Featured Trades: (CHINA), (SHANGHAI), (FXI), ($SSEC)

iShares FTSE/Xinhua China 25 Index ETF

South Korea iShares Index ETF

Thai Capital Fund, Inc.

Singapore iShares ETF

iShares MSCI Turkey Investable Market Index Fund ETF

iShares MSCI Chile Investable Market Index Fund ETF

Brazil iShares ETF

PowerShares India Portfolio ETF

Market Vectors Russia ETF Trust ETF

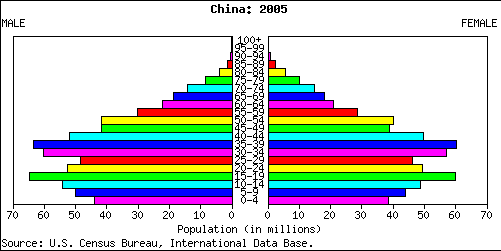

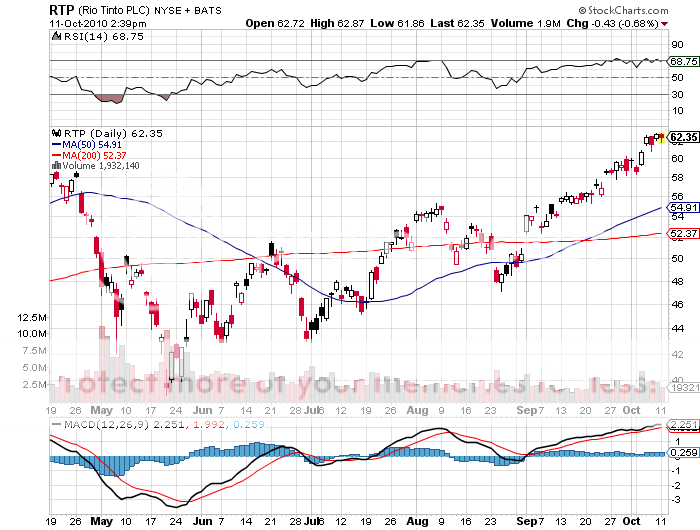

2) Time to Double Up on China. Last week, I posted an extensive piece on my evening with the Chinese Intelligence Service, concluding that it was time to get back into the Middle Kingdom (click here for the piece). It proved to be a timely call, as QEII has since gone global, taking the Shanghai index up 11% since then, the move this week being particularly explosive. Yesterday, we blasted through the 200 day moving average, suggesting that this move may have the legs of Secretariat.

I really like the idea of increasing my weighting in China here. Both the Chinese, and the many trading partners I talk to, tell me that things are going well there, that inflation is under control, and rumors or its imminent demise are premature by at least a decade. Jim Chanos, please widen your circle of contacts.

The recent international action has been predominantly in the second tier emerging markets which I have been aggressively pushing, including Indonesia (IDX), Chile (ECH), Thailand (TF), Singapore (EWS), and South Korea (EWY), while the mainline BRIC's slept. Many of these 'emerging, emerging' markets are now up 50% or more on the year. I can really see cash rotating out of these virile, young sprinters back into the established BRIC long distance runners as a great risk control measure. That way, if you get a sudden risk reversal, and markets can turn on a dime these days, your downside will be much less.

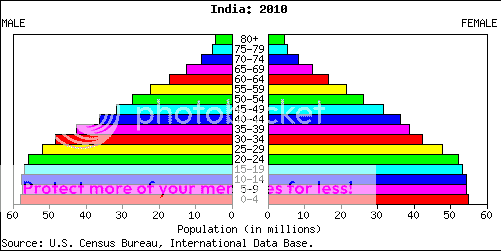

With Ben Bernanke fitting both turbochargers and superchargers to the printing presses in Washington as I write this, I loathe to tell anyone to sell anything, even their Beenie Baby collection. So use any new cash inflows from new and existing clients to add to positions on dips not only China (FXI), but Brazil (EWZ), India (PIN), and Russia (RSX) as well. If you have been following the advice of this letter all year, you should have new cash pouring in through the transome.

No! No! Don't Sell Me!