As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

The Bank of Japan renewed its membership in the international quantitative easing club last week, announcing that it was substantially expanding its bond repurchases.

Specifically, it will increase them from ?55 trillion to ?65 trillion, a jump equivalent to $830 billion. To understand how big this is, consider that Japan?s GDP is one third the size of the US. That would be the same as the Federal Reserve announcing a repo program with $2.5 trillion here. Imagine what your asset prices would do if that happened.

For good measure, the Japanese also announced an inflation target of 1%, which is entirely wishful thinking for a country that is entering its 23rd year of deflation. It?s like a man on skid row planning on how to spend his prospective lottery winnings.

The government was prompted to action by the 2011 full year GDP figure, which came in at an appalling -0.9%, compared to a robust growth of 4.5% in 2010. The tsunami reconstruction program has fallen woefully behind schedule due to extreme mismanagement and incompetence by the authorities, despite being more than adequately funded. But after watching the Land of the Rising Sun for the last 20 years, I have come to expect incompetence. Slowdowns in Europe and China, plus the Thai floods and the Fukushima nuclear meltdown have provided additional headwinds.

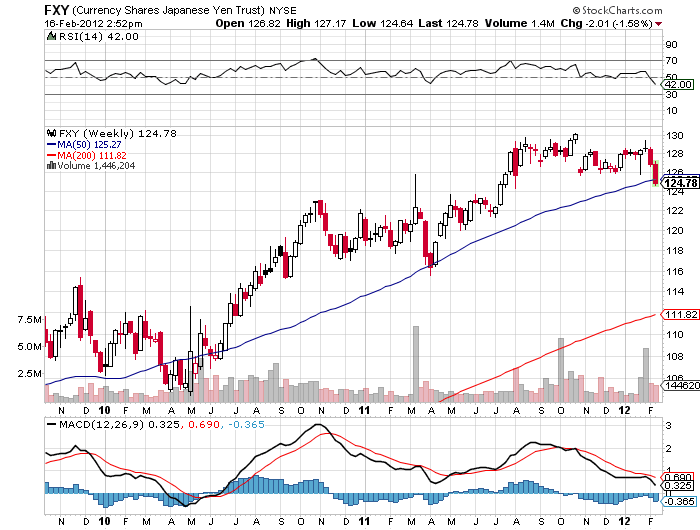

The immediate impact was to trigger a sharp selloff in the yen, delivering an immediate windfall to readers of my Trade Alert Service who were already long yen puts. Traders like myself are always looking for confirming cross market correlations.? You can find one in the movement of the Nikkei stock average, which has been the world?s most despised asset class for the last two decades.

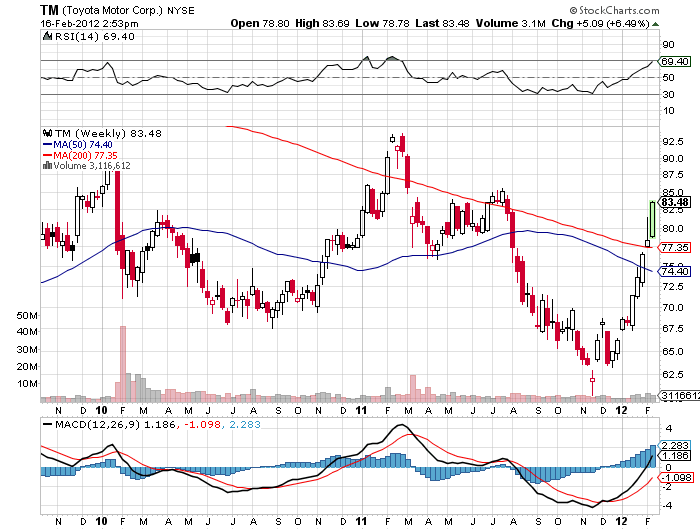

As you can see from the chart below, it is threatening an important multi month breakout to the upside. The reasons for this are simple. A cheaper yen makes Japanese exports more competitive. It also makes the foreign earnings of Japanese multinationals more valuable when translated back into yen. Look no further than the chart of Toyota Motors (TM), which have leapt by a blistering 30% this year.

If you are still unsure about the integrity of the yen collapse, check out the chart for the long dollar basket (UUP). It is setting up for a multiyear head and shoulders breakout to the upside. Uncle Buck has recently taken a steroid shot from the continuing weakness in Europe and the new recession in Japan.

Bottom line: keep selling the yen on rallies, possibly for the next several years.

Those Steroid shots are Definitely Helping Uncle Buck

I never cease to be amazed by the intelligence provided me by the US Defense Department, which after the CIA, has the world?s most impressive and insightful economic research team. There are few places a global strategist like myself can go to get an intelligent, thoughtful forty year views, and this is one.

Of course, they are planning how to commit ever declining resources in future military conflicts. I am just looking for great trading ideas for my readers, which my assorted three star and four star friends have in abundance. I usually have to provide some extra analysis and tweak the data a bit to obtain the precise ticker symbols and entry points, but then that?s what you pay me to do.

An evening with General Douglas Fraser did not disappoint. He is an Air Force? four star who is the commander of US Southern Command (SOUTHCOM), one of nine unified Combatant Commands in the Department of Defense. Its area of responsibility encompasses Central America, South America, and the Caribbean. SOUTHCOM is a joint command comprised of more than 1,200 military and civilian personnel representing the Army, Navy, Air Force, Marine Corps, Coast Guard, and other federal agencies.

The United States is now the second largest Hispanic country in the world, and it will soon become the largest. These industrious people now account for 15% of US GDP, and that figure will grow to 35% by 2050. The Hispanic birthrate in many parts of the US is triple that of any other ethnic group. Because of this, any politicians that pursue anti-immigrant policies are doomed to failure.

Latin America?s GDP is growing at 4% a year, more than double the current US rate. American trade with the region grew by 72% last year, with imports surging an eye popping 112%. It is the source of one third of our foreign energy supplies. It has tremendous wealth in copper, iron ore, and food production that have yet to be exploited. In the last decade, 40 million have risen out of poverty. Yet 13% of the inhabitants earn less than $1 a day.

This poverty has made Latin America fertile ground for the international drug trade, which poses one of the greatest threats to America?s security today.? Profits from the cocaine trade reached $88 billion in 2011, which is more than the GDP of any single Central American country. Some $33 billion worth of this narcotic made it into the US last year. Brazil is the world?s second biggest consumer of cocaine, after the US, with the UK the largest per capita consumer. The farther you move this product from the source, the more expensive it gets. Cocaine costs $2,000 a kilo in Brazil, $40,000 in the US, $80,000 in Europe, and $150,000 in the Middle East.

Technology has made communications, organization and logistics tools once only found in the military available to anyone. This creates a level playing field for international crime organizations of all sorts. The drug business is so profitable that the cartels are now building submarines in the jungles of Columbia at a cost of $4 million each, and sending them under water to the US to make a $100 million profit per voyage.

This illicit wealth is financing the growth of other illegal activities, like money laundering, arms dealing, human trafficking, and even the transportation of exotic animals. This is corrupting the smaller and weaker governments. Key transit point Honduras bas become so violent, with the highest murder rates in the world that the US recently had to withdraw 150 Peace Corps volunteers.

As a result, Fraser has had to modify the mission of SOUTHCOM from a primarily military one to non-traditional crime fighting. His planes are intercepting smugglers at the favored Venezuela-Honduras-US air corridor, as well as craft making it up the Central American west coast.? He is providing military assistance, training, and joint operations where he can, but must balance this with the human rights record in each country.

In additional to his other responsibilities, General Fraser is also keeping close track of China?s rapidly expanding trade relations in the area. They have begun selling inexpensive, low end weapons and military equipment to some of these countries.

The investment opportunities I picked up from General Fraser were legion. It certainly made the ETF?s for Brazil (EWZ), Chile (ECH), and Columbia (GXG) no brainers for a long term portfolio. The Brazilian Real and the Chilean peso are screamers. Copper (CU) and the grains, (CORN), (SOYB), and (WEAT), are probably also good bets.

General Fraser graduated from the Air Force Academy in 1974 and is fluent in Spanish. He has commanded Air Force combat units in Japan, Korea, and Germany. He was later a senior officer in the Space Operations Command. General Fraser joined SOUTHCOM in 2009 after serving as deputy commander of the Pacific Command.

After his briefing, the readers of the Diary of a Mad Hedge Fund Trader who came at my invitation that evening were given the opportunity to ask questions of one of America?s most senior military officers on a one on one basis. In a lighthearted moment, I mentioned to the General that his career total of 2,800 flight hours exceeding my own by only 600 hours. But his rides were vastly more exciting than mine, with most of his time spent in F-16?s and F-15-s, some of the most lethal weapons ever developed.? My log contains an assortment of aircraft that include a lot of more sedentary Cessna?s, a few C-130 Hercules, a P51 Mustang, a De Havilland Tiger Moth, and a few precious hours in a Russian Mig-25 and Mig-29.

Meet my Flight Instructor

?The Fed only knows two speeds; too fast, and too slow,? said Nobel Prize winning economist Milton Friedman to me over lunch one day.

Due to a number of technical difficulties, many potential new subscribers were denied the opportunity to buy my award winning Trade Alert Service at the old price of $1,997 before the price increase. Among other things, the site crashed a few times because of the sheer volume of people attempting to sign up at once.

Since I highly value loyalty, I am therefore offering this price one last time, this weekend only, to give people a chance to get in. On Monday, the price jumps 50%, right back to the now standard price of $3,000, where it will remain for the rest of this year.

It is an old adage in the investment business that you get what you pay for. My Trade Alert Service was the top performing online mentoring service of 2011. Those who closely followed my 56 trade alerts closely, which I shoot out through email and text messages, earned a 40.17% on the year. If my email traffic is anything to go by, many readers did much better than that.

It is looking like 2012 will be just as hot. Check out the returns of my the last few trades that went out over the past three weeks:

Short natural gas - +75%

Short Yen - +64%

Short Bank of America - +30%

My Global Trading Dispatch is a bundled package of services that includes the Trade Alert Service, a daily newsletter offering 3-4 investment ideas a day, a two million word online data base of trading ideas, a daily profit & loss plus risk analysis of my trading book, interviews with investment heavyweights on Hedge Fund Radio, and live customer support to make sure it all works seamlessly and effortlessly. The research explores long and short opportunities in global stocks, bonds, foreign currencies, commodities, energy, precious metals, and real estate.

To subscribe to the Mad Hedge Fund Trader?s Trade Alert Service, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button at the bottom. I look forward to working with you. And thank you for supporting my research.

I managed to catch a few comments in the distinct northern accent of Jim O'Neil, the fabled analyst who invented the 'BRIC' term, and who has been kicked upstairs to the chairman's seat at Goldman Sachs International (GS) in London.

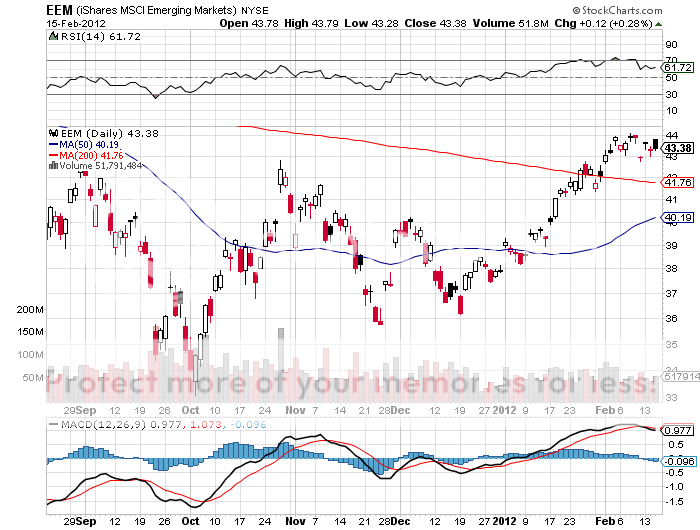

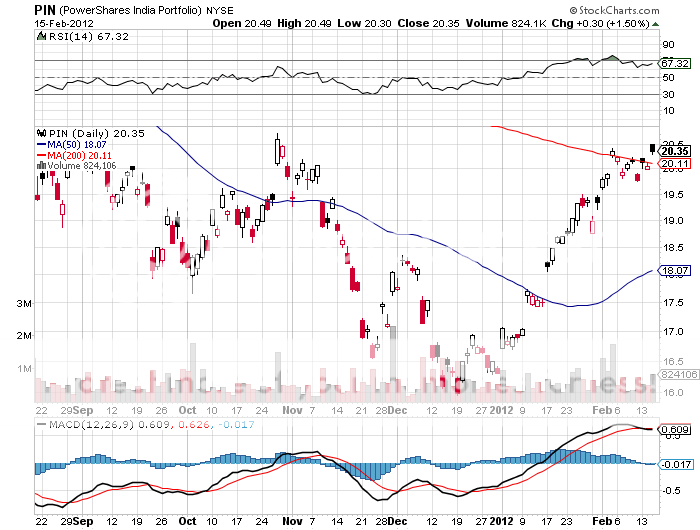

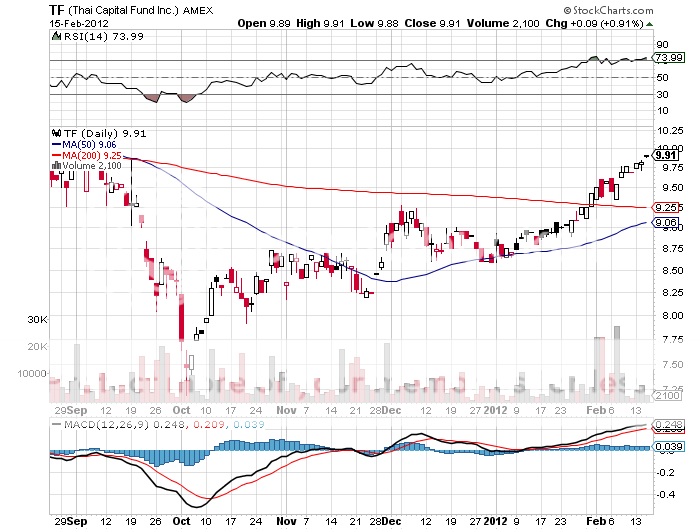

Jim thinks that it is still the early days for the space, and that these countries have another ten years of high growth ahead of them. As I have been pushing emerging markets since the inception of this letter in 2008, this is music to my ears. By 2018 the combined GDP of the BRIC's; Brazil (EWZ), Russia (RSX), India (PIN), and China (FXI), will match that of the US. China alone will reach two thirds of the American figure for gross domestic product. All that requires is for China to maintain a virile 8% annual growth rate for eight more years, while the US plods along at an arthritic 2% rate. China's most recent quarterly growth rate came in at a blistering 8%.

?BRIC? almost became the 'RIC' when O'Neil was formulating his strategy a decade ago. Conservative Brazilian businessmen were convinced that the new elected Luiz Ignacio Lula da Silva would wreck the country with his socialist ways. He ignored them and Brazil became the top performing market of the G-20 since 2000. An independent central bank that adopted a strategy of inflation targeting was transformative.

This is not to say that you should rush out and load up on emerging markets tomorrow. The entire asset class is still digesting its grim performance in 2011, which saw the average BRIC stock market fall 20%, and there may be some work to do here. American big cap stocks are the flavor of the day, and as long as this is the case, emerging markets will continue to blend in with the wall paper. Still, with growth rates triple or quadruple our own, they will not stay ?resting? for long.

I was saddened to hear of the death of my close friend, the Australian, Murray Sayle, after a long battle with Parkinson's disease at the age of 84.

Murray was one of the giants of journalism in the second half of the 20th century. He started by editing the newspaper at University of Sydney, where his incendiary opinions got him expelled from school. It seems there was a problem with his suggestion to erect a statue of Priapus at the administration building honoring the chancellor, but only at the back door. He moved on to London's Fleet Street in 1952, arriving as a wet behind the ears, but sassy colonial, and landed a job with a small paper named The People. This was when the media was then dominated by giant daily broadsheets. He went on to become the quintessential war correspondent, reporting for the London Times, known in the trade as the ?Thunderer?, because the building shook when its giant presses ran.

I first met Murray in 1975 at a Mensa meeting in Tokyo where I was presenting a paper on the chemical structure and properties of tetrahydrocanabinol. Murray was on the hunt for a story, as always. He was cooling off after a decade of dodging bullets, bombs, shrapnel, and napalm covering the war in Vietnam. Murray once told me that since his writings were often perceived as antiwar, it was a tossup who would shoot him first, the Vietcong or the Americans. Murray told me that the Foreign Correspondents' Club of Japan had one of the best English language libraries in the country, and that he would be happy to sponsor me for membership; thus inadvertently, launching me on a career in journalism.

Murray moved into a converted 19th century silk worm grower's farm house in a small mountain hamlet three hours outside of Tokyo with his wife Jenny, his tireless and loyal supporter. There, they raised three children who went through the local Japanese school system, soldiering on in their 19th century black German cadet uniforms as the only white kids in the district, emerging as flawless interpreters. I often made the long and arduous trip to Aikawa-cho (?Love River?) on weekends, spending long nights over endless flasks of hot sake listening to Murray drunkenly quote extended passages verbatim from Rudyard Kipling. We passionately debated the issues of the day until we fell asleep at the kotatsu. If I learned nothing else, it was that there is always another way to look at any issue. As I had the tendency to always turn up with a different Japanese girlfriend, his pet name for me became 'Randy'.

Over a career that spanned nearly 70 years, Murray scored countless interviews with notoriously difficult to reach figures, like Ch? Guevara and Yassir Arafat. He managed to nail defecting British spy, Kim Philby, by staking out the one newspaper stand in Moscow that sold the Financial Times. Murray would regale me with tales of Ugandan dictator 'Big Daddy' Idi Amin, who stored the severed head of his wife's former lover in his refrigerator. Murray won numerous awards for his Vietnam coverage and for his description of the barbarous downing of a Korean Airlines flight 007 off the coast of Japan by a Russian fighter in 1983, which killed 269 helpless civilians.

Just before he died, the university that shamefully ejected him 65 years earlier, made amends by awarding him an honorary doctorate. The wit, candor, and insight of this larger than life figure will be sorely missed.

?A central bank is best that governs least, but is prepared to govern radically when called upon,? said 19th century man of letters, Walter Bagehot, an early editor of The Economist

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.