When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 22, 2019

Fiat Lux

Featured Trade:

(I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(MARCH 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(BA), (FCX), (IWM), (JNJ), (FXB), (VIX), (JPM)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 20 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What do you make of the Fed’s move today in interest rates?

A: By cutting short their balance sheet unwind early and ending quantitative tightening (QT) early, it amounts to two surprise interest rate cuts and is hugely “RISK ON”. In effect, they are injecting $2.7 trillion in new cash into the financial system. New highs in stocks beckon, and technology stocks will lead. This is a game changer. In a heartbeat, the world has moved from QT to QE, and we already know what that means for socks. They go up.

Q: Why buy Boeing shares (BA) ahead of a global recession?

A: It’s an 18-day bet that I’ve made in the options market. The US economic data is already indicating recession. The data will continue to worsen and that will continue until we go into a recession. But that’s not happening in 18 trading days. Also, we’re getting into Boeing down 20% from the top so our risk is minimal.

Q: Why are we in an open Russell 2000 (IWM) short position?

A: We now have three long positions— 40% on the long side with the Freeport McMoRan (FCX) double position. It’s always nice to have something on the other side to hedge sudden 145-point declines like we have today. Ideally, you want to be hedged at all times. But it’s hard to fund good companies to sell short in a bull market.

Q: Do you need some euphoria to get the Volatility Index (VIX) to the $30-$60 level?

A: No, you don’t need euphoria. You need fear and panic. The (VIX) is a good “fear index” in that it rises when markets are crashing and falling when markets are slowly rising. And for that reason, I’m not buying (VIX) right now. With a sideways to slowly rising market, we could see the $9 handle again before this move is over.

Q: What should be the exit on the Russell 2000 (IWM)?

A: One choice is taking 80% of the maximum profit when you hit it—that’s where the risk-reward tips against you if you keep the position. The other option is to be greedy and run it all the way into expiration, taking the full profit. It depends on your risk tolerance. Remember, we hit the 80% profit three times in March only to stop out of positions for a loss. The market just doesn’t seem to want to let you take the whole 100%.

Q: Why are all your expirations on April 18?

A: That’s when the monthly options expire; therefore, they have the most liquidity of any other option expiration. If you go with the weeklies before or after the monthlies, the liquidity declines dramatically, which can be very frustrating. Since I used to cover only the largest clients, we could only trade in monthlies because we needed the size.

Q: Will Johnson and Johnson (JNJ) survive all those talcum powder lawsuits?

A: They’ve been going on for 10 years—you’d think they’d know by now if they have asbestos in their talcum powder or not. I highly doubt this will get anywhere; they’ll probably win everything on appeal.

Q: What do you anticipate on Brexit?

A: I think eventually Brexit will fail; we’ll have a referendum which will get voted down, Britain will rejoin Europe, and the British pound (FXB) will go to $1.65 to the dollar where it was when Brexit hit three years ago, up from $1.29 today. It would be economic suicide for Britain to leave Europe, as they would have to compete against Europe, the US, and China alone, and they are slowly figuring that out. Demographic change alone over three years would guarantee that another referendum fails.

Q: My partner owns JP Morgan (JPM). Do you still say banks are not a good place to be?

A: Yes. Fintech is eating their lunch. If they couldn't go up with interest rates moving up in the right direction, they certainly won’t be doing better now that interest rates are going down. Legacy banks are the new buggy whip industry.

Q: Why are commodities (FCX) increasing with a coming recession?

A: They are a hard asset and do better in inflation. Also, they’re stimulating their economy in China and we aren't—commodities do better in that situation as China is the world’s largest buyer of commodities, as do all Chinese investments.

Q: Would you buy Biogen (BIIB) on the dip? Its down 30% today.

A: Canceling their advanced phase three trials for the Alzheimer drug Aducanumab is the worst-case scenario for a biotech company. Some $12 billion in prospective income is down the toilet and many years of R&D costs are a complete write-off. Avoid (BIIB) until the dust settles.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

March 21, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) The Fed Eases Again, by cutting short their balance sheet unwind and ending quantitative tightening early. It amounts to two surprise interest rate cuts and is hugely “RISK ON”. New highs in stocks beckon. This is a game changer. Click here.

2) Biogen Blows Up, canceling their phase three trials for the Alzheimer drug Aducanumab. This is the worst-case scenario for a biotech drug and the stock is down a staggering 30%. Some $12 billion in prospective income is down the toilet. Avoid (BIIB) until the dust settles. Click here.

3) Micron Technology Comes in Line, with weak guidance and production cutbacks, but the shares soar anyway. Go figure. Investors really want to get into this stock in the worst way, even though the industry is still in its down cycle. Click here.

4) Europe Fines Google $1.7 Billion, in the third major penalty in three years. Clearly, there’s a “not invented here” mentality going on. It's sofa change to the giant search company. Buy (GOOG) on the dip. Click here.

5) Levi Strauss is a Hit, with the shares soaring 35% from the first day IPO price of $17. It’s interesting that the Haas family is unloading their legacy shares at this point in the economic cycle while still maintaining control of the iconic denim maker. Avoid (LEVI). Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(DIVING BACK INTO THE MOUSE HOUSE),

(DIS),

(THE ALPHABET NO-BRAINER),

(GOOGL)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 21, 2019

Fiat Lux

Featured Trade:

(DIVING BACK INTO THE MOUSE HOUSE),

(DIS),

Walt Disney (DIS) shares have just suffered a 6% dive on the news they will buy the assets of 20th Century Fox in one of the largest entertainment takeovers in history. The new combined mega-company will dominate Hollywood and content production in general.

In fact, the new acquisition will enable the company to go from strength, enabling it to become the most powerful media company in well….the universe, to borrow from one of its many franchises.

This gives us a rare entry point to get into. Disney is just about to launch its own streaming service which will allow them to take a generous share of the Netflix and Amazon businesses.

Disney is spending a staggering $12 billion on new content this year. The parks are all packed to the gills. They already launch so many blockbuster movies that they have to be rationed awards at the Oscars.

It really is a company that is firing on all cylinders, as long as its erstwhile CEO Bob Iger doesn’t run for president in 2020.

I am therefore buying the Walt Disney Corp (DIS).

I’ll never forget the first time I met Walt Disney. There he was smiling at the entrance on opening day of the first Disneyland in Anaheim, Calif., in 1955 on Main Street, shaking the hand of every visitor as they came in. My dad sold the company truck trailers and managed to score free tickets for the family.

At 100 degrees on that eventful day, it was so hot that the asphalt streets melted. Most of the drinking rooms and bathrooms didn’t work. And ticket counterfeiters made sure that 100,000 jammed the relatively small park. But we loved it anyway. The bandleader handed me his baton and I was allowed to direct the musicians in the most ill-tempoed fashion possible.

After Disney took a vacation to my home away from home in Zermatt, Switzerland, he decided to build a roller-coaster based on bobsleds running down the Matterhorn on a 1:100 scale. In those days, each ride required its own ticket, and the Matterhorn needed an “E-ticket,” the most expensive. It was the first tubular steel roller coaster ever built.

Walt Disney shares have been on anything but a roller-coaster ride for the past four years. In fact, they have absolutely gone nowhere.

The main reason has been the drain on the company presented by the sports cable channel ESPN. Once the most valuable cable franchise, the company is now suffering on multiple fronts, including the acceleration of cord-cutting, the demise of traditional cable, the move to online streaming, and the demographic abandonment of traditional sports such as football.

However, ESPN’s contribution to Walt Disney earnings is now so small that it is no longer a factor.

In the meantime, a lot has gone right with Walt Disney. The parks are going gangbusters. With two teenage girls in tow, I have hit three in the past two years (Anaheim, Orlando, Paris).

The movie franchise is going from strength to strength. Pixar has Frozen 2 and Toy Story 4 in the pipeline. Look for Lucasfilm to bring out a new trilogy of Star Wars films, even though Solo: A Star Wars Story was a dud. Its online strategy is one of the best in the business. And it’s just a matter of time before they hit us with another princess. How many is it now? Nine?

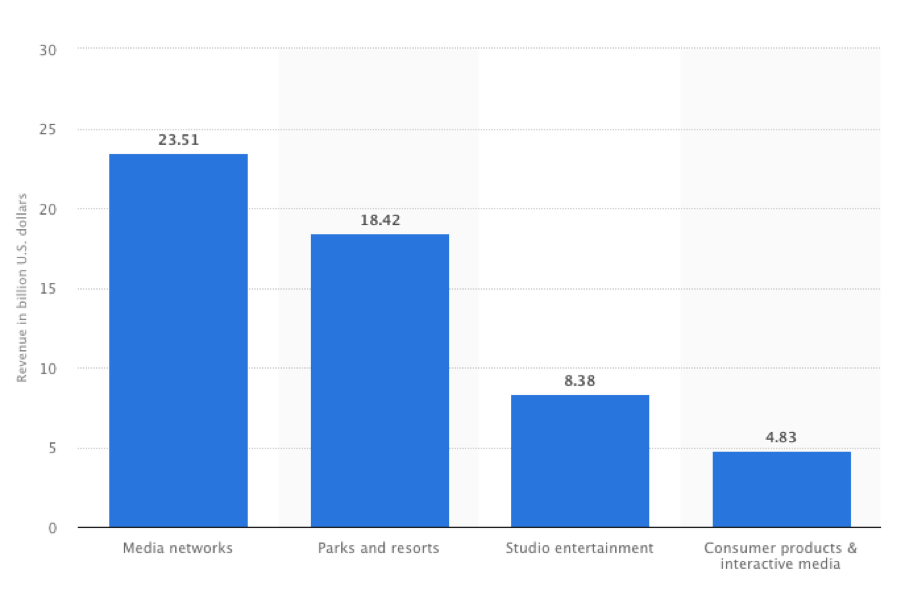

It is about to expand its presence in media networks with the acquisition of 21st Century Fox (FOX) assets, already its largest source of earnings. It will join the ABC Television Group, the Disney Channel, and the aforementioned ESPN.

It has notified Netflix (NFLX) that it may no longer show Disney films, so it can offer them for sale on its own streaming service. Walt Disney is about to become one of a handful of giant media companies with a near monopoly.

What do you buy in an expensive market? Cheap stuff, especially quality laggards. Walt Disney totally fits the bill.

As for old Walt Disney himself, he died of lung cancer in 1966, just when he was in the planning stages for the Orlando Disney World. All that chain smoking finally got to him. He used to start out every TV show with a non-filter Luck Strike in his hand.

My own grandfather died the same way from the same brand, the one who fought in the trenches of WWI where Euro Disney sits today. It is a small world after all.

Despite that grandfatherly appearance on the Wonderful World of Color weekly TV show, friends tell me he was a complete bastard to work for.

Mad Hedge Technology Letter

March 21, 2019

Fiat Lux

Featured Trade:

(THE ALPHABET NO-BRAINER)

(GOOGL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.