When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

April 23, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Meet John Thomas at His May 9 Las Vegas Strategy Luncheon. To buy tickets, please click here.

2) New Home Sales Jump 4.5%, in March, an 18 month high. Interesting how lower home mortgage rates, now 4.35% for the 30-year fixed, is feeding into more new home sales but not existing home sales. Avoid the homebuilders (ITB). Click here.

3) Lockheed Martin Guides Upward, causing the shares to pop, and taking the entire defense sector up with it. Big orders from Saudi Arabia for fighters and missiles were the driver. This sector has been in the doghouse since the Dems took the house. Buy (LMT) on dips. Click here.

4) Oil Hits new 2019 High, with West Texas hitting $66.19 a barrel, on tougher Iran sanctions. Watch out, this may be the stick that breaks the camel’s back and triggers a summer correction. Better plan a shorter vacation, or go electric. Click here.

5) Waymo’s Self Driving Fleet to be Operational by Summer, and it will be based in Detroit, where lots of cheap auto workers are available. The future is happening fast. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(LAS VEGAS MAY 9 GLOBAL STRATEGY LUNCHEON)

(APRIL 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (RWM), (IWM), (VXXB), (VIX), (QCOM), (AAPL), (GM), (TSLA), (FCX), (COPX), (GLD), (NFLX), (AMZN), (DIS)

(WHY YOU SHOULD KNOW ABOUT ATLASSIAN CORPORATION)

(TEAM), (ZM)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 23, 2019

Fiat Lux

Featured Trade:

(LAS VEGAS MAY 9 GLOBAL STRAGEGY LUNCHEON)

(APRIL 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (RWM), (IWM), (VXXB), (VIX), (QCOM), (AAPL), (GM), (TSLA), (FCX), (COPX), (GLD), (NFLX), (AMZN), (DIS)

Mad Hedge Technology Letter

April 23, 2019

Fiat Lux

Featured Trade:

(WHY YOU SHOULD KNOW ABOUT ATLASSIAN CORPORATION)

(TEAM), (ZM),

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 17 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What will the market do after the Muller report is out?

A: Absolutely nothing—this has been a total nonmarket event from the very beginning. Even if Trump gets impeached, Pence will continue with the same kinds of policies.

Q: If we are so close to the peak, when do we go short?

A: It’s simple: markets can remain irrational longer than you can remain liquid. Those shorts are expensive. As long as global excess liquidity continues pouring into the U.S., you’ll not want to short anything. I think what we’ll see is a market that slowly grinds upward until it’s extremely overbought.

Q: China (FXI) is showing some economic strength. Will this last?

A: Probably, yes. China was first to stimulate their economy and to stimulate it the most. The delayed effect is kicking in now. If we do get a resolution of the trade war, you want to buy China, not the U.S.

Q: Are commodities expected to be strong?

A: Yes, China stimulating their economy and they are the world’s largest consumer commodities.

Q: When is the ProShares Short Russell 2000 ETF (RWM) actionable?

A: Probably very soon. You really do see the double top forming in the Russell 2000 (IWM), and if we don’t get any movement in the next day or two, it will also start to roll over. The Russell 2000 is the canary in the coal mine for the main market. Even if the main market continues to grind up on small volume the (IWM) will go nowhere.

Q: Why do you recommend buying the iPath Series B S&P 500 VIX Short Term Futures ETN (VXXB) instead of the Volatility Index (VIX)?

A: The VIX doesn’t have an actual ETF behind it, so you have to buy either options on the futures or a derivative ETF. The (VXXB), which has recently been renamed, is an actual ETF which does have a huge amount of time decay built into it, so it’s easier for people to trade. You don’t need an option for futures qualification on your brokerage account to buy the (VXXB) which most people don’t have—it’s just a straight ETF.

Q: So much of the market cap is based on revenues outside the U.S., or GDP making things look more expensive than they actually are. What are your thoughts on this?

A: That is true; the U.S. GDP is somewhat out of date and we as stock traders don’t buy the GDP, we buy individual stocks. Mad Hedge Fund Trader in particular only focuses on the 5% or so—stocks that are absolutely leading the market—and the rest of the 95% is absolutely irrelevant. That 95% is what makes up most of the GDP. A lot of people have actually been caught in the GDP trap this year, expecting a terrible GDP number in Q1 and staying out of the market because of that when, in fact, their individual stocks have been going up 50%. So, that’s something to be careful of.

Q: Is it time to jump into Qualcomm (QCOM)?

A: Probably, yes, on the dip. It’s already had a nice 46% pop so it’s a little late now. The battle with Apple (AAPL) was overhanging that stock for years.

Q: Will Trump next slap tariffs on German autos and what will that do to American shares? Should I buy General Motors (GM)?

A: Absolutely not; if we do slap tariffs on German autos, Europe will retaliate against every U.S. carmaker and that would be disastrous for us. We already know that trade wars are bad news for stocks. Industry-specific trade wars are pure poison. So, you don't want to buy the U.S. car industry on a European trade war. In fact, you don’t want to buy anything. The European trade war might be the cause of the summer correction. Destroying the economies of your largest customers is always bad for business.

Q: How much debt can the global economy keep taking on before a crash?

A: Apparently, it’s a lot more with interest rates at these ridiculously low levels. We’re in uncharted territory now. We really don't know how much more it can take, but we know it’s more because interest rates are so low. With every new borrowing, the global economy is making itself increasingly sensitive to any interest rate increases. This is a policy you should enact only at bear market bottoms, not bull market tops. It is borrowing economic growth from futures year which we may not have.

Q: Is the worst over for Tesla (TSLA) or do you think car sales will get worse?

A: I think car sales will get better, but it may take several months to see the actual production numbers. In the meantime, the burden of proof is on Tesla. Any other surprises on that stock could see us break to a new 2 year low—that's why I don’t want to touch it. They’ve lately been adopting policies that one normally associates with imminent recessions, like closing most of their store and getting rid of customer support staff.

Q: Is 2019 a “sell in May and go away” type year?

A: It’s really looking like a great “Sell in May” is setting up. What’s helping is that we’ve gone up in a straight line practically every day this year. Also, in the first 4 months of the year, your allocations for equities are done. We have about 6 months of dead territory to cover from May onward— narrow trading ranges or severe drops. That, by the way, is also the perfect environment for deep-in-the-money put spreads, which we plan to be setting up soon.

Q: Is it time to buy Freeport McMoRan (FCX) in to play both oil and copper?

A: Yes. They’re both being driven by the same thing: China demand. China is the world’s largest new buyer of both of these resources. But you’re late in the cycle, so use dips and choose your entry points cautiously. (FCX) is not an oil play. It is only a copper (COPX) and gold (GLD) play.

Q: Are you still against Bitcoin?

A: There are simply too many better trading and investment options to focus on than Bitcoin. Bitcoin is like buying a lottery ticket—you’re 10 times more likely to get struck by lightning than you are to win.

Q: Are there any LEAPS put to buy right now?

A: You never buy a Long-Term Equity Appreciation Securities (LEAPS) at market tops. You only buy these long-term bull option plays at really severe market selloffs like we had in November/December. Otherwise, you’ll get your head handed to you.

Q: What is your outlook on U.S. dollar and gold?

A: U.S. dollar should be decreasing on its lower interest rates but everyone else is lowering their rates faster than us, so that's why it’s staying high. Eventually, I expect it to go down but not yet. Gold will be weak as long as we’re on a global “RISK ON” environment, which could last another month.

Q: Is Netflix (NFLX) a buy here, after the earnings report?

A: Yes, but don't buy on the pop, buy on the dip. They have a huge head start over rivals Amazon (AMZN) and Walt Disney (DIS) and the overall market is growing fast enough to accommodate everyone.

Q: Will wages keep going up in 2019?

A: Yes, but technology is destroying jobs faster than inflation can raise wages so they won’t increase much—pennies rather than dollars.

Q: How about buying a big pullback?

A: If we get one, it would be in the spring or summer. I would buy a big pullback as long as the U.S. is hyper-stimulating its economy and flooding the world with excess liquidity. You wouldn't want to bet against that. We may not see the beginning of the true bear market for another year. Any pullbacks before that will just be corrections in a broader bull market.

Good Luck and Good Trading

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Next on deck is Atlassian Corporation (TEAM).

What do they do?

They design, develop, license, and maintain global software products.

Part of the functions they provide are project tracking, content creation and sharing, and service management products.

The company's products include JIRA, a workflow management system that enables teams to plan, organize, track, and manage work and projects.

To complement JIRA, Confluence is a piece of software that acts as a content collaboration platform that is used to create, share, organize, and discuss projects.

Also, under its umbrella of software products is Trello, a web-based project management application for capturing and adding structure to fluid, fast-forming work for teams.

Cloud software has become ubiquitous because it is simpler to set up and operate, and benefits from the latest iterations through scheduled updates, and scales easily.

Most crucially, it allows customers to focus scarce time and resources on core businesses, instead of frittering it away solving infrastructure and hardware problems that often mutate into whack-a-mole by nature.

These collection of software products are uplifting Atlassian into a border line company that I would classify as a conviction buy.

Shares have demonstrated the success of the company by bursting with life, shares have doubled in the last 365 days and if you look at its performance all the way back to October 2015, shares have skyrocketed from 20 cents on the dollar to over $100 at the time of this writing.

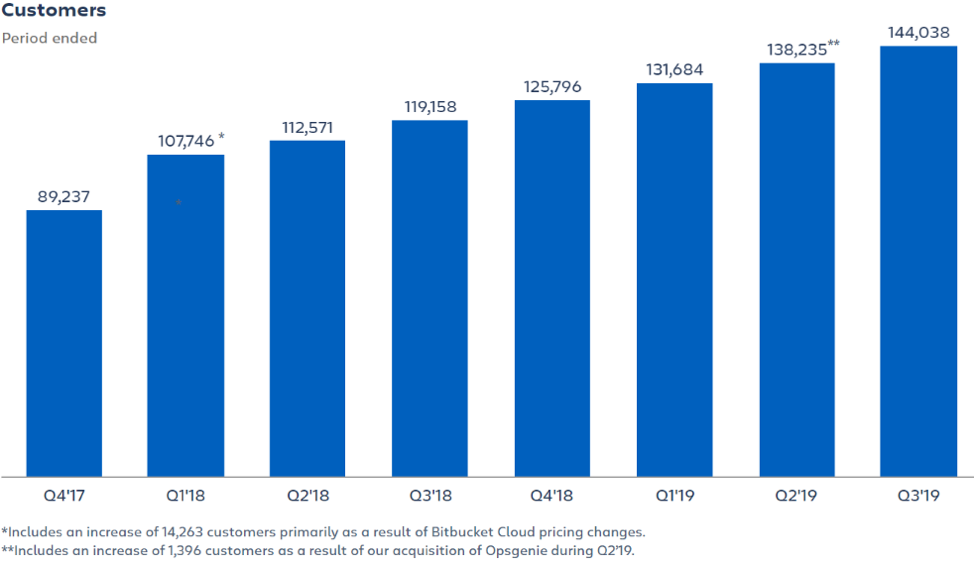

I took a quick glance at the paying customer metrics to gain an insight into why Atlassian is turning into a dominant company.

In Q3 2018, Atlassian racked up paid customers totaling 119,158 and followed that up a year later by totaling 144,038 in Q3 2019.

Atlassian’s clients represent diverse industries and geographies, from start-ups to blue chip companies, the highly automated sales model has given them a chance to target the Fortune 500 for growing margins.

Even on a sequential basis, sales are looking bright with Atlassian adding 5,803 from Q2 2019, combined with the revealing fact that over 90% of new customers in Q3 2019 chose one or more of Atlassian’s Cloud products.

Let me roll through some of the highlight deals with the ink still drying on the paper as we speak.

Flagship customers added to the all-star line-up include European online consumer lending company Sun Finance Group, shipping and logistics services supplier Cosco Shipping, retailer Dollar General, automobile manufacturer Isuzu, financial services firm Wedbush Securities, and New Zealand-based technology solutions provider Spark Digital just to name a few.

These companies don’t use Atlassian products in the same way, while it would be difficult to list the thousands of use cases for Atlassian products, examples illustrate the breadth of application and versatility of Atlassian products and demonstrate how the cloud software can expand across teams, departments, customer organizations, and hemispheres.

To offer one example that encapsulates what Atlassian services can actually achieve for burgeoning companies insistent on digitizing is vehicle history provider CARFAX.

When the Delivery Team at CARFAX doubled in just four years, the weaknesses in its work management system reached an inflection point.

As the team grew, so did the demand for a more robust, integrated system and they had been using several types of tools, none of which were in-tune with each other or aligned well with CARFAX’s entrenched processes.

Product managers lacked transparency into portfolio-wide metrics making it impossible for top executives to make guided decisions on major transformative initiatives.

After collaborating with Atlassian solution partner cPrime and standardizing workflow challenges on JIRA and Confluence, CARFAX discovered the optimal way to streamline their toolkit, connect its departments and systems, and reach its goals.

CARFAX teams now operate through JIRA daily, managing backlogs and keeping afloat with projects enterprise-wide.

Confluence has mushroomed into the go-to collaboration tool, and now has almost the same number of users as JIRA at CARFAX.

The broad absorption of Atlassian tools is unlike anything CARFAX has ever experienced before.

CARFAX has been the recipient of double-digit revenue growth and close to 90% customer satisfaction while hoisting the pillars to scale in the future.

Atlassian and its makeover for CARFAX is a crucial reason for the additional engineering efficiency to more regular updates and scalability without interruption for IT, to consistent and real-time analytics for the C-suite.

The software enhancements are a valuable source of enhanced productivity, and CARFAX continues to eagerly grab new product updates from Atlassian to embed into a myriad of automated processes.

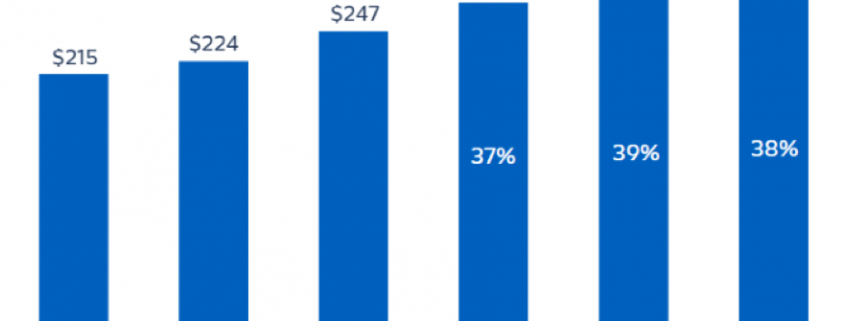

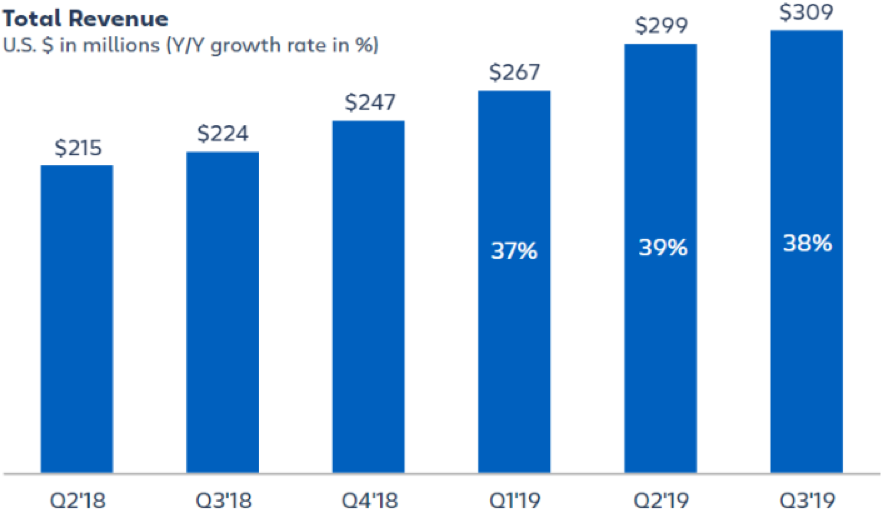

When many industries are on the brink of an earnings recession, Atlassian has bucked the trend with Q3 2018 revenues expanding 38% YOY to $309.3 million.

The company is even executing more efficiently by revealing healthier gross margins that increased from 79.8% in Q3 2018 to 82.5% in Q3 2019.

Even though Atlassian guided revenue to around $330 million for next quarter’s earnings, they guided down to 16 cents per share, lower than the 19 cents per share that analysts were estimating.

The expected earnings recession has offered an opportunistic chance for management to guide down, giving shares some breathing room before they march higher again which I believe is inevitable.

Atlassian is a robust enterprise software company in the early stages of hyper-growth with a long runway.

Not every company can enter into monopolies or duopolies in the tech world like Google, but the next best thing is the enterprise software market where analog companies need help juicing up products by automating the back, middle, and front end.

Companies such as Atlassian are at the forefront of this dynamic revolution and recent tech IPOs, such as video conferencing software for business users Zoom (ZM), epitomize where the pockets of growth have nestled in the current American economy.

This year is truly the year of enterprise software so enjoy the ride with Atlassian.

“If you make customers unhappy in the physical world, they might each tell 6 friends. If you make customers unhappy on the Internet, they can each tell 6,000 friends.” – Said Founder and CEO of Amazon Jeff Bezos

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.