While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 19, 2014

Fiat Lux

Featured Trade:

(THE DEATH OF GOLD),

(GLD), (ABX), (GDX),

(THE STRUCTURAL BEAR CASE FOR TREASURY BONDS),

(TLT), (TBT)

SPDR Gold Shares (GLD)

Barrick Gold Corporation (ABX)

Market Vectors Gold Miners ETF (GDX)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

If you want to delve into the case against the long-term future of US Treasury bonds in all their darkness, consider these arguments.

The US has not had a history of excessive debt since the Revolutionary War, except during WWII, when it briefly exceeded 100% of GDP.

That abruptly changed in 2001, when George W. Bush took office. In short order, the new president implemented massive tax cuts, provided expanded Medicare benefits for seniors, and launched two wars, causing budget deficits to explode at the fastest rate in history.

To accomplish this, strict ?pay as you go? rules enforced by the previous Clinton administration were scrapped. The net net was to double the national debt to $10.5 trillion in a mere eight years.

Another $6.5 trillion in Keynesian reflationary deficit spending by President Obama since then has taken matters from bad to worse. The Congressional Budget Office is now forecasting that, with the current spending trajectory and the 2010 tax compromise, total debt will reach $23 trillion by 2020, or some 130% of today?s GDP, 1.6 times the WWII peak.

By then, the Treasury will have to pay a staggering $5 trillion a year just to roll over maturing debt. What?s more, these figures greatly understate the severity of the problem.

They do not include another $9 trillion in debts guaranteed by the federal government, such as bonds issued by home mortgage providers, Fannie Mae and Freddie Mac. State and local governments owe another $3 trillion. Double interest rates, a certainty if wages finally start to rise and our debt service burden doubles as well.

It is unlikely that the warring parties in Congress will kiss and make up anytime soon, especially if we continue with a gridlocked congress after the November midterm elections. It is therefore likely that the capital markets will emerge as the sole source of any fiscal discipline, with the return of the ?bond vigilantes? to US shores after their prolonged sojourn in Europe. If you don?t believe me, just look at how bond owners have fared this week. Ouch!

Since foreign investors hold 50% of our debt, policy responses will not be dictated by the US, but by the Mandarins in Beijing and Tokyo. They could enforce a cut back in defense spending from the current annual $700 billion by simply refusing to buy anymore of our bonds.

The outcome will permanently lower standards of living for middle class Americans and reduce our influence on the global stage.

But don?t get mad about our national debt debacle, get even. Make a killing profiting from the coming collapse of the US Treasury market through buying the leveraged short Treasury bond ETF, the (TBT). Just pick your entry point carefully so you don?t get shaken out in a correction.

Looks Like I Can?t Afford the Next War

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 18, 2014

Fiat Lux

Featured Trade:

(SHE SPEAKS!),

(SPY), (FXE), (EUO), (FXY), (YCS), (GLD), (SLV), (TLT), (TBT),

(THE RECEPTION THAT THE STARS FELL UPON)

SPDR S&P 500 ETF (SPY)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

Like a deer frozen in a car?s onrushing headlights, markets have been comatose awaiting Federal Reserve governor Janet Yellen?s decision on monetary policy and interest rates.

Interest rates are unchanged. Quantitative easing gets cut by $15 billion next month, and then goes to zero. Most importantly the key ?considerable period? language stayed in the FOMC statements, meaning that interest rates are staying lower for longer.

Personally, I don?t think she?s raising interest rates until 2016. The number of dissenters increased from one to two, but then both of them (Fisher and Plosser) are lame ducks. And, oh yes, the composition of the 2015 Fed will be the most dovish in history.

The latest data points made this a no brainer, what with the August nonfarm payroll coming in at a weak 142,000, and this morning?s CPI plunging to a deflationary -0.20% for the first time since the crash.

Of course, you already knew all of this if you have been reading the Mad Hedge Fund Trader. You knew it three months ago, six months ago, and even a year ago, before Janet Yellen was appointed as America?s chief central banker. Such is the benefit of lunching with her for five years while she was president of the San Francisco Fed.

The markets reacted predictably, with the Euro (FXE), (EUO), and the yen (FXY), (YCS) hitting new multiyear lows, Treasury bonds (TLT), (TBT) breaking down, and precious metals (GLD), (SLV) taking it on the kisser.

What Janet did not do was give us an entry point for an equity Trade Alert (SPY), with the indexes close to unchanged on the day. The high frequency trader?s front ran the entire move yesterday.

Virtually all asset classes are now sitting at the end of extreme moves, up for the dollar (UUP) and stocks, and down for the euro, yen, gold, silver, the ags, bonds and oil. It?s not a good place to dabble.

Putting on a trade here is a coin toss. And when you?re up 30.36% on the year, you don?t do coin tosses. At this time of the year, protecting gains is more important than chasing marginal gains, which people probably won?t believe anyway.

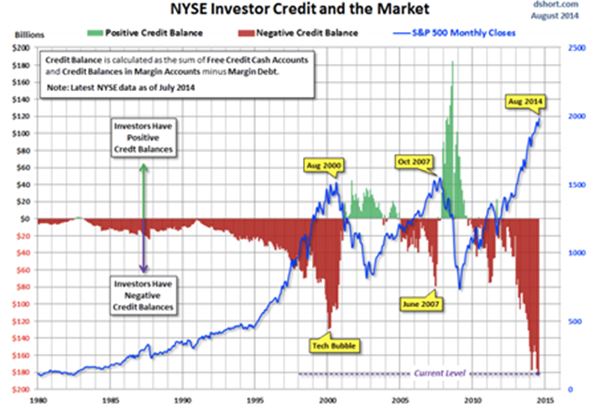

If you want to understand my uncharacteristic cautiousness, take a look at the chart below sent by a hedge fund buddy of mine. It shows that investor credit at all time highs are pushing to nosebleed altitudes. Not good, not good. Oops! Did somebody just say ?Flash Crash??

This is not to say that I?m bearish, I?m just looking for a better entry point, especially as the Q????????? 3 quarter end looms. I?ve gotten spoiled this year. Maybe the Scottish election results, the Alibaba IPO, or the midterm congressional elections will give us one. Buying here at a new all time high doesn?t qualify.

It?s time to maintain your discipline.

Sorry, no more pearls of wisdom today. I?ve come down with the flu.

Apparently, this year?s flu shot doesn?t cover the virulent Portland, Oregon variety. Was it the designer coffee that did it, the vintage clothes, or those giant doughnuts dripping with sugar?

Back to the aspirin, the antibiotics, the vitamin ?C?, and a chant taught to me by a Cherokee medicine man.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 17, 2014

Fiat Lux

Featured Trade:

(THURSDAY OCTOBER 9 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON),

(WHY I HAVE NO POSITIONS),

(TLT), (TBT), (AAPL), (XLE), (XLV),

?(IBB), (BIDU), (FXE), (FXY), (YCS),

(TAKING A BITE OUT OF STEALTH INFLATION), (SGG), (WEAT)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

Apple Inc. (AAPL)

Energy Select Sector SPDR ETF (XLE)

Health Care Select Sector SPDR ETF (XLV)

iShares Nasdaq Biotechnology (IBB)

Baidu, Inc. (BIDU)

CurrencyShares Euro ETF (FXE)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

iPath DJ-UBS Sugar SubTR ETN (SGG)

Teucrium Wheat ETF (WEAT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.