“The path to the CEO's office should not be through the CFO's office, and it should not be through the marketing department. It needs to be through engineering and design.” – Said Co-Founder and CEO of Tesla Elon Musk

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

November 12, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

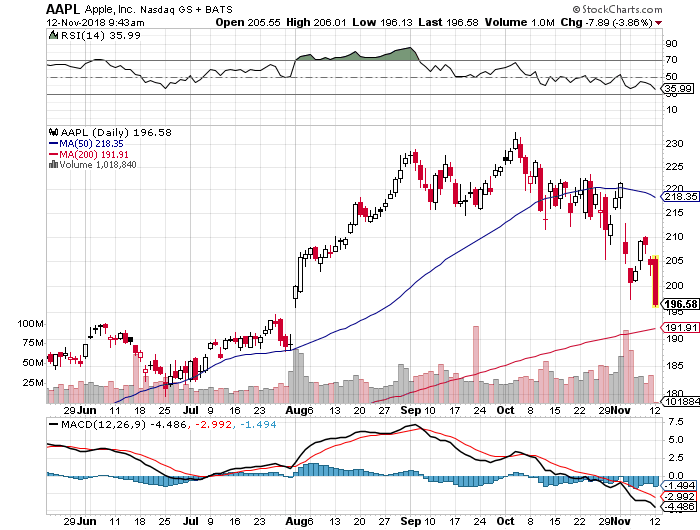

1) Suppliers Cut, Apple Swoons, off $9 on a report that demand for facial recognition parts is fading. I’m a buyer down here, off $40 from the October high. Click here.

2) US Dollar Surges to an 18-Month High. Look for more gains with interest rates hikes continuing unabated. Avoid emerging markets (EEM) and commodities (FCX) like the plague. Click here.

3) Alibaba Coins $1 billion in the First Minute of “Singles Day” in the Chinese “black Friday,” blasting all records. In all, (BABA) took in $25 billion on the day. However, the shares remain in a downtrend as long as the trade war continues. Click here.

4) The Smart Money is Moving Back into Gold. Some $1 billion poured into gold ETFs while cash poured out of stocks in October. In the meantime, the Bank of England has banned further gold sales by Venezuela’s central bank which has been conducting a fire sale of the barbarous relic. Click here.

5) Captain Thomas is Headed Off to Lead the Local Veterans Day Parade. After that, it’s off to Applebee’s to claim my free dinner. Urrah and Semper Fi!

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or IT’S FINALLY OVER),

(SPY), (TLT), (AAPL), (ROKU), (USO)

(THE NEXT OVERHYPED TECH PRODUCT TO BOMB)

(SSNGY), (AAPL), (GOOGL)

Global Market Comments

November 12, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or IT’S FINALLY OVER),

(SPY), (TLT), (AAPL), (ROKU), (USO)

Could it have been the election all along?

Did the massive uncertainty created by the midterm elections hold back investors for all of ten months?

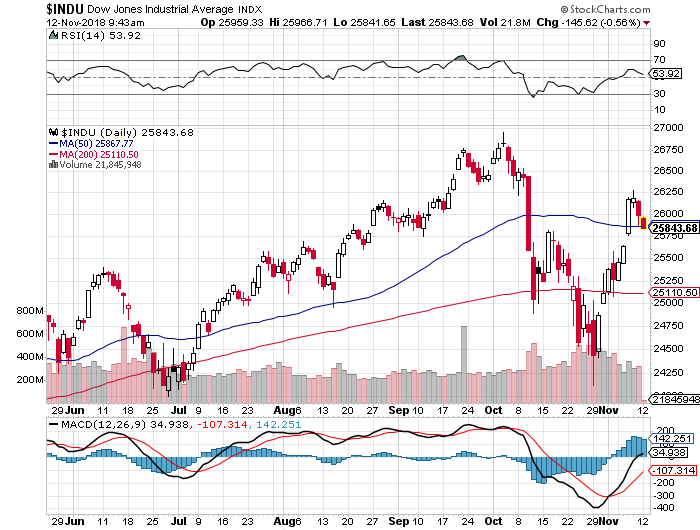

That’s what it looks like now. In a mere three days, shares made back half of what they lost in October, one of the worst trading months in stock market history.

All the market did was trade in a giant range until the day before we trudged out to our local ballot boxes. After that, it was off to the races. Who was the big winner? The people who want to make Donald Trump’s life miserable who now have countless means with which to do so.

Now that the wraps are off, the way is clear for markets to forge on to new all-time highs which they will do by yearend, or early 2019 at the latest.

The Mad Hedge Market Timing Index saw the sharpest rally in 30 years, from 4 to 29 in a week. I told you the market was cheap!

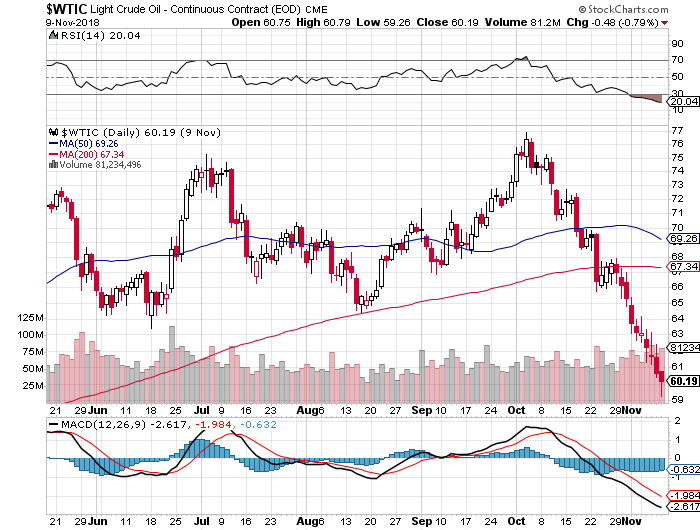

Oil prices (USO) are telling us we are already in recession. Prices are in free fall hitting $60 a barrel, a nine-month low. China certainly is hurting and they are the largest marginal new buyer of Texas tea.

What we are really seeing is a massive unwind of wrong-footed hedge fund oil longs who expected oil prices to soar with the implementation of new sanctions on Iran. They didn’t.

US Exports plunged 26% in September while tariffs paid by US companies soared by an eye-popping 54%. The destruction of American international trade is well underway. When will it end? Who’s benefiting?

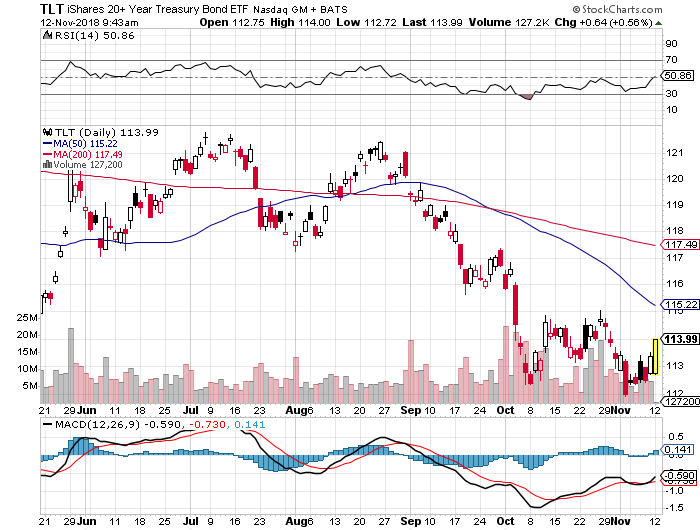

Asians are boycotting US Treasury sales and the US needs to sell to staggering $1.3 trillion in new debt in 2019. Keep hammering the (TLT) with those short positions, your new rich uncle trade.

The Producer Price Index Soared in October, up 0.6% versus 0.2% expected. Yikes, and double yikes! Inflation is here. Keep selling short those bonds (TLT)!

Trump threatened anti-trust action against all of big tech. Market yawned, with Amazon down only $50 after an enormous run-up. A 1% market share against falling prices and enormous customer satisfaction never triggered an anti-trust action before. Jeff Bezos is not the robber baron John D. Rockefeller. Could it be political?

The Number of Job Openings exceeded workers by 1 million in August, with 7.01 million openings versus 5.96 million unemployed. It’s the first time since the Dotcom Bubble top. Are we headed for a 3% Headline Unemployment Rate?

The Golden Age of Gridlock began with the Dems taking the House by flipping 40 seats and the Republicans holding the Senate. Now you can turn off your TV and focus on trading for the next two years. Buy stocks on dips, sell bonds on rallies. Oh, and the 2020 presidential election starts tomorrow.

Housing Sentiment hit a one year low, down a humongous five points, the second fastest drop in history. Rising interest rates have driven a stake through the heart of this once rip-roaring market, but it’s no 2008 replay.

November Share Buy Backs are poised to be the largest in history. Of course, you knew this was going to happen a month ago if you read Mad Hedge Fund Trader. Gotta love that tax reform!

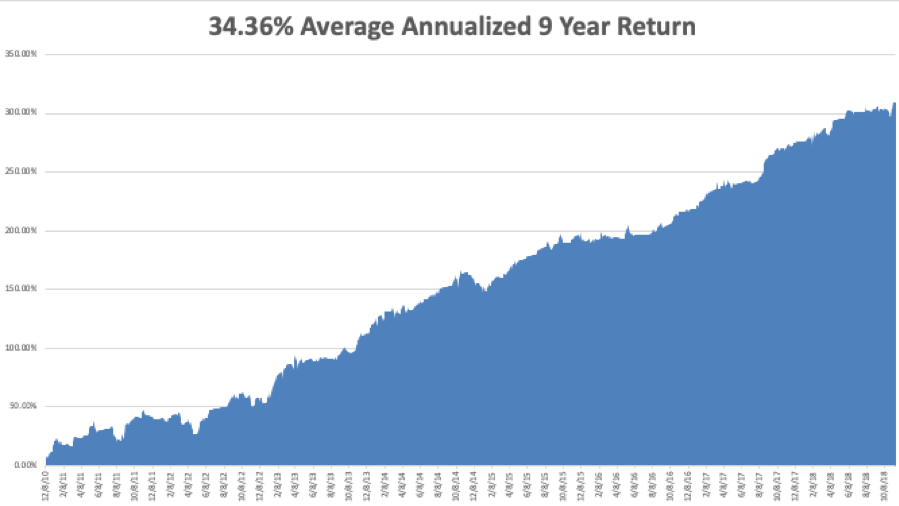

My year-to-date performance rocketed to a new all-time high of +32.94%, and my trailing one-year return stands at 35.33%. November so far stands at +3.31%. And this is against a Dow Average that is up a pitiful 4.43% so far in 2018.

My nine-year return ballooned to 309.41%. The average annualized return stands at 34.72%. 2018 is turning into a perfect trading year for me, as I’m sure it is for you.

In the week before the election, I strapped on the most aggressive long portfolio of this year. It worked like a charm. I then went almost entirely in cash before election day, locking a 12% gain for the model trading portfolio.

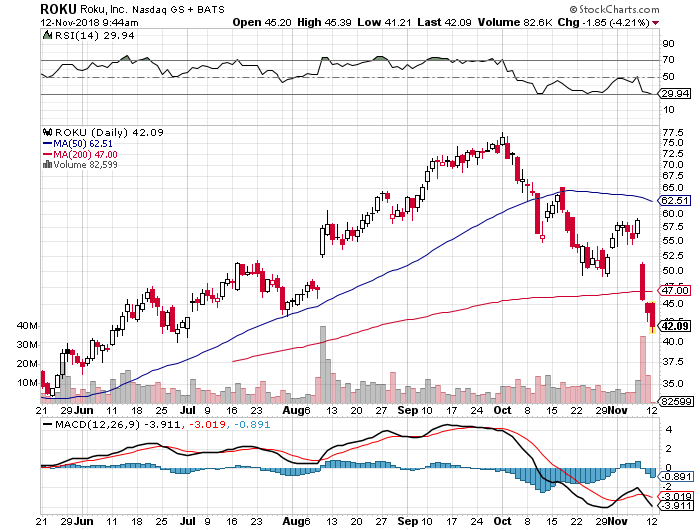

I lasted in cash on two days. On the first down 300 point Dow day, I started adding positions in the old familiar names, including Apple (AAPL), Roku (ROKU) for the Mad Hedge Technology Letter, and a short in the (TLT). Bonds could really get crushed going into yearend targeting a 3.50% yield.

Q3 earnings have finished with a whimper and the blackout periods for share buybacks are now over. Let the buying begin! Some $200 billion has to hit the market by yearend, mostly in technology stocks.

After all the recent fireworks, this will be a quiet week on the data front. The October CPI will be the big one, out on Wednesday.

Monday, November 12 is Veterans Day. Stock markets are open but bonds are closed.

On Tuesday, November 13 at 6:00 AM EST, the NFIB Small Business Optimism Index is released.

On Wednesday, November 14 at 8:30 EST, we have the all-important Consumer Price Index announced. How hot will it be?

At 10:30 AM the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, November 15 at 8:30, we get Weekly Jobless Claims. At the same time, October Retail Sales are put out.

On Friday, November 16, at 9:15 AM, the October Industrial Production is published.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I am on standby to volunteer as a pilot and serve as spotter for Calfire for the latest Northern California wildfires. I put my name on the waiting list last year, and they only just got around to calling me. There were 2,000 other volunteer pilots on the waiting list ahead of me.

You gotta love America.

Good luck and good trading.

Captain John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

November 12, 2018

Fiat Lux

Featured Trade:

(THE NEXT OVERHYPED TECH PRODUCT TO BOMB)

(SSNGY), (AAPL), (GOOGL)

I’m unimpressed.

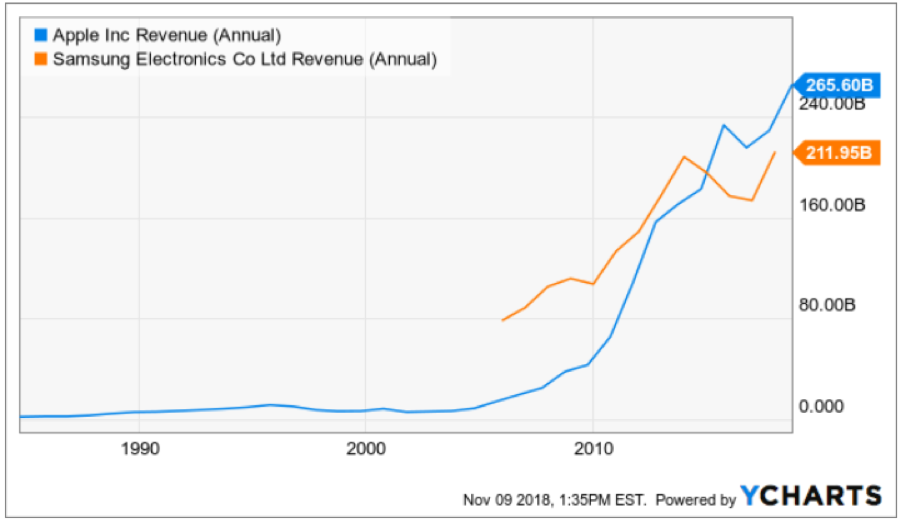

The Samsung (SSNGY) Galaxy F foldable smartphone will be a complete failure just like the Google Glass.

Heralding this product as the new disruptor ready to displace the Apple (AAPL) iPhone is a bunch of garbage.

Yes, Korean stalwart Samsung did achieve success with their flagship smartphone device the Samsung Galaxy which took 6 years to produce. But don’t expect anything similar in terms of sales and scale of adoption.

This will be a dud.

I will outline some of the problems creating a foldable smartphone for mass use.

In fact, why not call a laptop a “foldable smartphone”? I routinely wield my Google (GOOGL) Voice and Skype to call my Rolodex of phone numbers around the world from my computer and my laptop definitely folds!

This smells like desperation from Samsung who has grossly miscalculated gimmicky innovation coining it as a true gamechanger.

Illogically, the act of folding creates a second layer that will result in a bulky product. Logically, it makes sense to have one layer and one layer only.

The sleek smartphones of today are trending towards becoming A2 paper thin and lugging around a brick is not what contemporary-minded netizens had in mind.

Naturally, each future iteration will gradually solve this problem just like Moore’s law observes that the number of transistors in a dense integrated circuit doubles about every two years, meaning you can pack more components into a product over time.

But will there be a second version of this foldable phone?

And then manufacturers must keep in mind which addressable market could this foldable device disrupt. Will it replace the smartphone or the tablet?

Smartphone screens have become bigger with each generation eroding the share and application of the tablet once the smartphone eclipsed the 6-inch screen size.

The tablet industry has suffered since with smartphone enhancements only adding to the misery. This is all evident in this year’s tablet sales down 5.4% YOY through September.

If this foldable phone is pigeonholed as a replaceable tablet product, then sales would address a niche market product at best and have a higher chance of being an outsized flop.

No matter how you cut it up, iPhone users won’t gravitate towards this gimmicky device and chuck their iPhones in the bin.

Cost is also a big factor in this type of product because of the capital thrown at it by Samsung.

They no doubt hope to recoup some of the exorbitant R&D that went into building a brand-new product from scratch.

Rumors floating around the Samsung developer conference pin this foldable phone at a retail price of around $2000.

With this high of price point, I would expect the phone to fly out of my pocket by itself and fold out without me physically doing anything or something similarly impressive.

I highly doubt that Samsung can pull off something that innovative.

The nature of Apple producing brilliant smartphones is that to topple the iPhone, something special is needed to clearly surpass the predecessor along with a must have “it” factor.

That is what you got with the hoards of customers camping overnight in a tent outside of Apple stores dotted around the world waiting to be the first to buy the next version of the iPhone.

That type of pandemonium and hoopla surrounding a consumer product hasn’t been replicated since the days of Steve Jobs.

In general, customers want convenience and the arduous nature of folding out a phone will become tedious in actual reality because most phone users have the propensity to check their phone 15 times per hour.

That also means folding out a phone 15 times per hour and that doesn’t dovetail well with most phone users who, as of now, just slip their phone in and out of a coat or trouser pocket ready in half a second to navigate the e-world.

In short, this device isn’t practical and the targeted market who has the cash to pay for this will dislike the inconvenience of the application.

The user experience is demonstrably inferior to the Apple iPhone.

On the surface, the Galaxy F phone looks innovative and the adaptable nature of the foldable screen is a novelty, but Samsung will have to go back to the drawing board on this one.

I incessantly drum up the issue of the lack of visionaries at the helm of tech companies. The number can be counted on one hand, maybe two.

The type of class where you find the Jack Dorsey and Elon Musk level of visionaries is not a dime a dozen.

When you have a lack of vision, consumers get foldable phones.

Forcibly wedging in hyper-charged display technology into a smartphone is a recipe for disaster.

Maybe someday this technology can be more relevantly applied to a consumer product, but this Frankenstein type product is a mix of two sets of technologies not meant to marry each other.

The act of intent is of equal importance.

The bigger takeaway from this fanciful experiment is that the next wave of innovation to replace the smartphone is in full swing and happening as we speak.

Even though Samsung’s Hail Mary pass looking for that elusive last-second touchdown on the last heave of the game will be a bust. It is only a matter of time before another Steve Job’s lookalike hits the jackpot with the perfect consumer device wooing the billions starting another cult-like phenomenon.

In the next 10 years, display technology will be completely revolutionized adorning our megacities and billboards in ways we never imagined.

This is all just the beginning and filtering out the right formula is what we see taking place from all these tech companies determined to become the king of the jungle.

All of this foldable display technology reverts back to one constant desire – the demand for larger screens.

The 6-inch smartphone was the first baby step to something brilliant.

But ultimately, producing a digital device that can easily fit into our pocket, instantaneously ready for action, possessing beautiful optics with the largest screen possible is the eventual chosen one who will win this sweepstake.

And the first company that can figure out how to get the phone out of our pockets, in front of our eyes without the need for human fingers will have the inside track to revolutionize the world.

We are not there yet, but we are inching closer every day because of the hyper-accelerating rate of technology.

Waiting in the queue are Samsung’s biggest rivals looking to enter the foldable phone market such as Huawei, LG, Lenovo, and many other Chinese Android manufacturers.

There have been whispers that Apple has had some patents filed for foldable technology. And with Sir Jonathan Paul Ive, the Chief Design Officer of Apple, a remarkably special talent designing Apple’s revolutionary products, he certainly has something special to offer hidden up his sleeves.

He always does.

“My style is to have a big vision, a big commitment.” – Said CEO of Softbank Masayoshi Son

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.