When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 19, 2018

Fiat Lux

Featured Trade:

(DIVING BACK INTO THE VIX),

(VIX), (VXX), (SPX),

(THE GREAT AMERICAN JOBS MISMATCH)

I think we are only days, at the most weeks, away from the next crisis coming out of Washington. It can come for any of a dozen different reasons.

Wars with Syria, Iran or North Korea. The next escalation of the trade war with China. The failure of the NAFTA renegotiation. Another sex scandal. The latest chapter of the Mueller investigation.

And then there's the totally unexpected, out of the blue black swan.

We are spoiled for choice.

For stock investors, it's like hiking on the top of Mount Whitney during a thunderstorm with a steel ice axe in hand.

So, I am going to buy some fire insurance here while it is on sale to protect my other long positions in technology and financial stocks.

Since April 1, the Volatility Index (VIX) has performed a swan dive from $26 to $15, a decline of 42.30%.

I have always been one to buy umbrellas during parched summers, and sun tan lotion during the frozen depths of winter. This is an opportunity to do exactly that.

Until the next disaster comes, I expect the (VXX) to trade sideways from here, and not plumb new lows. These days, a premium is paid for downside protection.

The year is playing out as I expected in my 2018 Annual Asset Class Review (Click here for the link.). Expect double the volatility with half the returns.

So far, so good.

If you don't do options buy the (VXX) outright for a quick trading pop.

You may know of the Volatility Index from the many clueless talking heads, beginners, and newbies who call (VIX) the "Fear Index."

For those of you who have a PhD in higher mathematics from MIT, the (VIX) is simply a weighted blend of prices for a range of options on the S&P 500 index.

The formula uses a kernel-smoothed estimator that takes as inputs the current market prices for all out-of-the-money calls and puts for the front month and second month expirations.

The (VIX) is the square root of the par variance swap rate for a 30-day term initiated today. To get into the pricing of the individual options, please go look up your handy-dandy and ever-useful Black-Scholes equation.

You will recall that this is the equation that derives from the Brownian motion of heat transference in metals. Got all that?

For the rest of you who do not possess a PhD in higher mathematics from MIT, and maybe scored a 450 on your math SAT test, or who don't know what an SAT test is, this is what you need to know.

When the market goes up, the (VIX) goes down. When the market goes down, the (VIX) goes up. Period.

End of story. Class dismissed.

The (VIX) is expressed in terms of the annualized movement in the S&P 500, which today is at $806.06.

So, for example, a (VIX) of $15.48 means that the market expects the index to move 4.47%, or 121.37 S&P 500 points, over the next 30 days.

You get this by calculating $15.48/3.46 = 4.47%, where the square root of 12 months is 3.46 months.

The volatility index doesn't really care which way the stock index moves. If the S&P 500 moves more than the projected 4.47%, you make a profit on your long (VIX) positions. As we know, the markets these tumultuous days can move 4.47% in a single day.

I am going into this detail because I always get a million questions whenever I raise this subject with volatility-deprived investors.

It gets better. Futures contracts began trading on the (VIX) in 2004, and options on the futures since 2006.

Since then, these instruments have provided a vital means through which hedge funds control risk in their portfolios, thus providing the "hedge" in hedge fund.

If you make money on your (VIX) trade, it will offset losses on other long positions. This is how the big funds most commonly use it.

If you lose money on your long (VIX) position, it is only because all your other long positions went up.

But then no one who buys fire insurance ever complains when their house doesn't burn down.

"Chance Favors the Prepared," said French scientist Louis Pasteur.

With the Weekly Jobless Claims bouncing around a new 43-year low at 220,000, it's time to review the state of the US labor market.

Yes, I know this research piece isn't going to generate an instant Trade Alert for you.

But it is essential in your understanding of the big picture.

There are also thousands of students who read my website looking for career advice, and I have a moral obligation to read the riot act to them.

With a 4.1% headline unemployment rate, the US economy is now at its theoretical employment maximum. If you can't get a job now, you never will.

We may see a few more tenths of a percent decline in the rate from here, but no more. To get any lower than that you have to go all the way back to WWII.

Then there was even a shortage of one-armed, three-fingered, illiterate recruits with venereal disease, the minimum US Army recruitment standards of the day.

Speaking to readers across the country and perusing the Department of Labor data, I can tell you that not all is equal in the jobs market today.

You can blame America's halls of higher education, which are producing graduates totally out of sync with the nation's actual skills needs.

Take a look at this table of graduating majors to job offers, and you'll see what I am talking about:

Major - Job Offers Offered per Graduating Major

Computer Science - 21:1

Engineering - 15:1

Physical Sciences (oil) - 13:1

Humanities - 5:1

Business and accounting - 4:1

Economics - 4:1

Agriculture - 2:1

Education - 0.4:1

Health Sciences - 0.2:1

To clarify the above data, there are 21 companies attempting to hire each computer science graduate today, while there are five kids battling it out to get each job in Health Sciences.

To understand what's driving these massive jobs per applicant disparities, take a look at the next table nationally ranking graduating majors desired by corporations.

Graduating Majors Desired by Employers

81% - Business and Accounting

76% - Engineering

64% - Computer science

34% - Economics

21% - Physical Science

12% - Humanities

5% - Agriculture

2% - Health Science

There is something screamingly obvious about these numbers.

Colleges are not producing what employers want.

This is creating enormous imbalances in the jobs market.

It explains why computer science students are landing $150,000-a-year jobs straight out of school, complete with generous benefits and health care. Many employers in Silicon Valley are now offering to pay down student debt in order to get the most desirable candidates to sign a contract.

In the meantime, Health Sciences and Humanities graduates are lucky to land a $25,000-a-year posting at a nonprofit with no benefits and Obamacare. And there are no offers to pay down student debt, which can rise to as much as $200,000 for an Ivy League degree.

Agriculture grads usually go to work on a family farm, which they eventually inherit.

As a result of these dismal figures, the character of American education is radically changing.

With students now graduating with an average of $35,000 in debt, no one can afford to remain jobless upon graduation for long.

That's why the number of Humanities graduates has declined from 9% in 2012 to 6% today.

Colleges are getting the message. Since 1990, one-third of those with the words "liberal arts" in their name or prospectus have dropped the term.

Students who do stick with anthropology, philosophy, English literature, or history are learning a few tricks as well.

Add a minor in Accounting and Management and it will increase your first-year salary by $13,000. Toss in some Data Base Management skills, and the increase will be even greater.

And online marketing? The world is your oyster!

These realities have even come home to my own family.

I have a daughter working on a PhD in Education from the University of California, and the mathematics workload is enormous, especially in statistics.

It is all so she can qualify for government research grants upon graduation.

The students themselves are partly to blame for this mismatch.

While recruiters report an average of $45,000 a year as an average first year offer, the graduates themselves are expecting an average first-year income of $53,000.

Companies almost universally report that interviewees have a "bloated" sense of their own abilities, poor interviewing skills, and unrealistic pay expectations.

Some one-third of all applicants are unqualified for the jobs for which they are applying.

The good news is that everyone gets a job eventually. A National Association of Colleges and Employers survey says that companies plan to hire 5% more college graduates than last year.

And where do all of those Humanities grads eventually go.

A lot become financial advisors.

Just ask.

Sorry, STEM Students Only!

Mad Hedge Technology Letter

April 19, 2018

Fiat Lux

Featured Trade:

(HOW ROKU IS WINNING THE STREAMING WARS),

(ROKU), (FB), (AMZN), (NFLX), (GOOGL), (BBY), (DIS)

The whole digital ad industry dodged a bullet.

Facebook (FB) CEO Mark Zuckerberg's wizardry on Capitol Hill will stave off the data regulation hyenas for the time being.

One company in particular is perfectly placed to reap the benefits.

The Facebook of online streaming - Roku (ROKU).

Roku is a cluster of in-house, manufactured, online streaming devices offering OTT (over-the-top) content in the form of channels on its proprietary platform.

The company has two foundational drivers propelling business - selling hardware devices and selling digital ads.

It pays dividends to be entrenched at the intersection of two monumental generational trends of cord cutters' mass migration to online streaming, and the disruption of the digital ad revolution that is shaking up traditional media giants.

The percentage of American homes paying for an online streaming service ripped higher to 55% of households, which is up from 49% the previous year.

This $2.1 billion per month spend on streaming service is specifically as a result of access to premium content at an affordable price relative to traditional cable bundles.

Roku is a microcosm of the healthy climate for quality technology stocks in 2018.

It is among countless other firms that leverage large-scale data or cloud tools to capture profits.

Roku is best of breed of smart TV platforms and is in the early stages of robust growth.

This year will be the first year Roku's ad revenue surpasses hardware sales, indicating strong platform growth.

Roku pinpointed building account user growth, top-line gross revenue, and enhancing the platform capabilities as ways to move the business forward.

This year will also be the first year Roku posts an overall profit.

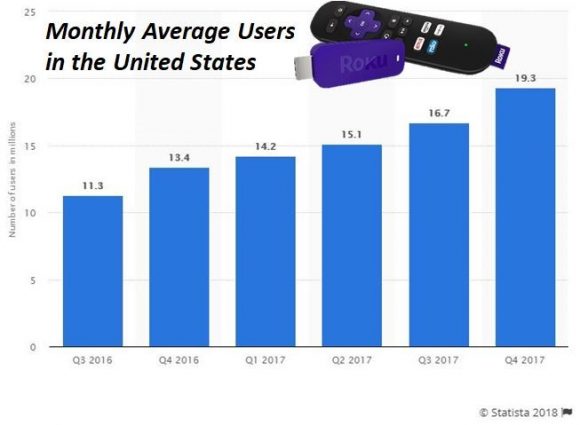

Active accounts grew 44% YOY to 19.3 million.

Roku offers consumers a cheap point of entry selling its Roku express box for only $29.99.

Its device is even free with a two-month purchase of Sling TV, which is the best online substitute to a legacy cable package. It has two sets of unique bundles available, charging $20 per month and $40 per month.

Once the Roku home screen populates, users can choose content through a la carte streaming options.

There is no monthly fee to operate Roku, and the device is used primarily by millennials.

More than 60% of 18- to 29-year-olds watch TV from online streaming, according to a Pew survey.

The quality and easy-to-use interface aids user navigation across the ecosystem.

It's the most convenient avenue to subscribe to multiple online streaming services all on one platform. It entices finicky users with extra mobility - those who love to jump around to different services based on particular upcoming content loaded up in the pipeline.

Many of these services offer no contract, cancel-anytime models that millennials love rather than the "old-school" rigid rules of cable providers that mostly charge a cancellation penalty of $300.

It is shocking how far traditional media fell behind the curve, but they are in rapid catch-up mode now.

Remember that content is king, and the overall boost in content quality has really shaken Hollywood executives to their core.

The golden age of streaming continues unabated with a Netflix 2018 annual content budget of $8 billion.

Roku does not create original content and it desires no skin in the game.

Content is expensive, and Roku would rather become the best place to host it.

Netflix's 2017 total revenue was a staggering $11.69 billion in 2017, and content costs will easily surpass 50% of total revenue in 2018. Overnight, it has become one of the biggest players in Hollywood, as its presence at the Emmy Awards amply demonstrates.

Exorbitant content costs are the new normal in 2018, and Spotify has reason to moan about the cost of content being 79% of total revenue.

Heightened content costs are the main reason why firms relying on content creation lose money each year.

However, as the overall pie grows, there is room for the tide to lift all boats. Being the premier platform to host premium content is why Roku's business model is eerily similar to Facebook's hyper-targeting ad model.

They make money the same way.

The incessant demand for online streaming functionality and smart TV operating systems show no signs of waning with Amazon (AMZN) announcing a new partnership with frenemy Best Buy (BBY) to produce smart TVs with Best Buy's in-house TV brand Insignia.

This is the first time Best Buy has been afforded a direct route to Amazon customers.

Disney (DIS) is turning around its legacy company into an online streaming behemoth announcing its first foray into online streaming with ESPN+.

Disney has tripled down on online streaming, acquiring New York-based BAMTech in late 2017, a company focused on developing streaming technology and made famous by its production of pro baseball's MLB TV.

BAMTech exudes pure quality. Anyone who has used MLB TV streaming service understands the great end-product it offers consumers.

The outstanding success with MLB TV attracted new online streaming converts to BAMTech to execute the transition to online streaming, including the WWE, Fox Sports, PlayStation Vue, and Hulu.

HBO went to BAMTech in 2014, after botching its attempt at creating a reliable stand-alone streaming service.

Disney's BAMTech-produced online streaming service will come to market in 2019, and will certainly be available on Roku TV.

Expect new blockbuster hits to debut on this new streaming service, such as new versions of Star Wars.

It is the perfect stock to mutate into an online streaming service because it possesses amazing content especially through ESPN.

The announcement of ESPN+ levitated Roku shares by 10% because investors understand this is the first baby step to shifting more of its content online.

This was on top of the announcement that Stephen A. Cohen's Point72 Asset Management had acquired a 5.1% stake in Roku for about $14 billion.

Furthermore, every major streaming service that enters Roku's system is worth an extra 5% to 10% bump in share price because of the wave of eyeballs and digital ads that grow Roku's coffers.

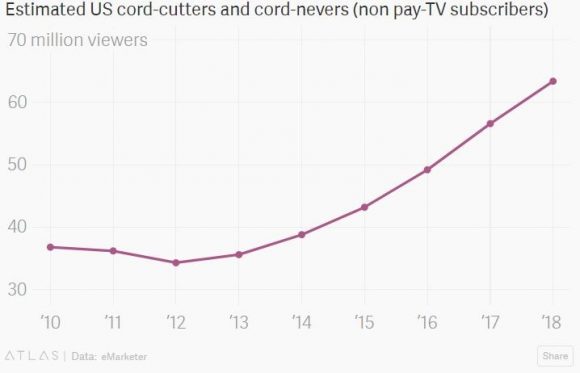

It is certain that 2018 and 2019 will sway more cord cutters to adopt Roku TV as this cohort approaches 70 million in 2018 on its way to 80 million in 2019.

The critical growth lever is its digital ad business as it hopes to take home a slice of this $70 billion per year business that is 75% controlled by Alphabet (GOOGL) and Facebook.

Roku has made great strides with half of Ad Age's top 200 advertisers already on the Roku interface.

Roku is taking the playbook right out from under Facebook's nose, piling funds into further enhancing its ad-tech division.

The blood, sweat, and tears shed is showing up in the financials with ARPU (Average Revenue per User) rocketing by 48% YOY, and more than 65% of this gap up is attributed to digital ad revenue.

Total revenue was up 29% YOY to $513 million, and platform revenue grew 129% in Q4 2017 to $85.4 million.

It is estimated that ad revenue will surpass $300 million in 2018, up from around $200 million in 2017.

Roku expects total revenue to grow 32% in 2018, approaching $700 million.

Profit margins are thriving under the platform segment, pumping out a stellar 74.6% in gross margin.

Roku does not make money on the hardware. Its push into ad distribution will ramp up as its digital ad revenue beelines toward an expected $700 million windfall by 2020.

Roku has a fantastic growth trajectory relative to other tech companies. Heightened volatility will make sell-offs hard to swallow but give fabulous entry points into a budding business.

The fertile path of international user adoption has barely scratched the surface. However, Netflix's successful foray abroad will inject confidence that Roku will have no problem expanding to greener pastures overseas as domestic account growth is always first to mature.

__________________________________________________________________________________________________

Quote of the Day

"AI is one of the most important things humanity is working on. It is more profound than electricity or fire." - said Google CEO Sundar Pichai

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.