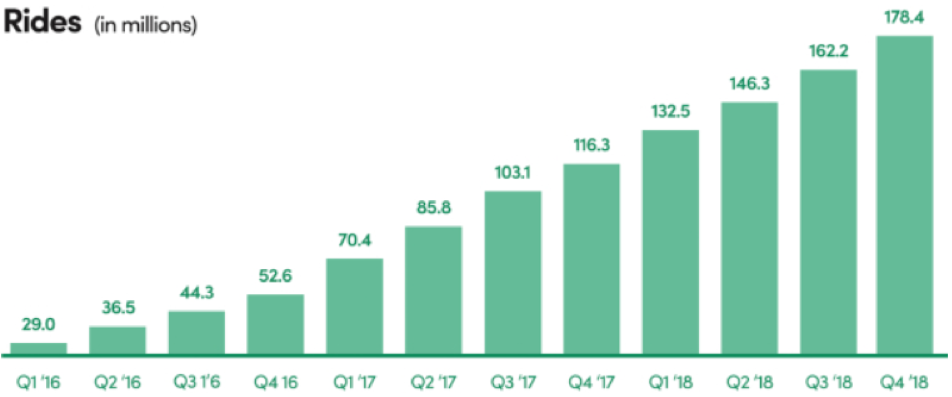

Even though this company is a huge cash burning enterprise, the fact is that they have been catching up to industry leader Uber and snatching away market share from the incumbent.

It was only in January 2017 that Lyft had accumulated 27% of the domestic market share, and in the recent filing for the IPO, that number had exploded to 39%.

If Lyft can start to gnaw into Uber's lead even more, shares will be prime to rise beyond the likely $62 to $68 level.

Let's remember that one of the main reasons for Uber giving up ground in this 2-way race is because of the toxic work environment embroiling many of the upper management and the subsequent damage to its broad-based public image.

If you wanted the definition of a public relations disaster, Uber was the poster boy.

Story after story leaked detailing payment problems to Uber drivers, a huge data leak revealing millions of lost personal information, and even a crude video of the founder berating a driver went viral.

There might be no Cinderella ending for this ride-hailing operation as litigious time bombs stemming from an aggressive high-risk, high-reward strategy skirting local taxi laws have flaunted the feeling of corporate invincibility in the face of government.

Being the first of its kind to hit the market, I do believe the demand will outstrip the supply.

There is a scarcity value at play here that cannot be quantified.

And an initial pop from the low-to-mid $60 range to about $80 is a real possibility in the short-term.

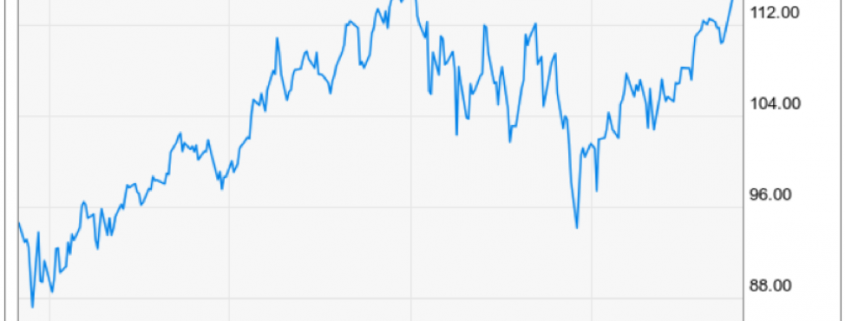

However, expect any robust price action to be met with rip-roaring volatility, meaning there is a legitimate chance that shares will consolidate back to $50 before they head up to $100.

Some of my favorite picks have echoed this same price action with fintech juggernaut Square (SQ) and streaming platform Roku (ROKU) mimicking heart-stopping price action with 10% moves up or down on any given day.

This doesn't mean that these are bad companies, but they do become harder to trade when entry points and exit points become harder to navigate around because of the extreme beta attached to the package.

The big winner of this IPO is ultimately self-driving technology.

Let's not skirt around the issue - Lyft loses a lot of money and so does Uber and that needs to stop.

It has been customary for tech companies to go public in order for the initial venture capitalists to cash out so they can rotate capital into different appreciating assets.

When companies are on the verge of ex-growth, maintaining the same growth trajectory becomes almost impossible without even more incremental cash burn relative to sales.

This leads to an even more arduous pursuit of revenue acceleration with stopgap solutions calling for riskier strategies.

What this means for Lyft is that they will need to double down on their self-driving technology because they are incentivized to do so, otherwise face an existential crisis down the road.

The most exorbitant cost for Uber and Lyft is by far employing, servicing, and paying out the drivers that shuttle around passengers.

I cannot envision these companies becoming profitable unless they find a way to eliminate the human driver and automate the driving function.

I will say that Uber benefitting from the Uber Eats business has been a high margin bump to the top line.

Yet, food delivery is not the main engine that will spur on these IPO darlings.

This part of the business is getting more saturated with margins getting chopped down every day.

What food delivery mainstays like Doordash and GrubHub don't have, is the proprietary self-driving technology that at some point will be present in every vehicle in the United States and the world.

What we are seeing now is a race to perfect, optimize, and implement this technology in order to further license it out to food delivery operations and other logistic heavy business that focus on the last mile.

The licensing portion out of self-driving technology will become a massive revenue driver eclipsing anything that the actual ride-hailing revenue from passengers can inject.

Well, that is at least the hope.

And because Lyft going public might force the company to remove the subsidies provided to the lift operators, this could translate into higher costs per unit.

The pathway is a no-brainer – Lyft needs self-driving technology more than the technology needs them.

And even though Google is head and shoulders the industry leader with Waymo, Lyft and Uber don't have a world-famous search engine that they can fall back on if the sushi hits the fan.

I believe Lyft passengers will have to pay more for rides in the future because of the demand for meeting short-term targets incentivizing management to raise fares.

Going public first will allow them to set the industry standards before Uber can participate in the discussion gifting a tactical advantage to Lyft.

That is why Uber is attempting to go public as fast as possible because every day that Lyft is a public company is every day that they can push their unique narrative and standardize what is a nascent industry that never existed 20 years ago with their new capital.

If high risk is your cup of tea, then buy shares when you get the first crack at it, otherwise, take a backseat with a bag of popcorn and watch history unfold.

This trade is not for the faint of heart and until we can get some more color on the business model and the ability or not of management to meet quarterly or annual expectations, there will be many moving parts with cumbersome guesswork involved.

To read up on Lyft’s IPO filing on the SEC website, please click here.

LYFT’S ARRAY OF SERVICES