When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 30, 2018

Fiat Lux

SPECIAL FIXED INCOME ISSUE

Featured Trade:

(ITALY'S BIG WAKE-UP CALL),

(TLT), ($TNX), (TBT), (SPY), ($INDU), (FXE), (UUP), (USO),

(WELCOME TO THE DEFLATIONARY CENTURY),

(TLT), (TBT)

Those planning a European vacation this summer just received a big gift from the people of Italy.

Since April, the Euro (FXE) has fallen by 10%. That $1,000 Florence hotel suite now costs only $900. Mille grazie!

You can blame the political instability on the Home of Caesar, which has not had a functioning government since March. The big fear is that the extreme left would form a coalition government with the extreme right that could lead to its departure from the European Community and the Euro. Think of it as Bernie Sanders joining Donald Trump!

In fact, Italy has had 61 different governments since WWII. It changes administrations like I change luxury cars, about once a year. Welcome to European debt crisis part 27.

I can't remember the last time markets cared about what happened in Europe. It was probably the first Greek debt crisis in 2011. This month, 10-year Italian bond yields have rocketed from 1% to 3%. But they care today, big time.

Given the reaction of the global financial markets, you could have been forgiven for thinking that the world had just ended.

U.S. Treasury Bond yields (TLT) saw their biggest plunge in years, off 15 basis points to 2.75%. The Dow Average ($INDU) collapsed by $500 to $24,250, with interest sensitive banks such J.P. Morgan Chase (JPM) and Bank of America (BAC) delivering the worst performance of the day.

Even oil prices collapsed for an entirely separate set of reasons - so far, the best performing commodity of 2018. The price of Texas Tea pared 10% in a week.

Saudi Arabia looks like it is about to abandon the wildly successful OPEC production quotas that have been boosting oil prices for the past year, and there are concerns that Iran will withdraw from the nuclear non-proliferation treaty. The geopolitical premium is back with a vengeance.

So, if the Italian developments are a canard why are we REALLY going down?

You're not going to like the answer.

It turns out that rising inflation, interest rates, oil and commodity prices, the U.S. dollar, U.S. national debt, budget deficits, and stagnant wage growth are a TERRIBLE backdrop for risk in general and stocks specifically. And this is all happening with the major indexes at the top end of recent ranges.

In other words, it was an accident waiting to happen.

Traders are extremely nervous, global uncertainty is high, the seasonals are awful, and Washington is s ticking time bomb. If you were wondering why I was issuing so few Trade Alerts in May these are the reasons.

This all confirms my expectation that markets will remain in increasingly narrow trading ranges for the next six months until the mid-term congressional elections.

Which is creating opportunities.

If you hated bonds at a 3.12% yield from two weeks ago, you absolutely have to despise them at 2.75% today. That's why I added outright bond put options today to my model trading portfolio.

Stocks are still wildly overvalued for the short term, so I'll keep my short position there. As for oil (USO), gold (GLD), and the currencies, I don't want to touch them here.

So watch for those coming Trade Alerts. I'm not dead yet, just resting.

Waiting for My Shot

Mad Hedge Technology Letter

May 30, 2018

Fiat Lux

Featured Trade:

(WHICH UNICORN WILL EAT YOUR LUNCH?),

(UBER), (AIRBNB)

Ignore the lessons of history, and the cost to your portfolio will be great. Especially if you are a bond trader!

Meet deflation, up-front and ugly.

If you looked at a chart for data from the United States, consumer prices are showing a feeble 2.5% YOY price gain. This is slightly above the Federal Reserve's own 2% annual inflation target, with most of the recent gains coming from rising oil prices.

And here's the rub. Wage growth, which accounts for 70% of the inflation calculation, has been practically nil. So, don't expect inflation to rise much from here, despite an unemployment rate at a 17-year low.

We are not just having a deflationary year or decade. We may be having a deflationary century.

If so, it will not be the first one.

The 19th century saw continuously falling prices as well. Read the financial history of the United States, and it is beset with continuous stock market crashes, economic crisis, and liquidity shortages.

The union movement sprung largely from the need to put a break on falling wages created by perennial labor oversupply and sub living wages.

Enjoy riding the New York subway? Workers paid 10 cents an hour built it 120 years ago. It couldn't be constructed today, as other more modern cities have discovered. The cost would be wildly prohibitive.

The causes of 19th century price collapses were easy to discern. A technology boom sparked an industrial revolution that reduced the labor content of end products by 10 to hundredfold.

Instead of employing 100 women for a day to make 100 spools of thread, a single man operating a machine could do the job in an hour.

The dramatic productivity gains swept through then developing economies like a hurricane. The jump from steam to electric power during the last quarter of the century took manufacturing gains a quantum leap forward.

If any of this sounds familiar, it is because we are now seeing a repeat of the exact same impact of accelerating technology. Machines and software are replacing human workers faster than their ability to retrain for new professions.

This is why there has been no net gain in middle class wages for the past 30 years. It is the cause of the structural high U-6 "discouraged workers" employment rate, as well as the millions of Millennials still living in parents' basements.

To the above add the huge advances now being made in healthcare, biotechnology, genetic engineering, DNA-based computing, and big data solutions to problems.

If all the major diseases in the world were wiped out - a probability within 10 years - how many health care jobs would that destroy?

Probably tens of millions.

So the deflation that we have been suffering in recent years isn't likely to end any time soon. If fact, it is just getting started.

Why am I interested in this issue? Of course, I always enjoy analyzing and predicting the far future, using the unfolding of the last half-century as my guide. Then I have to live long enough to see if I'm right.

I did nail the rise of eight-track tapes over six-track ones, the victory of VHS over Betamax, the ascendance of Microsoft operating systems over OS2, and then the conquest of Apple over Microsoft. So, I have a pretty good track record on this front.

For bond traders especially, there are far-reaching consequences of a deflationary century. It means that there will be no bond market crash, as many are predicting, just a slow grind up in long-term interest rates instead.

Amazingly, the top in rates in the coming cycle may only reach the bottom of past cycles, around 3% for 10-year Treasury bonds (TLT), (TBT).

The soonest that we could possibly see real wage rises will be when a generational demographic labor shortage kicks in during the 2020s. That could be a decade off.

I say this not as a casual observer, buy as a trader who is constantly active in an entire range of debt instruments.

So, the bottom line here is that there is additional room for bond prices to fall and yields to rise is pretty limited. But not by that much, given historical comparisons. Think of singles, and not home runs.

It really will just be a trade. Thought you'd like to know.

Yup, This Will Be a Real Job Killer

Hold onto your hats or you might get swept up.

Avoid the projectiles while you're at it.

There are no imminent tsunami warnings. But something else is happening in the world that you might want to know about.

Disruption.

The pace of disruption is accelerating beyond all recognition.

CEOs are here today and gone tomorrow, exiting through the revolving door of companies devoured by disruption.

Are we on the verge of the rise of the robots?

I wouldn't go that far ... yet.

But the truth is that disruption is redefining the world as we know it.

The latest stage of modern disruption came to us by way of smartphone apps.

This application created clear-cut platforms allowing companies to penetrate deep into the smartphone ecosystem where most of the youth are hanging out with consequences galore.

The unfolding of the sharing economy has been nothing short of breathtaking.

Take Uber.

Uber was so disruptive that its former CEO, Travis Kalanick, disrupted himself out of a job at Uber.

That is quite disruptive.

First, look at its business model.

Uber does not actually create intrinsic value.

It does not create something you can eat, sleep on, or imbibe.

Uber is a vanilla app that brings together a marketplace for riders and ride givers effectively becoming a de facto broker.

Brokers have been around since the advent of time.

This type of technology lacks quality, and half the undergraduate computer engineers in university could fabricate something similar with ease.

Disrupters formulate a plan, scavenge for weak points, identify backdoor entrances, then wreak havoc to the guts of the system.

At an auction late last year in 2017, New York City taxi medallions were going for a derisory $186,000, precipitously lower than the $1.3 million in 2014. A spate of taxi driver suicides ensued.

The 86%-plus drop in value is directly correlated to Uber's advancement into the taxi industry.

It's that simple.

Taxi drivers have been left holding the bag and in big-time debt crying their eyeballs out.

Buy low and sell high. I guess taxi drivers didn't get the message.

The initial point of attack was to render the taxi medallion utterly useless.

To find drivers of its own, Uber subcontracted regular people as drivers.

Genius! Another problem solved.

In one fell swoop, the Uber app made every adult with a driver's license a taxi driver anywhere in the world.

Ka-ching!

New York City capped the total amount of medallions in circulation at 13,587.

The flood of new drivers crushed the price of taxi fares around the world bettering the lives of the average Joe.

Uber also figured it would be cheaper to allow drivers to use their own private car, shedding the costs to maintain, finance, and service one of the highest inputs of taxi business models.

Uber and the rest of the tech industry benefit from being the least regulated industry in the world.

The lack of regulation was a golden ticket to test the rules of the road.

That is exactly what unfolded.

Management even approved an app inside the Uber app bent on skirting the challenges of secret strings organized by police enforcement.

The app, called Greyball, reaffirmed the company ethos of pushing regulation to the brink of no return.

Any emerging tech company not pushing the borders of regulation should not be in technology.

Everything reverts back to the fact that emerging tech is held in check by one metric - growth.

Growth solves anything in the eyes of tech investors.

Yes, it's unfair that Walmart and traditional media companies don't get the same free pass, but life is unfair.

Uber had incentive to break all the rules because surpassing growth targets would lure in additional financing.

The outperforming growth is the main logic justifying an investment in a cash-burning enterprise.

People don't like losing money but people with deep pockets will wait it out if they know there is a golden prize at the end of the road.

The administration has grossly failed to regulate technology, even after the Cambridge Analytica scandal came to light.

This all bodes well for technology companies.

Europe is the hotbed for global data regulation. Large tech companies have been astutely planning for the new General Data Protection Regulation (GDPR) rules to take effect.

The companies that do not create anything proprietary are at serious risk of being passed over in the history books.

Therefore, the aggressive tactics "broker apps" adopt are completely justified, and it is paying off in spades as the 2019 IPO approaches.

That upcoming momentous day will enrich many people associated with Uber and in hindsight, management might acknowledge that its initial wild ways were worth the price of the mild rebuke.

The underlying problem is tech disruption, and the success of it has many unintended consequences - particularly social upheaval and job losses.

Myanmar born "Kenny" Chow's body was found floating face down in the river around the Brooklyn Bridge after his family said he disappeared a few days ago.

This was the fifth New York taxi driver suicide in the past five months.

Chow had taken out high-interest loans to pocket his $700,000 New York City medallion and his precarious financial situation, brought upon by the success of Uber, led him to leap to his death.

Sadly, the thirst to grow means taking away other people's livelihood and even their option to live.

We know the pace of change is in full gear. However, the amount of people being economically and socially displaced is a worrying sign that public opinion cannot absorb the accelerating pace of disruption.

More regulation? Probably not.

Chow isn't the first person to lose a job because of technology and won't be the last.

Enter the hotel industry.

Accommodation-sharing app Airbnb was the end for hotels as we knew them.

Airbnb is the Uber of short-term rentals, matching renters with private home owners. They earn revenue by the servicing fee incurred for the brokering.

The harbinger of doom never came to materialize for the hotel industry, which is enjoying record profits - the likes we have never seen before.

The synchronized economic recovery fueled the demand for hotel rooms located in economic hubs close to urban centers.

As we found out, 90% of business travelers have no desire to stay in other people's houses, and the assortment of services hotels offer is critical for the prototypical business traveler.

The hotel industry saved its bacon while Airbnb is thriving. A win-win situation.

You thought wrong.

Airbnb services are a hit with tech-savvy Millennials, which data reveals as upper-middle class, young, and addicted to wanderlust.

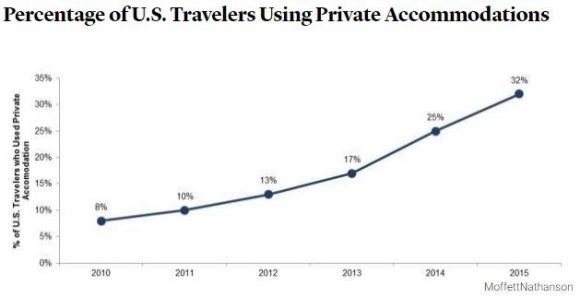

The percentage of American travelers using private housing has more than quadrupled since 2010.

The surge in Airbnb users coincides with an explosion of global tourism led by the bourgeoning Chinese middle-class flooding tourist meccas all over the world.

The app that champions individuals to open up their personal homes is effectively pricing out locals from the dwindling supply of available residential housing.

The problem is most acute in Spain and every other tourist haven.

Madrid currently has 9,000 private units rented out to globe-trotting tourists, a sevenfold rise since 2013.

Of these 9,000 units, 2,000 are illegal and do not possess the necessary permits.

In the port city of Valencia, online-based private housing rose more than 30% since 2016.

To cope with the droves of tourists, the local government is attempting to pass legislation by removing 95% of the housing supply from house-sharing applications, in effect giving local residents back their neighborhoods.

Airbnb is another prime example of the severe lack of regulation that tech revels in, which in turn boosts the pace of technological disruption.

Blame the government. Lawless industries breed marginal behavior. We are all just a function of our environment.

Local neighborhoods are being ravaged by these short-term rentals and entire cities are being turned into massive tourist depots with little afterthought of the local people.

Examples are legion. Venice, Italy; Prague, Czech Republic; Dubrovnik, Croatia; Lisbon, Portugal. And the list goes on and on.

These cities are the victims of their own success and are grappling with hordes of tourists ruining the charm and souls of their beloved cities.

Granted, rapid development of the tourist industry trended toward this result, but the pace of upheaval has accelerated beyond anyone's wildest dreams.

For years, taxi drivers were seen as the first cohort to eventually be swept away with the magic of technology, but it happened too fast for people to accept.

I hope your uncle isn't a taxi driver.

Unfortunately, things are about to get a lot worse as the first stage of disruption transitions to the history books and the next stage is upon us.

The second stage will displace even more people as this unregulated industry sees everything as a zero-sum game.

This stage will incorporate higher grade tech - not just a broker app - that will change the world faster and to a larger degree than anything witnessed today.

And the next stage will incorporate proprietary technology the world has never seen before.

Imminent rollout of self-driving cars hitting the market in 2019 to 2020, will be the first progression for investors to digest.

Followed directly after self-driving will be the broad-based adoption of 5G delivering Internet connection speeds more than 100 times faster than current speeds, stoking a new leg up of commercialization.

As for now, Uber and Airbnb, which both plan to go public in 2019, are eye-opening success stories catapulting them into the top five of global unicorns along with the Uber of China (Didi Chuxing), the Apple of China (Xiaomi), and the Grubhub of China (Meituan-Dianping).

And if you somehow descend on Barcelona during this summer's tourist season, you might want to avoid the tourist protests.

_________________________________________________________________________________________________

Quote of the Day

"They counterfeit our goods, steal our intellectual property rights, and hack the computers of our industries and government. Something must be done about it." - said Director of the United States National Economic Council Larry Kudlow when asked about a specific country.

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.