Due to a number of technical difficulties, many potential new subscribers were denied the opportunity to buy my award winning Trade Alert Service at the old price of $1,997 before the price increase. Among other things, the site crashed a few times because of the sheer volume of people attempting to sign up at once.

Since I highly value loyalty, I am therefore offering this price one last time, this weekend only, to give people a chance to get in. On Monday, the price jumps 50%, right back to the now standard price of $3,000, where it will remain for the rest of this year.

It is an old adage in the investment business that you get what you pay for. My Trade Alert Service was the top performing online mentoring service of 2011. Those who closely followed my 56 trade alerts closely, which I shoot out through email and text messages, earned a 40.17% on the year. If my email traffic is anything to go by, many readers did much better than that.

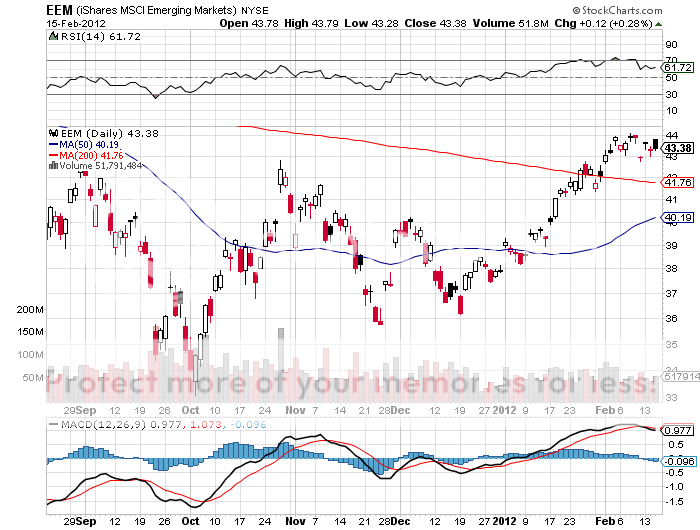

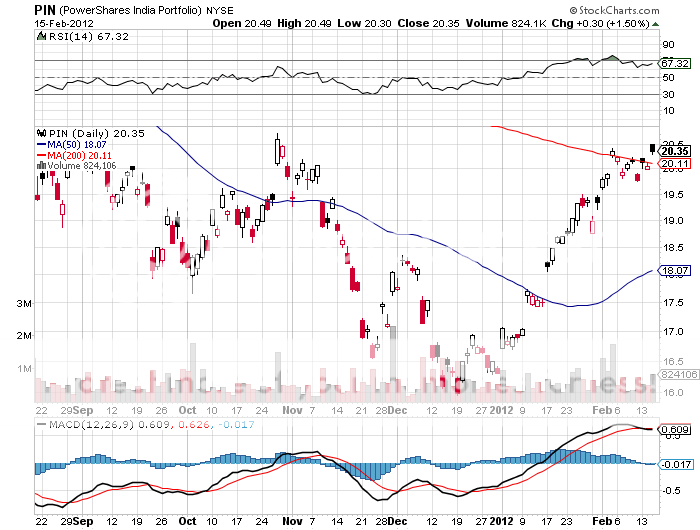

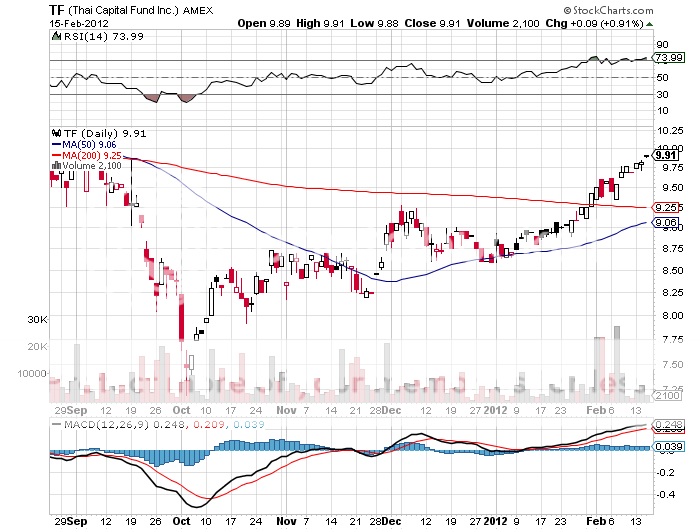

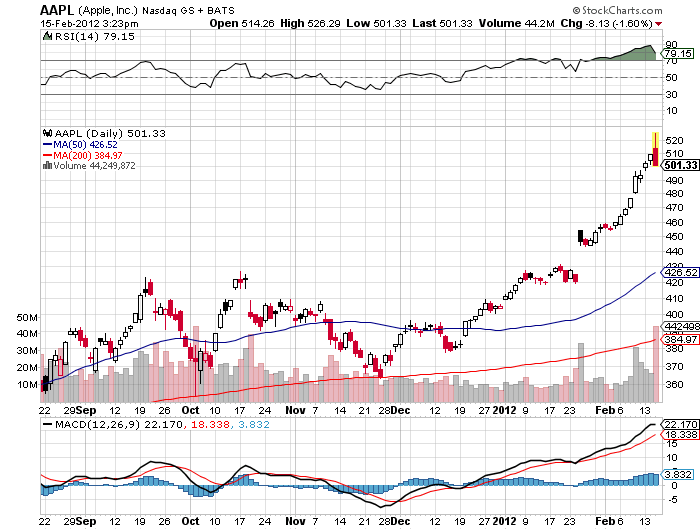

It is looking like 2012 will be just as hot. Check out the returns of my the last few trades that went out over the past three weeks:

Short natural gas - +75%

Short Yen - +64%

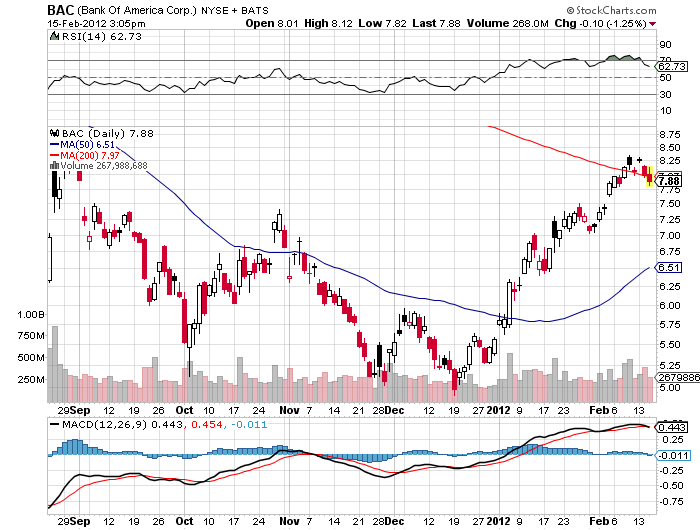

Short Bank of America - +30%

My Global Trading Dispatch is a bundled package of services that includes the Trade Alert Service, a daily newsletter offering 3-4 investment ideas a day, a two million word online data base of trading ideas, a daily profit & loss plus risk analysis of my trading book, interviews with investment heavyweights on Hedge Fund Radio, and live customer support to make sure it all works seamlessly and effortlessly. The research explores long and short opportunities in global stocks, bonds, foreign currencies, commodities, energy, precious metals, and real estate.

To subscribe to the Mad Hedge Fund Trader?s Trade Alert Service, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button at the bottom. I look forward to working with you. And thank you for supporting my research.