If you are looking for an opportunistic trade in an up and coming tech growth story, then look no further than Stitch Fix (SFIX) which is a product of an algorithm meeting a stylish wardrobe.

This online personal styling service offering denim, dresses, blouses, skirts, shoes, jewelry, and handbags for men, women, and kids under the Stitch Fix brand is a first of a kind.

This company is a technology company because the underlying business deploys data science to work with personal stylists and machine learning (AI) for personalized recommendation.

Let’s take a peek at how they do it.

They send individually picked clothing and accessories items for a one-time styling fee.

Customers fill out a survey online about their style preferences then an in-house stylist chooses five items to send to the customer.

Human stylists pick items according to a customer's survey answers and any access the customer gives them to their social media profiles such as Facebook.

The customer schedules a date to receive the shipments, which is referred to as a "Fix".

Once the shipment is received, the customer has three days to choose to keep the items or partially return the order or send it all back.

If the customer keeps at least one item, the initial styling fee is credited towards the cost of the item.

In addition to the styling fee being credited, if the customer decides to keep all five items, the customer receives 25% off the total cost of the items.

Customers choose the shipping schedule, such as every two weeks, once a month, or every two months.

The company also supports integration with Pinterest boards, allowing customers to add photos of fashion looks that appeal to them.

Developing around the importance of client relationships is the heart and soul of the business.

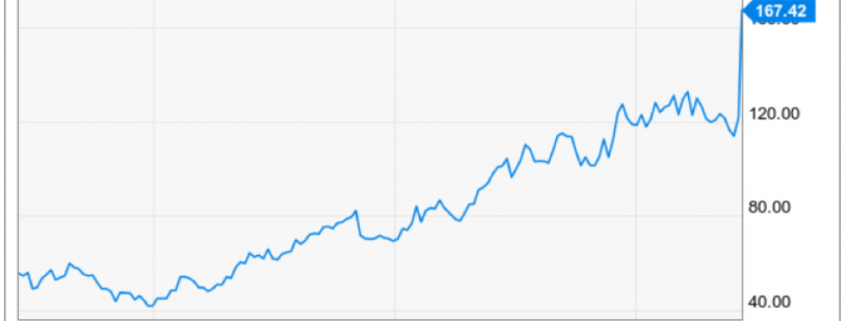

There were many financial highlights in the second quarter that provide more color on how Stitch Fix manages the business and continue to drive this sustainable long-term growth.

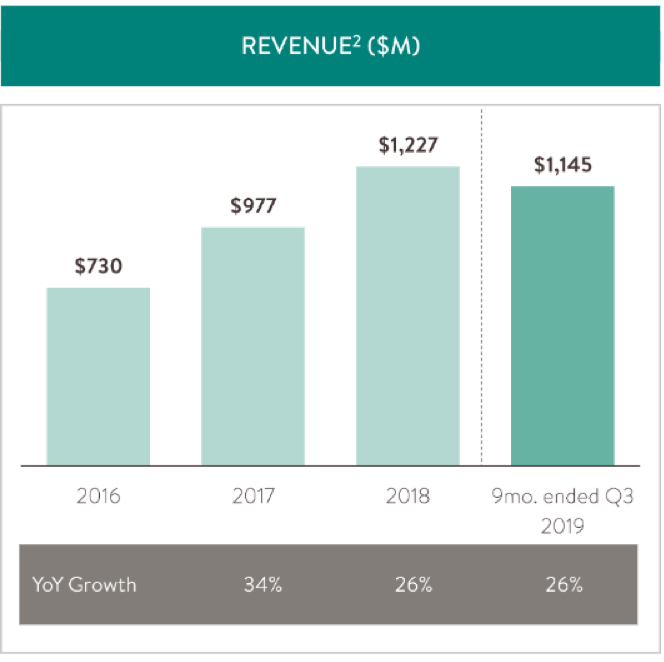

In the second quarter, they generated a net revenue of $370 million blowing away guidance and representing 25% year-over-year growth.

The 25% growth year-over-year is exceeding the believed guidance of 22% to 24% growth.

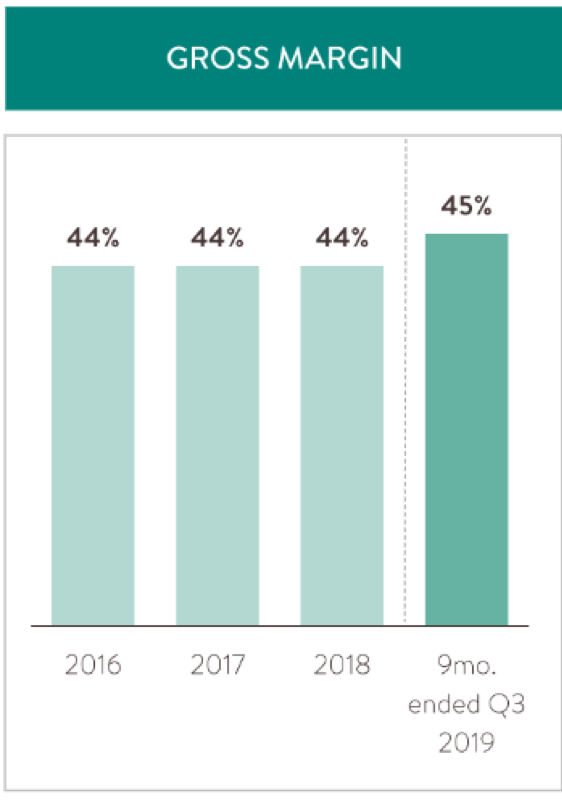

Q2 gross margin was 44.1%, 110 basis points higher than last year's Q2 reflecting a higher sell-through rate combined with lower inventory reserve expense and lower clearance activity year-over-year.

Stitch Fix delivered $12 million in net income and $19.2 million in adjusted EBITDA which also exceeded guidance.

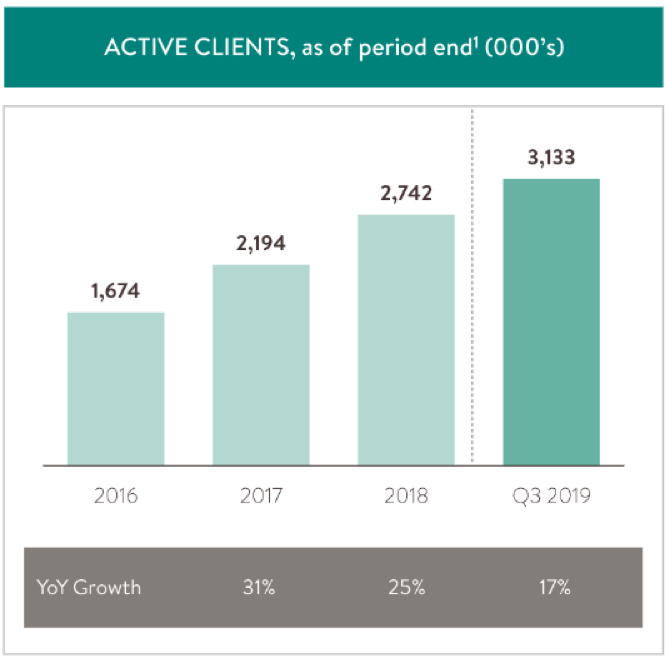

The firm grew active client count to 3 million as of the first month of 2019, an 18% increase year-over-year.

These results show the deep commitment to delivering long term growth while making significant investments in future categories and capabilities.

More proof of the robust growth projections can be understood with healthy projections for the upcoming quarter, for Q3 2019, Stitch Fix expects net revenue between $388 million and $398 million dollars, representing growth of 22% to 26% year-over-year.

The last quarter of 2019 should be even better with revenue growth accelerating, for Q4 2019 specifically, projected net revenues is between $410 million to $430 million, representing growth of 29% to 35% year-over-year.

If the company can hit the upper limit of growth and register 35% year-over-year growth in Q4, then shares will easily surpass $40 barring any black swan catastrophes from the geopolitical scene.

Marketing is another lever Stitch Fix made use of.

In the past, for instance, they chose to market more aggressively with men or less with plus-sized clients depending on the available inventory at each product group.

The sales and marketing provide Stitch Fix with the flexibility to manage growth and ensure they can deliver a positive experience to all clients.

Putting this framework into context, in Q2, Stitch Fix had higher than anticipated demand from existing clients.

This was proven by the year-to-date repeat rate of 88%.

As a result of this increased demand, repeat clients is good for the inventory in the quarter.

Hammering down on that technology advantage that is turning out to be the difference maker, Stitch Fix launched a new inventory optimization algorithm to more effectively allocate inventory across the customer base.

Historically, Stitch Fix has optimized inventory allocation one client at a time based on which client was first in line.

But this new algorithm gauges the preferences of a broader universe of clients in the queue, to determine which inventory should be made available to Style as they start for each client.

This guarantees suitable inventory to meet each client's style preferences regardless of the client's position and our style in queue.

Early signs from this new algorithm demonstrated increases in client satisfaction and engagement.

Stitch Fix believes this superior algorithm will enable them to effectively serve a growing client base over time while also driving efficiencies across styling, inventory management and operation.

Stitch Fix is also expanding abroad with a local U.K. team and investing in the ground operations.

The company is leveraging data science capabilities to serve the unique preferences of UK fashion.

They are on track for a Q4 U.K. launch and hope to capitalize on an expanded U.S. and UK addressable market of over $430 billion.

The latest financials make it hard to slap on anything other than a buy rating.

As many tech companies are experiencing a drain of decelerating growth to their models, Stitch Fix is still in their sweet spot and shares should reap the rewards for this type of execution.

Giving what the market wants is never a bad idea.