As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

The street is chattering today over the prospect of an enormous payday with the imminent IPO for the social media company, Facebook. Price talk is valuing the company as high as $100 billion, making it the largest such floatation in history. Could the mega deal spell the end of the current bull market?

Look at it this way. Assuming that Facebook sells only 5% of itself to the public, that sucks $5 billion out of the stock market. It is $5 billion that gets diverted away from existing equity allocations. Many investors will need to sell existing positions in other companies to pay for their new Facebook shares, especially in the technology sector.

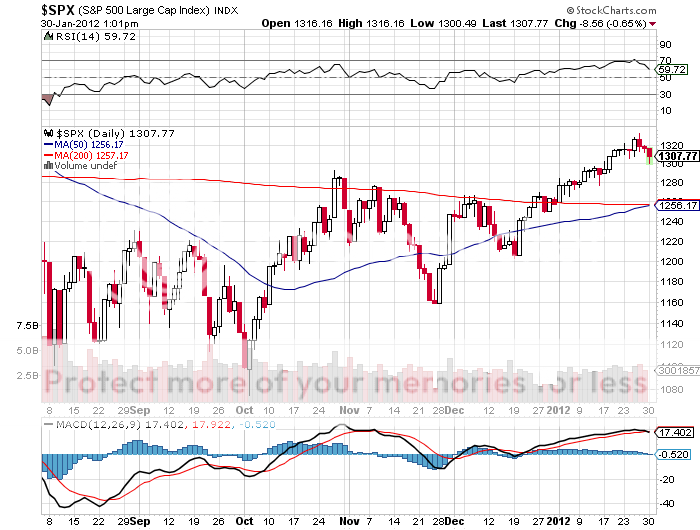

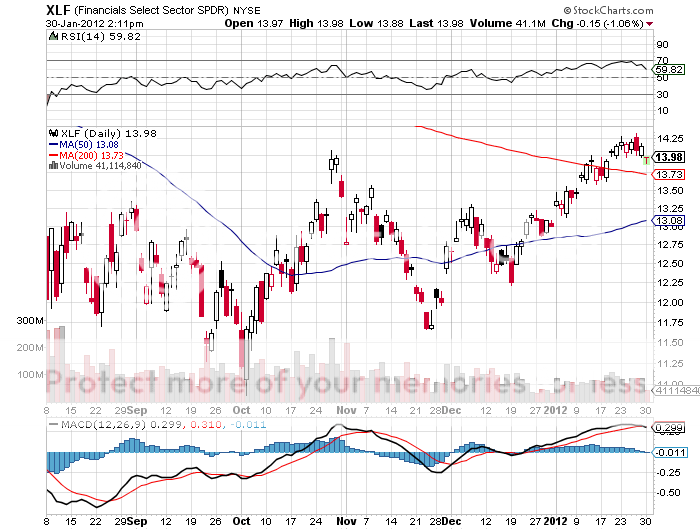

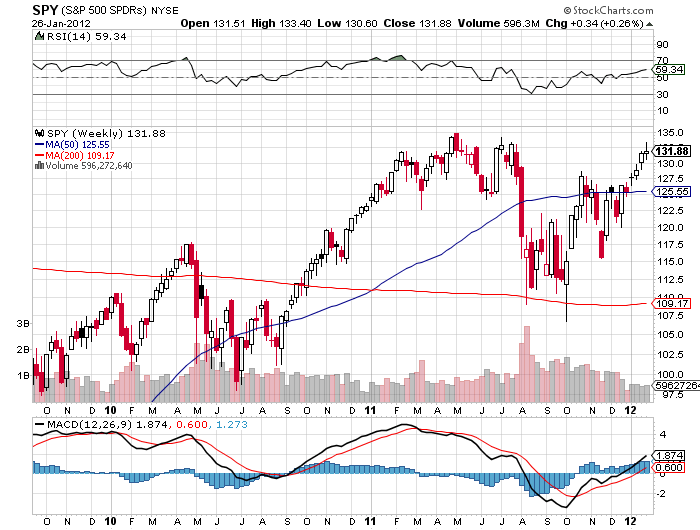

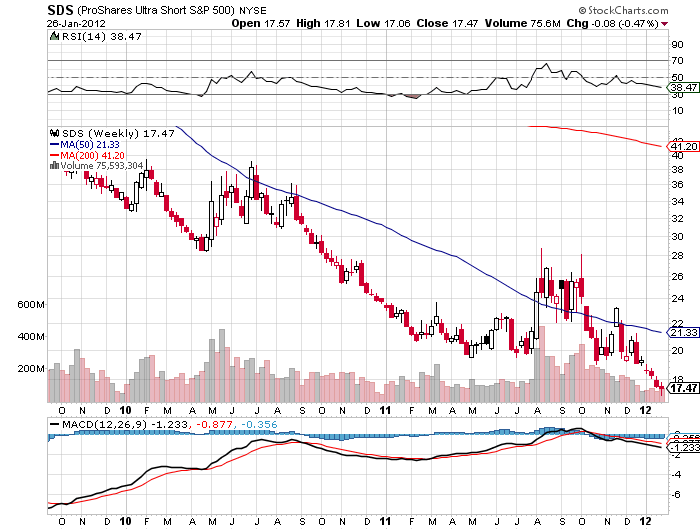

Can the market afford to lose $5 billion in buying power in its current fragile condition? I think not. Take a look at the chart below which has the (SPY) making a near parabolic move since the beginning of the year. At the very least, we need to pull back to just above $126, which takes us down to 1,256 on the S&P 500, smack dab on the 200 day moving average. If you don?t believe me, then take a look at the chart for the financials sector ETF (XLF), which has led the market this year and is clearly rolling over.

I?ll tell you who the big winner in a Facebook IPOP will be. The San Francisco Bay area. $100 billion is a ton of money to pour into a single urban area. The issue is expected to create several billionaires and as many as 3,000 new millionaires in my neighborhood.

The last time that happened was when Google (GOOG) went public, creating a wealth effect that never went away, taking the waiting list for a new Ferrari or Tesla out two years. Better buy real estate near Facebook?s Menlo Park headquarters, such as in Atherton, Palo Alto, and Mountain View. The bidding wars are about to begin!

If you have any doubts about this analysis, you can take it up with any of my 1,209 Facebook friends by clicking here.

Is Mark a Market Killer?

?People are investing with a rear view mirror. Last year, you had people legitimately scared out of the market. Unfortunately, you are losing a generation of investors at a time when they ?out to be thinking about buying high quality stocks,? said Hersh Cohen of Clearbridge Advisors.

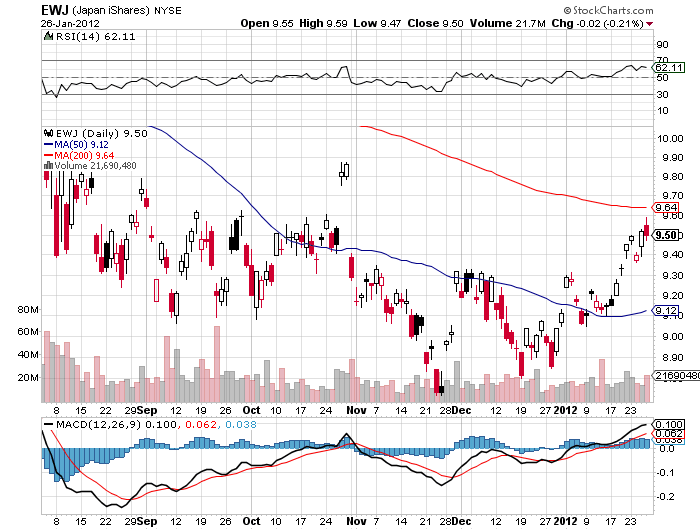

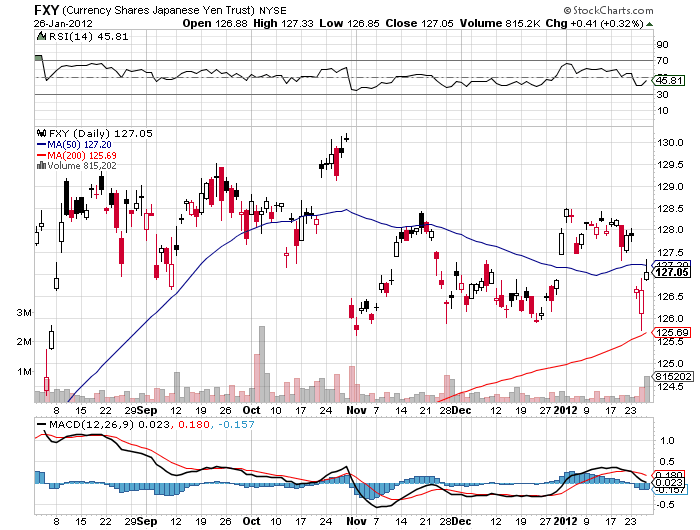

?Oh, how I despise the yen, let me count the ways.? I?m sure Shakespeare would have come up with a line of iambic pentameter similar to this if he were a foreign exchange trader. I firmly believe that a short position in the yen should be at the core of any hedged portfolio for the next decade, but so far every time I have dipped my toe in the water, it has been chopped off by a samurai sword.

I was heartened once again this week when Japan?s Ministry of Finance released data showing that the country suffered its first annual trade deficit since 1980. Specifically, the value of imports exceeded exports by $39 billion. Japan still ran healthy surpluses with the US and Europe. But it ran a gigantic deficit with the Middle East, its primary supplier of energy.

You can blame the March tsunami and the Fukushima nuclear meltdown that followed for much of this. Japan depended on nuclear power for 25% of its electric power generation, and since then the number of operating plants has been cut from 54 to just 5. Conventional plants powered by oil and LNG have had to make up the difference, causing a surge in imports. Crude?s leap from $75/barrel in the fall to $100 made matters worse.

It also hasn?t helped that Japan has offshored much of its low end manufacturing to China over the last 30 years, as America has done. Exacerbating the problem were the Thai floods, which caused immense supply chain problems, further eroding exports.

To remind you why you hate all investments Japanese, I?ll refresh your memory with this short list of the other problems bedeviling the country:

* With the world?s weakest major economy, Japan is certain to be the last country to raise interest rates.

* This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets.

* Japan has the world?s worst demographic outlook that assures its problems will only get worse. They?re not making Japanese any more.

* The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt exceeding 200% of GDP, or 100% when you net out inter-agency crossholdings, Japan is at the top of the hit list.

* The Japanese long bond market, with a yield of 0.98%, is a disaster waiting to happen.

* You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji, if they must, to get the yen down and bail out the country?s beleaguered exporters.

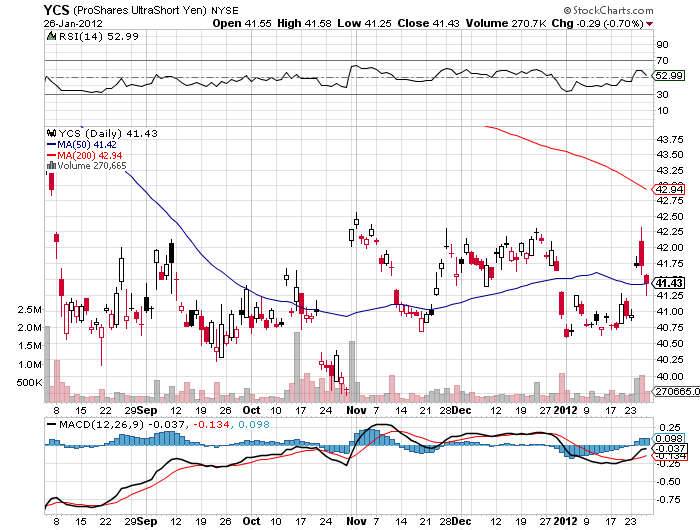

When the big turn inevitably comes, we?re going to ?100, then ?120, then ?150. That could take the price of the leveraged short yen ETF (YCS), which last traded at $41.43, to over $100.? But it might take a few years to get there. The fact that the Japanese government has come on my side with this trade is not any great comfort. Many intervention attempts have so FAR been able to weaken the Japanese currency only for a few nanoseconds.

If you think this is extreme, let me remind you that when I first went to Japan in the early seventies, the yen was trading at ?305, and had just been revalued from the Peace Treaty Dodge line rate of ?360. To me the ?78 I see on my screen today is unbelievable.

Noted hedge fund manager Kyle Bass says he is already in this trade in size. All he needs for it to work is for Japan to run out of domestic savers essential to buy the government?s domestic yen bond issues, who have pitifully had sub 1% yields forced upon them for the past 17 years. Then the yen, the bond market, and the stock market all collapse like a house of cards. Kyle says that could happen as early as the spring.

It?s All Over For the Yen

?The next big story in credit is going to come from Asia and that will be in Japan,? said Tres Knippa of Kenai Capital Management.

Well, they didn?t really say that, but they could have, and perhaps should have, and the bond market wholeheartedly agrees with them. That is my takeaway from the Fed minutes released yesterday indicating that the Federal Reserve intends to extend its hyper accommodative policies for at least another 6-9 months to ?late 2012.? It also lowered its long term economic growth forecast from 2.5%-2.9% down to 2.2%-2.7%, a major downshift from the 3% plus it was predicting a year ago. That also brings them nicely to my own estimate of 2%, which I nailed on the mast over a year ago.

The reasons offered were many. Business fixed investment is slow, inflation is stable, unemployment is declining only slowly, and international risks are substantial. It was enough to create one of those odd trading days where everything went up. The Dow flipped a 100 point loss to a near 100 point gain. Bonds rocketed, with ten year Treasuries dropping 10 basis points in yield, and five year paper utterly collapsing from 0.89% to 0.77%.

The risk markets rallied like this was a new quantitative easing, which it isn?t. Bernanke is just ?thinking? about QE3, which is nothing new. If the economy worsens again, he?ll pull the trigger. If it continues to poke along as it has done, he?ll do nothing.

I have said this countless times before, but I?ll say it again. When the stock and bond markets deliver a contradictory message, you always believe the bond market. It is right 90% of the time. Right now, the stock market is saying that the economy is growing a 4%, while bonds say it is expanding by 2% or less. I?ll go with the later and wait for a great entry point to short more stocks.

Looking forward, I see a coming drought in upside surprises. Tomorrow, we see Q4 US GDP, which should be over a healthy 3%. Next week promises another sizzling nonfarm payroll on Friday. After that, there is nothing on the horizon until we get the final word on Greece, or the next Fed meetings in March and April.

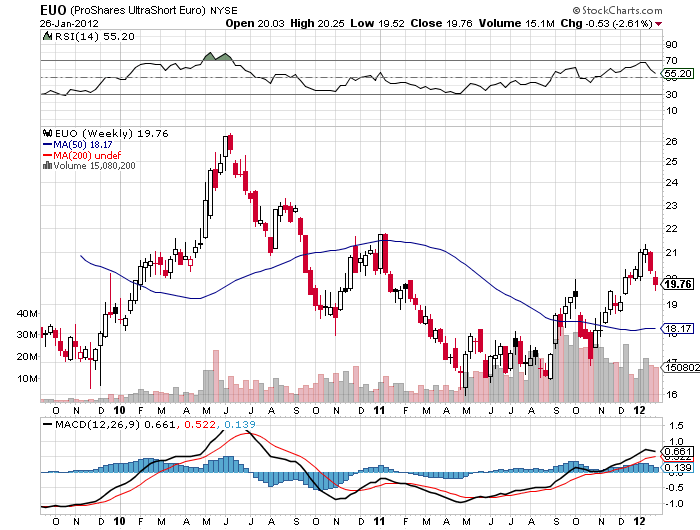

All of this encourages me to hang on to my tiny short positions in the (SPY) and the Euro, even though we are trading close to my stops. Bernanke?s easing yesterday could be the ?buy the rumor, sell the news? event that the market has been rallying on for the last three weeks. If it is, then the downside could be just around the corner.

The Market?s Message Yesterday Was Clear

I am writing this letter at a table in the alcove of the Polo Lounge at the legendary Beverly Hills Hotel. They did not disappoint on the movie star front, with more than an ample supply. At the table on my right, John Hamm, who plays the predatory ad man Don Draper in AMC?s Mad Men, is having a friendly chat with Lorne Michaels, the producer of Saturday Night Live. Jamie Lee Curtis is on my left, apparently lecturing a young family member about some indiscretion. A Desperate Housewife of Beverly Hills is across the room signing autographs. Who says that I don?t like to name drop? Hedda Hopper, eat your heart out.

To get here, I had to negotiate the notorious Los Angeles freeway system, where traffic frequently backs up because of drivers found dead the wheel, the victims of daily road rage incidents. You never use your turn signal here. It only encourages people to speed up to take your space. But cut anyone off, and you risk your life.

The freeways here are more a state of mind that a transportation system, and it brings out the full range of human emotion. ?Drive the Pasadena Freeway and you are experiencing the full force of an action video game set in the 1930's. Make the turn from the 101 to the 110 and you are plunged into a hopeless maze where only the most aggressive rat escapes alive. But turn off from the 10 over the magnificent elliptical overpass to the 405 and you are soaring with the eagles.

The global strategy seminar at Nicks Martini Lounge broke all records for attendance, with many last minute sign ups insuring a packed room. There was much discussion about the longer term outlook for the financial markets, which I viewed with caution for the rest of the year. A recession in Europe and substantial slowdowns in China and India appear to be more than our own feeble and structurally impaired economy can cope with. Whereas last year?s ?sell in May? worked out great, this year January might be a better idea.

The banks will become the major victims of the next melt down, as they have yet to amortize the losses of the last crash, and house prices are still falling. The only distinction is that there will be no TARP, no bail outs, and no stimulus package. A gridlocked congress offers no safety net. Then, the chips really will fall where they may. Residential real estate may fall another 25% and then bump along the bottom for another decade.

This is enough to cause the stock market to plunge 30% from current levels. But it won?t crash to the 2009 low of 666 in the S&P 500 or lower. That means you want to use the next sell off to load the boat once again. For me, a 2% GDP growth rate assures that we will remain trapped in a narrow range for many more years, which you should play for fun and profit.

It looks like Obama can win another election, especially if the large numbers of minorities and young people return to the polls after going missing in action in 2010. Campaigning for his own job will make a huge difference. He should have a win in Libya in his back pocket, and his successful hit against Osama bin Laden has certainly reinforced his anti-terrorism credentials. At the moment, the republican candidates are doing everything they can to assure that the others are unelectable, and Obama is literally singing from the sidelines. However, a democratic win could be offset by the republicans taking both houses of congress, assuring another four years of gridlock and histrionics.

The spanner in the works will be unemployment. With every level of government cutting staff to staunch deficits, and with large companies keeping a death grip on their cash hoards, I don't expect any improvement here. The structural headwinds are so severe, that I doubt we can make it to the 7% handle for the jobless rate. The 25 million jobs we shipped to China are never coming back. Booming companies are doing well because they don?t hire anyone, offshoring new work or replacing workers with technology instead. There is nothing Obama or anyone else can do about this, no matter what they say.

I am planning a rather ambitious lunch schedule for the rest of the year, which you can find on my website. I look forward to seeing the rest of you then. In the meantime, I see that Victoria Secret model, Giselle B?ndchen, who has recently become available, has just appeared at the door. I?ll see you later. Let?s see if she needs some investment advice.

?China has been doing everything right for the last ten years. Our government is made up of 'C' students that were political science majors, whereas, the Chinese government is made up of PhD's that were educated at Cambridge and Harvard,' said one Washington observer.

Newspapers, TV, radio, and the Internet all carried the same headline in San Francisco today: ?Apple Now World?s Largest Company.? That was the response to the company?s Q4 earnings of $13 billion announced yesterday that drove its market capitalization skyward to $415 billion, surpassing ExxonMobile?s (XOM) once again.

What is even more amazing is that its cash position now sits at $97.6 billion, greater than the GDP of all but a handful of countries. In the midst of the current political debate, it is fascinating to note that the greatest capitalist enterprise in history was created by a vegan hippy college dropout from California who took LSD, walked around barefoot, and never took a bath.

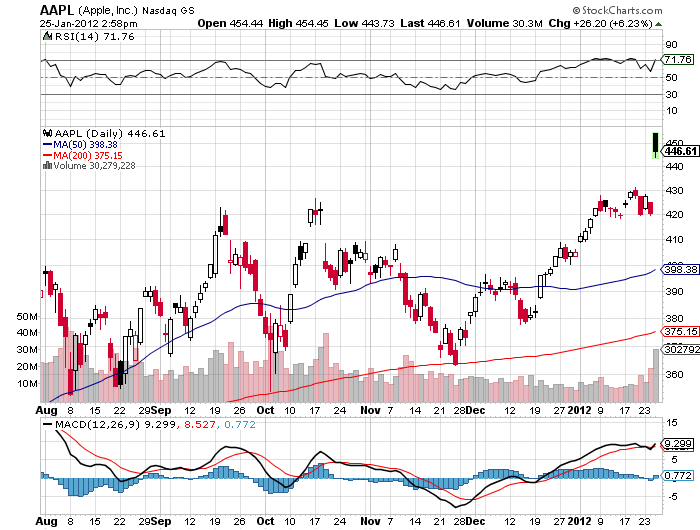

Watching Apple (AAPL) post a new all-time high of $457 today, I was struck by a wave of nostalgia. When I took a young, cocky, long haired, Levis wearing Steve Jobs around to meet Morgan Stanley's institutional investors to pitch an Apple secondary share offering 28 years ago, I vowed never to buy anything from the man. He was such a great salesman, and possessed such a messianic devotion to his product, the risk of getting legged over had to be great.

This proved a good strategy for the next 18 years, when the company nearly went under three times, and the stock repeatedly plunged from its initial listing price of $22 down to $4. Disastrous products like the Lisa came and went, and then poor Steve got fired by a man he hired, John Sculley. Ouch!

Living in the San Francisco Bay Area, I was also creeped out by the fanatical cult following that Steve enjoyed. Criticize an Apple product here, and you risk getting attacked, ostracized, deleted from address books, chopped off Christmas card lists, banned from Facebook pages, and ejected from Twitter accounts. There was also no end of abuse from my IPod, IMac, and Tablet addicted kids who accused me of being a dinosaur sticking with my wheezing and spam infected Windows based PC.

I have to confess now that my prior prejudices led me to miss the boat on Apple for the last decade, when the stock soared 115 times. To see the company sell 37 million IPhones in a single quarter during unstable economic conditions is nothing less than amazing. While Main Streets around America sit empty, the Apple stores are easily identifiable because they are packed like a New York subway car at rush hour.

Forecasts for the global smart phone market are ratcheting up by the day on the back of surging demand from emerging markets. Sales could reach 250 million units annually by 2012, of which 17% currently is sold by Apple. China Mobile, with a staggering 600 million mainland customers, or six times Verizon?s, is now considering adopting the IPhone.

The company has become a monster cash flow generator. Apple now has the envious problem in that sales of several of its products are going hyperbolic at the same time.

Apple announced net profits of $13.06 billion, or $13.87 per share, up 11% from the previous year. If the company just maintains that rate for the rest of the year, it will generate $55.48 in earnings, which at the current 11.5 multiple should take the stock up to $638, up 40%. If Apple makes it up to a market multiple, the stock should rise to $721, a gain from here of 58%.

If the multiple expands to its pre-crash average of 35 X, that would take the stock to a positively nose bleeding $1,941, giving you a 424% return from current levels. Then the company would be worth $2.8 trillion and rank 5th in the world in GDP, more than France, and just behind Germany. Wow!

It all reinforces my view that Apple shares will reach my long term target of $1,000 sooner than anyone thinks. Long term readers are well aware that I have been making this call for the past two years back when it was trading at a lowly $240. More recent subscribers will also recall that I predicted that Apple would be the top performing technology stock in my 2012 Annual Asset Class Review.

I'm not saying that you should rush out and load up on stock today. But it might be worth taking a stake on the next wave of fear that strikes the market.

Analysts continue to be stunned by the rate at which cash is rolling into Apple (AAPL). At current cash flows, the company?s hoard is expected to grow from $96.7 billion to $130 billion by next June, an increase of nearly $220 million a day!

So far, the company has resisted every entreaty to part with some of this dosh, either through a share buyback or a dividend. Now some are speculating that the passing of founder, Steve Jobs, and the succession of new CEO, Tim Cook, could lead to a loosening of the purse strings.

Let?s face it. Apple has had a great, decade long run. Hundreds of my readers, many of them Apple employees, are faced with the enviable problem that, having ridden the stock up from $4 to $457, they have too much of their wealth concentrated in a single asset. That is never a good idea from a risk control point of view. But every time I look for reasons to sell Apple, I find three more reasons to buy it. It?s a case of the grass being greener on my side of the fence.

Let me list just a few avenues for continued meteoric performance:

*As the Apple generation reaches the ranks of senior management, more Fortune 500 companies will begin to support their products. Thousands would love to quit carrying around a Blackberry for business and an incompatible IPhone for personal use, with the associated chargers. (note to self: short (RIMM) on the next rally).

*Despite this torrid growth, the stock trades at 11.5 times earnings a discount to the S&P 500 at 13 times earnings.

*The Apple of today is essentially a spanking brand new, high growth company. The company?s only decrepit product is the IMac. The IPhone is only 5-6 years old, while the Ipad and Ap Store are only 1-2 years old and still in their infancy. The potential near term growth of these products is huge.

*IPhones only have a 5% penetration of the world market. Past market leaders like Nokia (NOK) and Motorola (MOT) have reached market shares well into double digits.

*Apple has just scratched the surface in China, where it only has six official stores (but lots of fake imitators), and is already the premium product. The growth opportunities there are massive. Everyone there wants an IPhone, and they are traveling to Hong Kong to get them. When the Beijing store was unable to open due to the crush of customers waiting to buy the new IPhone 4s, it was pelted with eggs.

*There was always a fear of what would happen to Apple stock after Steve Jobs was gone. That is now behind us. In the wine bars around the company?s futuristic Cupertino, California headquarters at One Infinite Loop, I am hearing that Steve left behind enough new product ideas, improvements, upgrades, and direction to keep Apple forging ahead for another five years. The vast, interlocking, synergistic ecosystem he envisioned is still maturing.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.