When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

April 9, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE'S THE BIG CALL),

(JPM), (GOOGL), (GLD), (TLT), (VXX),

(HOW TO "SNOWBALL" YOUR FORTUNE WITH BENJAMIN FRANKLIN)

Well that tears it!

Flamethrowers! Yes, on the list of 125 products that China is imposing new 25% import duties are flamethrowers.

And I was so looking forward to getting a flamethrower of my own with which to singe lazy and errant stock analysts from whom we all are afflicted.

I guess I'll just have to buy American, which I already do with my cars (Teslas).

The real call here is that the NASDAQ has entered a well-defined trading range, from 6,600 to 7,600, where it will remain trapped for six months until the November midterm congressional elections. After that, we will rally 10% in year-end rally.

The deep in-the-money call spread strategy I employ is ideally suited to this kind of go-nowhere market. While other traders are tearing their hair out, you'll be raking in the money every month as if you've just been adopted by a new rich uncle.

The president, absolutely cacophonous about the riches created by a rising stock market, has developed lockjaw in a falling one.

The reason was provided by trade advisor Peter Navarro, who said quite simply that the markets were wrong in their belief that trade wars decimate share prices.

My half century of trading tells that markets are never wrong, only people are.

And while the chief architect of our China trade policy has never been there, I managed to find it in 1974. It's easy. You just head east.

Here are some harsh numbers to show you how quixotic the administration policies are. By imposing $25 billion in import duties to protect dying American industries, investors cut $3 trillion off of US stock market capitalization.

That is a 120:1 risk reward AGAINST us. That's NOT the kind of trade I'm used to strapping on.

I'm sure the Chinese are thinking, "How would you like to lose another $3 trillion?" "How about a recession and bear market?" and "See you $25 billion and raise you $50 billion!"

Here is a number that gets lost in translation of the $1 trillion in two-way trade between the US and China. Some 90% of the profits accrue to the US. It is an issue that officials in Beijing have been complaining to me about for decades, which essentially makes them the low-waged manufacturing colony.

That iPhone X that Foxconn makes for $100 Apple (AAPL) sells for $1,000 in the US.

One then has to ask the cogent question, "If you're winning the game, why change the rules?"

The Chinese are not a nation you want to antagonize. They endured 2 million casualties in Korea just to inflict 50,000 on us. Chosin Reservoir looms large in my family - the best fighting retreat in history carried out by the Marine Corp.

The Chinese can also suffer more pain than Americans, with most only one or two generations out of a $300 annual per capita income.

Will the US November congressional election affect economic fundamentals" I doubt it. The mere fact that the election is out of the way is worth a 10% stock market rally into year-end.

The March Nonfarm Payroll Report was a disappointment for the second month in a row, coming in at a feeble 103,000. The headline unemployment rate remains at a decade low of 4.1%.

The stock market didn't care, with the overwhelming focus now on trade issues.

The really important numbers now, Average Hourly Earnings, were up a slightly inflationary 0.3%, but no one noticed.

The January and February reports we revised downward by a steep 50,000.

Manufacturing gained 22,000 jobs, Health Care was up 22,000, and Professional and Business Services up 33,000. Construction lost 15,000 jobs, thanks to raising interest rates.

The Broader U-6 "Discouraged Worker" unemployment rate dropped 0.2% to 8.0%, a new decade low.

As a stand-alone number, the report is not important. However, look at it in the context of a rising tide of recent, slightly negative economic data reports and one has to start to get concerned. Is it the weather, or the beginning of something larger?

We are only a week off from when the Q1, 2018 earnings season kicks off, which will probably deliver some of the strongest reports in US history.

Until then, the data reports will be relatively benign.

On Monday, April 9, nothing of note is announced.

On Tuesday, April 10, we receive March NFIB Small Business Optimism Index.

On Wednesday, April 11, at 8:30 AM EST, we learn the all-important Consumer Price Index, the most important read on inflation. Bed Bath & Beyond (BBBY) reports.

Thursday, April 12, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a dramatic rise of 24,000 last week (another bad number). BlackRock (BLK) reports.

On Friday, April 13, at 10:00 AM EST, we get the JOLTS Report on private sector job openings. It is the big day for bank earnings, with Citigroup (C), JP Morgan (JPM), and Wells Fargo (WFC) all reporting.

The week ends as usual with the Baker Hughes Rig Count at 1:00 PM EST. Last week brought a drop of 2.

Followers of the Mad Hedge Trade Alert Service enjoyed one of their best weeks in years. Executing on the views above, I nailed the market bottom, hauling in an eye-popping 5.06% in performance in a single day.

I artfully used the huge sell-off days to pile on long positions in Google (GOOGL) and JP Morgan (JPM), and sell short US Treasury bonds and volatility (VXX). On the up days I bought gold (GLD).

It all worked like a charm, and every position is now profitable.

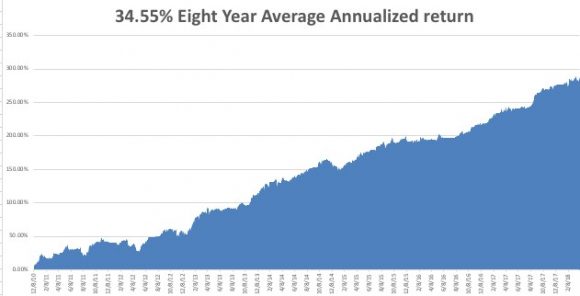

That brings April up to a +4.76% profit, my trailing one-year return to +49.72%, and my eight-year average annualized return up to 34.55%. We are an eyelash short of a new all-time performance high.

As for me, I'll be shutting down my Lake Tahoe estate for a while, not that the snow has turned to rain. The lake level is at a 118-year high, and Reno, NV, is worried about flooding. All the floodgates are open.

What a winter! I barely had time to tear myself away from my screens to visit the slopes.

Good Luck and Good Trading.

Mad Hedge Technology Letter

April 9, 2018

Fiat Lux

Featured Trade:

(HOW TO LOSE MONEY IN TECHNOLOGY STOCKS),

(AAPL), (MSFT), (OFO), (UBER), (MOBIKE), (OneCoin), (BABA)

Every new bull market in technology brings its excesses, and this time is more different.

Today, I'll outline some of the more egregious cases, which you and your money should avoid like the plague.

Spoiler alert: You are better off just parking your money in Apple (AAPL) or Microsoft (MSFT) and then forgetting about it.

The thirst to own a little sliver of technology in the greatest bull market of all time has reached a fever pitch with capital allocating to marginal assets.

Serious investors need to avoid the madness.

The excess was bred from the realization of how valuable data extraction and generation is to profitability.

The investment climate is reminiscent of the dot-com bubble during the 1990s that spawned companies with no intention of ever turning a profit.

This time, loss-making is blatant.

Ride-share vehicle services such as Uber and Lyft are great at losing money, and passengers would stand aside if prices became exorbitant.

Paying a derisory sum to ride in someone else's car while being chauffeured around is part of the allure of this business model.

The result is an artificially low price for the benefit of consumers amid a vicious price war with competitors.

The biggest problem with these ride-share services is they create nothing.

They are not building a proprietary operating system or creating technology that did not exist before.

Hence, these types of companies execute risky strategies that backfire.

Any technology company that expects to be in the game long term must create something unique and organic that other companies value and cannot copy.

These ride-hailing companies simply use an app on a smartphone, and this smartphone app can be created by any half decent high school app programmer.

Uber lost $4.5 billion in 2017, and that was great news for CEO Dara Khosrowshahi because Uber is losing less than before.

If you thought a tech company glorifying an annual loss of $4.5 billion was strange, then analyzing the state of the ride-share business model for the industry one degree further out on the risk curve will leave you scratching your head.

And by the way, Uber will try to soak your wallet when it launches its initial public offering next year.

Enter dockless ride-sharing bicycles.

Dockless bike-sharing has mushroomed around the world, spreading like wildfire fueled by grotesquely large injections of venture capital.

Ofo, a Chinese firm, initially raised more $1.2 billion and another $866 million from Alibaba (BABA) from a recent round of fundraising. CEO Dai Wei has stated that his company is worth north of $2 billion.

Mobike lured in more than $900 million in venture capital.

China is the epicenter of the bicycle ride-sharing experiment. More than 40 firms have sprouted up creating a bizarre scenario in major Chinese cities because of these companies dumping bicycles on every public street corner.

According to Xinhua News Agency, more than 2.5 million bikes are littered throughout the city by 15 companies in Beijing alone.

Local American firms have jumped on the bandwagon, too, with examples such as LimeBike, based in San Mateo, CA, that raised $12 million from Andreessen Horowitz in 2017, and topped up another $50 million from Coatue Management.

Meanwhile, Spin, the first stationless bikeshare company in the US, raised $8 million led by Grishin Robotics.

More than 40 bike-sharing companies have beat down the price of renting a bicycle to the paltry rate of 1 RMB (renminbi) ($0.15 USD) per 30-minute trip.

The intentional dumping at absurd price levels is not sustainable. The business model is predicated on collecting an initial deposit of $15 before a customer can hop on a bike.

The deposit has proved high risk as some companies have disappeared or gone bust.

Bluegogo, the third leading company in this space, emptied out its headquarters office, locked the doors, and failed to notify employees who claimed their wages had been garnished.

By last count, Bluegogo had distributed roughly 700,000 bicycles, and was estimated to have 20 million users, each paying $15 deposits to use the service.

Bluegogo was considered a legitimate competitor in the space along with Mobike and Ofo.

The $300 million dollars in Bluegogo deposits floated up to money heaven, and the deposits will never be repaid to customers.

Didi Chuxing, China's version of Uber and subsidiary of Tencent and Alibaba (BABA), purchased the bankrupt bike-sharing company, paid the work staff, and slipped them inside its portfolio of emerging tech firms in January 2018.

Mingbike, which failed in Shanghai and Beijing, migrated to emptier pastures in third and fourth tier Chinese cities and sacked 99% of its staff.

All told, $3 billion to $4 billion has been funneled into these bicycle-share monstrosities in the past 18 months.

It gets a lot worse in terms of high risk.

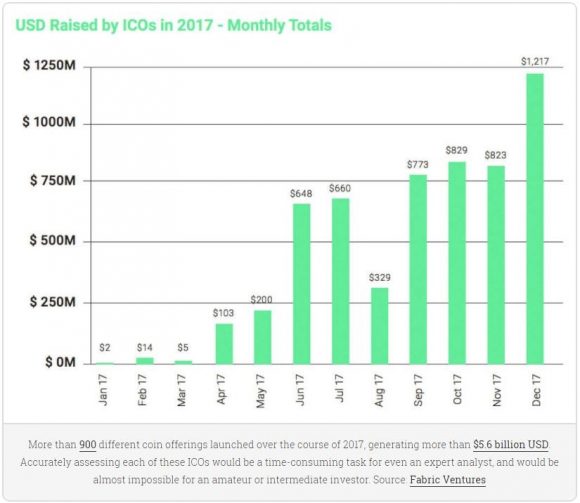

Another frontier of interest that has gone absolutely bananas is the ICO (Initial Coin Offering). ICOs are an unregulated new cryptocurrency venture raising funds by crowdfunding. A certain percentage of coins is sold to early investors in exchange for legal tender or Bitcoin.

This controversial means of raising money is a hotbed for scams galore. Of 1,000 that now exist, maybe 10 are legit.

These criminals are taking advantage of the headline effect of cryptocurrencies, promising every Joe and Jane early retirements and an easy way to provide college funds for children.

It's true that a founder of a cryptocurrency demonstrably benefits financially from leading this new form of payment.

Simply put, these ICOs function as Ponzi schemes with the last one to buy holding the bag when the sushi hits the fan after the founders run for the exits.

These fraudulent ICOs take on some of the characteristics of real Ponzi schemes such as guaranteed profits, promising their blockchain technology will solve all of the world's ills, no detailed roadmap except collecting funds, and lack of an online digital footprint.

Adding to the outsized risk is the confusion of which jurisdiction these companies are in and absence of any proper compliance.

OneCoin was a cryptocurrency promoted by offshore companies OneCoin Ltd (Dubai) and OneLife Network Ltd (Belize), founded by Ruja Ignatova. Many of the shady characters crucial to OneCoin were architects of similar Ponzi schemes, which was a dead giveaway to authorities.

Bulgarian enforcement officials raided and hauled away servers and other sensitive evidence at OneCoin's office in Sofia, Bulgaria, at the request of the prosecutor's office in Bielefeld, Germany.

German police and Europol also busted 14 other companies connected to OneCoin.

OneCoin CEO Ignatova was imprisoned in India for swindling investors after being investigated by Indian authorities in 2017.

The Ministry of Planning and Investment of Vietnam even issued a rebuttal that a forged document OneCoin used as proof to show it was the official licensed cryptocurrency in Vietnam was fake. It stated there was no possibility this document could ever exist.

SEC chairman Jay Clayton recently chimed in after being asked if all ICOs are fraudulent, boldly stating, "Absolutely not."

Uber and Ofo also are not frauds, but that does not mean investors should take a flier on it.

The strength of technology has attracted the marginal character to its doorstep; separating the wheat from the chaff is more important than ever.

These nascent industries can look good in the shop window, and slick advertising campaigns numb our rational decision making, but investors need to stay away at all costs.

The bicycle-sharing industry is a way for cash-rich venture capitalists to hoard data for applications irrespective of operating at a profit. The ICOs are charlatans attracted to the fluid cash flow tech companies command desiring a share in the spoils.

Keep your money in your pockets and wait for my next actionable trade alert.

__________________________________________________________________________________________________

Quote of the Day

"Stay away from it. It's a mirage, basically." - said legendary investor Warren Buffett when asked about cryptocurrency.

"The car business is hell," said Tesla co-founder Elon Musk, when announcing he would sleep in the Fremont, CA, Tesla factory until Model S production reaches 2,500 units a week.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.