The Latest on Quantum Computers

When I was a kid, radios were built with vacuum tubes.

I remember my dad taking me to the supermarket where a large display case sporting dozens of sockets identified the tube you needed.

All you had to do then was install it without electrocuting yourself.

Then transistors were invented and everything changed overnight. Suddenly, solid-state electronics took over the market. Everything was lighter, cheaper, and much faster.

A decade later, Intel took over the computer market launching its revolutionary 4004 microprocessor.

It looks like I am going to live long enough to see another great leap forward in computing power.

Imagine a single computer that was so powerful that its processing power exceeded that of all the other computers in the world combined.

Applied to the stock market, such a machine would be able to algorithmically extract hundreds of billions of profits without anyone noticing.

It would be able to break any code in the world in seconds, rendering all security programs useless.

It would also act as an adrenaline shot for all of the artificial intelligence efforts currently out there.

Oh, and to understand how to interpret its output, we will have to invent a new form of advanced high mathematics.

You may be forgiven for thinking I spent my weekend reading science fiction.

But you would be wrong.

I actually got to see a working prototype for such a machine known as a quantum computer at the NASA Ames Research Center in nearby Mountain View, California.

Dominated by an enormous wooden airship hangar once owned by the Navy, the facility is home to a joint venture between NASA and Google to develop the next generation of supercomputers.

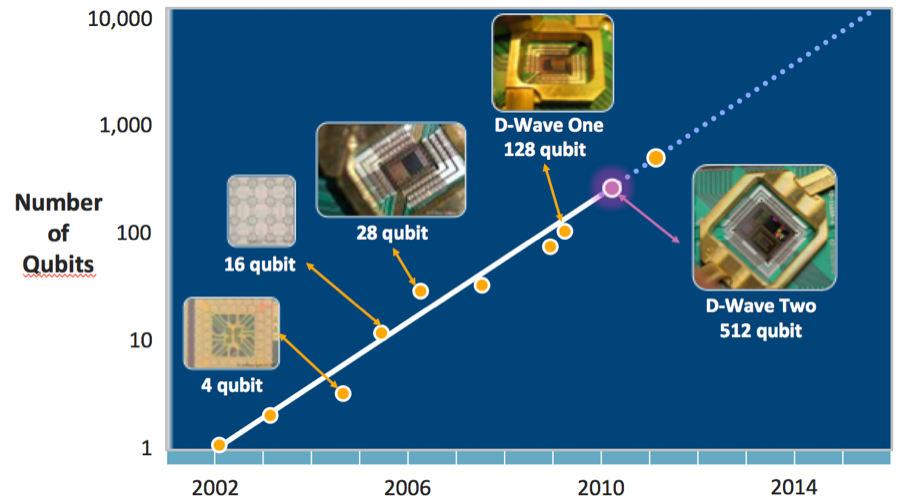

The machine was built by D-Wave, a small Canadian start-up in Burnaby, a suburb of Vancouver, Canada. It was founded in 1999 by a former wrestler, Geordie Rose and Haig Farris.

To understand how such a breakthrough is possible, it is necessary for me to explain some basic particle physics.

Classical computers operate through a system of silicon gates that allow electrons to pass through or not. This is expressed in computer code as a 0, a 1, or nothing at all, known as “bits.”

And yes, I am old enough to have programmed simple computers with only 0’s and 1’s.

The problem is that this technology, launched during the 1960s, is reaching its theoretical limits.

According to Moore’s law, the number of circuits squeezed on a microprocessor doubles every two years until 2015. A few ingenious tweaks and modifications by manufacturers have extended that deadline by five years to 2020.

After that, a Great Depression was supposed to hit, as all progress in technology ground to a halt.

Enter quantum computing.

Instead of only two possible choices in each code entry, the number of possible solutions becomes infinite for quantum computing.

It does this by changing the physical statue of electrons for each piece of code. Some electrons spin clockwise, others counterclockwise, while others still spin on a northeast-southwest axis, and so on.

As a result, the number of calculations that can be performed by a quantum algorithm increased exponentially, as does its speed.

The computational unit of a quantum computer is called a “quantum bit,” or “qubit.”

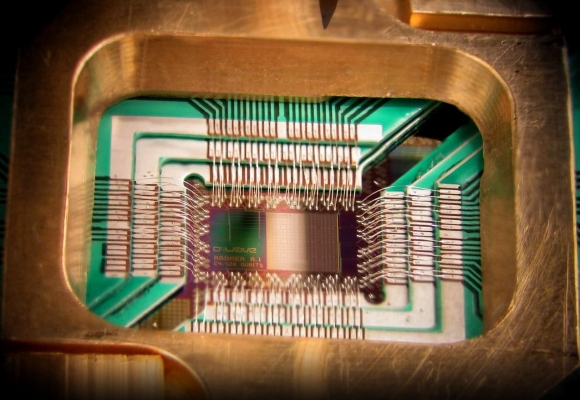

The machine I saw has 1,000 qubits, powered by two chips containing 500 niobium loops each, and was code-named “Washington.”

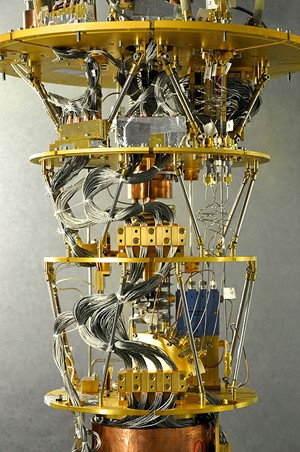

The quantum computer I saw doesn’t look anything like a computer. Instead, it looks like a small walk-in freezer.

That is essentially what it is, as 90% of the hardware is devoted to dissipating heat and shielding it from electromagnetic and magnetic interference.

There is no silicon involved in this computer. Instead, the chips are made of hundreds of 2-micron-wide threads of Niobium, a rare earth, cooled at close to absolute zero.

Gold-plated copper disks are used as heat sinks.

The next-generation quantum computer is expected to have chips made out of aluminum.

The quantum code is now so fragile that the mere presence of matter can erase it and convert it into a useless classical computer.

Its speed is measured through a process known by “entanglement” whereby distant atoms display the mirror image of nearby ones.

And now we’re over my pay grade, and probably yours too.

For that reason, its output can only be transmitted through fiber optic cable.

D-Wave is not alone in its efforts at quantum computing. Do any search on the term, and the number of research institutions involved runs into the hundreds. And who knows what is going on in China and Russia?

D-Wave is a private company. Its largest investors include venture capital firm Draper Fisher Jurvetson, Amazon’s Jeff Bezos, and In-Q-Tel, the venture capital arm of the CIA.

It is possible that D-Wave may never see the light of day as a public company in which you and I can invest. Instead, its total production may be reserved for its original investors.

However, you can invest directly into those shareholders most likely to benefit, including Amazon (AMZN) and Alphabet (GOOG).

There are other models for advanced supercomputing underway that may also reach economic viability, such as DNA-based computing. I’ll be covering those in a future letter.

One of the many goals of the Diary of a Mad Hedge Fund Trader is to discover advanced technologies early, and then get out in front of them with trading recommendations.

Ever wonder why Amazon shares have tripled this year?

This might be the reason.

To learn more about D-Wave and its amazing technology, please click here.