While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 30, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or INTERESTING TIMES ARE UPON US)

(MO), (PM), (FXB), (SPY), ($INDU), (GS), (MTCH), (USO), (UUP)

“May you live in interesting times.” The question is whether this old Chinese proverb is a blessing or a curse.

Our beleaguered lives have certainly been getting more interesting by the day, if not the hour. Trump has been withholding military aid from foreign leaders to fish for dirt on those who may run against him in 2020. The prospects of the Chinese trade negotiations seem to flip flop by the day.

Prospective IPOs for Saudi ARAMCO and WeWork have been stood up against a wall and shot. The Altria (MO) - Philip Morris (PM) merger went up in smoke. Brexit (FXB) has turned into a runaway roller coaster that has lost its brakes. And that was just last week!

All of this is happening with the major indices (SPY), ($INDU) mere inches away from all-time highs, with valuations at the high end of the decade-old band. A worse risk/reward for initiating new positions I can’t imagine. I think I’ll go take a long nap instead.

There are times to trade and there are times to engage in research and this is definitely time for the latter. That means when it is time to strike, you already have a list of short names on which to execute. The worst time to initiate research is when the Dow is down 1,000 points.

I believe the markets are gridlocked until we get a good look at Q3 corporate earnings. If they are as bad as the macro data is suggesting, markets will tank. If they aren’t, we may see a begrudging slow-motion grind up to new highs.

Our launch of the Mad Hedge Biotech and Healthcare Letter was a huge success. Let me tell you, we have some real blockbusters lined up in our newsletter queue. The Tuesday letter will have a link that will enable you to get in at the $997 a year founders’ price. Otherwise, you can find it in our store now for $1,500 a year. Please click here.

The WeWork IPO is on the Rocks, with the CEO soon to be fired for self-dealing. In any case, the company has minimal added value and will not survive the next recession when the bulk of its tenants walk. Don’t touch this one on pain of death, even down three quarters from its original valuation.

Watch out for October, says Goldman Sachs (GS), which will see a volatility (VIX) spike 25%. Shockingly poor Q3 corporate earnings results could be the trigger with almost every company negatively impacted by the trade war. This could set up our next entry point on the long side.

The Saudi ARAMCO IPO is on the skids in the wake of the mass drone attack. Terrorist attacks on your key infrastructure is not a great selling point for new shareholders. It just underlines the high-risk investing in the area. The world’s largest IPO may get cancelled.

A huge killing was made on the Thomas Cook affair. It looks like short sellers raked in $2.7 billion in profits on the collapse. Some 600,000 mostly British travelers were stranded or had future vacations cancelled.

Thomas Cook never figured out the Internet, were destroyed by the collapse of the pound triggered by Brexit and, horror upon horrors, bought an airline. It’s all great news for surviving European tour operators and discount airlines. Airfares are already rising.

The S&P Case Shiller ticked up in July, showing that the National Home Price Index rising 3.2%. It’s the first positive move in more than a year. It’s got to be super-low interest rates finally kicking in. But the real move up won’t start until SALT deductions come back in 18 months.

That went over like a lead balloon. From the moment Trump started speaking at the United Nations, stocks went into free fall, dropping 450 points from top to bottom. It’s trade war against everyone all the time with his withdrawal from globalization. Oh, and if you want to resist America’s incredible military might, we will crush you. It’s not what traders wanted to hear.

In the meantime, the impeachment moved forward, with younger Democrats forcing Pelosi’s hand. The Ukraine scandal, a Trump effort to have candidate Joe Biden arrested, was the stick that broke the camel’s back. Fortunately, the stock market could care less. Stocks rose 20% during the last impeachment in the 1990s.

US Consumer Confidence dove in September from 133 estimated down to 125.1 as trade war concerns take their toll. It’s one of the first September data points to come out and presages worse to come. News fatigue has to be a factor.

Bitcoin Crashed 15% to a new three-month low, hitting $7,944. Other cryptos fell 20%. All of the explanations were technical as they always are with this bogus asset class.

The Vaping Crisis demoed the Altria-Philip Morris merger. Suddenly, the crown jewels are toxic and about to be made illegal. The Juul CEO has resigned and the company may be about to go down the tubes. One of the largest mergers in history that would have created a $200 billion company has been tossed on the dustbin of history.

In a rare positive data point, New Homes Sales soared 7.1% in August to a 713,000 annualized rate. Median sales prices rise by 2.2% YOY to $328,400. Inventories drop from 5.9 to 5.5 months. The big numbers are happening in the south and west. Historically low-interest rates are kicking in big time.

The FTC Slammed Match Group (MTCH), the owner of Tinder and OK Cupid, for security lapses and scamming their own customers. Apparently, that gorgeous six-foot blond who speaks six languages who want to meet me if I only subscribed doesn’t actually exist. Oh well.

Q2 GDP final read came in at 2.0% with no change from the last report. Coming quarters will almost certainly be worse as the chickens come home to roost from a global trade war. We may already be in a recession and not know it. Inventories are building at a tremendous rate. Certainly, Fortune 500 CEOs think so.

Tesla deliveries may hit new high in Q3, topping 100,000, according to last week’s leak. The stock is back in play. It looks like I am going to get a new entertainment package upgrade too.

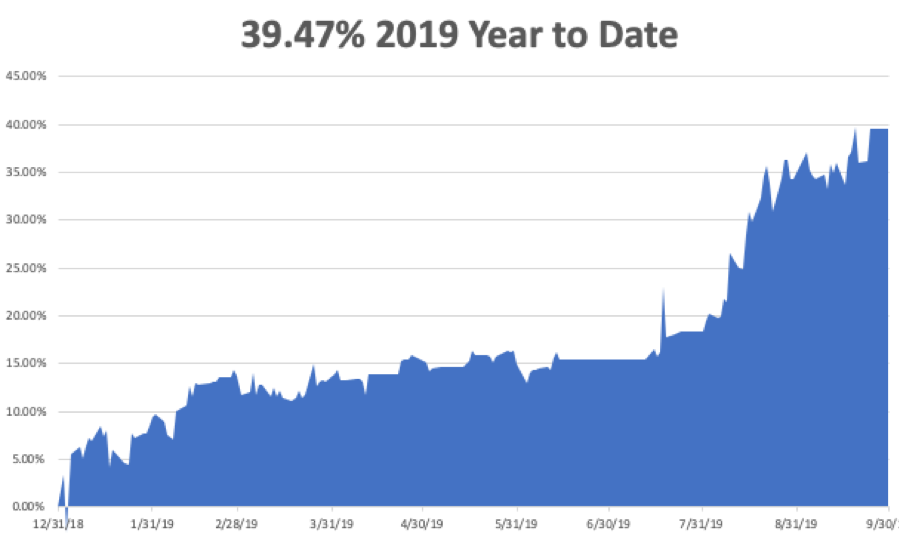

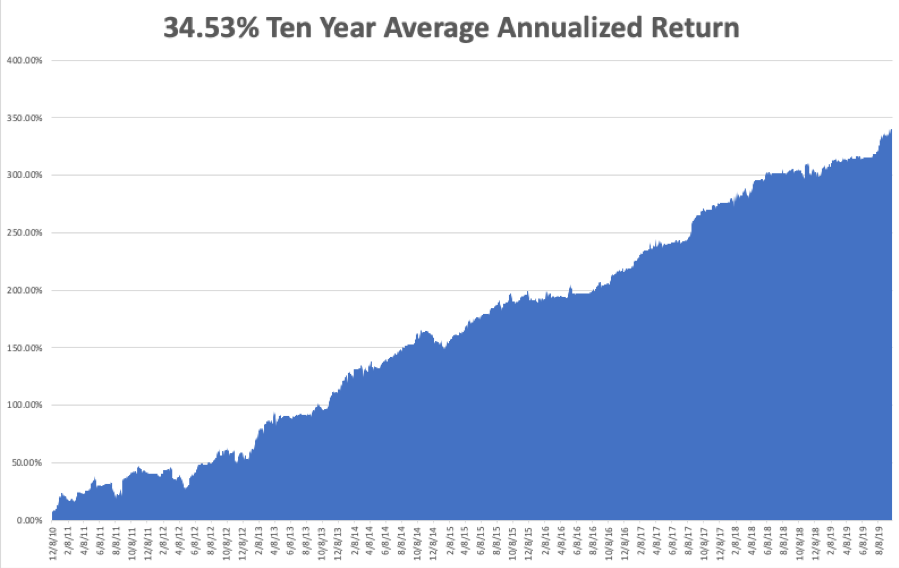

The Mad Hedge Trader Alert Service has blasted through to yet another new all-time high. My Global Trading Dispatch reached new apex of 336.07% and my year-to-date accelerated to +39.47%. The tricky and volatile month of September closed out +3.08%. at My ten-year average annualized profit bobbed up to +34.53%.

Some 25 out of the last 27 trade alerts have made money, a success rate of 92.59%. Under-promise and over-deliver, that's the business I have been in all my life. It works.

I took profits in my short position in oil (USO) earlier in the week, capturing a 12% decline there. That gives me a rare 100% cash position. I’m itching to get back in, but conditions right now are terrible

The coming week is all about the September jobs reports. It seems like we just went through those.

On Monday, September 30 at 9:45 AM, the Chicago Purchasing Managers Index for September is out.

On Tuesday, October 1 at 10:00 AM, the US Construction Spending for August is published

On Wednesday, October 2, at 8:15 AM, we learn the ADP Private Employment Report is out for September.

On Thursday, October 3 at 8:30 AM, the Weekly Jobless Claims are printed. At 3:00 PM, we get US Vehicle Sales for September.

On Friday, October 4 at 8:30 AM, the September Nonfarm Payroll Report is announced. Last month was a big disappointment so this month could set a new trend.

The Baker Hughes Rig Count is released at 2:00 PM.

As for me, I’ll be camping out with 2,500 Boy Scouts at the Solano Fair Grounds to attend Advance Camp. That’s where scouts have the opportunity to earn any of 50 merit badges in a single day.

I will be teaching the Swimming Merit Badge class. The basic idea is that if you throw a scout in the pool and he doesn’t drown, he passes. Personally, I wanted to take the welding class. The bonus is that we get to ride nearby roller coasters at Six Flags for free.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

September 30, 2019

Fiat Lux

Featured Trade:

(COMMISSION-FREE TRADING IS HERE)

(IBKR), (ETFC), (SCHW), (AMTD)

It’s been a long time coming since I first started trading 50 years ago and was charged 25 cents a share to place an order.

The race to zero is over in internet discount brokering world as Interactive Brokers Group, Inc. (IBKR) announced IBKR Lite, a new offering that will provide commission-free, unlimited trades on US exchange-listed stocks and Exchange Traded Funds (ETFs).

It was just a matter of time before one of the big internet brokerages started to offer zero commissions and this move will force the likes of Charles Schwab (SCHW), E-trade (ETFC), TD Ameritrade (AMTD) to follow suit in order to stay competitive.

I’ve written numerous times that this was going to happen and Robinhood, the millennial broker of choice, was the trendsetter coming out the gates with zero commissions and forcing the traditional broker’s hand.

The future is now and welcome to the funeral of trading commissions.

IBKR Lite is for traders seeking a simple, cost-free way to trade US exchange-listed stocks and ETFs and will complement Interactive Brokers’ existing services, which will be rebranded as IBKR Pro. IBKR Lite will be available in October.

I am not surprised that it is Interactive Brokers that is first to roll out a no-commission product.

They are, by far and away, the king of big volume trading and their commissions weren’t that high in the first place.

The customer they deal with is not like the Schwab’s or Fidelity’s who hardly generate large volumes.

Interactive Brokers is able to provide superior pricing because they specialize in data and automating.

This will enable the firms to offer no account minimums and means it will be free to maintain an account for IBKR Lite for professional and retail investors.

What will happen is that Interactive Brokers will sell off your data to analytic companies who know how to scrape the value out of these numbers.

Investors can choose between using IBKR Lite and IBKR Pro and switch between the two levels of service up to three times and then once per quarter.

The broker will re-route the orders of IBKR Lite clients to market makers in exchange for receiving payment for order flow.

Clients that prefer IBKR Pro will continue to receive the best prices generated from a sophisticated algorithm.

So, it becomes a backdoor revenue-generating function like Facebook who resells personal data to third-party analytics companies and in turn allow users to use their platform.

Order flow is inherently valuable for many high-frequency traders (HFT).

But I would say offering trade execution is an actual service where Facebook doesn’t offer anything of note.

A platform to “share” your personal information is not an actual product in my world no matter how you tweak the verbiage.

Either way, the price to the trader is now zero and anyone who trades large volumes is incentivized to go sign up with Interactive Brokers.

This industry has been getting away with highway robbery for years by not only selling order flow but also charging $4.95 or more to trade stocks and ETFs on top of the order flow revenue.

Once the best of the rest see trading volume evaporating as order flow migrates to IBKR, what other options do they have?

I predict that not every broker will be able to execute in this new model and consolidation will be ripe in the future as the weak perish.

As long as these other broker’s stick with the $4.95 per trade of yore, I hate to do it, but slapping on a sell rating is justified.

Welcome to the brave new world of discount stockbroking.

“I am so disturbed by kids who spend all day playing videogames.” – Said Founder of Oracle Larry Ellison

Mad Hedge Technology Letter

September 27, 2019

Fiat Lux

Featured Trade:

(THE REBIRTH OF WESTERN UNION)

(WU), (PYPL), (SQ)

This is not your father’s Western Union (WU).

Western Union (WU), the payment remittance service, is a legacy company that is going to harvest the most from a full migration to digital.

That is exactly what is currently happening.

Part of the 25% gain in the stock this year is a nod of approval in the direction the company is heading to.

At its most recent investors’ day presentation, the firm boosted its positive earnings guidance, which was primarily driven by its growth strategy on different verticals.

Western Union’s revamped growth strategy is buttressed by its ability to meet increasing demand from global consumers and businesses for fast and reliable cross-border money transfer and payment solutions.

The company is shying away from the brick-and-mortar operations of yore and choosing a strategy that leverages Western Union’s continued investment in key capabilities such as digital, real-time account payout, compliance, and artificial intelligence.

These nice additions have positioned the company to show strength in one of the most holistic and versatile payment engines in the world.

Western Union has its eyes set on expanding its core consumer-to-consumer business as well as other payment segments where global organizations can utilize its cross-border solutions to expand into fresh markets or better serve existing customers.

Western Union predicts a 23% operating margin by 2022 and a low-double-digit EPS CAGR through 2022.

The operating margin and EPS targets presume a 2020-2022 revenue CAGR of 2% to 3%, compared with the 2019 revenue base excluding divestitures.

The revenue ramp up signals growth in consumer money transfer, driven by its website westernunion.com and other third-party digital services and mid-single-digit growth from Business Solutions.

Operating profit margin and EPS targets also reflect $150 million in total annual savings expected by 2022.

The company expects to succeed in operating efficiencies from initiatives aimed at optimizing commissions and reducing third-party spending.

These initiatives will boost the bottom line an extra $50 million in annual savings to operating profit by 2022.

From 2020 to 2022, Western Union expects to extract more than $3 billion of operating cash flow and return approximately $2.5 billion to $3 billion to shareholders through dividends and share repurchases.

The company is a cash cow and attractive for many traditional investors who value this type of cash flow.

Other pathways to higher revenue include partnerships that provide customized payments solutions to organizations such as e-Commerce businesses expanding into emerging markets, end-to-end cross-border solutions to third-party organizations to solve consumer money transfer needs, and cross-border services, such as foreign exchange and cash management.

Slagging off the brick-and-mortar payments model for the digital platform is the low-lying fruit here and Western Union has a phase of overperformance in them before they will be thwarted with substantial revenue resistance.

Could this one day turn into a legitimate and mature fintech payment platform such as PayPal Holdings (PYPL) and Square (SQ)?

Offering low cost and efficient services is the first step in the right direction and I can say I’ve seen weirder things happen in the world.

Western Union certainly is in a position of strength as it cruises into the first innings of its digital migration and I believe there is more room to run for the stock until $30.

“New technology is not good or evil in and of itself. It's all about how people choose to use it.” – Said Writer Jason Pargin

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.