While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 26, 2014

Fiat Lux

Featured Trade:

(AUGUST 27 GLOBAL STRATEGY WEBINAR),

(WHY I?M COVERING SOME EURO SHORTS),

(FXE), (EUO),

(THAT WAS SOME SHAKER!)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

We have snatched 92% of the potential profit in the Currency Shares Euro Trust (FXE) September, 2014 $133-$135 in-the-money bear put spread, riding the Euro (FXE) down on the short side, from $1.33 down to $1.30.

The risk/reward of continuing with such a large position is no longer justified.

So I am going to reduce my overweight position down from 20% back to a more normal 10%. If you are similarly overweight the ProShares Ultra Short Euro ETF (EUO), I would also be lightening up, retuning to a normal weighting there as well.

I have not suddenly fallen in love with the beleaguered continental currency. I think we are headed towards $1.27, $1.20, and eventually $1.00. This is just a short-term tactical move.

That way, if by some miracle, we get a two-cent rally in the Euro, I will have plenty of dry powder to reload with and add more shorts.

The big event of the weekend was European Central Bank President, Mario Draghi, ramping up his war on his own currency.

On Friday evening, after the markets closed and traders were long gone for the Hamptons, Bal Harbor, or Napa Valley (oops), Draghi ramped up his rhetoric, warning that he would use ?all available tools? to spur Europe?s economy. This is central banker talk for throwing down the gauntlet at the feet of the monetary hawks (read Germans).

He then threw the fat on the fire, opining that the recent decline an inflation expectations were a concern, and this was a topic for the coming September 4 ECB meeting. Translation: this is a central banker?s equivalent to giving the hawks the middle finger salute, and then putting the pedal to the metal on the easing front.

The bottom line for all of this is that the ECB is almost certain to cut Euro interest rates next week. As interest rates differentials are the primary driver of foreign exchange markets, this is great news for the greenback and terrible news for the Euro.

After that, we may get a small rally in the Euro, as short sellers, like me, take profits. This has been the pattern with other Euro interest rates reductions in the past. That is the rally I want to resell into.

You can expect this pattern to continue until Europe solves its structural monetary problems, which will take years. The current flawed system dramatically undervalues Germany?s currency, while overvaluing the currencies of Italy, Spain, Portugal, and Greece.

This is why the German economy is healthy, while everyone else?s economies suck. Without the Euro, the old deutschmark would be double or triple what it was, demolishing the country?s massive export business. In the meantime, the other countries would be devaluing their own currencies like crazy.

We caught the entire reaction to Draghi?s verbiage at this morning?s opening, with the Euro gapping down a full half-cent against the dollar. The stop loss selling was severe.

I wish all my trades were this easy. Since I doubled up on the short side, the Euro has been in a complete free fall. European dithering has been one of the lowest risk bets of 2014.

That said, I think I?ll get back to cleaning up my earthquake damage.

Wow! There is nothing like being tossed out of bed at 3:20 AM by a massive earthquake! It really gets the juices flowing. I was really praying that the wooden roof creaking and groaning above was not about to land on my head.

After hurriedly getting dressed, I grabbed a flashlight and ran downstairs to check the gas lines and water mains. So far, so good. Compliant with state law, my water heaters are strapped to the wall, so they were OK.

It looks like I escaped the biggest earthquake in Northern California in 25 years with a mere six foot long horizontal crack in the stucco on my home.

The earthquake was devastating for the wine industry, where owners today are mopping up the wine spilled from millions of smashed bottles. Some 200 buildings have been ?red tagged?, cited by city inspectors as unsafe for habitation.

Every road going into and out of Napa buckled, or was cut in half by giant cracks. Some unlucky drivers drove right into the buckles in the darkness, totaling their cars.

There were more than 90 water main breaks and 50 gas lines sheared, which meant that fire engines had insufficient water to fight fires. The unfortunate residents of one mobile home park saw their residences burn down almost immediately.

I spent the day next to my cell phone, waiting for notice of an emergency call up as a rescue pilot. When the ?big one? comes, I am set up to fly into devastated areas to transfer patients to other hospitals.

But the call fortunately never came. Napa?s Queen of the Valley Medical Center was able to handle the 200 injuries that arrived, mostly from flying glass.

We all knocked on wood that the damage had not been greater. If the earthquake had happened just eight hours later, the sidewalks packed with thousands of peak season tourists would have been showered with glass. Decades of retrofitting bridges at enormous expense paid off, as all passed inspection nicely.

One interesting wrinkle was that the University of California at Berkeley?s earthquake warning system worked, giving a ten second heads up, at least to those who were awake at 3:20 AM. Expect to hear a lot more about this in the future.

Many thanks for the emails I received from around the world voicing concern for my safety. It takes more than a lousy 6.0 earthquake to do in this trader in.

We are all keeping our fingers crossed that this is not the prelude to a much bigger quake, which sometimes happens.

Hey, why have waves suddenly appeared in my coffee cup...?

![Crack in Stucco]() The Price of Living in the Golden State

The Price of Living in the Golden State

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 25, 2014

Fiat Lux

Featured Trade:

(MY END 2014 STOCK MARKET FORECAST), (SPY),

(ALL I WANT TO DO IS RETIRE),

(TAKE A LOOK AT OCCIDENTAL PETROLEUM),

(OXY), (BP), (OIL), (UNG),? (NSANY), (XOM)

SPDR S&P 500 (SPY)

Occidental Petroleum Corporation (OXY)

BP plc (BP)

iPath S&P GSCI Crude Oil TR ETN (OIL)

United States Natural Gas (UNG)

Nissan Motor Co. Ltd. (NSANY)

Exxon Mobil Corporation (XOM)

If anyone had any doubts about the future direction of stocks this year, you better take a look at the chart below for the S&P 500.

It shows a very convincing trend upward at almost a perfect 45-degree angle going back for the past year. The range is 100 points wide. It?s almost as if an architect drew it with drafting tools.

To take maximum advantage of this trend, you have to buy every 80 dip, as the floor is constantly rising. It?s as simple as that. Think of Trading 101 for Dummies.

We have had a host of challenges that threatened to knock us out of this channel for the past year.

A second Cold War with Russia? Wake me up when it?s over.

The ongoing collapse of Iraq? Snore?

The suspension of oil exports from Libya barely elicited a blip on your screen, as did the horrific civil war in Syria, a replay of the Middle Ages.

China slowdown? Pshaw! ?Sell in May and Go Away?? Cancelled!

Subpar American economic growth? No problemo.

All of these problems the market has weathered nicely, much like a wet dog shakes off water.

In fact, it has been three years since we endured the distress of a 10% correction, the self-inflicted wound triggered by the government?s hand wringing debt ceiling crisis.

In the end, it amounted to nothing, and was the last decent buying opportunity traders have seen. It has all be one giant ?chase? for performance and reach for yield since then.

The lesson of all of this is that what counts is the good old USA. That is what really is driving markets. All of those foreign distractions are just so much noise. At the end of the day, only the health of the American economy is what matters.

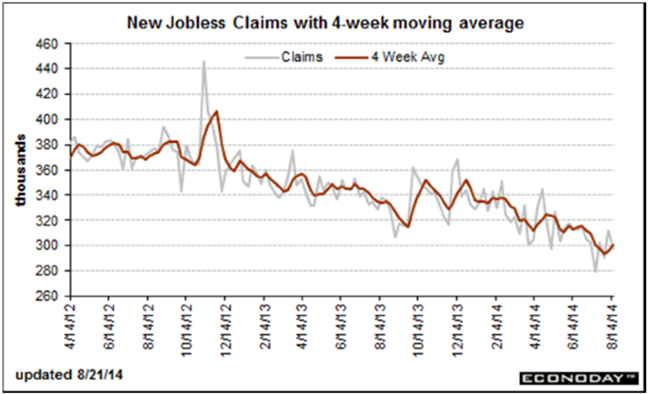

That?s all great news, because our economy is looking pretty darn muscular. Just last week, we saw the Markit August Purchasing Managers Index rocket from 55.8 to 58.0. Weekly jobless claims, the most accurate predictor of true business activity in this cycle, is plumbing seven-year lows. Housing data has just engineered a dramatic turnaround.

It gets better. The upshot of last week?s gathering of Federal Reserve officials at Jackson Hole, Wyoming is that ?normalization? is the new word du jour. What does this mean to us plebeians?

That the economy is so healthy that the government is actually thinking of raising interest rates sometime in the far future, possibly at the end of 2015, and then only by a little bit. That would bring to an end eight years of zero interest rate policy.

Until then, you have a government issued license to print free money. Buy the dips and sell the rallies, and work the 100-point range. If we continue ascending as we have done, the (SPX) should reach 2,100 by December, which happens to be my long held yearend target.

My bet is this could run all the way until April, when the next round of seasonal weakness kicks in again. If there is a risk of anything, it is that the buyers start to panic over missing the move and the (SPY) melts up, possibly as high as 2,200 by January, and 2,300 by March.

Of course, it?s always useful to engage in what my role model, Albert Einstein, called ?thought experiments? and consider what might cause the wheels to fall off of the bull market. To consider that in depth, please read ?What Could Derail the Coming Golden Age? by clicking here.

So what individual sectors should you focus on now? I hate to sound redundant and repetitive. As you may have noticed, ?boring? is not in my DNA (sending Trade Alerts on my iPhone while hanging by ropes from a cliff in the Swiss Alps during a ferocious storm?).

However, I?ll hark back to my favorite three legs for the economy, technology, energy, and health care. Biotechnology continues to sizzle, as do the car companies. And if bonds are peaking, as I believe, the entire financial sector is a screaming buy here.

One unknown is how the markets will take the Alibaba IPO in September, with an expected $150-$200 billion valuation, the largest in history. If institutions have to unload their existing holdings to make room for the new issues, it could trigger our next 4% correction. If that happens, buy the dip with both hands.

By the way, now that the summer is ending, subscription renewals are coming, so don?t forget to ?re-up? if you want to continue with your 41% average annualized returns.

Hey, the house is starting to shake. I think it?s an earthquake, a big one. Better get this out before the broadband goes down?

Uncle Sam is Looking Pretty Muscular These Days

Uncle Sam is Looking Pretty Muscular These Days

There are a lot of belles at the ball, but you can?t dance with all of them.

While a student at UCLA in the early seventies, I took a World Politics course, which required me to pick a country, analyze its economy, and make recommendations for its economic development. I chose Algeria, a country where I had spent the summer of 1968 caravanning among the Bedouins, crawling out of the desert half starved, lice ridden, and half dead.

I concluded that the North African country should immediately nationalize the oil industry, and raise prices from $3/barrel to $10.? I knew that Los Angeles based Occidental Petroleum (OXY) was interested in exploring for oil there, so I sent my paper to the company for review. They called the next day and invited me to their imposing downtown headquarters, then the tallest building in Los Angeles.

I was ushered into the office of Dr. Armand Hammer, one of the great independent oil moguls of the day, a larger than life figure who owned a spectacular impressionist art collection, and who confidently displayed a priceless Faberg? egg on his desk. He said he was impressed with my paper, and then spent two hours grilling me.

Why should oil prices go up? Who did I know there? What did I see? What was the state of their infrastructure? Roads? Bridges? Rail lines? Did I see any oil derricks? Did I see any Russians? I told him everything I knew, including the two weeks in an Algiers jail for taking pictures in the wrong places. His parting advice was to never take my eye off the oil industry, as it is the driver of everything else. I have followed that advice ever since.

When I went back to UCLA, I told a CIA friend of mine that I had just spent the afternoon with the eminent doctor (Marsha, call me!). She told me that he had been a close advisor of Vladimir Lenin after the Russian Revolution, had been a double agent for the Soviets ever since, that the FBI had known this all along, and was currently funneling illegal campaign donations to President Richard Nixon. Shocked, I kicked myself for going into an interview so ill prepared, and had missed a golden opportunity to ask some great questions. I never made that mistake again.

Some 40 years later, while trolling the markets for great buying opportunities set up by the BP oil spill, I stumbled across (OXY) once more (click here for their site). (OXY) has a minimal offshore presence, nothing in deep water, and huge operations in the Middle East and South America. It was the first US oil company to go back into Libya when the sanctions were lifted in 2005. (OXY?s) substantial California production is expected to leap to 45% to 200,000 barrels a day over the next four years. Its horizontal multistage fracturing technology will enable it to dominate California shale. The company has raised its dividend for the tenth year in a row, by 15% to 1.56%. Need I say more?

The clear message that came out of the BP oil spill is that onshore energy resources are now more valuable than offshore ones. I decided to add it to my model portfolio. Energy is one of a tiny handful of industries I am willing to put my money in these days (technology, industrials, and health care are the others).

Oh, and I got an A+ on the paper, and the following year Algeria raised the price of oil to $12.

A Faberge Egg

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.