While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

October 23, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Dow Plunges 450 at the Opening, on a Caterpillar and 3M (MMM) downshift in guidance. These two stocks account for half the index loss. Give me a break. It’s one of the biggest BS moves I have ever seen. Click here.

2) Bonds Rocket on “RISK OFF” Move. With the Chinese still dumping their massive $1 trillion in US Treasury holdings and the budget deficit soaring towards $1 trillion, I am more than happy to sell short here. Check your inbox for the Trade Alert.

3) NASDAQ is having its Worst Month since 2008. And you wondered why I spent most of the summer in cash. Click here.

4) China Stock Crash Comes Home to Roost. Up yesterday, down today, maybe trade wars are harder to win than someone thought. Click here.

5) Stocks Give Up All 2018 Gains. Ho hum, easy come, easy go. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(WATCH OUT FOR THE UNICORN STAMPEDE IN 2019),

(TSLA), (NFLX), (DB), (DOCU), (EB), (SVMK), (ZUO), (SQ),

(A NOTE ON OPTIONS CALLED AWAY), (MSFT),

(THE CLOUD FOR DUMMIES)

(AMZN), (MSFT), (GOOGL), (AAPL), (CRM), (ZS)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 23, 2018

Fiat Lux

Featured Trade:

(WATCH OUT FOR THE UNICORN STAMPEDE IN 2019),

(TSLA), (NFLX), (DB), (DOCU), (EB), (SVMK), (ZUO), (SQ),

(A NOTE ON OPTIONS CALLED AWAY), (MSFT)

I am always watching for market topping indicators and I have found a whopper. The number of new IPOs from technology mega unicorns is about to explode. And not by a little bit but a large multiple, possibly tenfold.

Six San Francisco Bay Area private tech companies valued by investors at more than $10 billion each are likely to thunder into the public market next year, raising buckets of cash for themselves and minting new wealth for their investors, executives, and employees on a once-unimaginable scale.

Will it kill the goose that laid the golden egg?

Newly minted hoody-wearing millionaires are about to stampede through my neighborhood once again, buying up everything in sight.

That will make 2019 the biggest year for tech debuts since Facebook’s gargantuan $104 billion initial public offering in 2012. The difference this time: It’s not just one company, and five of them are based in San Francisco, which could see a concentrated injection of wealth as the nouveaux riches buy homes, cars and other big-ticket items.

If this is not ringing a bell with you, remember back to 2000. This is exactly the sort of new issuance tidal wave that popped the notorious Dotcom Bubble.

And here is the big problem for you. If too much money gets sucked up into the new issue market, there is nothing left for the secondary market, and the major indexes can fall, buy a lot.

The onslaught of IPOs includes ride-sharing firm Uber at $120 billion, home-sharing company Airbnb at $31 billion, data analytics firm Palantir at $20 billion, FinTech company Stripe at $20 billion, another ride-sharing firm Lyft at $15 billion, and social networking firm Pinterest at $12 billion.

Just these six names alone look to absorb an eye-popping $218 billion, and that does not include hundreds of other smaller firms waiting on the sidelines looking to tap the public market soon.

The fear of an imminent recession starting sometime in 2019 or 2020 is the principal factor causing the unicorn stampede. Once the economy slows and the markets fall, the new issue market slams shut, sometimes for years as they did after 2000. That starves rapidly growing companies of capital and can drive them under.

For many of these companies, it is now or never. The initial venture capital firms that have had their money tied up here for a decade or more want to cash out now and roll the proceeds into the “next big thing,” such as blockchain, health care, or artificial in intelligence. The founders may also want to raise some pocket money to buy that mansion or mega yacht.

Or, perhaps they just want to start another company after a well-earned rest. Serial entrepreneurs like Tesla’s Elon Musk (TSLA) and Netflix’s Reed Hastings (NFLX) are already on their second, third, or fourth startups.

And while a sudden increase in new issues is often terrible for the market, getting multiple IPOs from within the same industry, as is the case with ride-sharing Uber and Lyft, is even worse. Remember the five pet companies that went public in 1999? None survived.

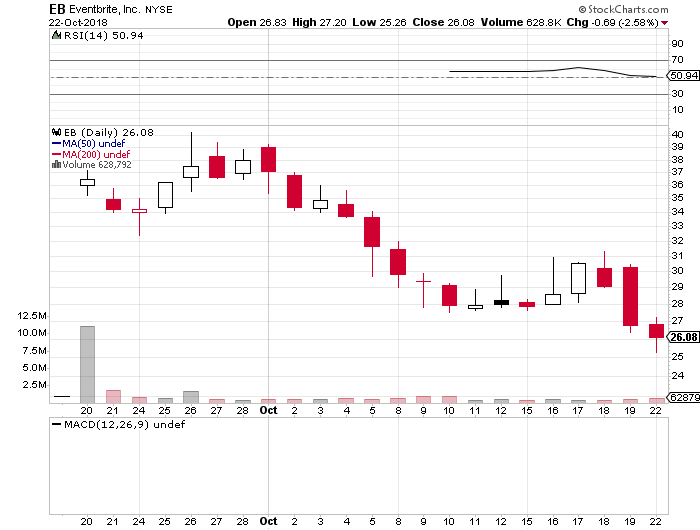

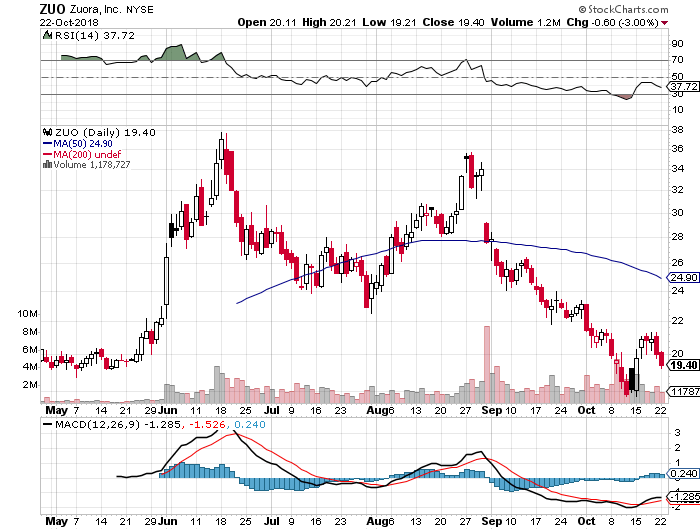

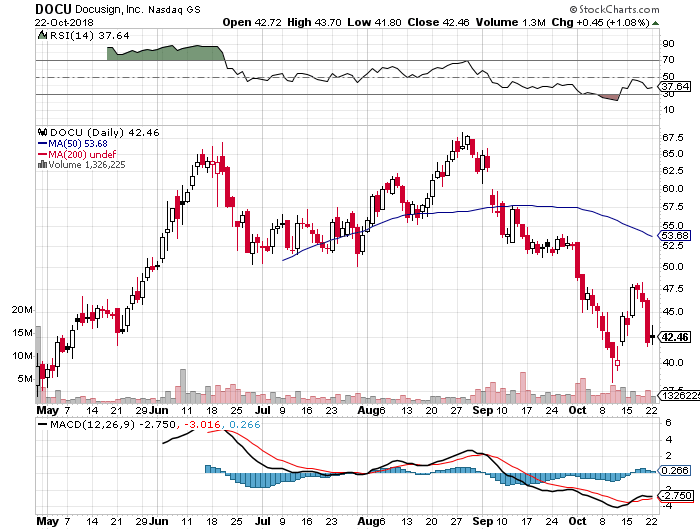

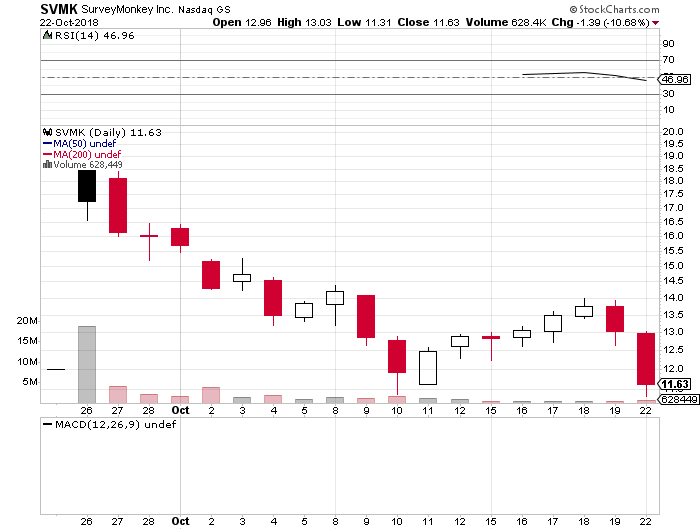

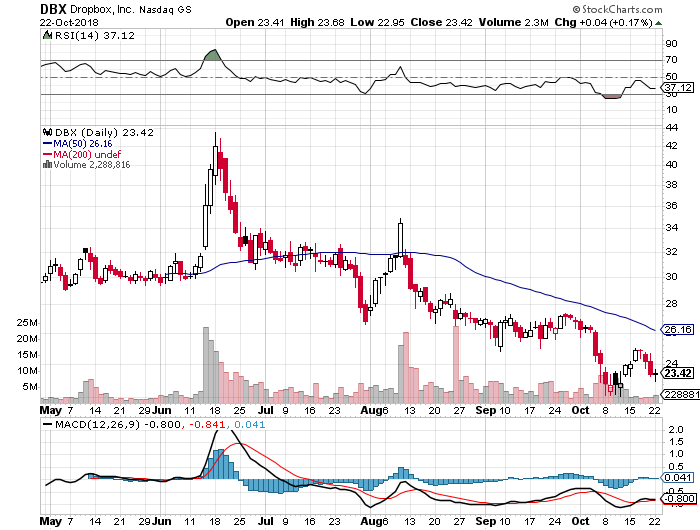

The move comes on the heels of an IPO market in 2018 that was a huge disappointment. While blockbuster issues like Dropbox (DB) and DocuSign (DOCU) initially did well, Eventbrite (EB), SurveyMonkey (SVMK), and Zuora (ZUO) have all been disasters.

Some 80% of all IPOs lost money this year. This was definitely NOT the year to be a golfing partner or fraternity brother with a broker.

What is so unusual in this cycle is that so many firms have left going public to the last possible minute. The desire has been to milk the firms for all they are worth during their high growth phase and then unload them just as they go ex-growth.

The ramp has been obvious for all to see. In the first nine months of 2018, 44 tech IPOs brought in $17 billion, according to Dealogic. That’s more than tech IPOs reaped for all of 2016 and 2017 combined.

Also holding back some firms from launching IPOs is the fear that public markets will assign a lower valuation than the last private valuation. That’s an unwelcome circumstance that can trigger protective clauses that reward early investors and punish employees and founders. That happened to Square (SQ) in its 2015 IPO.

That’s happening less and less frequently: In 2017, one-third of IPOs cut companies’ valuations as they went from private to public. In 2018, that ratio has dropped to one in six.

Also unusual this time around is an effort to bring in more of the “little people” in the IPO. Gig economy companies like Uber and Lyft are lobbying the SEC for changes in new issue rules that will enable their drivers to participate even though they may be financially unqualified.

As a result, when the end comes, this could come as the cruelest bubble top of all.

Don’t Get Run Over

Mad Hedge Technology Letter

October 23, 2018

Fiat Lux

Featured Trade:

(THE CLOUD FOR DUMMIES)

(AMZN), (MSFT), (GOOGL), (AAPL), (CRM), (ZS)

With stock market volatility greatly elevated and trading volumes through the roof, there is a heightened probability that your short options position gets called away.

If it does, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money call option spread, it contains two elements: a long call and a short call. The short called can get assigned, or called away at any time.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

The 5:30 AM phone call was as shrill as it was urgent.

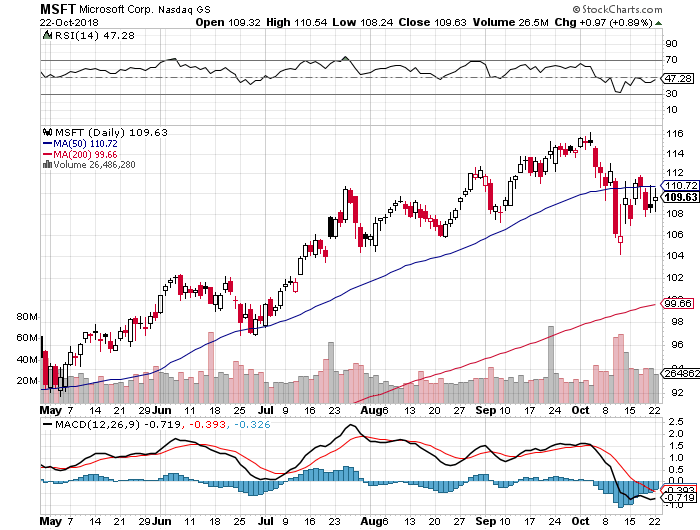

A reader had employed one of my favorite strategies, buying the Microsoft (MSFT) November 2018 $90-$95 in-the-money vertical call spread at $4.50.

He had just received an email from his broker informing him that his short position in the (MSFT) November $95 calls was assigned and exercised against him.

He asked me what to do.

I said, “Nothing.”

For what the broker had done in effect is allow him to get out of his call spread position at the maximum profit point 20 days before the November 16 expiration date.

All he had to do was call his broker and instruct him to exercise his long position in his November $90 calls to close out his short position in the $95 calls.

Calls are a right to buy shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

In other words, he bought (MSFT) at $90 and sold it at $95, paid $4.50 cents for the right to do so, his profit is 50 cents, or ($0.50 X 100 shares X 22 contracts) = $1,100. Not bad for a nine-day limited risk play.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

A call owner may need to sell a long stock position right at the close, and exercising his long November $95 calls is the only way to execute it.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, calls even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

"Life is not fair; get used to it," said the founder of Microsoft, Bill Gates.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.