While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 29, 2018

Fiat Lux

Featured Trade:

(IS IT ALL OVER FOR ARTIFICIAL INTELLIGENCE?),

(GOOGL), (TSLA), (NVDA), (LRCX), (AMD), (BOTZ),

(CHINA'S COMING DEMOGRAPHIC NIGHTMARE)

Take a look at the worst performing stocks of the past two weeks and they all have one theme in common: artificial intelligence.

You can trace the beginning of the move back to the Arizona crash by an Uber AI autonomous driven car that killed a pedestrian.

As all those who have studied chaos theory in mathematics, it's like the proverbial butterfly that flapped its wings in a Brazilian rain forest, which then triggered a typhoon in Japan.

Never mind that the pedestrian was jaywalking at night wearing dark clothes. AI is supposed to see this. My guess is that only a sensor failure could have caused the accident, a dud $5 part, which means it has nothing to do with AI.

This is the second autonomous driving death in three years. The last one, involving a Tesla Model S-1 in Florida, didn't see the back of a white truck while driving into the sun, and crashed into it, killing the driver.

And here is the problem if you are a trader or investor.

Autonomous driving has been a major theme in the entire tech sector for the past two years.

You can start with the car companies, Tesla (TSLA), Uber, and Google's (GOOGL) Waymo, and extend all the way out through the entire ecosystem.

That would include the chip makers, NVIDIA (NVDA), which is suspending its autonomous program, Intel (INTC), Advanced Micro Devices (AMD), and the chip equipment maker Lam Research (LRCX).

So, is it game over for these companies? Is it time to pick up our marbles and play elsewhere (there is nowhere else)?

I don't think so.

Let's look at the hard numbers involving automobile accidents. During the same three-year period that AI cars killed two people, human drivers killed a staggering 100,000, and left millions with injuries.

So there is absolutely no doubt that AI is the superior technology. AI-driven cars don't text while driving, drink, take drugs, drive while tired, overdo it with an afternoon of wine tasting in Napa Valley, or look down at their cell phones, as did the safety driver in the ill-fated Uber car in Phoenix.

AI is not just a self-driving car theme. It is permeating every aspect of the modern economy and will continue to do so at an accelerating pace. It is no one-hit wonder.

All that is happening now is that AI and tech stocks in general are backing off from grievously overbought conditions.

As we approach the next round of earnings reports in a month, the market focus rapidly will shift back from tedious and distressful technicals. That's when they will rocket again.

There is an old market term for the current state of technology stocks. It is known as a "Buying Opportunity."

I haven't been able to touch stocks I love for months because they were completing upward moves of 50% to 300% over the past two years.

They have just become touchable once again.

To watch the video of the Phoenix crash and the expression of the clueless safety driver, please click here.

Thanks to China's "one child only" policy adopted 30 years ago, and a cultural preference for children who grow up to become family safety nets, there are now 32 million more boys under the age of 20 than there are girls.

Large-scale interference with the natural male:female ratio has been tracked with some fascination by demographers for years and is constantly generating unintended consequences.

Until early in the last century, starving rural mothers abandoned unwanted female newborns in the hills to be taken away by "spirits."

Today, pregnant women resort to the modern day equivalent by getting ultrasounds and undergoing abortions when they learn they are carrying girls.

Millions of children are "little emperors," spoiled male-only children who have been raised to expect the world to revolve around them.

The resulting shortage of women has led to an epidemic of "bride kidnapping" in surrounding countries. Stealing of male children is widespread in Vietnam, Cambodia, Laos, and Mongolia.

The end result has been a barbell-shaped demographic curve unlike that seen in any other country.

The Beijing government says the program has succeeded in bringing the fertility rate from 3.0 down to 1.8, well below the 2.1 replacement rate.

As a result, the Middle Kingdom's population today is only 1.2 billion instead of the 1.6 billion it would have been.

Political scientists have long speculated that an excess of young men would lead to more bellicose foreign policies by the Middle Kingdom.

But so far the choice has been for commerce, to the detriment of America's trade balance and Internet security.

In practice, the one-child policy was only applied to those who live in cities or had government jobs. That is about two thirds of the population.

On my last trip to China I spent a weekend walking around Shenzhen city parks. The locals doted over their single children, while visitors from the countryside played games with their three, four, or five children. The contrast couldn't have been more bizarre.

Economists now wonder if the practice also will understate China's long-term growth rate. Parents with boys tend to be bigger savers, so they can help sons with the initial big-ticket items in life, such as an education, homes, and even cars.

The endgame for this policy has to be the Japan disease; a huge population of senior citizens with insufficient numbers of young workers to support them. The markets won't ignore this.

In the latest round of reforms announced by the Chinese government was the demise of the one-child policy.

But no matter how hard you try, you can't change the number of people born 30 years ago.

The boomerang effects of this policy could last for centuries.

Mad Hedge Technology Letter

March 29, 2018

Fiat Lux

Featured Trade:

(TECHNOLOGY'S UPSIDE IN THE TRADE WAR)

(RHT), (DBX), (SPOTIFY)

After watching the performance of technology stocks over the past two weeks, you may be on the verge of slitting your wrist, overdosing on drugs, and then jumping off the Golden Gate Bridge.

However, the results reported by tech companies this week say you should be doing otherwise.

As tech companies confront upcoming regulation and an overseas trade war, it has felt like a death by a thousand cuts.

It almost is starting to feel as if being a technology company is akin to drinking from a poisoned chalice.

I beg to differ.

I will tell you why the destiny of tech is quite positive.

The long-term secular growth drivers will prevail of accelerated earnings amid a backdrop of global economic synchronized expansion.

Assiduous capital reallocation programs will attract investors instead of detract from them.

The ironic angle to the precarious diplomatic tumult is that regulation will ultimately benefit the current pacesetters and culprits of technology because the barriers of entry become insurmountable.

The trade war has the same effect as the data regulation because it is ultimately for the betterment and protection of domestic, made-in-USA technology.

Washington knows the FANGs all too well, and the bull market will cease to exist if Beijing buys out our technological expertise.

Short-term pain for long-term gain. That's it in a nutshell.

The White House further understands that it's better to start a trade war now when it holds a stronger hand. No doubt after 20 more years of an ascending China, the Middle Kingdom will leverage its economic clout for diplomatic power dictating the outcome more ruthlessly.

Effectively, Trump's trade fracas is a one step back and two steps forward policy. During the one step back phase simply seems as if the economy is taking a nosedive into the ocean floor.

Love it or hate it, technology is becoming more (and not less) ubiquitous. However, it's gone too far too fast, and society and public officials require time to absorb the new environment or you risk the current backlash.

Simultaneously, America is in the one step back phase of data regulation, trade laws, and society's backlash of encroaching tech.

Bad timing.

The teething problems will gradually subside, the stock market will re-ignite, and tech will advance further into regular life.

The market even has seen some green shoots with the blockbuster Dropbox (DBX) IPO up over 40% intraday on the first day of trading.

In the S-1 filing required for IPOs, (DBX) stated that it may "not be able to achieve or maintain profitability" because of increasing expenses. The disclosure also prefaced its "history of net losses" to justify the business direction.

(DBX) lost $111.7 million in 2017, on revenues of just over $1 billion.

Technology must be doing something right if loss-making firms are treated with a 40% gain on IPO day; and, Spotify, an even bigger money loser, will go public next week.

If investors are smitten with loss-making tech companies, I imagine they feel quite comfortable with the ones earning billions in quarterly profits and growing at a pace where analysts cannot hike their price targets quick enough, making them look foolish.

The outstanding gains by (DBX) was for one reason and one reason only.

It's a pure cloud play, and pure cloud plays have been rewarded in spades.

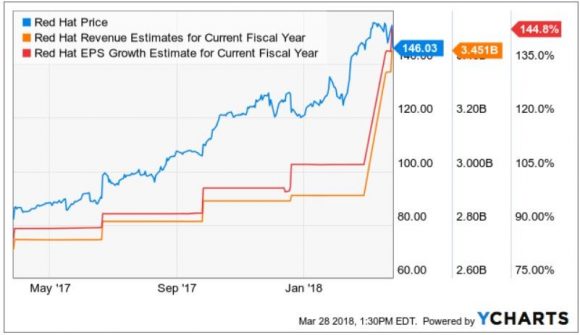

Red Hat's (RHT) stellar earnings were on the heels of the (DBX) IPO success.

Red Hat is a medium-size unadulterated cloud play that lacks the financial resources of the FANGs but is still turning a profit.

It is the poster boy for enterprise cloud companies flourishing in an unrelenting fierce environment.

If the world is going to hell in a handbasket, then how did Red Hat achieve aggregate billings growth of 25%?

Everyone and their uncle expect tech companies to start floundering, but the opposite is true. They overpromise then over deliver to the upside every quarter.

Red Hat booked the most deals over $1 million in Q4 2017 in its history.

Cross-selling cloud applications was especially strong with 81% of deals over $1 million spending on multiple software services.

The critical subscription revenue comprised 88% of Q4 revenue and is up 15% YOY. Application development-related subscriptions were up 42% YOY, higher than the infrastructure-related subscription revenue growing 17% YOY.

Companies are churning out innovation on top of their existing platforms using various software solutions. And every company in the world is migrating toward cloud software and infrastructure. There has never been a better time to be a pure cloud company.

The most poignant telltale sign was that Red Hat renewed 99 out of 100 of its top deals and disclosed that multiyear deals were healthy.

Ansible, its software for automating data center operations, OpenShift, its software for container-based deployment and management, and OpenStack, an infrastructure-as-a-service (IaaS) for cloud computing are the underpinnings to Red Hat's supreme business.

The reoccurring revenue salted away is legion.

The FY 2018 guidance was even more impressive than the quarterly earnings report. Red Hat expects a revenue range between $800 million and $810 million, up from the $748 million last quarter and expects quarterly EPS at $0.81, up from $0.70 last quarter.

Toward the end of the earnings call, Red Hat CEO Jim Whitehurst described the cloud growth environment as "very, very, very fast growth."

Market conditions and heightened volatility could stay irrational for longer than expected but leadership stocks are always the last to fall.

If (DBX) can catch a bid, and headway is made on political issues, then jump back into the cloud names that perform like Red Hat and about which I have been beating the drum.

And don't forget that these regulatory and political hindrances all point toward giving big cap tech cozier conditions and an elevated runway from which to operate.

__________________________________________________________________________________________________

Quote of the Day

"We know where you are. We know where you've been. We can more or less know what you're thinking about." - said Eric Schmidt in 2010, the former executive chairman of Google from 2001-2017

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in New York, NY, on Thursday, June 14, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $278.

I'll be arriving at noon and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Denver, CO on Friday, June 15, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Tickets are available for $228.

I'll be arriving at 11:30 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.