When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

December 19, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) (SPX) 1,530 Held. Is this the final bottom of the move? Have we really been in a bear market for 11 months and are about to enter a new bull market? Interesting thought. I jumped from a 10% to 40% long yesterday. Click here.

2) All Eyes Are on the Fed. Their interest rate decision is out at 2:00 PM EST. Everything else is irrelevant. I can’t remember when so much attention is focused on our nation’s central bank. Click here.

3) Stock Buybacks Hit an All-Time High at $1.1 trillion in 2018, on an authorized basis with only $800 billion already spent. Boeing (BA), Johnson & Johnson (JNJ), United Health Services (UNH), and of course, Apple (AAPL) have been the biggest buyers. Will there be a buyback panic going into yearend? Click here.

4) November Existing Home Sales Down 7.0% YOY, the worst read since 2011. December alone was up 1.9%. The West took the biggest hit because it has the highest prices. Will the last one to leave please turn out the lights? Click here.

5) Is the Border Wall a Mirage? If so, stocks would love it as the Friday government shutdown will be averted. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

SPECIAL INFLATION ISSUE

(THE GREAT INFLATION HEDGE YOU’VE NEVER HEARD OF)

(HOW TECH IS EATING INTO HEALTHCARE COSTS)

(VEEV), (CRM), (GSK), (AZN), (MRK), (NVS), (DBX), (OKTA), (TWLO)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

December 19, 2018

Fiat Lux

Featured Trade:

(HOW TECH IS EATING INTO HEALTHCARE COSTS)

(VEEV), (CRM), (GSK), (AZN), (MRK), (NVS), (DBX), (OKTA), (TWLO)

It’s undeniable that American healthcare costs are a big part of a family’s monthly expenses.

Rising deductibles and out-of-network fees are a few of the out-of-pocket costs that can singe a hole in the average joes’ pocket.

It was only in 2016 when healthcare insurance costs eclipsed more than $10,000 a year per person, and over the past 12 months, 68% of people surveyed admitted that future healthcare costs would probably consume a larger part of their earnings.

The result is that healthcare companies are making money hand over fist.

Is there something that I deduce from this lucrative part of the economy that has the potential to feed into the tech sector?

The tidal wave of money spilling into the healthcare industry has also given impetus to these firms hoping to buttress their networks and IT with modern tech infrastructure to take advantage of the efficiencies on offer.

Building the best cloud services geared towards specific industries has been a winning formula and the generated momentum will continue into the next calendar year.

Prime models can be seen all over the tech ecosphere and they will be big winners of 2019.

One example is Twilio (TWLO) who has quietly risen the bar for communication cloud products.

A panoply of small companies can now offer professionalized email, text message, automated voice mail services amongst other services that do the work of 100 employees.

Recently, I touched on a cloud company named Okta (OKTA) responsible for managing the facilitation of passwords.

This identity management company was formed by a group of former Salesforce executives.

In my book, a Salesforce (CRM) credential is a golden stamp of approval for newly formed cloud-companies seeking to develop new cloud products in broad industries.

Why?

Salesforce’s client relationship management platform (CRM) is ubiquitous and the most popular enterprise software.

The way they develop their model is by launching and acquiring new e-commerce and marketing services - which lure in customers into its walled gardens.

Salesforce also applies its artificial intelligence platform Einstein to harness customer relationships and help businesses carry out decisions based on data alone instead of testosterone and emotion.

This all means that Salesforce executives have their finger on the pulse of the cloud landscape and know how to build a cloud business from scratch which is valuable.

They know what certain industries require to mushroom and can deploy resources in the quickest way possible while surrounding themselves by hordes of software engineers who can be poached for a certain fee.

The framework being in place is a massive bounty for these executives who just line up the dots then motor on to an industry confirmed by the data.

And remember that 99.9% of people do not have access to this proprietary data.

Consequently, they know more about corporate America than most Fortune 500 CEOs.

Marrying up the healthcare industry to the cloud was just a matter of time.

Veeva Systems (VEEV) is a cloud-computing company focused on pharmaceutical and life sciences industry applications.

Founder and CEO of Veeva Systems Peter Gassner cut his teeth at Salesforce serving as Senior Vice President of Technology.

His job was building the salesforce.com platform including product, marketing and developer relations.

Gassner has effectively transplanted the Salesforce platform model and applied it to the life sciences industry and has done a great job doing it.

The Veeva Commercial Cloud includes a CRM platform that aids drug company’s management of clients.

The Veeva Vault is a tool that tracks industry regulations, clinical trials, and recommends actionable habits in the cloud.

Veeva's CRM platform is powered by the Salesforce1 app development platform and is integrated into the broader Salesforce Marketing and Service Clouds.

The first mover advantage has offered all the low-hanging fruit for Veeva.

The lack of competition surely never lasts but the extra time to pad their lead is only a positive to its business model.

Veeva has already lured in some of the health industries biggest names such as GlaxoSmithKline (GSK), AstraZeneca (AZN), Merck & Co. (MRK), and Novartis (NVS).

These heavy hitters are meaningfully tied to its ecosystem, and it is safe to say that these relationships are only scratching the surface and have the potential to expand as Veeva installs more add-on tools into its platform.

The popularity shows up in the numbers with Veeva’s 3-year sales growth rate hovering around 30%.

Even better, the profitability of Veeva is indicative of the strength in its business model. They are simply at the right place at the right time to capture the momentum from the digital crossover in the healthcare industry.

Many similar names like Dropbox (DBX) are enormous loss-making enterprises but Veeva has shrugged off this stereotype that many cloud companies of its size can’t be profitable.

The effect of being strategically placed in a position to cherry pick the lucrative healthcare industry has also seeped into the strong profit margins of Veeva able to grow it to over 32%.

Touching more on the profitability, EPS has kicked into gear sequentially rising 80%, and the long-term outperformance is backed up with a 3-year EPS growth rate of 41%.

This cloud company is incredibly profitable for its size, and part of that is the absence of competition which increases pricing power.

Dropbox does not have that luxury of favorable pricing schemes which cripple profitability and leads to attrition and just as harmful – a price war.

Veeva’s forecasts for next year blew past Wall Street’s estimates and the company is modeling for EPS of $1.58 and revenue around $856 million in 2019.

Gassner has even publicly acknowledged that he expects 2019 revenue to come in between $1 billion and $1.1 billion which is a full year ahead of schedule.

The bullish guidance is a clue that the overall cloud story is alive and kicking, and there is absolutely no weakness whatsoever.

Making this story even more compelling is that in the last five years, profits are up six-fold, revenue is up four-fold, and the number of new products is up three-fold.

As we advance into 2019, I believe Veeva is a buy-on-the-dip candidate because of its favorable market position, rapidly expanding margins, and its low enterprise value of $11 billion which deems it, as I daresay, a lucrative buyout target for larger industry cloud players like Salesforce.

The tech industry has a habit of coming full circle become of its network effect of capital, talent, and management.

I would be interested in dipping my toe into any of Salesforce’s offspring because these models are built to scale and are waiting on the doorstep to seize revenue from industry migrating to digital.

Okta did it, and Veeva Systems made the leap of faith too, confirming that the Salesforce method is a path to untold profits for cloud-based software companies.

When the market can finally digest the macro rigmaroles, shares for this innovative and hyper-growth cloud company is set to take off.

“You must always be able to predict what's next and then have the flexibility to evolve.” – Said Founder and CEO of Salesforce Marc Benioff

Global Market Comments

December 19, 2018

Fiat Lux

SPECIAL INFLATION ISSUE

Featured Trade:

(THE GREAT INFLATION HEDGE YOU’VE NEVER HEARD OF)

So, what am I talking about here?

Blue chip growth stocks? Diamonds? Residential real estate? Gold?

No, I am talking about grand pianos manufactured by Steinway & Sons of Queens, New York.

Did you say pianos?

Yup, the kind with which you sit down and play “As Time Goes By.” (Casablanca).

During the 19th century, there were over 1,200 US piano makers manufacturing a product which can include more than 12,000 parts. It was the technological Boeing 474 of its day.

Today, there are only five American piano makers, and just one, Steinway, is considered investment grade.

That’s because when Carnegie Hall, London’s Royal Albert Hall, or Beijing’s Concert Hall National Grand Theater is in the market for a new concert grand piano, they only consider Steinways.

You can start with an entry level 5’1” Steinway Model M baby grand piano, or ostentatiously splurge with an opera house filling nine-foot-long concert grand Model D.

I received the bad news from my kids’ piano teacher a few months ago. After six years of lessons, they had outgrown their piano, a modest entry level 1966 Wurlitzer spinet.

I approached the matter as I do everything, with exhaustive, no stone unturned research. What I learned was fascinating.

Given the available space in my home and the kids’ commitment to the enterprise, I decided that a seven-foot Steinway Model B would do.

My first visit was to the local Steinway dealer. For a mere $100,000, and $110,000 with tax I could buy a brand new 6’11” Model B.

For an extra $15,000 I could buy a model B with the Spirio technology that enabled the piano to play itself to incredible symphony standard.

Financing was available at a hefty 10%, compared to only 2% for my Tesla. Banks are not allowed to accept pianos as collateral.

Steinway also sells used pianos, but will only go back 15 years, getting me down to the $70,000 range. I thought I’d look around more.

So I plunged into my favorite source of incredible, once-in-a-lifetime deals, eBay (EBAY).

The offerings were vast.

They included everything from a $13,500 1897 Model B in desperate need of a complete $30,000 rebuild to a 2013 Model B in showroom condition for $87,500.

Obviously, I had my work cut out for me especially since I am not a musician myself. Coming from a family of seven kids, there was never enough money for music lessons.

Thus, I have been a lifetime consumer of music rather than a producer.

It turns out that, like Rolls Royce’s (that other great unknown inflation hedge), no one ever throws a Steinway away. A fully restored 130-year-old model can almost cost as much as a new one.

And there is your inflation play.

The list price for a Steinway Model B in 1900 was $1,050. Some 117 years later, it is up 100-fold, giving you a compound annual growth rate of 3.97% a year.

This compares to 5.18% for ten-year US Treasury bonds, and 9.71% for the S&P 500 over the same time period. But then you can’t play a stock certificate, let alone make your kids practice on it.

A Steinway is, in fact, the perfect instrument with which to make these long-term inflation calculations.

Vintage cars, diamonds, and homes are all unique, have varying quality, and are all susceptible to overvaluation and hype from aggressive salesmen and dealers. Even gold coins can have huge differences in valued based on grade and rarity.

Save for a few patents issued in the 1930s covering keyboard and soundboard manufacturing, Steinways are built almost identically to the way they were made 117 years ago. Tour their factory and you find workshops filled with primitive 100-year-old iron and wooden tools.

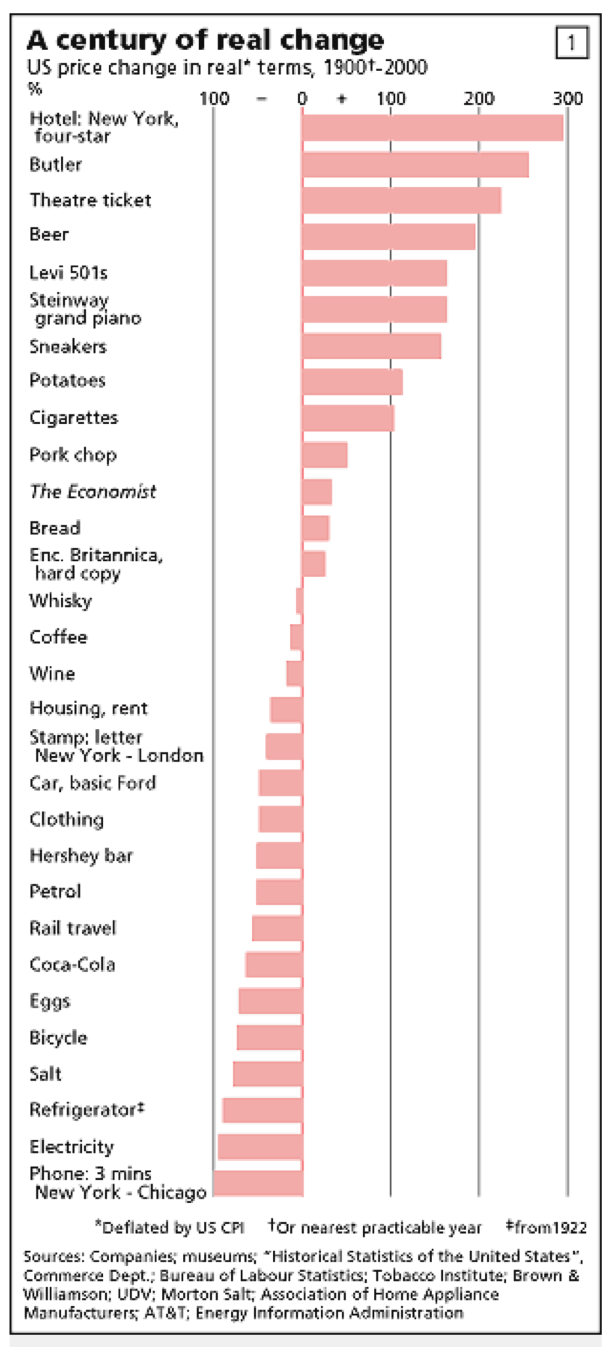

Every other manufactured product has seen massive productivity and technology improvements over a century that have caused real prices to completely collapse.

Take computers, for instance, which have suffered an average annual price decline of 30% since 1950. The cost of telephone calls has fallen by almost 100% in real terms since 1900 (see table below which I lifted from my former employers at The Economist)

That is the source of the rise in our standard of living.

It gets better. The prices of Steinways are rising fairly dramatically in real terms relative to almost everything else, thanks to a host of geopolitical reasons.

It turns out that the Chinese are taking over the global market.

While 200,000 pianos a year are sold in the US, the figure is over 1 million in China.

Many Chinese parents hope their children will achieve the international prominence of 35-year-old Lang Lang who commands millions of dollars a year in global performance and licensing fees. Many aspiring parents drive their kids to practice eight hours a day.

As a result, the Chinese have been buying up all the used premium pianos in the world including Steinways in the US, Bechsteins and Bosendorfers in Germany, Faziolis in Italy, and Yamahas and Kawais in Japan.

Whenever Chinese buy a luxury apartment in San Francisco, the first thing they do is outfit it with a Steinway grand piano even if they don’t play. It is the ultimate status symbol not only because of the price they pay but the space it takes up.

As a result, Steinways not only sell at a large premium to other pianos but are dear relative to ALL manufactured products over the expanse of time.

Researching the history of Steinway, you find a storied company that has undergone the sad but familiar travails of American manufacturing over the last century.

In short, it’s a miracle that this company still exists.

The first pianos were sold by a German immigrant from Hamburg in 1856. By 1972, a lengthy strike and competition from Japanese imports forced the original Steinway family to sell out to CBS after five generations.

Then there was a brief but disastrous experiment with Teflon parts in the 1970s. Suddenly Steinways didn’t sound like Steinways.

A private equity deal followed in 1985. From 1996 to 2013 it traded on the New York Stocks exchange under its own ticker symbol (LVB) (for Ludwig von Beethoven).

Steinway was then bought by my friend and newsletter client, hedge fund legend John Paulsen for $500 million. It produced its 600,000th piano in 2015.

If you want to watch a film about old-fashioned American manufacturing, vanishing skills, the pride of craftsmanship and working with your hands, watch the highly entertaining documentary movie “Note by Note: The making of Steinway L1037.”

It has won several awards.

It is wonderful to watch with the kids in that it shows what work was like in the old United States I remember, and can be streamed online for $4.99 by clicking here. https://www.amazon.com/Note-Harry-Connick-Jr/dp/B002ZS0R5I/ref=tmm_aiv_swatch_0?_encoding=UTF8&qid=&sr=

As for my own Steinway search, it had a very happy ending.

eBay enabled me to find a local Craigslist listing in Jackson, Mississippi for a 1951 Model B that was originally purchased by the University of Mississippi Music Department. It had been played by every noted pianist touring the South for a half century.

Some 20 years ago, a local doctor then purchased it right off the stage at a university surplus equipment sale.

This year the doctor retired, sold his mansion but had no room for a grand piano in his rapidly downsizing lifestyle.

He listed the piano for a low-ball price of $18,000, the cost of his 1997 ground up restoration. After I had a professional musician visit the house to check the condition and tone, I was the only bidder.

I figure if the kids ever get sick of practicing, I can always flip it to the Chinese for double. That’s me, always the trader.

I am totally comfortable buying big-ticket items off of eBay as I have been trading there for 20 years. I have bought five cars there for assorted family members.

If you aren’t comfortable with eBay, there is always Bruno.

Dallas, Texas-based Maestro Bruno Santo is a Julliard graduate, former Steinway dealer, and the most knowledgeable individual I ran into during my far-ranging research. He is also quite the salesman.

He runs a high-volume, low-margin business model which I admire and can probably get you a very nice Steinway in the mid $30,000s.

You can reach him through his website at http://redbirdllc.com/home

To learn more about the interesting and beautiful world of Steinway pianos, please visit the company’s website at http://www.steinway.com

Getting an 800-pound finely tuned musical instrument from Jackson, Mississippi to San Francisco, California is a whole new story on its own.

What I learned about the national trucking industry was amazing, and boy, did I get a deal!

Watch for my future research piece on “What I learned Moving My Steinway Grand Piano.”

As for the old Wurlitzer, it is now happily ensconced in my Lake Tahoe beachfront estate. Neighbor Michael Milliken has already completed the quality of the play.

The Winning Bid

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.