While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 17, 2019

Fiat Lux

Featured Trade:

(UPDATING THE MAD HEDGE LONG TERM MODEL PORTFOLIO),

(USO), (XLV), (CI), (CELG), (BIIB), (AMGN), (CRSP), (IBM), (PYPL), (SQ), (JPM), (BAC), (EEM), (DXJ), (FCX), (GLD)

I rarely make changes to the Mad Hedge Long Term Model Investment Portfolio.

This is my shot at recommending portfolios of assets and individual stocks that investors never have to touch. You just put your money in, and don’t cash in until you hit your retirement age of 65 or 70.

After all, changes in the drivers of our $22 trillion economy rarely occur. Trends usually last for decades.

However, this year is completely different. The rate of change in the drivers of our economy is changing so fast that the whole idea of “long term” is becoming a distant relic. Not to update my portfolio would have been irresponsible.

So please find the new Mad Hedge Long Term Model Portfolio by clicking here. You must be logged into your account to gain access. There you can download an Excel spreadsheet containing the entire portfolio.

Here are my comments on the changes.

I have taken my energy weighting (USO) from 10% to zero. With falling demand and rising supply from fracking and alternatives, it is hard to see that any investment in the area will do well. When Saudi Arabia wants to get out of the oil business, as it was with its ARAMCO IPO, so do you. Eventually energy prices will approach near zero.

I am increasing my allocation to biotech healthcare (XLV) from 20% to 25%, which I believe will become one of the two dominant sectors of the 2020s. Scientific advancement is accelerating on all front, creating enormous profit opportunities. This is why I launched the Mad Hedge Biotech and Healthcare letter.

I am also increasing my weighting in technology from 25% to 30% as their share of the global economy expands significantly. I am changing the mix here, taking our holding in legacy IBM (IBM) and adding PayPal (PYPL) and Square (SQ), betting on the future of fintech.

I am maintaining my share of banks at 10%, betting on an eventual resurgence in interest rates and the growth of the US economy. JP Morgan Chase (JPM) and Bank of America (BAC) are looking good and are selling below book value.

I am keeping my international exposure at a low 10%. But I am doing a substitution, dumping Europe and adding the iShares MSCI Emerging Markets ETF. (EEM) has been down for so long that it has essentially already discounted the next recession.

As for bonds, I am cutting my allocation from 10% to zero. With a ten-year US Treasury bond yield at 1.72%, the risk/reward for this entire asset class on a long-term basis is terrible. Adding $1.5 trillion in new debt every year will come back to haunt this market.

I am cutting my short position into the foreign exchange market from 20% and flipping to a long of 10%. As long as the US has the world’s highest major currency interest rates, the downside will be limited. However, the end of the Brexit saga will also be hugely Euro positive.

Regarding commodities, I am keeping my 5% holding in Freeport McMoRan (FCX), which has already fully discounted the next recession. You need to have some cash in areas that will explode coming out the other side of the next short recession, and this is one of them.

I am also reentering the gold market on the long side with a 10% weighting. Gold (GLD) is a hedge against the next recession and is also a play on China moving a major portion of its reserves out of US Treasuries and into precious metals.

Staying out of agriculture completely has been one of the smartest things I have done in recent years. I have even stopped covering it in my newsletters. It has been a major trade war victim as I expected. But it is also suffering from hyper-accelerating technology, which is delivering ever large amounts of crops at very lower prices. Here zero stays zero.

So, that’s it. Make your reallocations and go back to sleep. I’ll wake you up at the end of 2020.

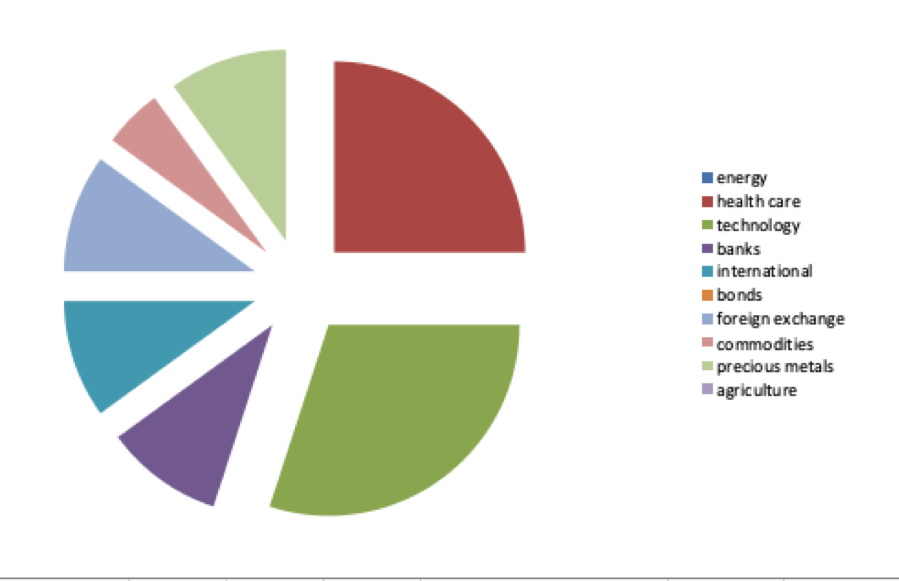

Energy - 0%

Healthcare - 25%

Technology - 30%

Banks - 10%

International - 10%

Bonds - 0%

Foreign Exchange - 10%

Commodities - 5%

Precious Metals - 10%

Agriculture - 0%

Total - 100%

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 16, 2019

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS OR OPTIONS CALLED AWAY),

(MSFT)

(DECODING THE GREENBACK),

Mad Hedge Technology Letter

October 16, 2019

Fiat Lux

Featured Trade:

(IS 3D PRINTING A WASTE OF SPACE?)

(SSYS), (ETSY), (MSFT), (BA), (NFLX), (GE), (LMT)

With stock market volatility greatly elevated and trading volumes through the roof, there is a heightened probability that your short options position gets called away.

If it does there, is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit on your position.

Most of you have short options position, although you may not realize it. For when you buy an in-the-money call option spread, it contains two elements: a long call and a short call. The short call can get assigned or called away at any time.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

The 5:30 AM phone call was as shrill as it was urgent.

A reader had employed one of my favorite strategies, buying the Microsoft (MSFT) November 2018 $90-$95 in-the-money vertical call spread at $4.50.

He had just received an email from his broker informing him that his short position in the (MSFT) November $95 calls was assigned and exercised against him.

He asked me what to do.

I said, “Nothing.”

For what the broker had in effect done is allow him to get out of his call spread position at the maximum profit point 20 days before the November 16 expiration date.

All he had to do was call his broker and instruct him to exercise his long position in his November $90 calls to close out his short position in the $95 calls.

Calls are a right to buy shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

In other words, he bought (MSFT) at $90 and sold it at $95, paid $4.50 cents for the right to do so, his profit is 50 cents, or ($0.50 X 100 shares X 22 contracts) = $1,100. Not bad for a nine-day limited risk play.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

A call owner may need to sell a long stock position right at the close and exercising his long November $95 calls is the only way to execute it.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there, which may arrive at some twisted logic that the puts need to be exercised.

Many require rebalancing of hedges at the close every day, which can be achieved through option exercises.

And yes, calls even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker, but is a terrible thing for the trader to do from a risk point of view, likely generating a loss by the time everything is closed and netted out.

Avarice could have been an explanation here, but I think stupidity, poor training, and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers, but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long, and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

If you need a new investment theme – here’s one.

3D printing.

Yes, the same 3D printing that was once considered a raging but hopeless fad.

A lot has changed since then.

Early adopters were largely cut down at the knees as they tried to traverse the rocky terrain from a niche market to going full out mainstream.

Production complications and the lack of specialists in the industry meant that problems were rampant and nurturing an industry from scratch is harder than you think.

Believe me, I’ve been there and done that.

It is time to stand up and take notice of 3D printing, this time it is here to stay.

Certain tech companies love this technology like e-commerce company Etsy (ETSY) who focuses on personalized handcrafts.

The cost of production doesn’t change whether you’re producing one item or a million because of the economies of scale.

The previous 3D printing bonanza was a frenzy and this corner of tech became known for the use of buzzwords representing the potential to reinvent the world.

With lofty expectations, there was a natural disappointment when outsiders understood growing pains were part of the critical evolution instead of a direct route to profits.

The initial goal was to democratize production which sounds eerily similar to bitcoins mantra of democratizing money.

The way to do this was to make it simple to produce whatever one wishes.

That would assume that the general public could pick up professional production 3D printing skills on arrival.

That was wishful thinking.

The truth was that applying 3D printers was tedious.

Issues cropped up like faulty first-generation hardware or software -problems that overwhelmed newbies.

Then if everything was going smoothly on that front, there was the larger issue of realizing it’s just a lot harder to design specific things than initially thought without a deep working knowledge of computer-aided software (CAD) design.

Most people know how to throw a football, but that doesn’t mean that most people can be Super Bowl quarterback Tom Brady.

The high-quality 3D printing designs were reserved for authentic professionals that could put together complicated designs.

The move to compiling a comprehensive library will help spur on the 3D printing revolution while upping the foundational skill base.

Then there is the fact that 3D printing technology is heaps better now than it once was, and the printing technology has come down in price making it more affordable for the masses.

These trends will propel broad-based adoption and as the printing process standardizes, more products can rely on this technology from scratch.

The holy grail of 3D printing would be 3D printing on demand, but imagine this on-demand 3D printing would function to personalize a physical product on the spot.

Think of a hungry customer walking into a restaurant and not even looking at a menu because one sentence would be enough to trigger specific models in the database that could conjure up the design for the meal.

This would involve integrating artificial intelligence into 3D printing and the production process would quicken to minutes, even seconds.

At some point, crafting the perfect meal or designing a personalized Tuscan villa could take minutes.

The 3D printing industry is reaching an inflection point where the advancement of the technology, expertise, and an updated production process are percolating together at the perfect time.

The company at the forefront of this phenomenon is Stratasys (SSYS).

Stratasys produces in-office prototypes and direct digital manufacturing systems for automotive, aerospace, industrial, recreational, electronic, medical and consumer products.

And when I talk about real pros who have the intellectual property to whip out a complex CAD-based 3D design, I am specifically talking about Stratasys who have been in this business since the industry was in its infancy.

And if you add in the integration of cloud software, 3D printing would dovetail nicely with it.

All the elements are in perfect in place to fuel this industry into the mainstream.

Take for example airplanes made by Boeing (BA) and Airbus - 3D printer-designed parts comprise only 0.1% of the actual plane now.

It is estimated that 3D printed design parts could potentially consist up to 25% of the overall plane.

These massive airline manufacturers like Boeing (BA) have profit margins of around 15% to 20%, and carving out more 3D printer-designed parts to integrate into the main design will boost profit margins close to 60%.

The development of the 3D printing process into aerospace technology is happening fast with Boeing inking a multi-year collaboration agreement with Swiss technology and engineering group Oerlikon to develop standard processes and materials for metal 3D printing.

Any combat pilot knows who Oerlikon is because they are famed for building ultra-highspeed machines to shoot down, you guessed it, airplanes and missiles.

They will collaborate to use the data resulting from their agreement to support the creation of a standard titanium 3D printing processes.

GE’s Aviation’s GEnx-2B aircraft engine for the Boeing 747-8 is applying a 3D printed bracket approved by the Federal Aviation Administration (FAA) for the engine, replacing a traditionally manufactured power door opening system (PDOS) bracket.

With the positive revelations that the (FAA) is supporting the adoption of 3D printing-based designs, GE has already started mass production of the 3D printed brackets at its Auburn, Alabama facility.

Defense companies are also dipping their toe into the water with aerospace company Lockheed Martin (LMT), the world’s largest defense contractor, winning a $5.8 million contract with the Office of Naval Research to help further develop 3D printing for the aerospace industry.

They will partner up to investigate the use of artificial intelligence in training robots to independently oversee the 3D printing of complex aerospace components.

3D printed designs have the potential to crash the cost of making big-ticket items from cars to nuclear plants while substantially shortening the manufacturing process.

As it stands, Stratasys is the industry leader in this field and if you believe in this long term then this stock would be for you.

It’s nonetheless still a speculative punt but a compelling pocket of the tech industry.

“Capitalism has worked very well. Anyone who wants to move to North Korea is welcome.” – Said Founder and Former CEO of Microsoft Bill Gates

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.