Winter 2018 was a time to remember as American tech shares were caught up in a perfect storm of a global growth scares, interest rate gyrations, and a political tug of war that sees no end in sight.

All of this made investors run for the hills after a huge run-up of tech shares since the February correction in 2018.

Even after all the chaos, there is one tech stock that has muscled out the noise and is hovering at all-time highs.

Coincidently, this is a name that I recommended last year as a strong 2019 play and I would like to reaffirm my prognosis by doubling down on cloud communications company Twilio.

Twilio will be a darling of 2019 because it seeks to upgrade a whole swath of communications in legacy companies that are scurrying to compete with the rest who have forged ahead.

The start of 2019 has been a positive omen for Twilio shares, and are almost 10% higher in this short span of time.

It’s discernable that it is not only me who believes in this company and naysayers are few and far between.

Twilio doesn’t get as much PR as it should because making sure the back-end communication channels are executing at optimum levels is not exactly a sexy part of tech with shiny smartphones and wearable gadgets.

This company produces software and are good at what they do.

Many of you might not have even heard of them but I am sure you have heard of companies such as Uber, Lyft, and Airbnb.

Why do I mention these three private tech companies that are on the verge of going public this year?

Because this trio of unicorns is all powered by Twilio’s communication technology that is best of breed in their genre of cloud software.

More specifically, Twilio is a platform as a service (PaaS) firm offering programmatic phone call functions, can automate sending and receiving text messages, and performs other communication functions using its web service APIs.

When your shaggy-haired Uber driver calls asking you to reveal yourself out of a concrete apartment block or your lavish gated community, this is all facilitated by Twilio’s technology.

At the 2018 Twilio Signal Conference in San Francisco, Twilio indicated that its latest “call center in a box” product called Flex was up and running after announcing in March last year.

Prior to Twilio’s roll-out, this type of call center functionality was only reserved for the Fortune 500 companies that could afford expensive software to serve its minions of customers.

The small guy was left out in the cold as usual.

Twilio has reshaped the call center and, at $1 per hour or $150 per month, has made itself a gamechanger for SMEs who don’t have the manpower or capital to fund exorbitant back-end operations.

Twilio is really going after anyone with a light or bulky-shaped wallet as you see from their all-star lineup of customers. U-Haul, real estate website Trulia, and data analytic firms Scorpion and Centerfield are just a few of their customers proving the incredible flexibility and inclusive nature of the software.

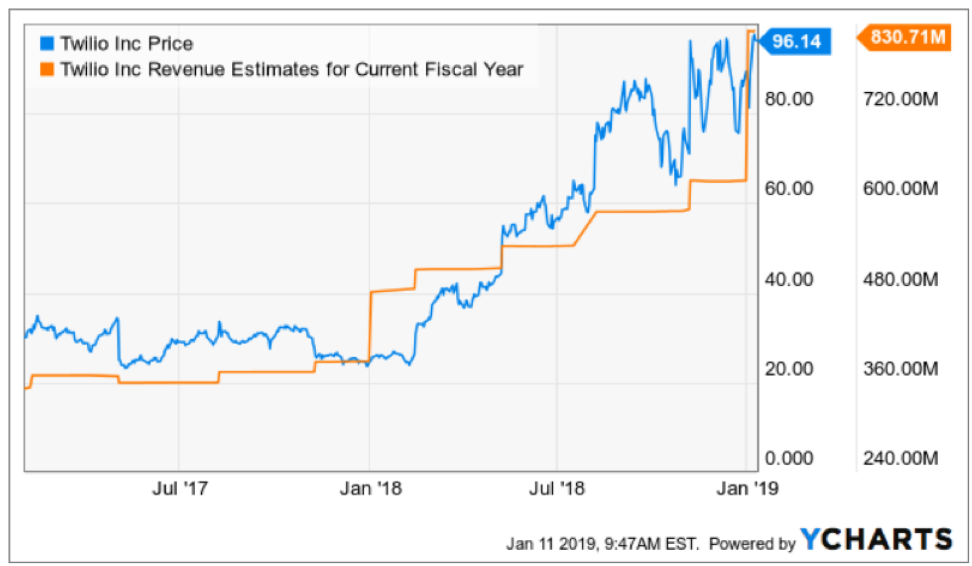

It’s not a shock that this stock has gone ballistic in 2018 surging over 200% and I must admit investors need to wait for this molten hot stock to cool down.

But how can you blame a company that habitually beats any expectations by investors because of its super growth model and rapid broad-based adoption?

From the fourth quarter of last year, revenue accelerated to 48% YOY and Twilio followed that up with a blistering 54% YOY quarter.

Then they pulled a shocker guiding down only expecting 35% to 37% growth but dismantled any whiff of jangling investors' nerves by posting another quarterly growth rate of 54%.

If you average out the three-year sales growth rate, few can topple the 57% Twilio has registered.

Performance has been fantastic, to say the least, and Flex could be the product that widens their industry lead and fortifies the moat around them.

Airbnb, Uber, and Lyft will avoid tinkering with the back end of their operations before their 2019 IPOs boding well for Twilio who are on a hot streak scoring a series of big contracts.

And as their IPO dates creep closer, I firmly believe that the quiet story of Twilio will jump to the fore.

There is only so long this brilliant company can be kept under wraps.

If you take a long-term view of companies, this cloud company will be investor’s ticket to early retirement.

Even though Twilio has failed to become profitable, this year bodes well with EPS growth expected to be over 10%.

This year will be the precursor to 2020 when Twilio really invigorates earnings capability with analysts forecasting over 48% EPS growth in 2020.

Sometimes cloud companies must move mountains and absorb years of losses to finally breach the profitability marker, that time is about to come for Twilio and along with maintaining its riveting growth, the business model will become more sustainable with a vast improvement in cash flow.

Although Twilio’s competitive advantage is not as large as Microsoft (MSFT), this company has the same type of momentum going into 2019.

I believe many institutional investors have yet to hear this name echo around investment offices, and if any tech stock is going to be the darling of 2019, it will be Twilio.

I expect Twilio shares to shortly eclipse the $100 mark and maintain that level with an infusion of zeal that mimics Microsoft’s share price.

Notice that through hell and high water, any massive sell-off that crushes Microsoft swan diving below $100, shares find itself above $100 again in a jiffy.

I expect Twilio to exude similar characteristics, albeit with more volatility.

Twilio has the ability to rise 10% or even 15% on any given day on good news.

Being at all-time highs again only illustrates the attractiveness of the name.

In general, this should really be a software-as-a-service (SaaS) year for investors as the migration to these services picks up speed.

Any meaningful dip that can be attributed to outside forces should be bought because there are no fundamental problems with Twilio.

Don’t chase the stock here because it’s up almost 300% in the past 365 days - wait for it to fall into your wheelhouse.

To add the cherry on top, this company is far away from the geopolitical trade winds.

And even though fundamental differences have yet to be hashed out, at least it debugs one potential headwind to the fundamental story.

Twilio should outperform this year relative to the large tech stocks, it’s up to you if you want to ride on the coattails of this story or try your luck on less qualified names.

And not to toot my own horn, but this stock is already up almost 30% since I urged readers to pile into it.

I am strongly bullish Twilio.